Illinois Ptr Form

Illinois Ptr Form - For more information, see instructions frequently asked questions expand. Web the instructions include that: If you didn't, though, there's no need to worry. It’s easy, free, and you will. Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. No filing extensions are allowed. If you didn't, though, there's no need to worry. Web what is the illinois income and property tax rebates? Make sure to sign your form on. As a part of the illinois family relief plan, the illinois income and property tax rebates were announced on.

This form is for income earned in tax year 2022, with tax returns due in april. As a part of the illinois family relief plan, the illinois income and property tax rebates were announced on. Taxpayers eligible for both rebates will receive one. Enter your name, address, and social security number at the top of. Make sure to sign your form on. Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. It’s easy, free, and you will. For more information, see instructions frequently asked questions expand. No filing extensions are allowed. 17 to fill out the proper.

If you didn't, though, there's no need to worry. Web the instructions include that: Web what is the illinois income and property tax rebates? It’s easy, free, and you will. 17 to fill out the proper. If you didn't, though, there's no need to worry. Those seeking rebates have until oct. Make sure to sign your form on. Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one.

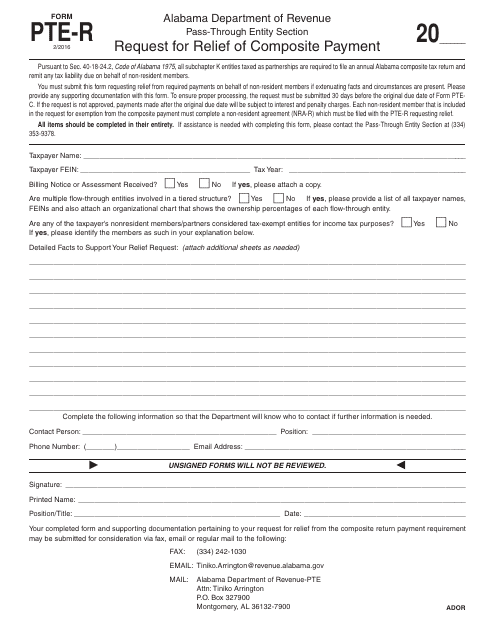

Form PTER Download Fillable PDF or Fill Online Request for Relief of

17 to fill out the proper. If you didn't, though, there's no need to worry. Taxpayers eligible for both rebates will receive one. It’s easy, free, and you will. No filing extensions are allowed.

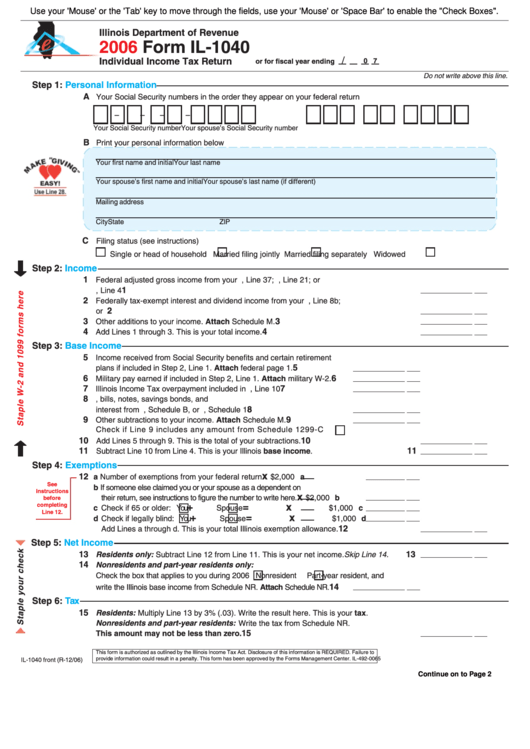

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

17 to fill out the proper. If you didn't, though, there's no need to worry. Enter your name, address, and social security number at the top of. This form is for income earned in tax year 2022, with tax returns due in april. As a part of the illinois family relief plan, the illinois income and property tax rebates were.

Fillable Form Il1040 Individual Tax Return 2006 printable

Web the instructions include that: It’s easy, free, and you will. If you didn't, though, there's no need to worry. Taxpayers eligible for both rebates will receive one. For more information, see instructions frequently asked questions expand.

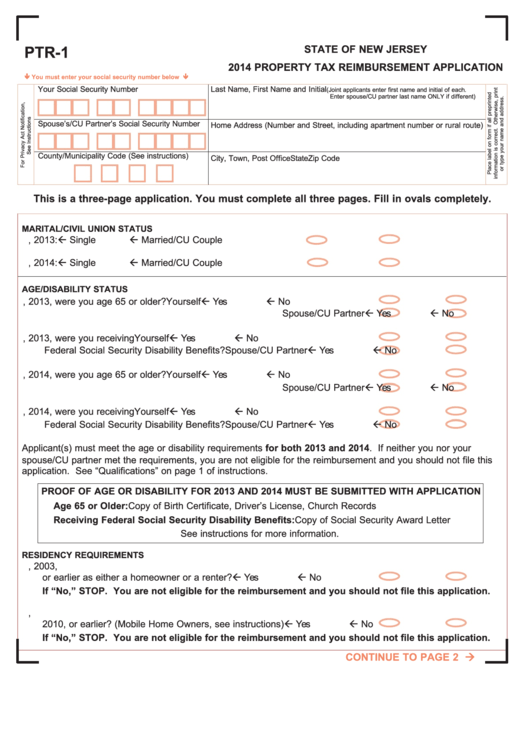

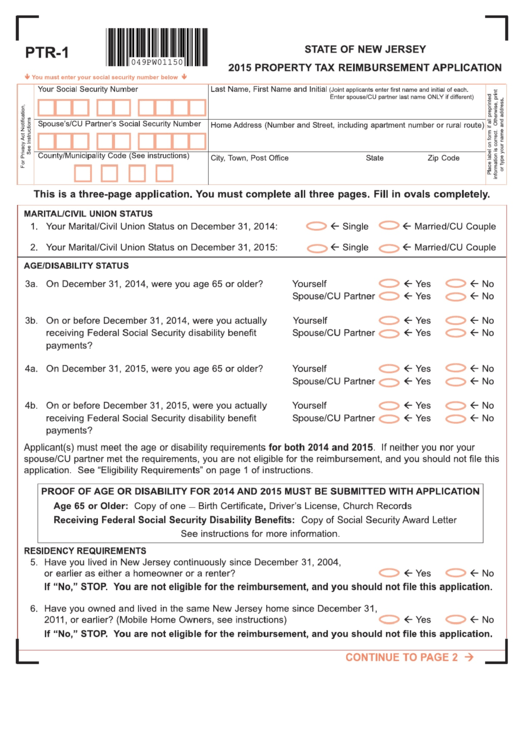

Fillable Form Ptr1 Property Tax Reimbursement Application 2014

This form is for income earned in tax year 2022, with tax returns due in april. Complete steps 1 and 2. Those seeking rebates have until oct. Taxpayers eligible for both rebates will receive one. Web what is the illinois income and property tax rebates?

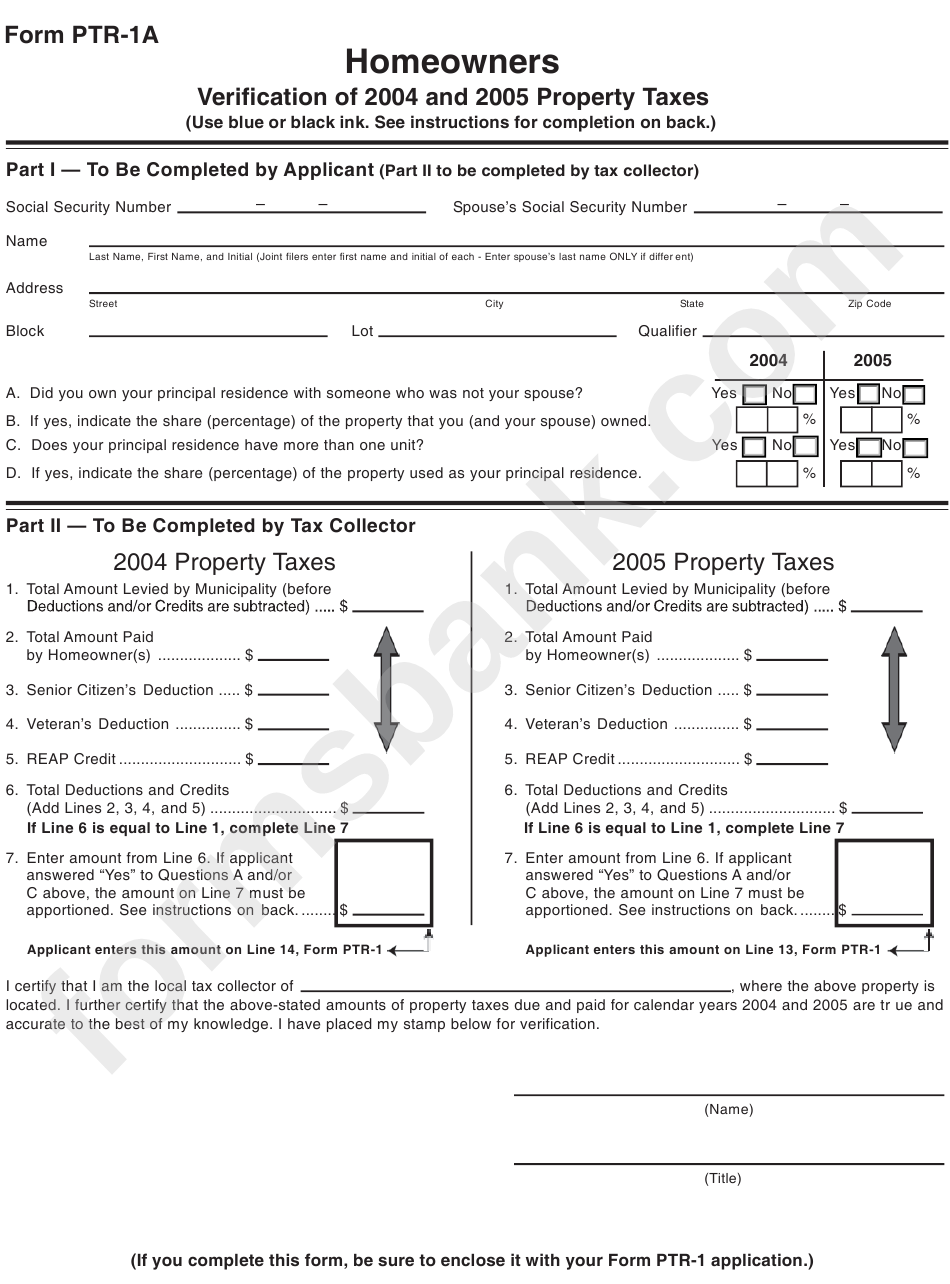

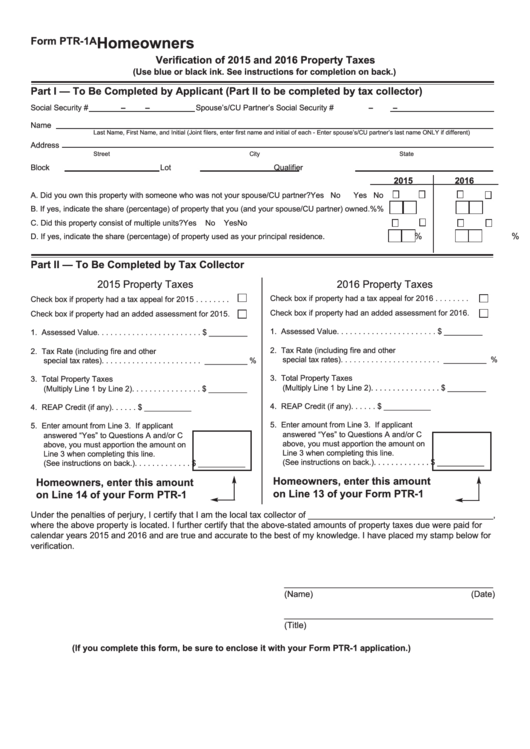

Form Ptr1a Homeowners Verification Of 2004 And 2005 Property Taxes

If you didn't, though, there's no need to worry. Complete steps 1 and 2. Enter your name, address, and social security number at the top of. Taxpayers eligible for both rebates will receive one. Those seeking rebates have until oct.

Fillable Form Ptr1 Property Tax Reimbursement Application 2015

Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. This form is for income earned in tax year 2022, with tax returns due in april. No filing extensions are allowed. Taxpayers eligible for both rebates will receive one..

Form Ptr1a Homeowners Verification Of 2015 And 2016 Property Taxes

This form is for income earned in tax year 2022, with tax returns due in april. 17 to fill out the proper. Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. Those seeking rebates have until oct. Web.

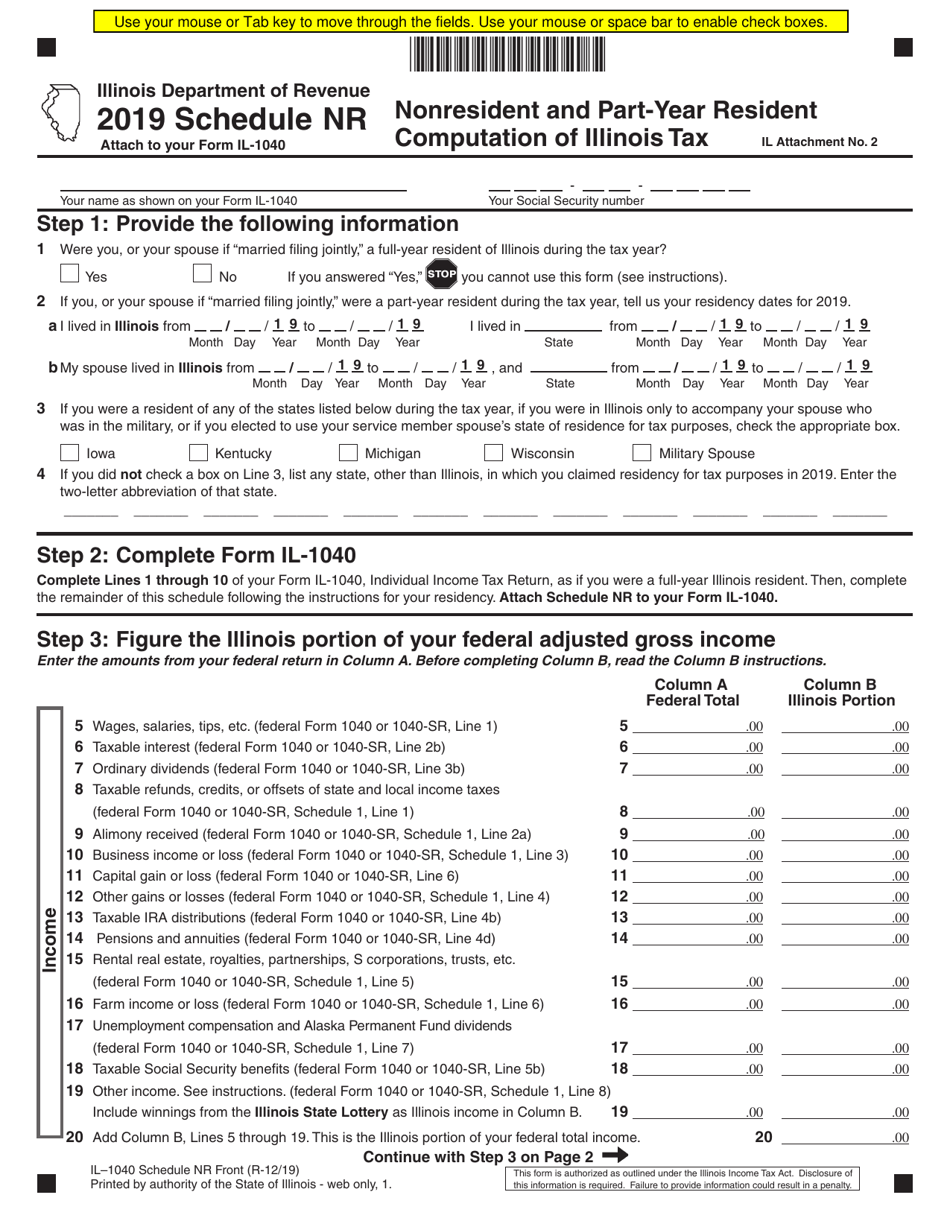

Form IL1040 Schedule NR Download Fillable PDF or Fill Online

Taxpayers eligible for both rebates will receive one. If you didn't, though, there's no need to worry. Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. Make sure to sign your form on. No filing extensions are allowed.

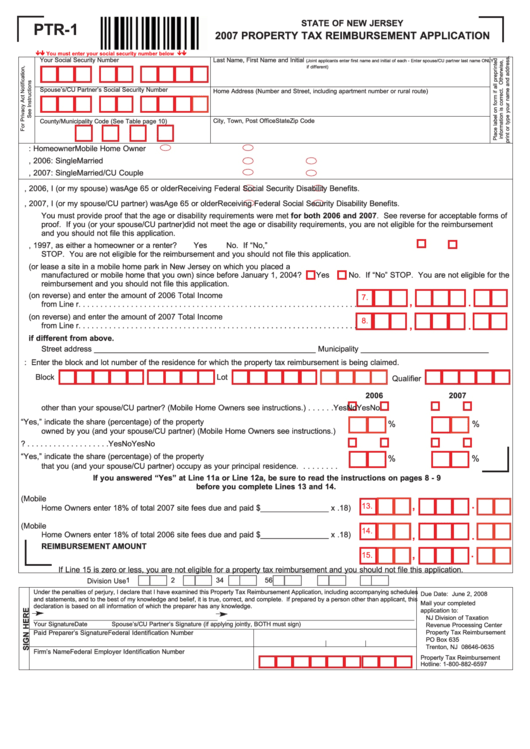

Fillable Form Ptr1 Property Tax Reimbursement Application 2007

Enter your name, address, and social security number at the top of. 17 to fill out the proper. For more information, see instructions frequently asked questions expand. As a part of the illinois family relief plan, the illinois income and property tax rebates were announced on. Taxpayers eligible for both rebates will receive one.

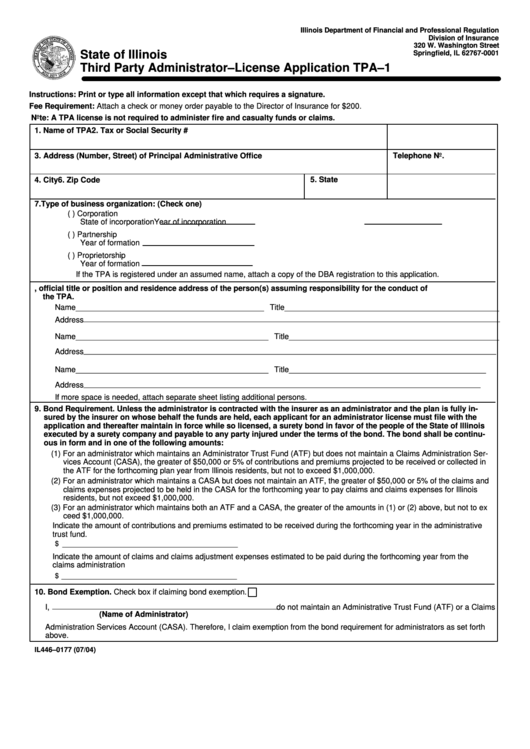

Fillable Form Il 4460177 State Of Illinois Third Party Administrator

No filing extensions are allowed. Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. It’s easy, free, and you will. Web what is the illinois income and property tax rebates? As a part of the illinois family relief.

Web What Is The Illinois Income And Property Tax Rebates?

Taxpayers eligible for both rebates will receive one. It’s easy, free, and you will. Those seeking rebates have until oct. Web the instructions include that:

17 To Fill Out The Proper.

Web older adults and retirees in illinois who were not required to file an illinois income tax return for 2021 are encouraged to claim their property tax rebate of up to. For more information, see instructions frequently asked questions expand. As a part of the illinois family relief plan, the illinois income and property tax rebates were announced on. Enter your name, address, and social security number at the top of.

If You Didn't, Though, There's No Need To Worry.

Make sure to sign your form on. This form is for income earned in tax year 2022, with tax returns due in april. If you didn't, though, there's no need to worry. No filing extensions are allowed.

Taxpayers Eligible For Both Rebates Will Receive One.

Complete steps 1 and 2.