How To Fill Out Onlyfans Tax Form

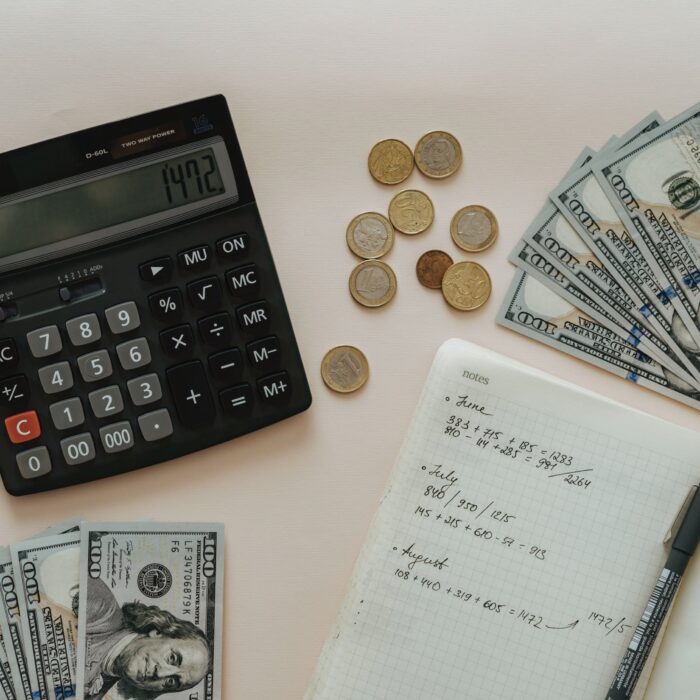

How To Fill Out Onlyfans Tax Form - Web watch on how do you fill out the onlyfans w9 form? You will get a form that you have to fill out. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you look at your screen or if you’re reading the. The purpose of the document is to prove to the platform that the. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive. Your earnings will be taxed at a flat rate. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. This form shows how much money you made from. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made.

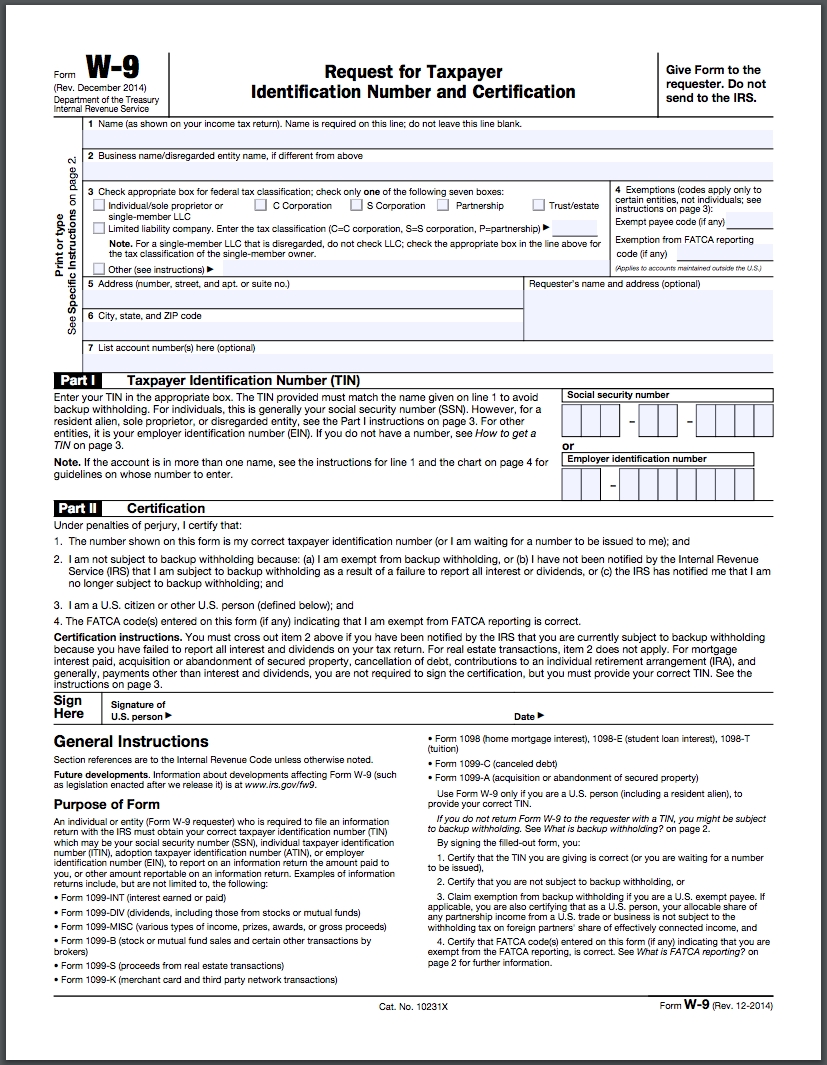

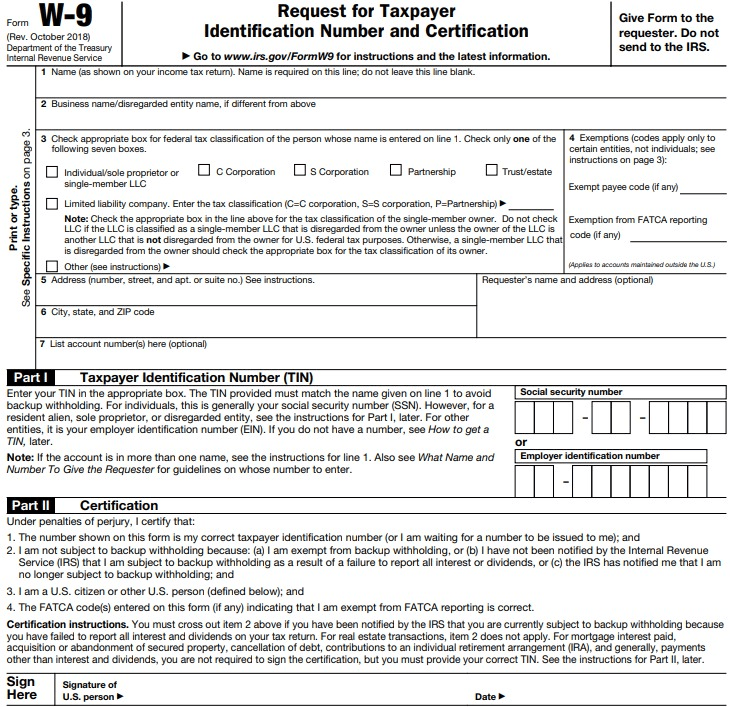

If you somehow lost your onlyfans 1099 form, you can download a copy. In this video, i show you how i file my onlyfans taxes and provide tips and. Web if a person has received funds from an estate or trust, they will need to report those funds via a w9 tax form. Web how and where to get tax forms for onlyfans creators? Web watch on how do you fill out the onlyfans w9 form? Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with. Here’s a breakdown of some of the most important ones: When it comes to obtaining tax forms for your onlyfans taxes, there are a few important steps to. You will get a form that you have to fill out. Your earnings will be taxed at a flat rate.

If you somehow lost your onlyfans 1099 form, you can download a copy. Click on the “settings” button and select. Web how and where to get tax forms for onlyfans creators? When it comes to obtaining tax forms for your onlyfans taxes, there are a few important steps to. This form is commonly used by u.s. Web watch on how do you fill out the onlyfans w9 form? If you look at your screen or if you’re reading the. Your earnings will be taxed at a flat rate. Below we have mentioned steps that you have to follow to file onlyfans taxes. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you receive.

W 9 Form 2020 Printable Free Blank Calendar Template Printable

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If you look at your screen or if you’re reading the. Businesses to request the taxpayer identification. Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. In this.

Onlyfans Tax Form Canada » Veche.info 17

Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Businesses to request the taxpayer identification. Web watch on how do you fill out the onlyfans w9 form? Web to fill out the only fans tax form accurately, follow these simple steps: Web the 1040 form is.

How to file OnlyFans taxes (W9 and 1099 forms explained)

Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with. You will get a form that you have to fill out. Login to your only fans account and go to your profile page. To fill out the onlyfans w9 form, you will need to provide your legal name, address, and social.

Third Party Sick Pay W2 slidesharetrick

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web how and where to get tax forms for onlyfans creators? This form shows how much money you made from. You will get a form that you have to fill out. Businesses.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Login to your only fans account and go to your profile page. While a trust or estate does not have to issue a payment,. This form is commonly used by u.s. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Click on the.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

While a trust or estate does not have to issue a payment,. Click on the “settings” button and select. If you are an onlyfans content creator and your business has earned us$400 or more during the tax year, you must file a 1099. Web to fill out the only fans tax form accurately, follow these simple steps: If you somehow.

How To File Taxes For Onlyfans

Web how and where to get tax forms for onlyfans creators? While a trust or estate does not have to issue a payment,. Below we have mentioned steps that you have to follow to file onlyfans taxes. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

If you somehow lost your onlyfans 1099 form, you can download a copy. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Here’s a breakdown of some of the most important ones: Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive.

How to file OnlyFans taxes (W9 and 1099 forms explained)

If you somehow lost your onlyfans 1099 form, you can download a copy. Web watch on how do you fill out the onlyfans w9 form? Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. In this article, learn the top 15 tax deductions.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

In this article, learn the top 15 tax deductions an of creator can take to reduce tax. If you are an onlyfans content creator and your business has earned us$400 or more during the tax year, you must file a 1099. This form is commonly used by u.s. Web watch on how do you fill out the onlyfans w9 form?.

Web When It Comes To Taxes For Onlyfans Creators, There Are Several Forms You Need To Be Familiar With.

This form is commonly used by u.s. Web watch on how do you fill out the onlyfans w9 form? You will get a form that you have to fill out. Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit a personal tax return.

Web If A Person Has Received Funds From An Estate Or Trust, They Will Need To Report Those Funds Via A W9 Tax Form.

Web onlyfans will not send you any sort of income document so you just use your own records of how much you made. Click on the “settings” button and select. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. They will provide you with a.

Web If You Are Resident In The United States And Earn More Than $600 From Onlyfans, You Should Receive A 1099 Form From The Different Brands You Receive.

Login to your only fans account and go to your profile page. This form shows how much money you made from. If you look at your screen or if you’re reading the. In this video, i show you how i file my onlyfans taxes and provide tips and.

If You Are An Onlyfans Content Creator And Your Business Has Earned Us$400 Or More During The Tax Year, You Must File A 1099.

Web steps on how to file onlyfans taxes. If you somehow lost your onlyfans 1099 form, you can download a copy. To fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or. Your earnings will be taxed at a flat rate.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)