How To Fill Out Form 8863

How To Fill Out Form 8863 - Launch the program, drag and drop the irs form 8863 into pdfelement. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Knott 11.3k subscribers join subscribe 7.4k views 1 year ago #aotc students and their parents are generally eligible to claim either the american. Printable irs form 8863 as the tax season approaches, taxpayers across the united states are getting ready to file their annual tax returns. Web one of the most cr. Complete, edit or print tax forms instantly. Web how to fill out the 8863 form check your eligibility. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. Strange as it may sound, to fill out form 8863 you’ll want to start with part iii.

Your expenses must be from a. Ascertain that you are eligible to file for the credit. Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. Web in drake 15 and prior, details for two schools can be entered on the first 8863 screen for each student press page down to enter additional information for 3 or more schools on. Get ready for tax season deadlines by completing any required tax forms today. Web for the latest information about developments related to form 8863 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8863. If you can’t find it, or if. Web if by filling out this tax form you can take your tax bill as low as zero then you are eligible to receive a tax refund up to $1,000. Complete irs tax forms online or print government tax documents. Use form 8863 to figure and claim your.

Web what is form 8863? Web how to fill out the 8863 form check your eligibility. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete irs tax forms online or print government tax documents. The irs form 8863 determines the amount of this tax. Knott 11.3k subscribers join subscribe 7.4k views 1 year ago #aotc students and their parents are generally eligible to claim either the american. Open the template in the online editor. Your expenses must be from a. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Tax Time!

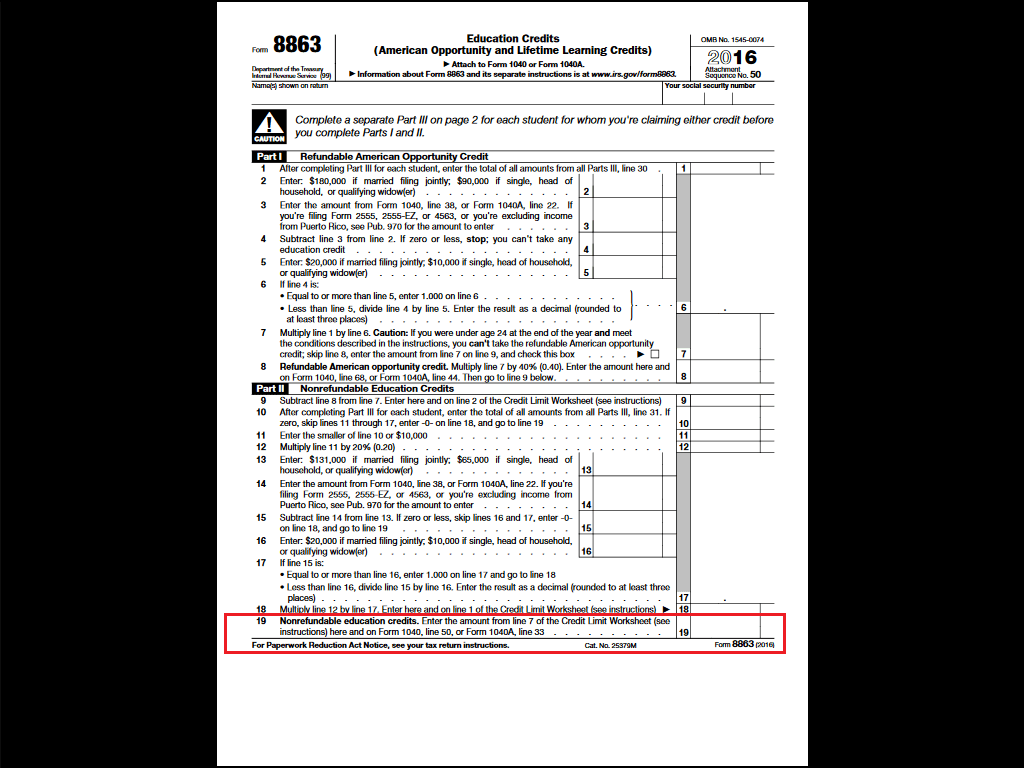

The irs form 8863 determines the amount of this tax. Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Complete irs tax forms online or print.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Before starting to fill the irs form 8863, you need to. Web follow these simple guidelines to get irs 8863 ready for sending: Select the form you will need in our collection of legal forms. Web one of the most cr.

Learn How to Fill the Form 8863 Education Credits YouTube

Ascertain that you are eligible to file for the credit. Use form 8863 to figure and claim your. Launch the program, drag and drop the irs form 8863 into pdfelement. Web how to fill out the 8863 form check your eligibility. Printable irs form 8863 as the tax season approaches, taxpayers across the united states are getting ready to file.

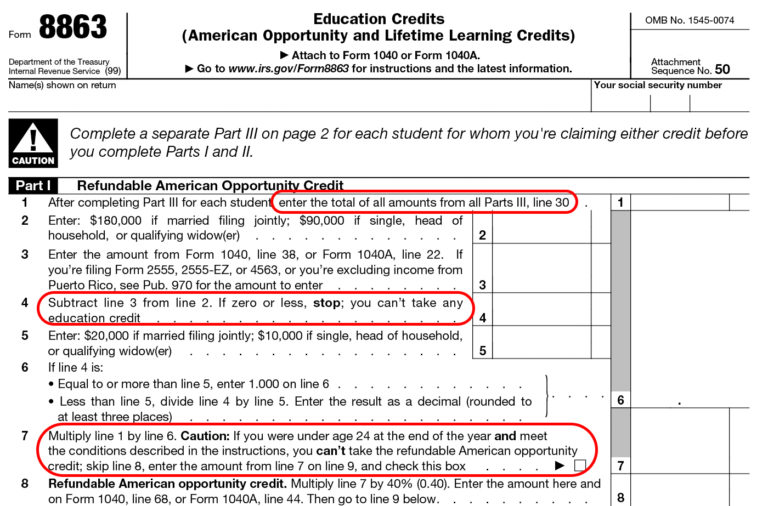

Understanding IRS Form 8863 Do I Qualify for American Opportunity

Use form 8863 to figure and claim your. Your expenses must be from a. Strange as it may sound, to fill out form 8863 you’ll want to start with part iii. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

form8863 YouTube

If you can’t find it, or if. Before starting to fill the irs form 8863, you need to. Use form 8863 to figure and claim your. Complete, edit or print tax forms instantly. Web follow these simple guidelines to get irs 8863 ready for sending:

Learn How to Fill the Form 1040ES Estimated Tax for Individuals YouTube

Web in drake 15 and prior, details for two schools can be entered on the first 8863 screen for each student press page down to enter additional information for 3 or more schools on. Web how to fill out the 8863 form check your eligibility. Web form 8863 is used by individuals to figure and claim education credits (hope credit,.

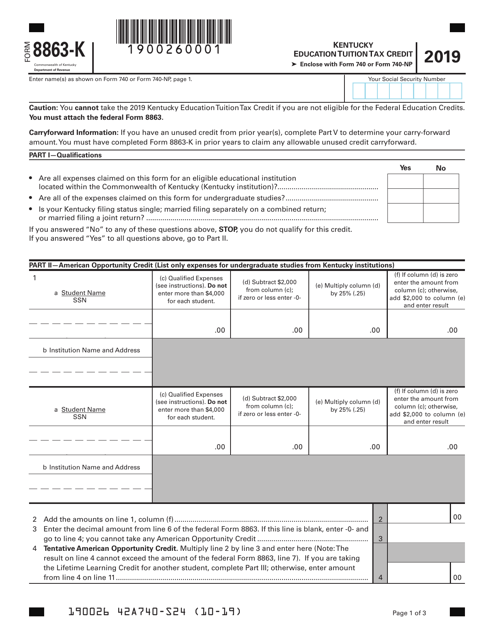

Form 8863K Download Fillable PDF or Fill Online Kentucky Education

Launch the program, drag and drop the irs form 8863 into pdfelement. Form 8863 typically accompanies your. Get ready for tax season deadlines by completing any required tax forms today. Before starting to fill the irs form 8863, you need to. Web in drake 15 and prior, details for two schools can be entered on the first 8863 screen for.

Form 8863 Instructions & Information on the Education Credit Form

Web one of the most cr. Open the template in the online editor. Web if by filling out this tax form you can take your tax bill as low as zero then you are eligible to receive a tax refund up to $1,000. Launch the program, drag and drop the irs form 8863 into pdfelement. Web form 8863 is used.

Form 8863 Instructions Information On The Education 1040 Form Printable

Select the form you will need in our collection of legal forms. Ascertain that you are eligible to file for the credit. Web how to fill out form 8863. Knott 11.3k subscribers join subscribe 7.4k views 1 year ago #aotc students and their parents are generally eligible to claim either the american. Form 8863 typically accompanies your.

Understanding IRS Form 8863 Do I Qualify for American Opportunity

Web how to fill out the 8863 form check your eligibility. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Complete, edit or print tax forms instantly. The irs form 8863 determines the amount of this tax. Web what is form 8863?

Web One Of The Most Cr.

Before starting to fill the irs form 8863, you need to. Ascertain that you are eligible to file for the credit. If you can’t find it, or if. Printable irs form 8863 as the tax season approaches, taxpayers across the united states are getting ready to file their annual tax returns.

The Irs Form 8863 Determines The Amount Of This Tax.

Web how to fill out form 8863. Select the form you will need in our collection of legal forms. Web what is form 8863? Use form 8863 to figure and claim your.

Launch The Program, Drag And Drop The Irs Form 8863 Into Pdfelement.

Web if by filling out this tax form you can take your tax bill as low as zero then you are eligible to receive a tax refund up to $1,000. Form 8863 typically accompanies your. Complete, edit or print tax forms instantly. Web in drake 15 and prior, details for two schools can be entered on the first 8863 screen for each student press page down to enter additional information for 3 or more schools on.

Open The Template In The Online Editor.

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Get ready for tax season deadlines by completing any required tax forms today. Web follow these simple guidelines to get irs 8863 ready for sending: Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).