How To Fill Out Form W-4P

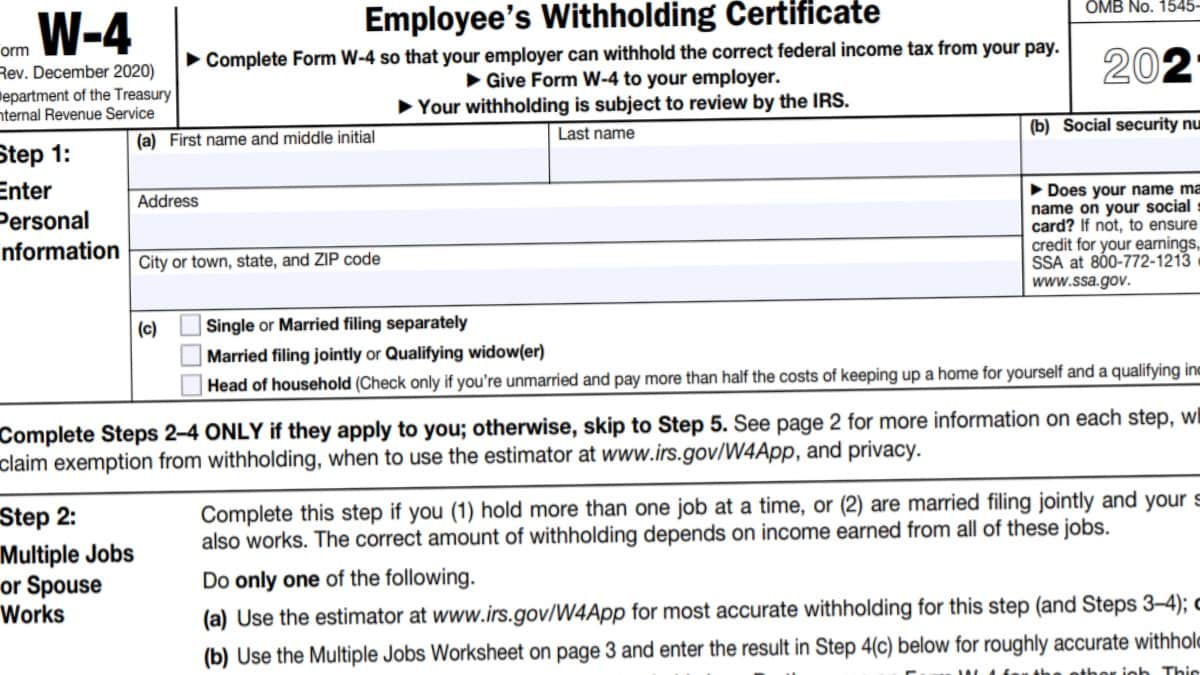

How To Fill Out Form W-4P - There are several ways to obtain the form. Take it line by line. Name, address, and then single, married, etc. Income from a job (s) or other pension (s). Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Web december 30, 2022. This lets people know how much in federal income taxes should be withheld from payments. How do i fill this out? It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs.

Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Take it line by line. Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who. How do i fill this out? Income from a job (s) or other pension (s). It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs. The first part of the form is the worksheet and you can keep that for your record. Name, address, and then single, married, etc. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. You can have income tax withheld from all of those sources of income or you can make periodic payments.

You can have income tax withheld from all of those sources of income or you can make periodic payments. The first part of the form is the worksheet and you can keep that for your record. Web december 30, 2022. There are several ways to obtain the form. It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs. Income from a job (s) or other pension (s). Take it line by line. This lets people know how much in federal income taxes should be withheld from payments. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who.

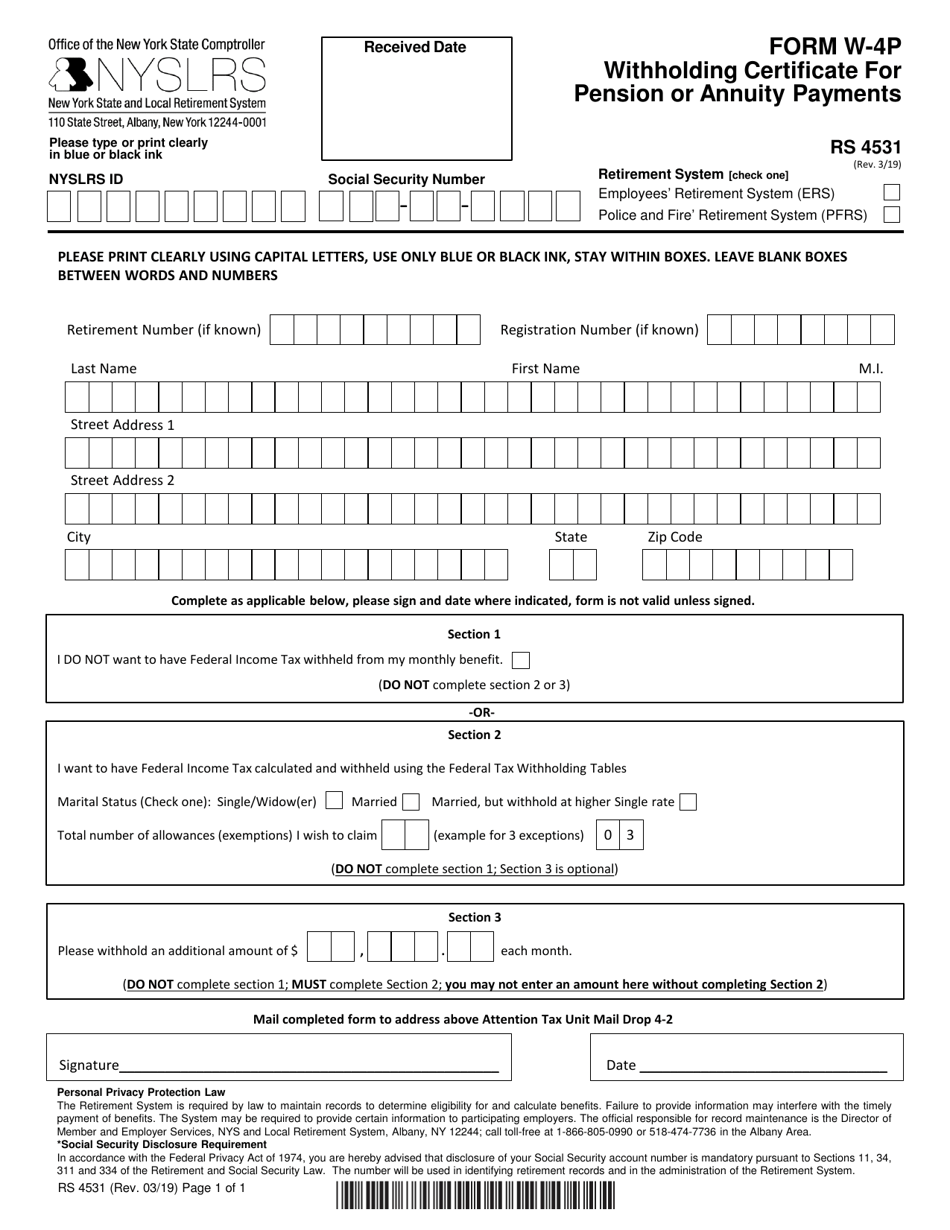

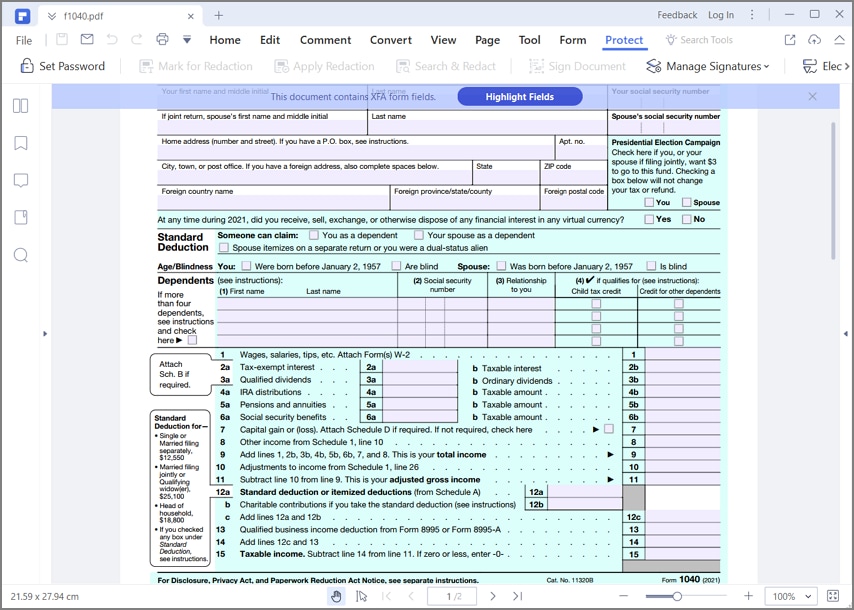

Form W4P (RS4531) Fill Out, Sign Online and Download Fillable PDF

The first part of the form is the worksheet and you can keep that for your record. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. This lets people know how much in federal income taxes should be withheld from payments. Web december 30, 2022. Income from a job (s) or other pension.

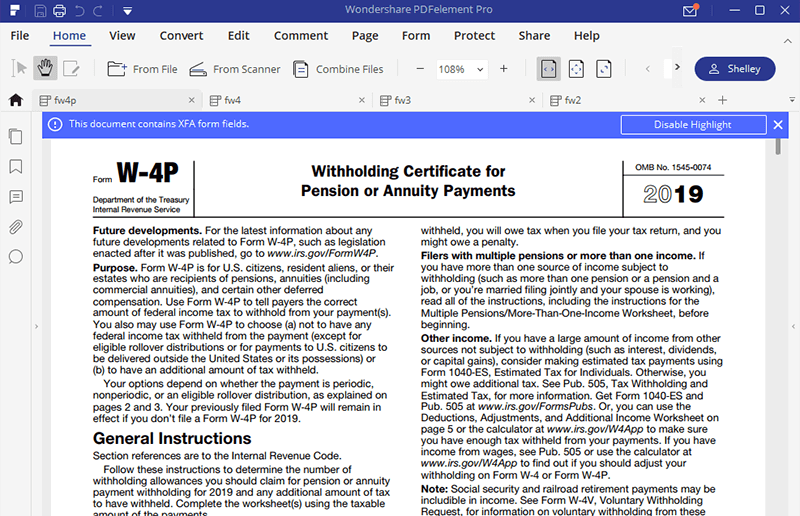

IRS Form W4P Fill it out in an Efficient Way

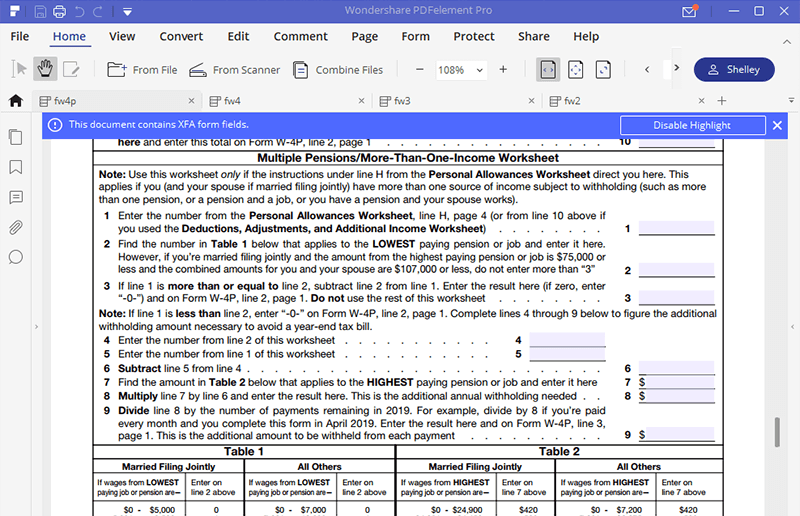

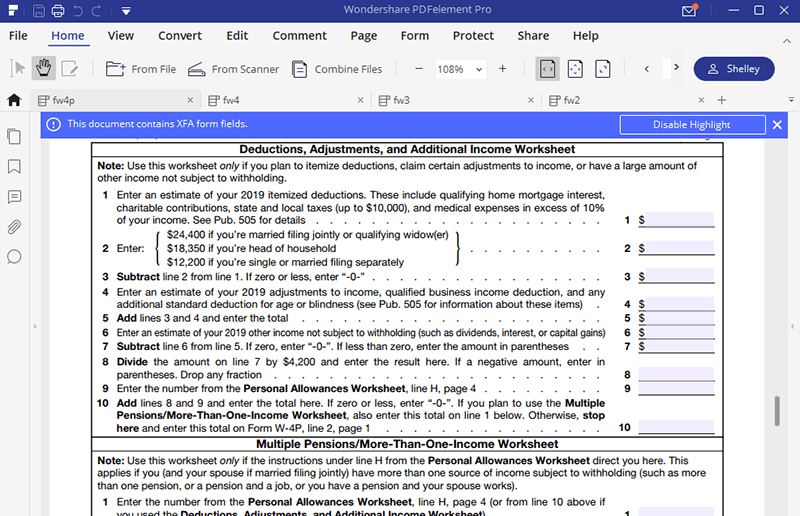

Income from a job (s) or other pension (s). How do i fill this out? You can have income tax withheld from all of those sources of income or you can make periodic payments. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. Take it line by line.

IRS Form W4P Fill it out in an Efficient Way

You can have income tax withheld from all of those sources of income or you can make periodic payments. Web december 30, 2022. This lets people know how much in federal income taxes should be withheld from payments. How do i fill this out? Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it.

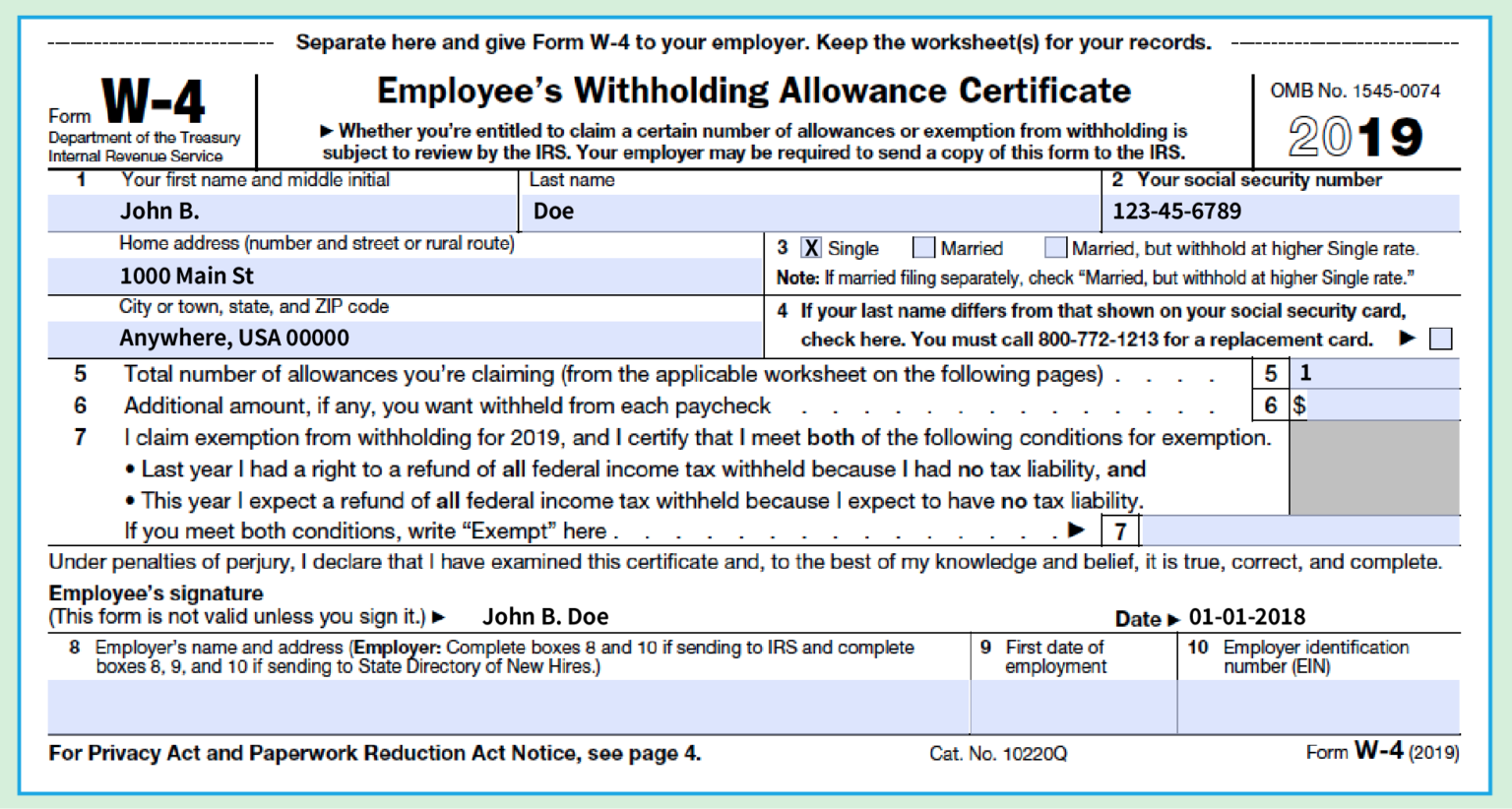

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

There are several ways to obtain the form. Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who. Take it line by line. It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent.

IRS Form W4P Fill it out in an Efficient Way

It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. Web december 30, 2022. Name, address, and then single, married, etc. You can have income tax withheld from all of those sources.

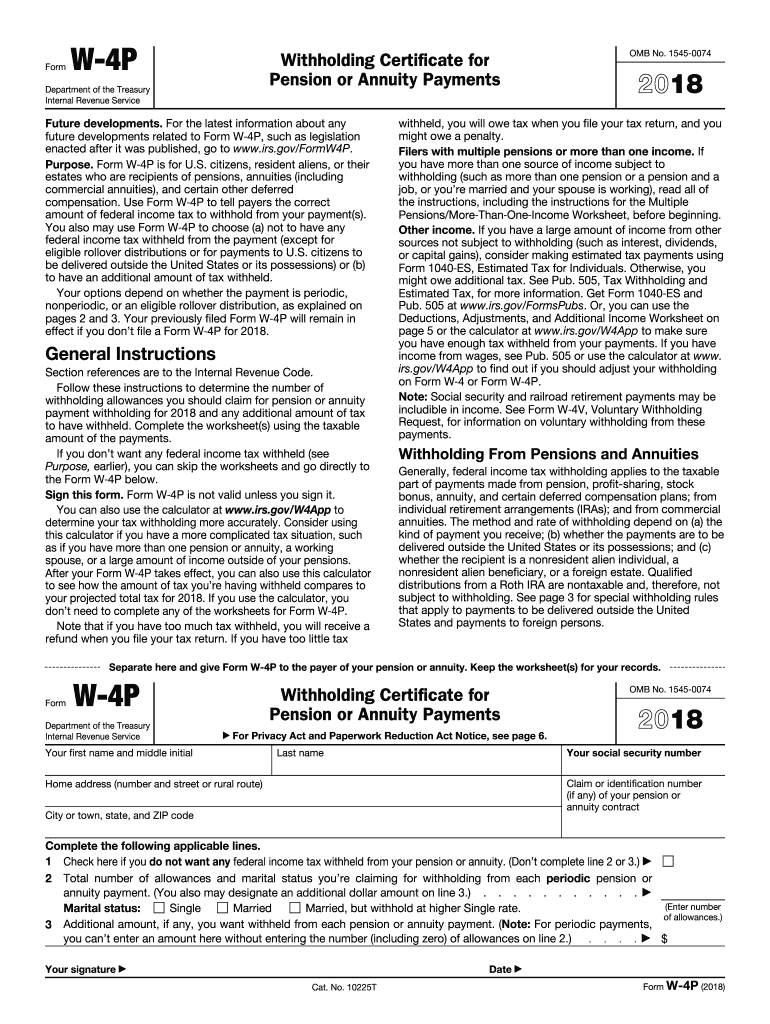

2018 Form IRS W4P Fill Online, Printable, Fillable, Blank pdfFiller

How do i fill this out? The first part of the form is the worksheet and you can keep that for your record. Take it line by line. Name, address, and then single, married, etc. You can have income tax withheld from all of those sources of income or you can make periodic payments.

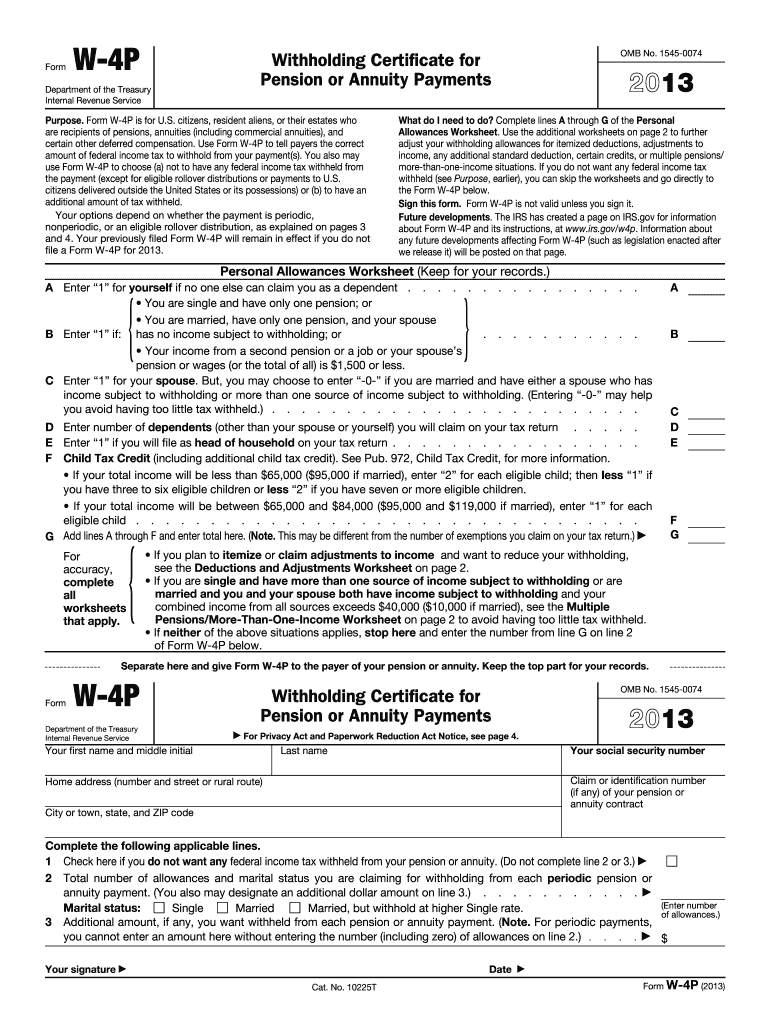

2013 Form IRS W4P Fill Online, Printable, Fillable, Blank pdfFiller

You can have income tax withheld from all of those sources of income or you can make periodic payments. How do i fill this out? Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who. There are several ways to obtain the.

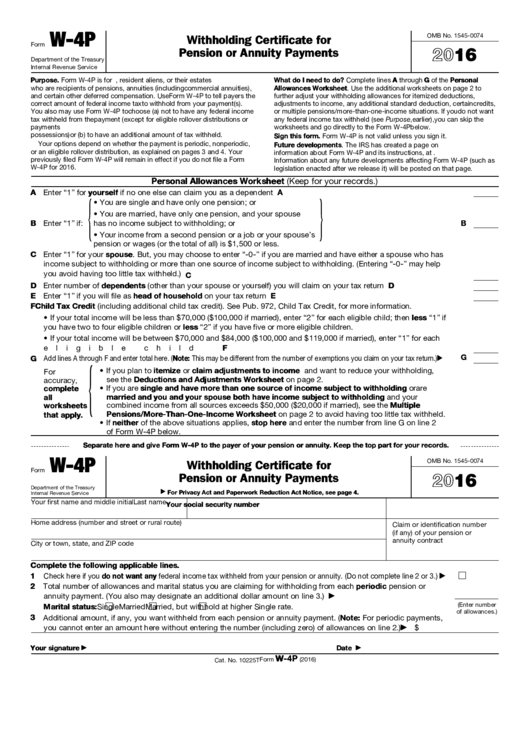

Fillable W 4p Form Printable Printable Forms Free Online

Income from a job (s) or other pension (s). Name, address, and then single, married, etc. Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable..

IRS Form W4P Fill it out in an Efficient Way

Take it line by line. The first part of the form is the worksheet and you can keep that for your record. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. There are several ways to obtain the form. This lets people know how much in federal income taxes should be withheld from.

W4 Form 2022 Instructions W4 Forms TaxUni

The first part of the form is the worksheet and you can keep that for your record. It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs. Name, address, and then single, married, etc. Income from a job (s) or other pension (s). How do i fill this.

You Can Have Income Tax Withheld From All Of Those Sources Of Income Or You Can Make Periodic Payments.

There are several ways to obtain the form. Web this form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. Income from a job (s) or other pension (s). Web december 30, 2022.

This Lets People Know How Much In Federal Income Taxes Should Be Withheld From Payments.

Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Name, address, and then single, married, etc. Take it line by line. How do i fill this out?

The First Part Of The Form Is The Worksheet And You Can Keep That For Your Record.

It is requested by your pension/retirement account administrator and is only sent back to them, it is never sent to the irs. Smith official 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who.