Illinois Form Il-1120-St Instructions 2022

Illinois Form Il-1120-St Instructions 2022 - Easily fill out pdf blank, edit, and sign them. This home was built in 1885 and last. Download past year versions of this tax form. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web open the illinois 1120 st instructions 2022 and follow the instructions easily sign the illinois 1120 with your finger send filled & signed illinois form 1120 st instructions 2022 or save. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Illinois department of revenue, p.o. Enjoy smart fillable fields and. The 2,456 square feet single family home is a 4 beds, 4 baths property. Web up to $40 cash back fill il 1120 st instructions, edit online.

This form is for income earned in tax year 2022, with tax returns due in april. For all other situations, see instructions to determine the correct form to use. For tax years ending before december 31, 2022, use the 2021. Enjoy smart fillable fields and. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Illinois department of revenue, p.o. This home was built in 1885 and last. Web oficial use only if you make your payment electronically, do not file this form. Web open the illinois 1120 st instructions 2022 and follow the instructions easily sign the illinois 1120 with your finger send filled & signed illinois form 1120 st instructions 2022 or save. The 2,456 square feet single family home is a 4 beds, 4 baths property.

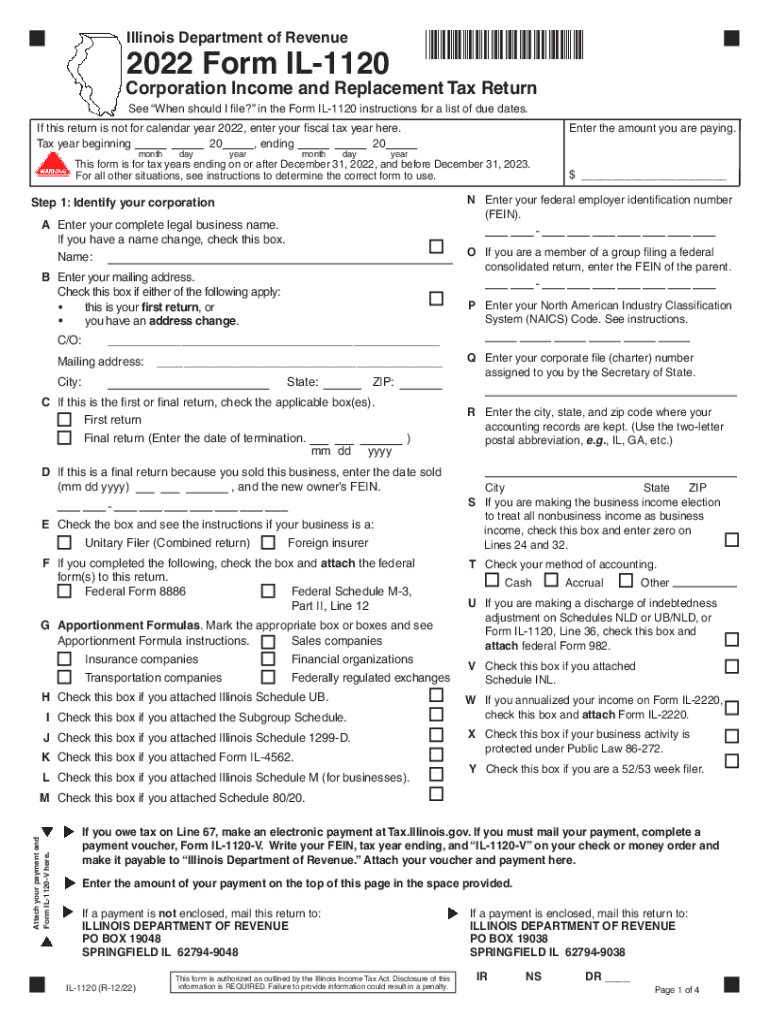

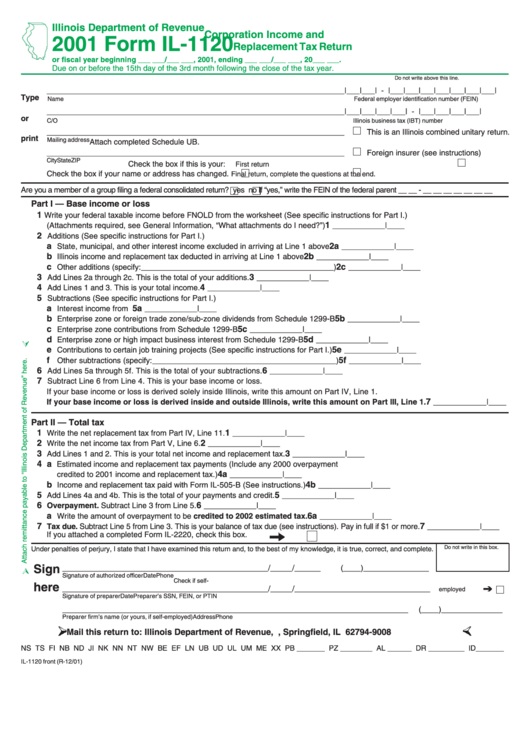

Illinois department of revenue, p.o. Get your online template and fill it in using progressive features. The 2,456 square feet single family home is a 4 beds, 4 baths property. Save or instantly send your ready documents. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Web up to $40 cash back fill il 1120 st instructions, edit online. Web oficial use only if you make your payment electronically, do not file this form. Corporation income and replacement tax return. Download past year versions of this tax form. See “when should i file?” in.

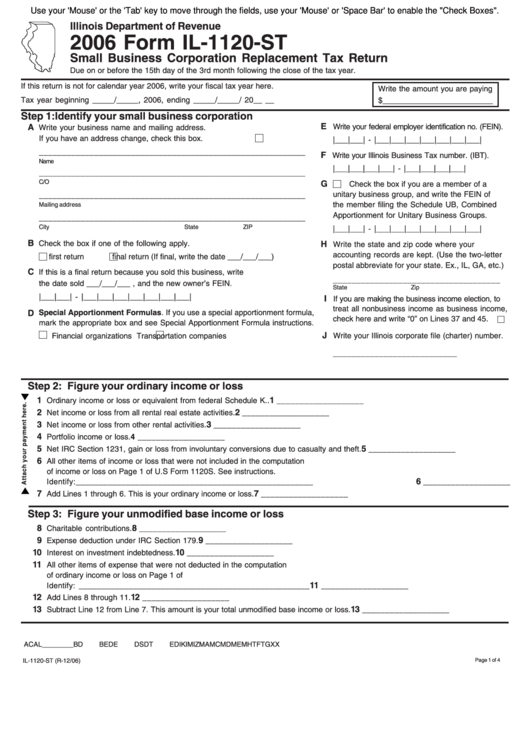

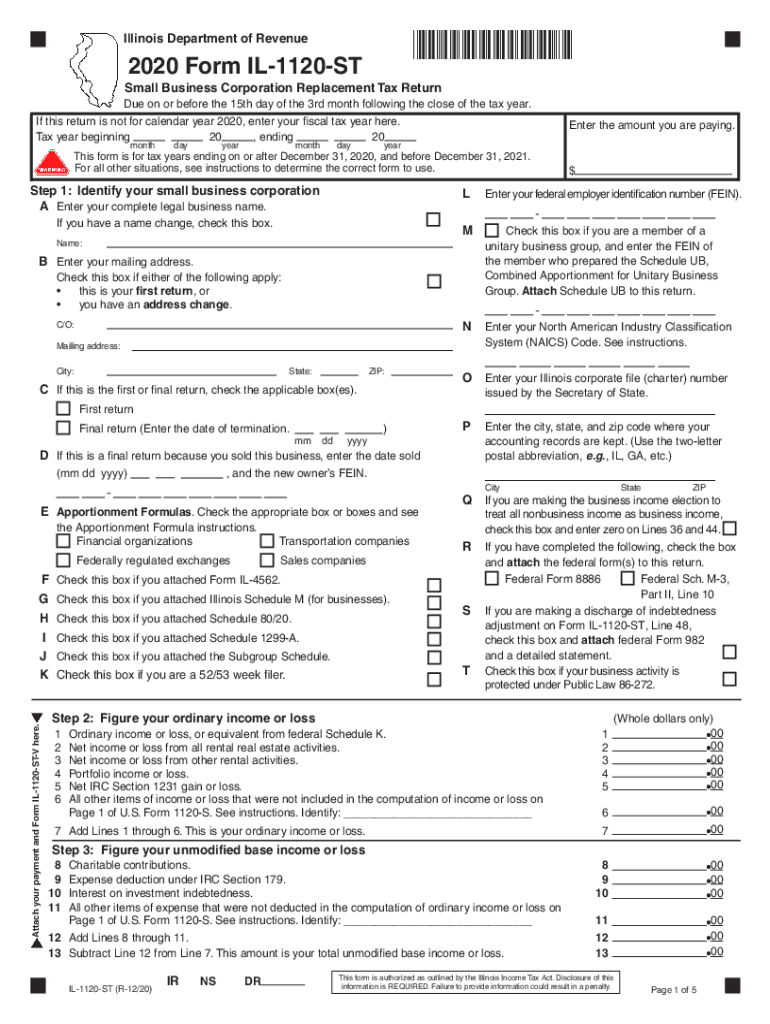

Fillable Form Il1120St Small Business Corporation Replacement Tax

Corporation income and replacement tax return. This home was built in 1885 and last. Enjoy smart fillable fields and. This form is for income earned in tax year 2022, with tax returns due in april. For all other situations, see instructions to determine the correct form to use.

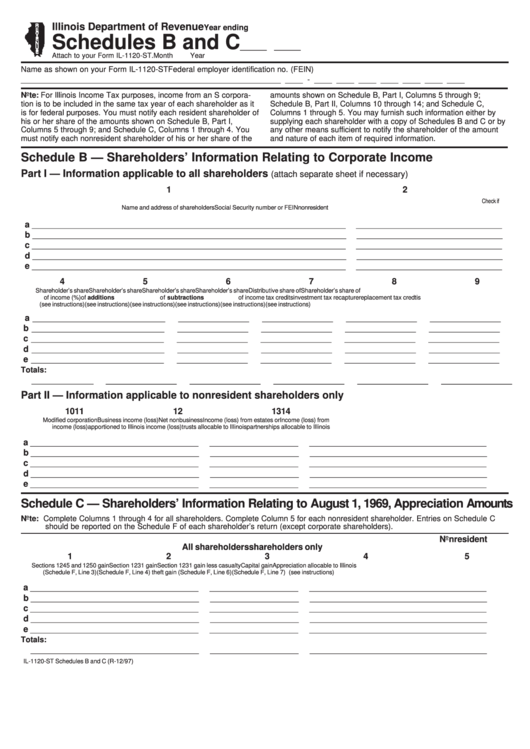

Fillable Form Il1120St Schedules B And C Shareholders

Web open the illinois 1120 st instructions 2022 and follow the instructions easily sign the illinois 1120 with your finger send filled & signed illinois form 1120 st instructions 2022 or save. This form is for income earned in tax year 2022, with tax returns due in april. Web this form is for tax years ending on or after december.

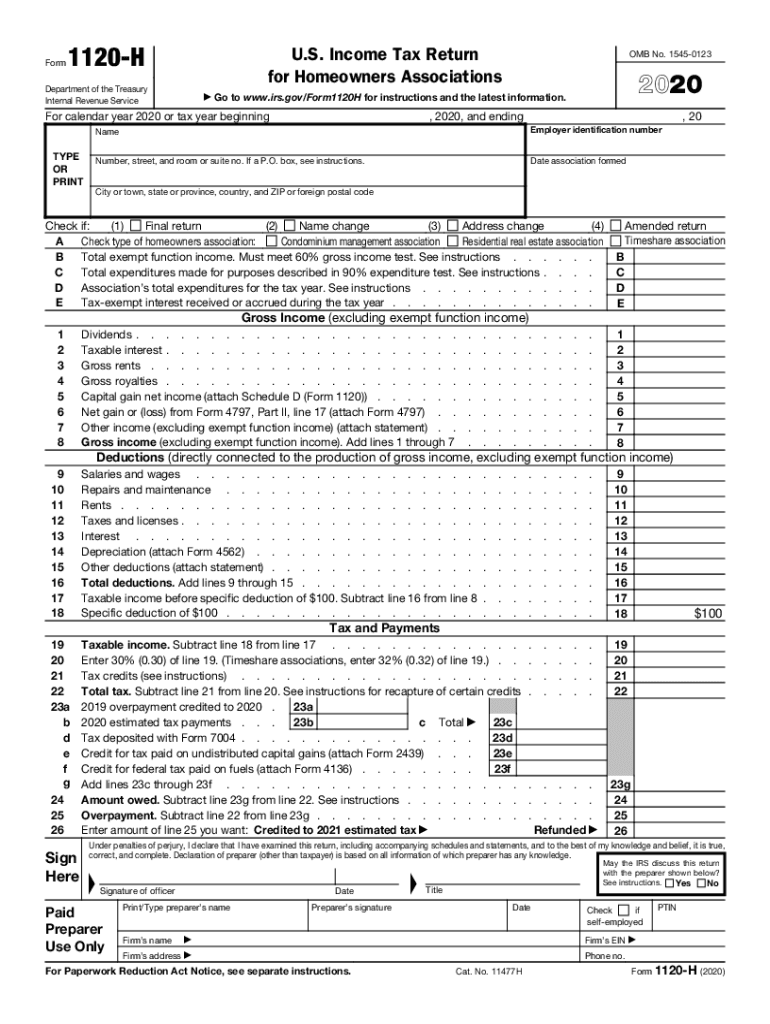

Form 1120 Fill out & sign online DocHub

The 2,456 square feet single family home is a 4 beds, 4 baths property. For all other situations, see instructions to determine the correct form to use. This form is for income earned in tax year 2022, with tax returns due in april. Web this form is for tax years ending on or after december 31, 2022, and before december.

Il 1120 Fill Out and Sign Printable PDF Template signNow

See “when should i file?” in. Corporation income and replacement tax return. Easily fill out pdf blank, edit, and sign them. Enjoy smart fillable fields and. Web oficial use only if you make your payment electronically, do not file this form.

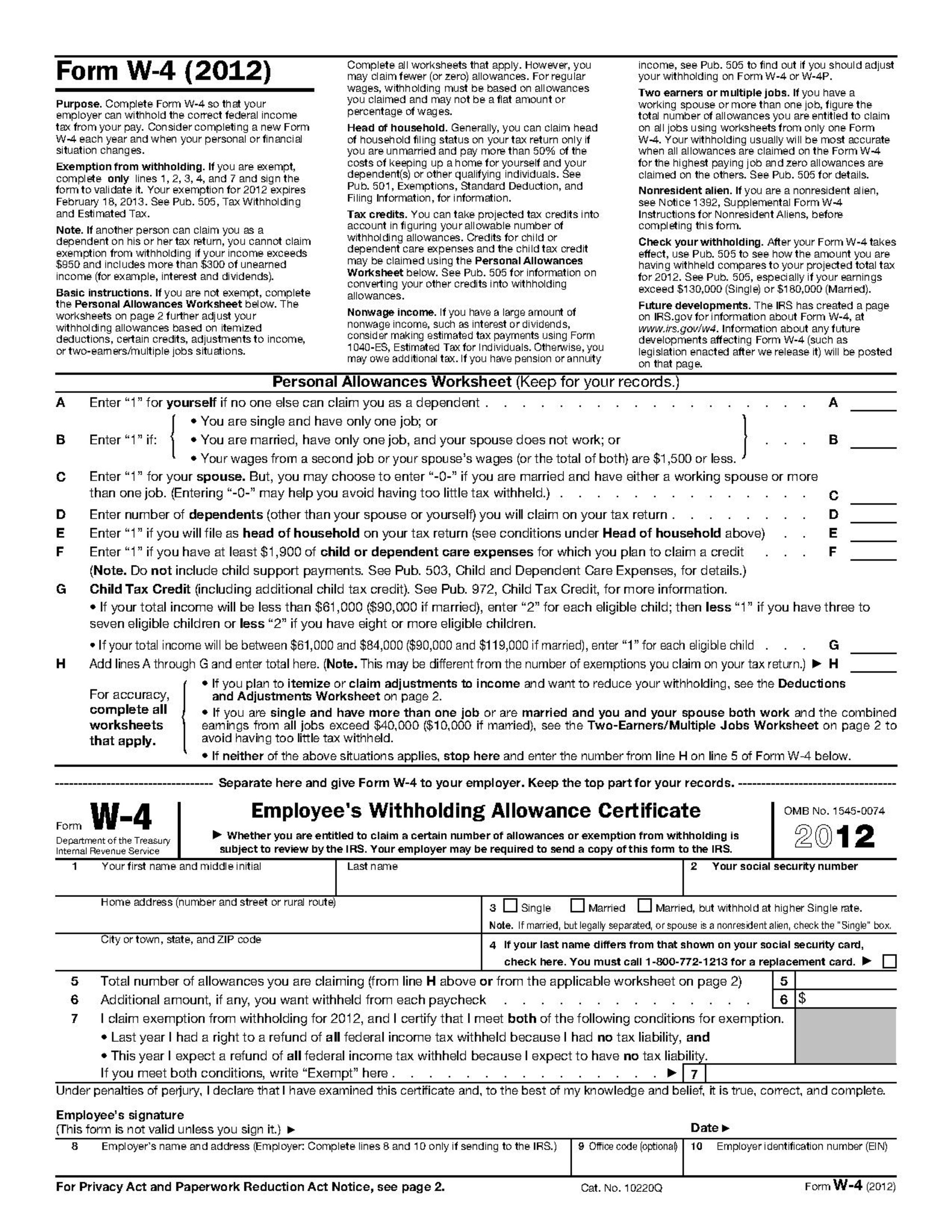

State Of Illinois W4 Form 2021 2022 W4 Form

This home was built in 1885 and last. This form is for income earned in tax year 2022, with tax returns due in april. Download past year versions of this tax form. Web up to $40 cash back fill il 1120 st instructions, edit online. The 2,456 square feet single family home is a 4 beds, 4 baths property.

Il 1120 St Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. For tax years ending before december 31, 2022, use the 2021. Corporation income and replacement tax return. The 2,456 square feet single family home is a 4 beds, 4 baths property. This home was built in 1885 and last.

Form Il1120 Corporation And Replacement Tax Return 2001

This home was built in 1885 and last. Web ★ 4.8 satisfied 28 votes how to fill out and sign 2020 il il 1120 st online? Get your online template and fill it in using progressive features. For tax years ending before december 31, 2022, use the 2021. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller.

Il 1040X Instructions 2017 Fill Out and Sign Printable PDF Template

This home was built in 1885 and last. Enjoy smart fillable fields and. For tax years ending before december 31, 2022, use the 2021. This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents.

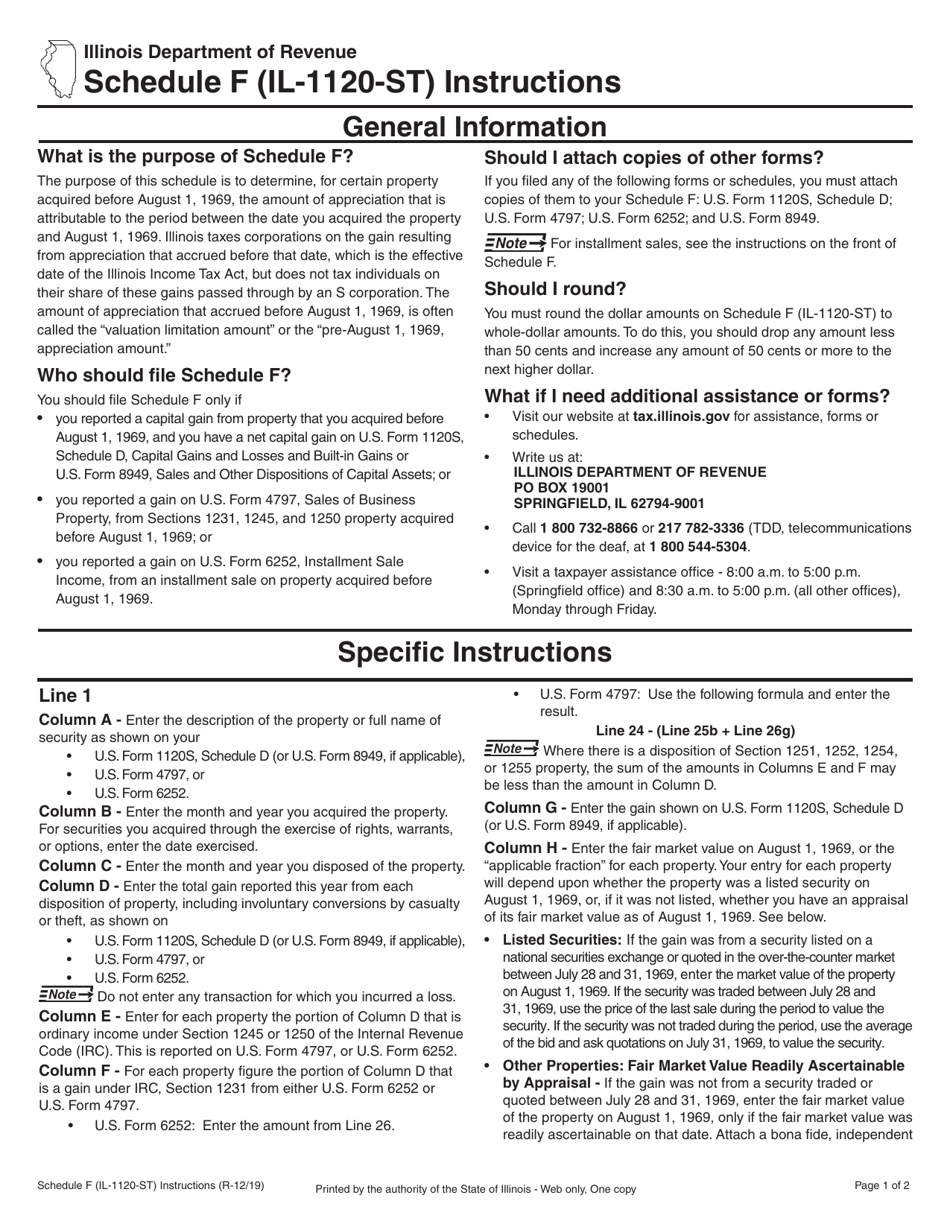

Download Instructions for Form IL1120ST Schedule F Gains From Sales

See “when should i file?” in. This form is for income earned in tax year 2022, with tax returns due in april. Download past year versions of this tax form. Web open the illinois 1120 st instructions 2022 and follow the instructions easily sign the illinois 1120 with your finger send filled & signed illinois form 1120 st instructions 2022.

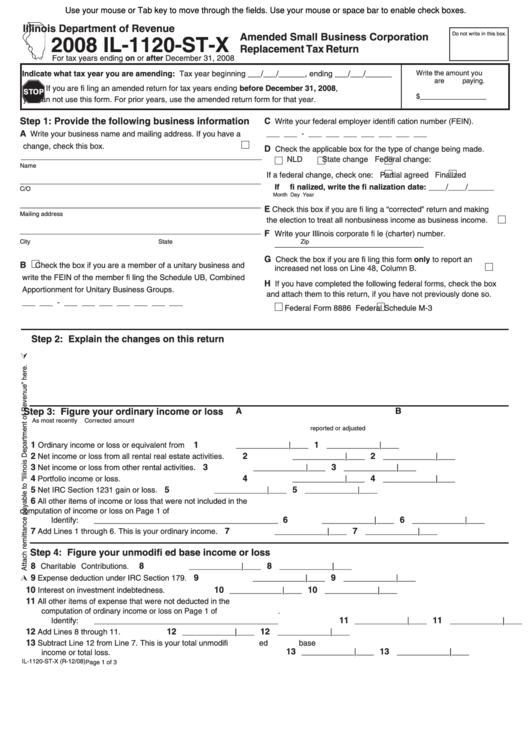

Fillable Form Il1120StX Amended Small Business

Easily fill out pdf blank, edit, and sign them. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web oficial use only if you make your payment electronically, do not file this form. For tax years ending before december 31, 2022, use the 2021. Download past year versions of this tax form.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

This form is for income earned in tax year 2022, with tax returns due in april. Enjoy smart fillable fields and. Web ★ 4.8 satisfied 28 votes how to fill out and sign 2020 il il 1120 st online? Corporation income and replacement tax return.

See “When Should I File?” In.

This home was built in 1885 and last. Download past year versions of this tax form. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Save or instantly send your ready documents.

Corporation Income And Replacement Tax Return.

Web oficial use only if you make your payment electronically, do not file this form. The 2,456 square feet single family home is a 4 beds, 4 baths property. Web up to $40 cash back fill il 1120 st instructions, edit online. Web open the illinois 1120 st instructions 2022 and follow the instructions easily sign the illinois 1120 with your finger send filled & signed illinois form 1120 st instructions 2022 or save.

Get Your Online Template And Fill It In Using Progressive Features.

For tax years ending before december 31, 2022, use the 2021. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. This form is for income earned in tax year 2022, with tax returns due in april. For all other situations, see instructions to determine the correct form to use.