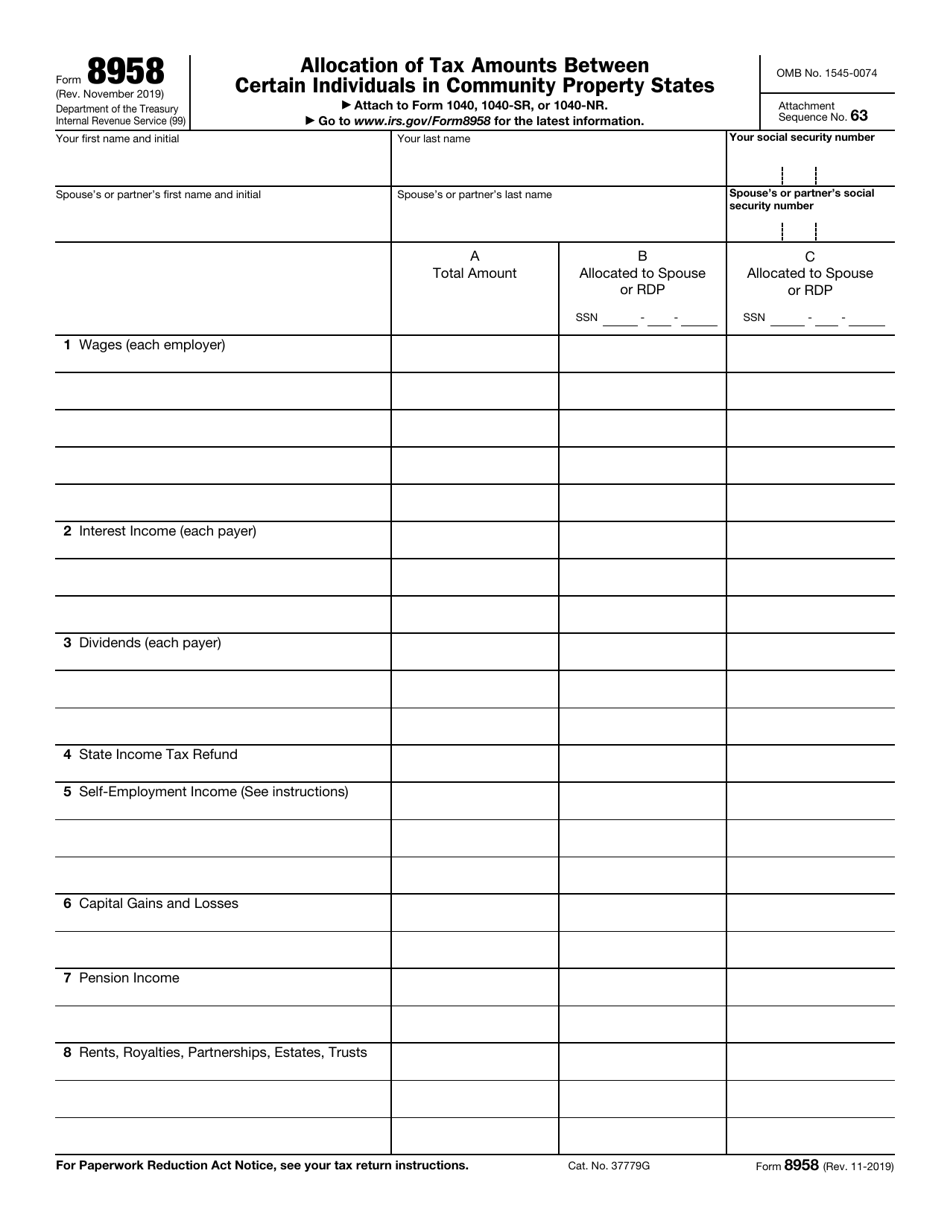

How To Fill Out 8958 Form

How To Fill Out 8958 Form - Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half of all community income and all your separately earned income. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). Follow the simple instructions below: Web the form 8958 is only used when filing as married filing separate (mfs). Web satisfied 283 votes what makes the example of completed form 8958 legally valid? Web up to $40 cash back get, create, make and sign form 8958 fillable pdffiller. The laws of your state govern whether you have community or separate property and income. Enjoy smart fillable fields and interactivity. Edit your form 8958 form online. Do not prepare it in a joint return before you split the.

★★★★★ how to fill out form 8958, im in texas. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. The form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be reporting on their. You must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. I got married in nov 2021. From within your taxact return ( online or desktop), click federal. Do i put the clients… how to fill out form 8958, im in texas. Web up to $40 cash back get, create, make and sign form 8958 fillable pdffiller. Also what if the client doesnt have the spouses. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half of all community income and all your separately earned income.

Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal return): Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). The form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be reporting on their. Web open screen 8958 in each split return and indicate how the income is allocated. My wife and i are filing married, filing separately for 2021. Follow the simple instructions below: Community property laws only apply to those who are actually domiciled in the. ★★★★★ how to fill out form 8958, im in texas. Enjoy smart fillable fields and interactivity. Web satisfied 283 votes what makes the example of completed form 8958 legally valid?

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web how do i complete the married filing separate allocation form (8958)? Web how to fill out and sign form 8958 instructions example online? Web satisfied 283 votes what makes the example of completed form 8958 legally valid? Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web bought.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web ask an expert tax questions this answer was rated: The laws of your state govern whether you have community or separate property and income. Do not prepare it in a joint return before you split the. I got married in nov 2021. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web satisfied 283 votes what makes the example of completed form 8958 legally valid? Web open screen 8958 in each split return and indicate how the income is allocated. Also what if the client doesnt have the spouses. From within your taxact return ( online or desktop), click federal. Type text, complete fillable fields, insert images, highlight or blackout data.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web bought with separate funds. Community property laws only apply to those who are actually domiciled in the. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property state. ★★★★★ how to fill out form 8958, im in texas. Web open screen 8958.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

About form 8958, allocation of tax amounts between. Web satisfied 283 votes what makes the example of completed form 8958 legally valid? Web how to fill out and sign form 8958 instructions example online? I got married in nov 2021. The laws of your state govern whether you have community or separate property and income.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web bought with separate funds. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal return): Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

Web how to fill out and sign form 8958 instructions example online? Web ask an expert tax questions this answer was rated: Web open screen 8958 in each split return and indicate how the income is allocated. You must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. This allocation worksheet.

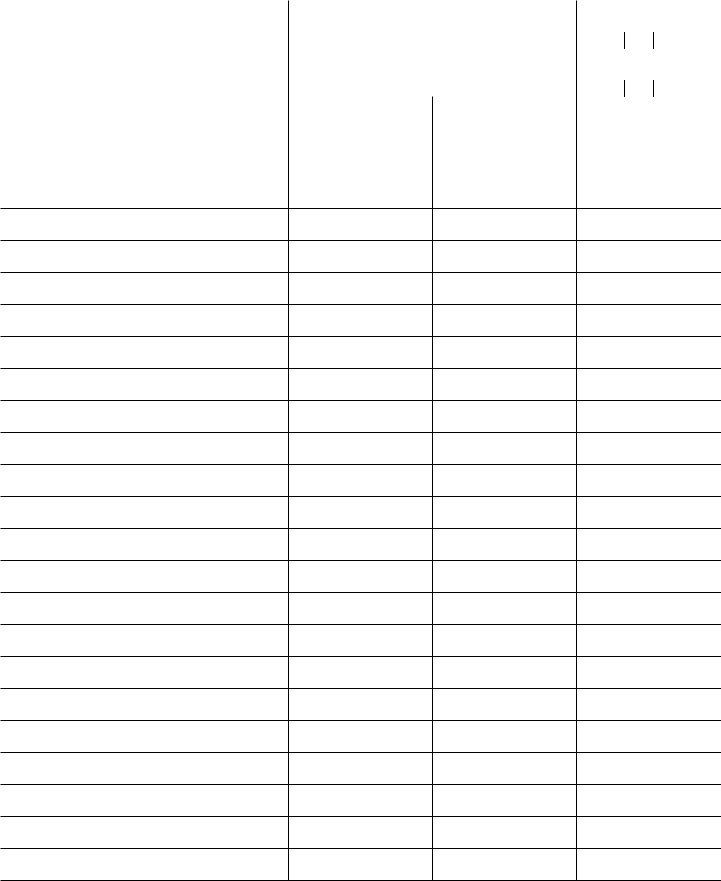

Form Steps to Fill out Digital 8959 Fill online, Printable, Fillable

I'm curious as to how to fill out form 8958 when it comes to our. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal return): Web form 8958 allocation of tax amounts between certain individuals in community.

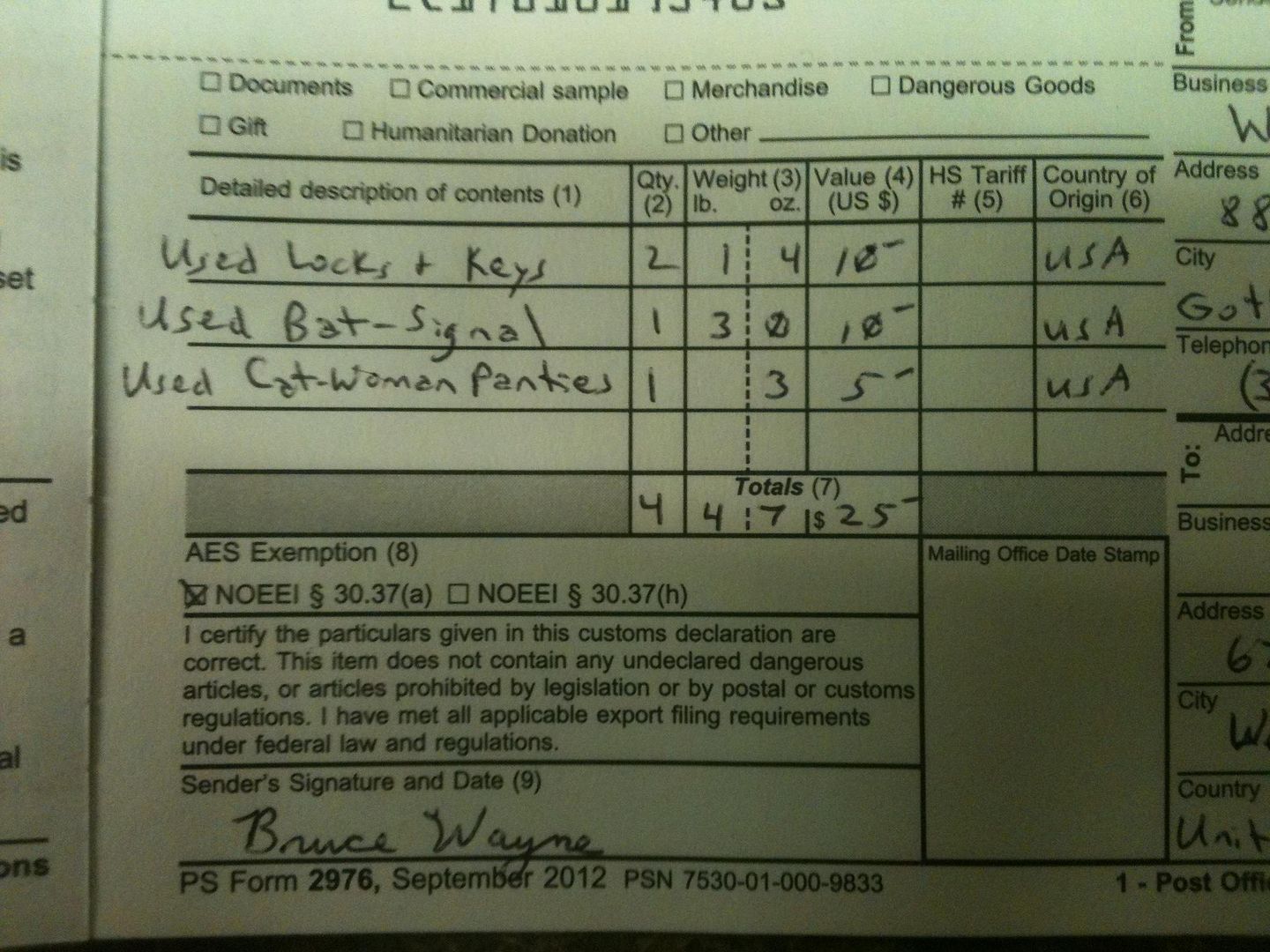

View topic ARF's guide to international shipping . Keypicking

You must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web bought with separate funds. About form 8958, allocation of tax amounts between. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Do not prepare it in a joint return before you.

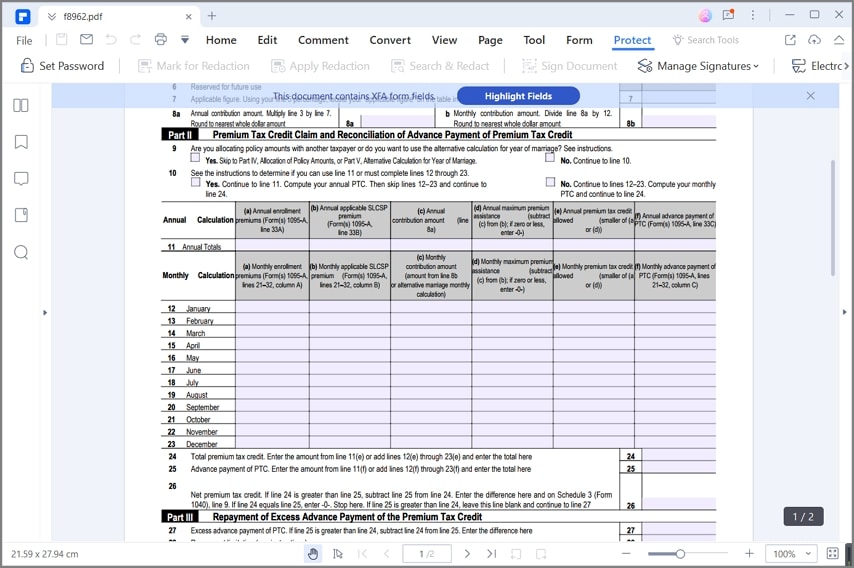

How to Fill out IRS Form 8962 Correctly?

Web how to fill out and sign form 8958 instructions example online? Make any adjustments in the split returns necessary to reflect that allocation. I got married in nov 2021. I'm curious as to how to fill out form 8958 when it comes to our. Web to enter form 8958 in the taxact program (this allocation worksheet does not need.

I Got Married In Nov 2021.

Web the form 8958 is only used when filing as married filing separate (mfs). Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. The form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be reporting on their. Refer to the information below to assist with questions regarding screen 3.1.

Web Ask An Expert Tax Questions This Answer Was Rated:

★★★★★ how to fill out form 8958, im in texas. Do not prepare it in a joint return before you split the. Follow the simple instructions below: Edit your form 8958 form online.

Web Up To $40 Cash Back Get, Create, Make And Sign Form 8958 Fillable Pdffiller.

The form 8958 isn’t an any different. This allocation worksheet does not need to be completed if you are only filing the state returns. About form 8958, allocation of tax amounts between. From within your taxact return ( online or desktop), click federal.

You Must Attach Form 8958 To Your Tax Form Showing How You Figured The Amount You’re Reporting On Your Return.

Not all income is community income needing to be divided. Web satisfied 283 votes what makes the example of completed form 8958 legally valid? Web how do i complete the married filing separate allocation form (8958)? Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er).