Instagram 1099 Form

Instagram 1099 Form - Web ig is not required, under its registration as a retail foreign exchange dealer with the national futures association (nfa) and commodity futures trading commission. Web quick fix what’s the quick fix to this? Web how to create forms for instagram. Web march 29, 2023, at 9:49 a.m. For tax year 2020 or a prior year, entities or people who have paid you money during the year (but who are not your employer) will. Talk to your tax professional about it, but it needs to be included either as other income or as a part. Start reporting your instagram income. Web when a company pays a contractor or individual more than $600 a year, they have to file at 1099 at tax time. Web to get the published link, just edit your form and go to the publish tab, then on the quick share link, get the url and you can share that anywhere you link. This information only applies to a us person as defined by the irs.

Web quick fix what’s the quick fix to this? There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is. Web your 1099 tax form will be sent to you by january 31, 2023 (note: Item sales reports about item level details for each order. Web when a company pays a contractor or individual more than $600 a year, they have to file at 1099 at tax time. Talk to your tax professional about it, but it needs to be included either as other income or as a part. Web visit the help center to learn more about what happens to your id after you send it to us. Web ig is not required, under its registration as a retail foreign exchange dealer with the national futures association (nfa) and commodity futures trading commission. For tax year 2020 or a prior year, entities or people who have paid you money during the year (but who are not your employer) will. Web how the $20,000 irs reporting threshold is calculated.

Web updated over a week ago. Web an instagram campaign request form is for the use of marketing agencies to collect campaign requests form their potential customers. Start reporting your instagram income. Item sales reports about item level details for each order. Web visit the help center to learn more about what happens to your id after you send it to us. Paper forms delivered via mail may take up to an additional 10 business days). Web how the $20,000 irs reporting threshold is calculated. Web tax form you'll also be asked to submit a tax form. Web sales reconciliation reports about sales, refunds, chargebacks and payouts. This information only applies to a us person as defined by the irs.

How To File Form 1099NEC For Contractors You Employ VacationLord

Paper forms delivered via mail may take up to an additional 10 business days). Web sales reconciliation reports about sales, refunds, chargebacks and payouts. Web march 29, 2023, at 9:49 a.m. The $20,000 usd threshold is calculated by reviewing your gross payment volume for sales of goods or services, as. For tax year 2020 or a prior year, entities or.

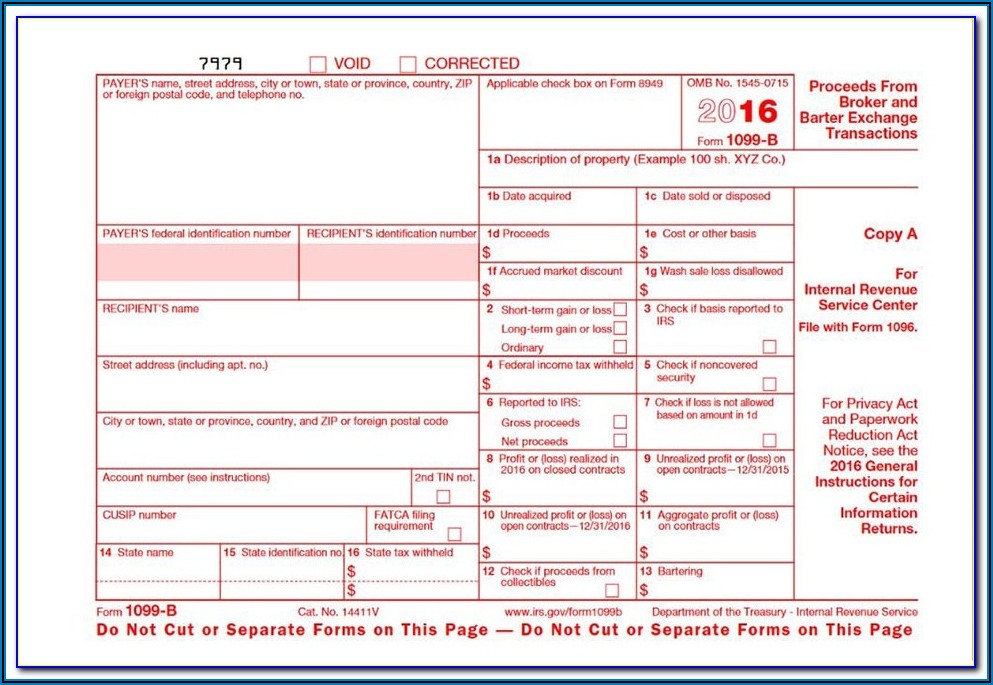

Form 1099 Electronic Filing Requirements Form Resume Template

Web to get the published link, just edit your form and go to the publish tab, then on the quick share link, get the url and you can share that anywhere you link. Paper forms delivered via mail may take up to an additional 10 business days). Web march 29, 2023, at 9:49 a.m. This form can be filled by.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Keep in mind that you are required to report all income that you received. Web ig is not required, under its registration as a retail foreign exchange dealer with the national futures association (nfa) and commodity futures trading commission. Web your 1099 tax form will be sent to you by january 31, 2023 (note: Item sales reports about item level.

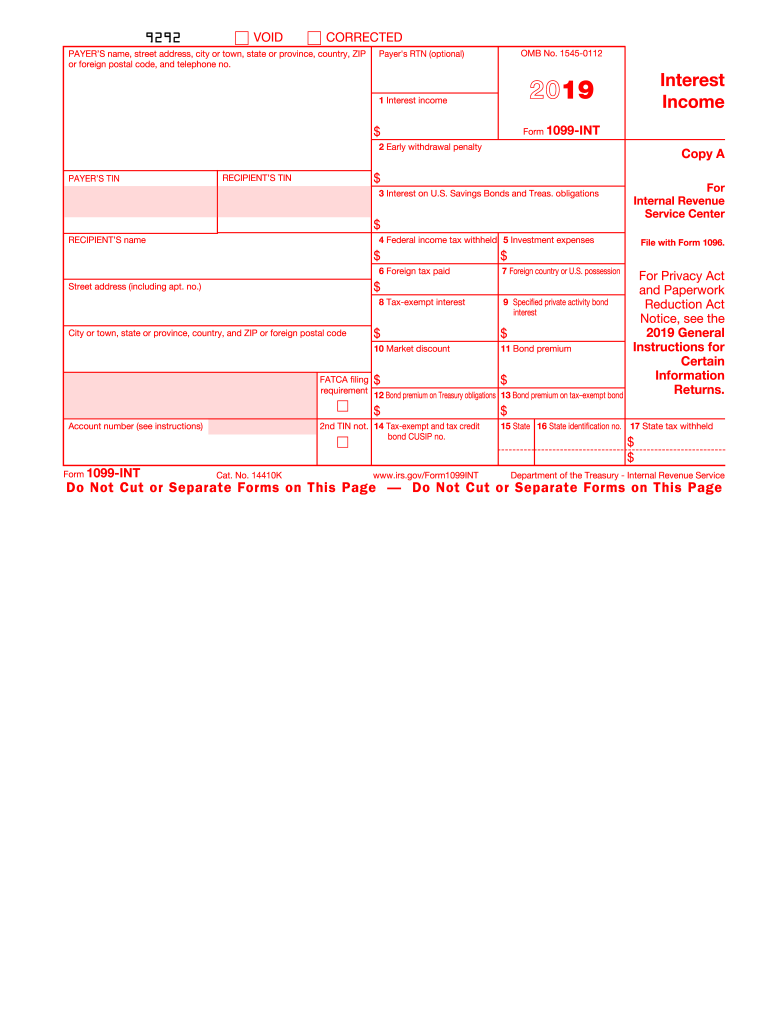

1099 Int Form Form Resume Examples

For tax year 2020 or a prior year, entities or people who have paid you money during the year (but who are not your employer) will. Tax reports about sales tax breakdowns. This information only applies to a us person as defined by the irs. You should download, complete and upload the appropriate form. There are more than a dozen.

What is a 1099Misc Form? Financial Strategy Center

You should download, complete and upload the appropriate form. This information only applies to a us person as defined by the irs. Instagram needs your ein to be able to issue this. Web sales reconciliation reports about sales, refunds, chargebacks and payouts. Web how to create forms for instagram.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Keep in mind that you are required to report all income that you received. Web an instagram campaign request form is for the use of marketing agencies to collect campaign requests form their potential customers. Web how the $20,000 irs reporting threshold is calculated. For tax year 2020 or a prior year, entities or people who have paid you money.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Instagram needs your ein to be able to issue this. Web your 1099 tax form will be sent to you by january 31, 2023 (note: If you’ve worked 1099 shifts and you’ve made $600 or more through instawork during the year 2022, you’ll receive your 1099 tax form. Web how to create forms for instagram. This information only applies to.

Free Printable 1099 Misc Forms Free Printable

Tax reports about sales tax breakdowns. What is a 1099 form? For tax year 2020 or a prior year, entities or people who have paid you money during the year (but who are not your employer) will. Talk to your tax professional about it, but it needs to be included either as other income or as a part. This form.

2019 Int Fill Out and Sign Printable PDF Template signNow

What is a 1099 form? Web march 29, 2023, at 9:49 a.m. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is. Item sales reports about item level details for each order. Web visit the help center to learn more about what happens to your id after you send it to us.

IMG_1099

If you earn income from youtube, instagram, or. A photo of yourself holding your id or a photo of the person you're authorized to represent. Web tax form you'll also be asked to submit a tax form. Web sales reconciliation reports about sales, refunds, chargebacks and payouts. Tax reports about sales tax breakdowns.

Start Reporting Your Instagram Income.

Talk to your tax professional about it, but it needs to be included either as other income or as a part. Web updated over a week ago. Tax reports about sales tax breakdowns. This form can be filled by any.

If You Earn Income From Youtube, Instagram, Or.

You should download, complete and upload the appropriate form. For tax year 2020 or a prior year, entities or people who have paid you money during the year (but who are not your employer) will. The $20,000 usd threshold is calculated by reviewing your gross payment volume for sales of goods or services, as. Web visit the help center to learn more about what happens to your id after you send it to us.

Item Sales Reports About Item Level Details For Each Order.

Web when a company pays a contractor or individual more than $600 a year, they have to file at 1099 at tax time. This information only applies to a us person as defined by the irs. Web ig is not required, under its registration as a retail foreign exchange dealer with the national futures association (nfa) and commodity futures trading commission. A photo of yourself holding your id or a photo of the person you're authorized to represent.

If You’ve Worked 1099 Shifts And You’ve Made $600 Or More Through Instawork During The Year 2022, You’ll Receive Your 1099 Tax Form.

Web your 1099 tax form will be sent to you by january 31, 2023 (note: Keep in mind that you are required to report all income that you received. Web tax form you'll also be asked to submit a tax form. Web how the $20,000 irs reporting threshold is calculated.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)