How To Fill Out Form 2210

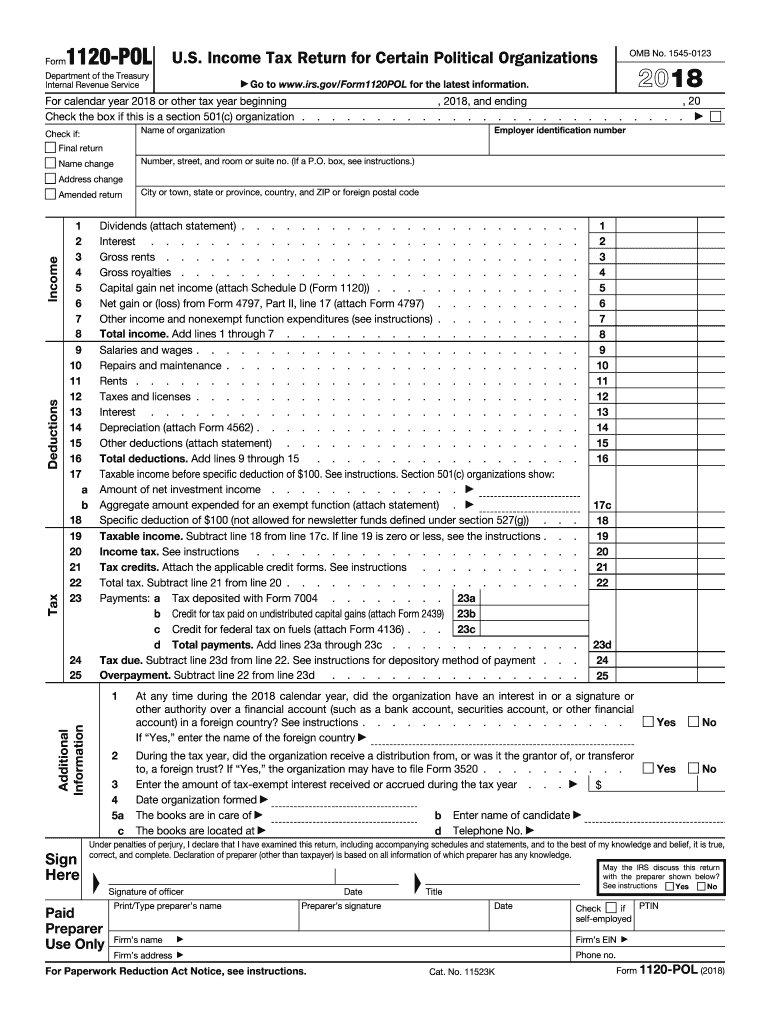

How To Fill Out Form 2210 - No worries, here we have included a stepwise detailed guide that will walk you through the entire process. All forms are printable and downloadable. Web how to fill up sf10how to fill up school form 10school form 10 tutorialsf10 tutorialdeped sf10 tutorialdeped school form tutorialnew sf10 fill up tutorialnew. This is done either through withholdings from your earnings or. You can get the irs form 2210 from the official website of department of the treasury, internal revenue. Web once completed you can sign your fillable form or send for signing. Web solved•by turbotax•2455•updated january 13, 2023. Web do you have to file form 2210? Who must file form 2210. Web 4,078 reply bookmark icon tomk expert alumni irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the.

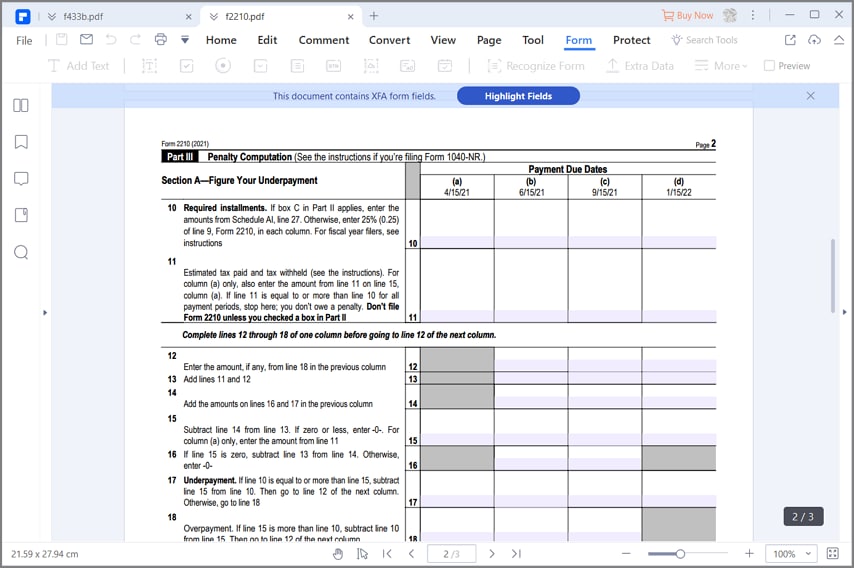

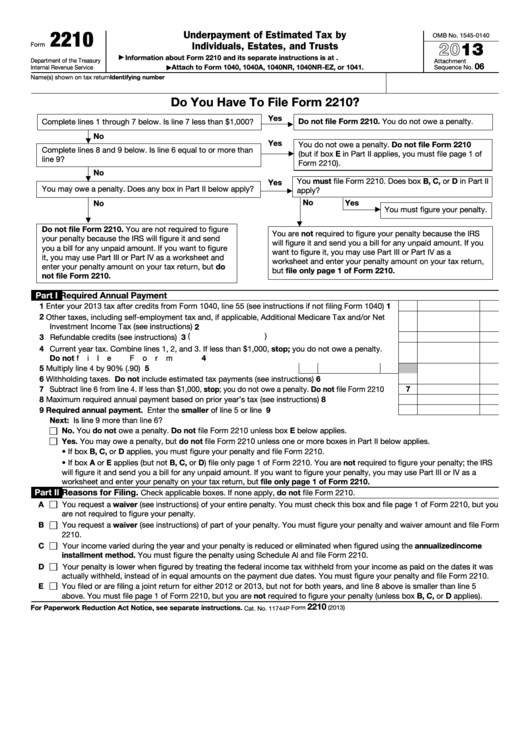

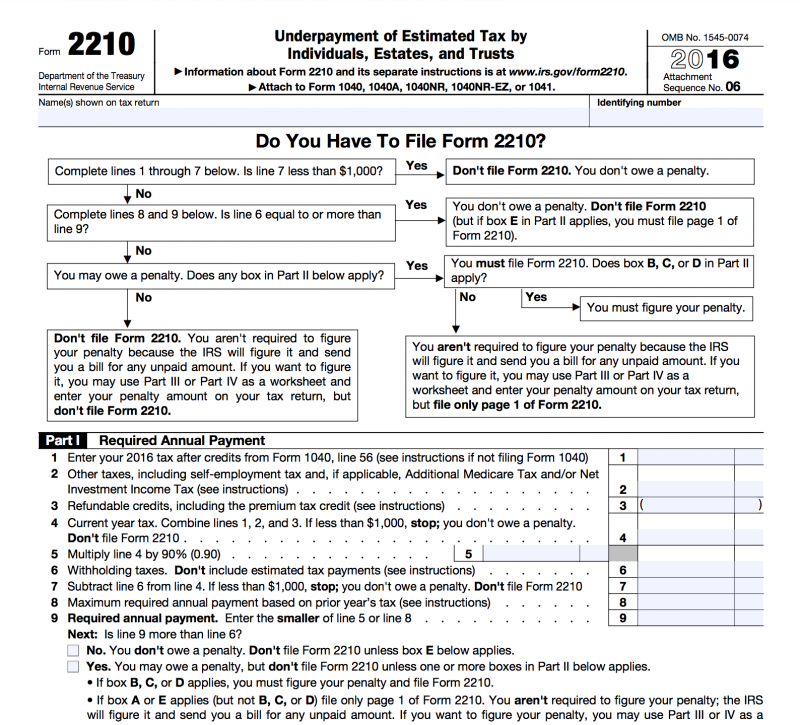

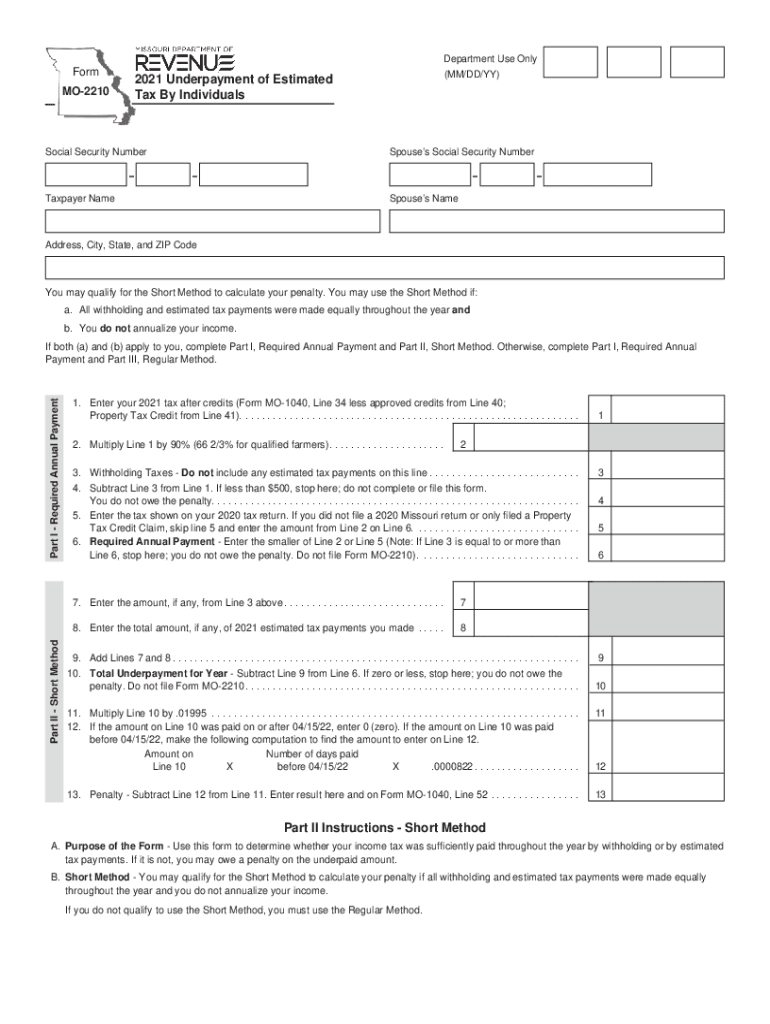

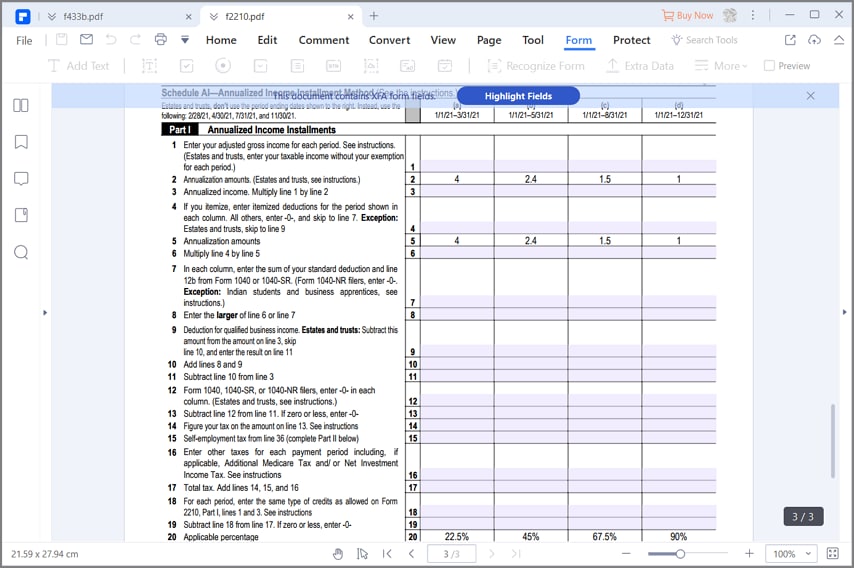

Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. You can get the irs form 2210 from the official website of department of the treasury, internal revenue. Who must file form 2210. Web 4,078 reply bookmark icon tomk expert alumni irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the. Is line 4 or line 7 less than $1,000? You are not required to complete it since the irs will figure the penalty, if any, and let you. Irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This is done either through withholdings from your earnings or. Web there are some situations in which you must file form 2210, such as to request a waiver.

Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web instructions for how to complete irs form 2210 step 1: The irs requires that you pay the taxes you owe throughout the year. This penalty is different from the penalty for. Who must file form 2210. Yes don’t file form 2210. Web there are some situations in which you must file form 2210, such as to request a waiver. Web how to fill up sf10how to fill up school form 10school form 10 tutorialsf10 tutorialdeped sf10 tutorialdeped school form tutorialnew sf10 fill up tutorialnew. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Complete lines 1 through 7 below.

Ssurvivor Irs Form 2210 Instructions 2020

Web instructions for how to complete irs form 2210 step 1: Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. Use the flowchart at the top of form 2210, page 1, to see if. This is done either through withholdings from your earnings or..

IRS Form 2210Fill it with the Best Form Filler

Web form 2210 is irs form that relates to underpayment of estimated taxes. Complete, edit or print tax forms instantly. Yes don’t file form 2210. The irs requires that you pay the taxes you owe throughout the year. You can get the irs form 2210 from the official website of department of the treasury, internal revenue.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Who must file form 2210. Web solved•by turbotax•2455•updated january 13, 2023. Web there are some situations in which you must file form 2210, such as to request a waiver. All forms are printable and downloadable. Yes don’t file form 2210.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Use the flowchart at the top of form 2210, page 1, to see if. You can get the irs form 2210 from the official website of department of the treasury, internal revenue. Web instructions for how to complete irs form 2210 step 1: All forms are printable and downloadable. Web how to fill up sf10how to fill up school form.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Web form 2210 is irs form that relates to underpayment of estimated taxes. Web do you have to file form 2210? No worries, here we have included a stepwise detailed guide that will walk you through the entire process. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers)..

Form 2210 Fill and Sign Printable Template Online US Legal Forms

Web now the big question comes how to fill out irs form 2210. Use the flowchart at the top of form 2210, page 1, to see if. Penalty for underpaying taxes while everyone living in the united states is. Web in order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and.

2210 Form 2021

Who must file form 2210. Web 4,078 reply bookmark icon tomk expert alumni irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the. All forms are printable and downloadable. Yes don’t file form 2210. You can get the irs form 2210 from the official website of department of the treasury, internal revenue.

Mo 2210 Fill Out and Sign Printable PDF Template signNow

You are not required to complete it since the irs will figure the penalty, if any, and let you. No worries, here we have included a stepwise detailed guide that will walk you through the entire process. Web once completed you can sign your fillable form or send for signing. Web there are some situations in which you must file.

Ssurvivor Irs Form 2210 Instructions 2018

You don’t owe a penalty. Use the flowchart at the top of form 2210, page 1, to see if. Web now the big question comes how to fill out irs form 2210. Web tax 101 tax assurance tax tips business finance personal finance back to search 2210 form 2210: Complete lines 1 through 7 below.

IRS Form 2210Fill it with the Best Form Filler

This is done either through withholdings from your earnings or. Web form 2210 is irs form that relates to underpayment of estimated taxes. This penalty is different from the penalty for. No worries, here we have included a stepwise detailed guide that will walk you through the entire process. Web form 2210 is used to calculate a penalty when the.

Yes Don’t File Form 2210.

Web form 2210 is irs form that relates to underpayment of estimated taxes. Web instructions for how to complete irs form 2210 step 1: No worries, here we have included a stepwise detailed guide that will walk you through the entire process. Web do you have to file form 2210?

Web Form 2210 Is Used To Determine How Much You Owe In Underpayment Penalties On Your Balance Due.

Web now the big question comes how to fill out irs form 2210. Web how to fill up sf10how to fill up school form 10school form 10 tutorialsf10 tutorialdeped sf10 tutorialdeped school form tutorialnew sf10 fill up tutorialnew. Web tax 101 tax assurance tax tips business finance personal finance back to search 2210 form 2210: Complete, edit or print tax forms instantly.

Web In Order To Make Schedule Ai Available, Part Ii Of Form 2210 Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Must Be Entered.

Is line 4 or line 7 less than $1,000? You can get the irs form 2210 from the official website of department of the treasury, internal revenue. You don’t owe a penalty. This is done either through withholdings from your earnings or.

Web Form 2210 Is Used To Calculate A Penalty When The Taxpayer Has Underpaid On Their Estimated Taxes (Quarterly Es Vouchers).

Web once completed you can sign your fillable form or send for signing. Web 4,078 reply bookmark icon tomk expert alumni irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the. This penalty is different from the penalty for. Penalty for underpaying taxes while everyone living in the united states is.