Illinois State Tax Withholding Form

Illinois State Tax Withholding Form - However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Gambling or lottery winnings in illinois paid to an illinois resident; Request certain forms from idor. Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. The new form has replaced withholding allowances with a five step process for determining employee withholding. When does my form il‐w‐4 take effect? However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year.

Request certain forms from idor. The new form has replaced withholding allowances with a five step process for determining employee withholding. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Gambling or lottery winnings in illinois paid to an illinois resident; Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. When does my form il‐w‐4 take effect? However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year.

The new form has replaced withholding allowances with a five step process for determining employee withholding. Gambling or lottery winnings in illinois paid to an illinois resident; However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Request certain forms from idor. When does my form il‐w‐4 take effect? Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year.

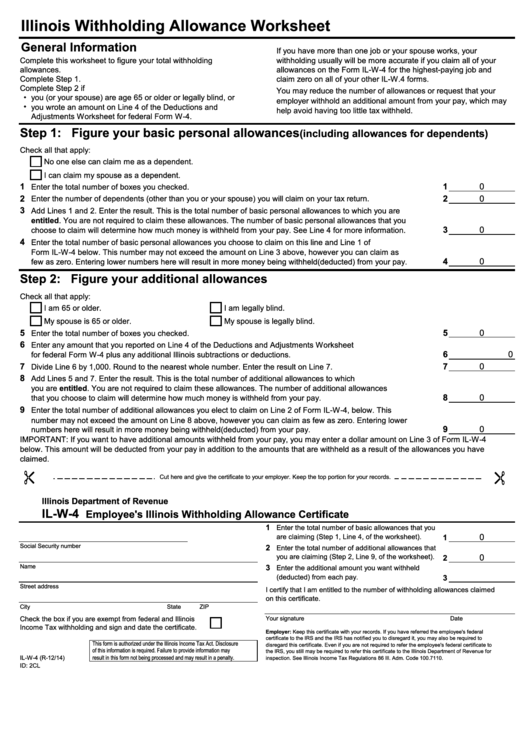

Form IlW4 Illinois Withholding Allowance Worksheet printable pdf

Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Gambling or lottery winnings.

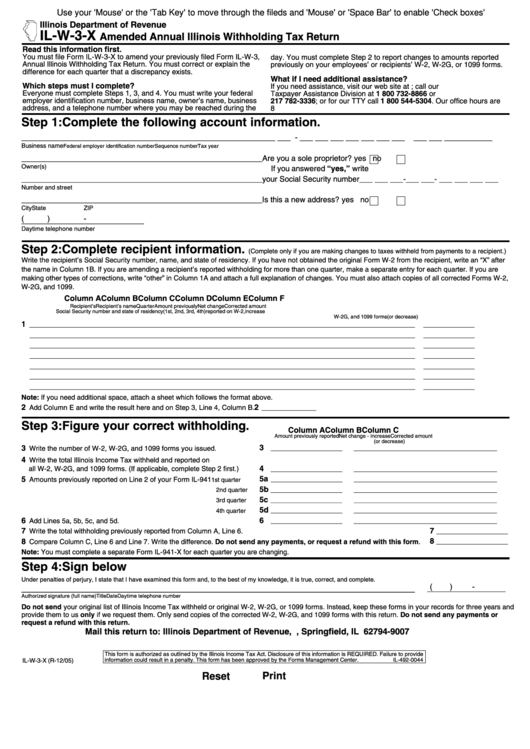

Fillable Form IlW3X Amended Annual Illinois Withholding Tax Return

Gambling or lottery winnings in illinois paid to an illinois resident; However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Request certain forms from idor. Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. However, the death of a spouse or a.

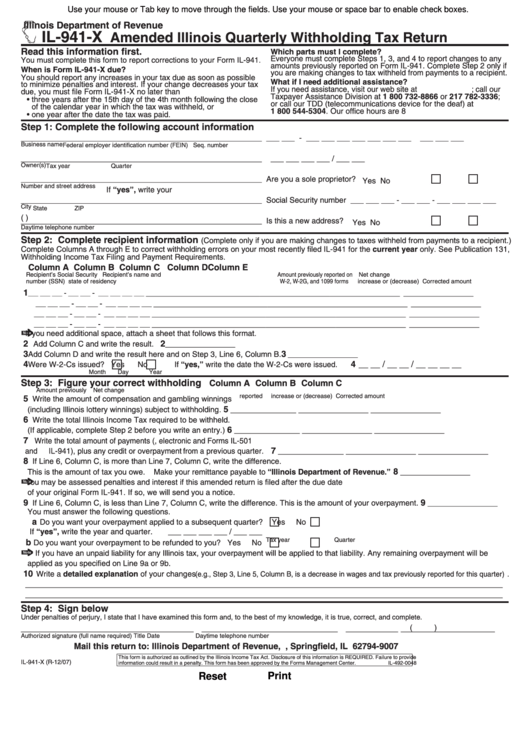

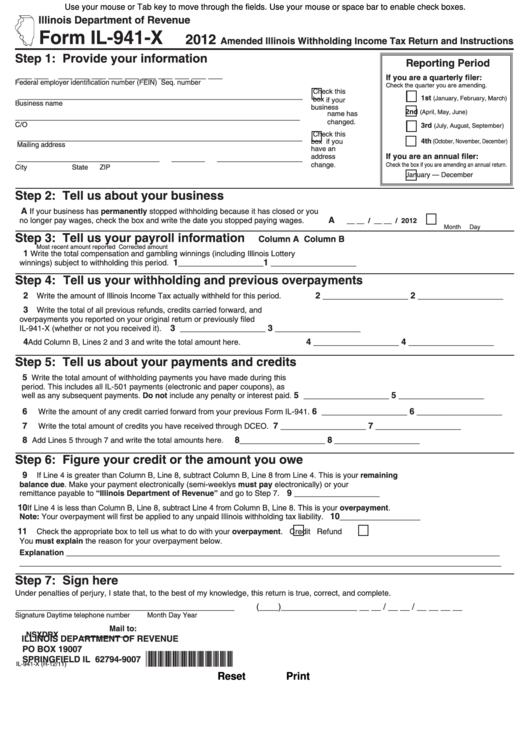

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

Gambling or lottery winnings in illinois paid to an illinois resident; The new form has replaced withholding allowances with a five step process for determining employee withholding. Request certain forms from idor. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. When does my form il‐w‐4 take effect?

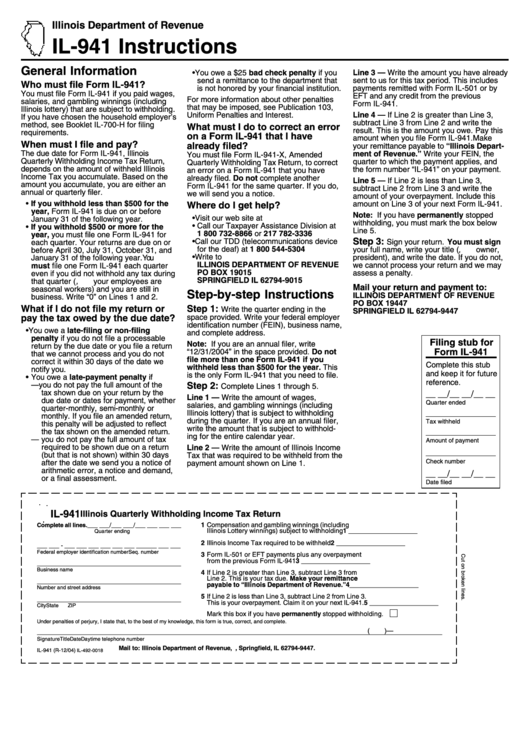

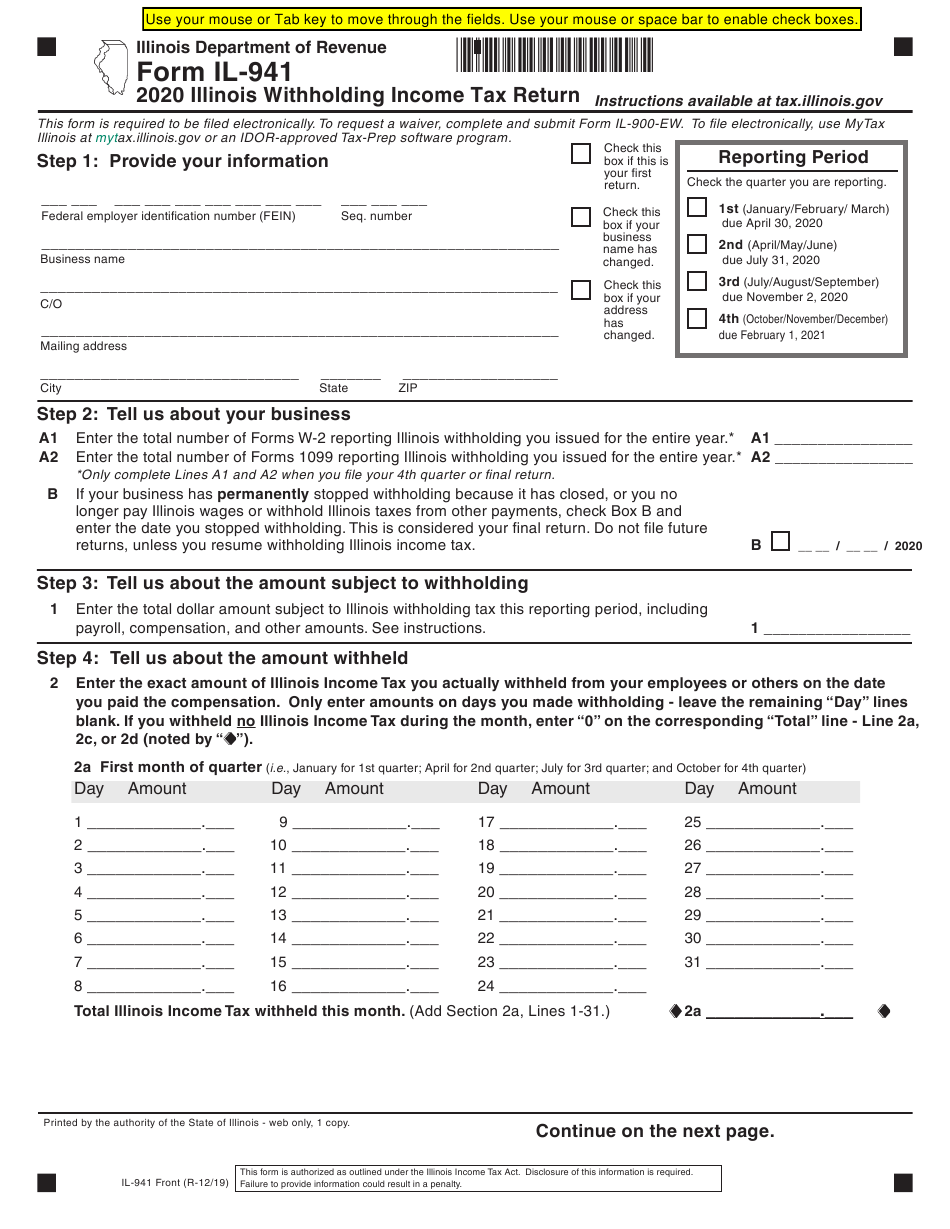

Form Il941 Illinois Quarterly Withholding Tax Return 2004

The new form has replaced withholding allowances with a five step process for determining employee withholding. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. Gambling or lottery winnings in illinois paid to.

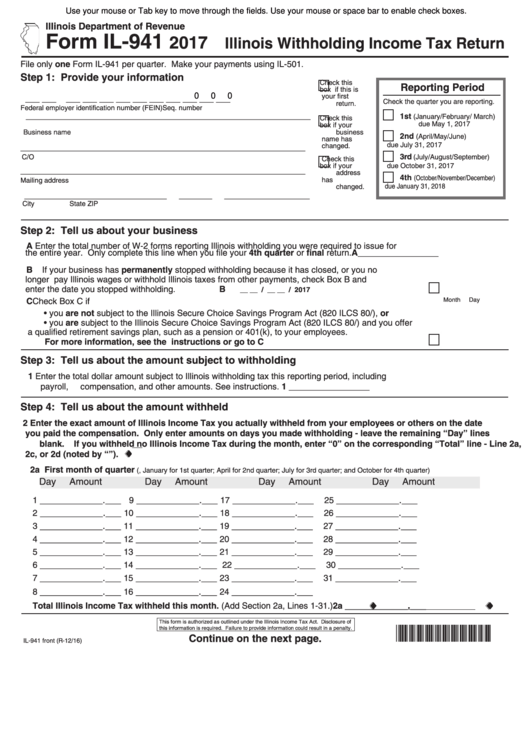

Fillable Form Il941 Illinois Withholding Tax Return 2017

Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. When does my form il‐w‐4 take effect? However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. However, the death of a spouse or a dependent does not affect your withholding allowances until the.

Form Il941X Amended Illinois Withholding Tax Return And

However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. When does my form il‐w‐4 take effect? Gambling or lottery winnings in illinois paid to an illinois resident; However, the death of a spouse.

30++ Personal Allowances Worksheet Worksheets Decoomo

The new form has replaced withholding allowances with a five step process for determining employee withholding. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Gambling or lottery winnings in illinois paid to an illinois resident; However, the death of a spouse or a dependent does not affect your.

The Caucus Blog of the Illinois House Republicans Calculating

However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Request certain forms from idor. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Web illinois services withholding income tax web filing file withholding income taxes online with mytax.

2021 Illinois Withholding Form 2022 W4 Form

However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. The new form has replaced withholding allowances with a five step process for determining employee withholding. However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. When does my form.

Illinois Tax Tables

The new form has replaced withholding allowances with a five step process for determining employee withholding. When does my form il‐w‐4 take effect? However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. Gambling or lottery winnings in illinois paid to an illinois resident; However, the death of a spouse.

However, The Death Of A Spouse Or A Dependent Does Not Affect Your Withholding Allowances Until The Next Tax Year.

Web illinois services withholding income tax web filing file withholding income taxes online with mytax illinois. Request certain forms from idor. Gambling or lottery winnings in illinois paid to an illinois resident; When does my form il‐w‐4 take effect?

However, The Death Of A Spouse Or A Dependent Does Not Affect Your Withholding Allowances Until The Next Tax Year.

However, the death of a spouse or a dependent does not affect your withholding allowances until the next tax year. The new form has replaced withholding allowances with a five step process for determining employee withholding.