Instructions For Form 8880

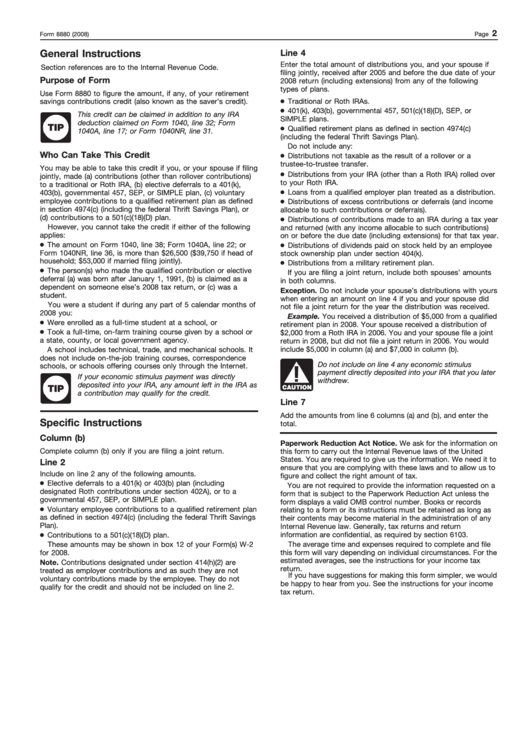

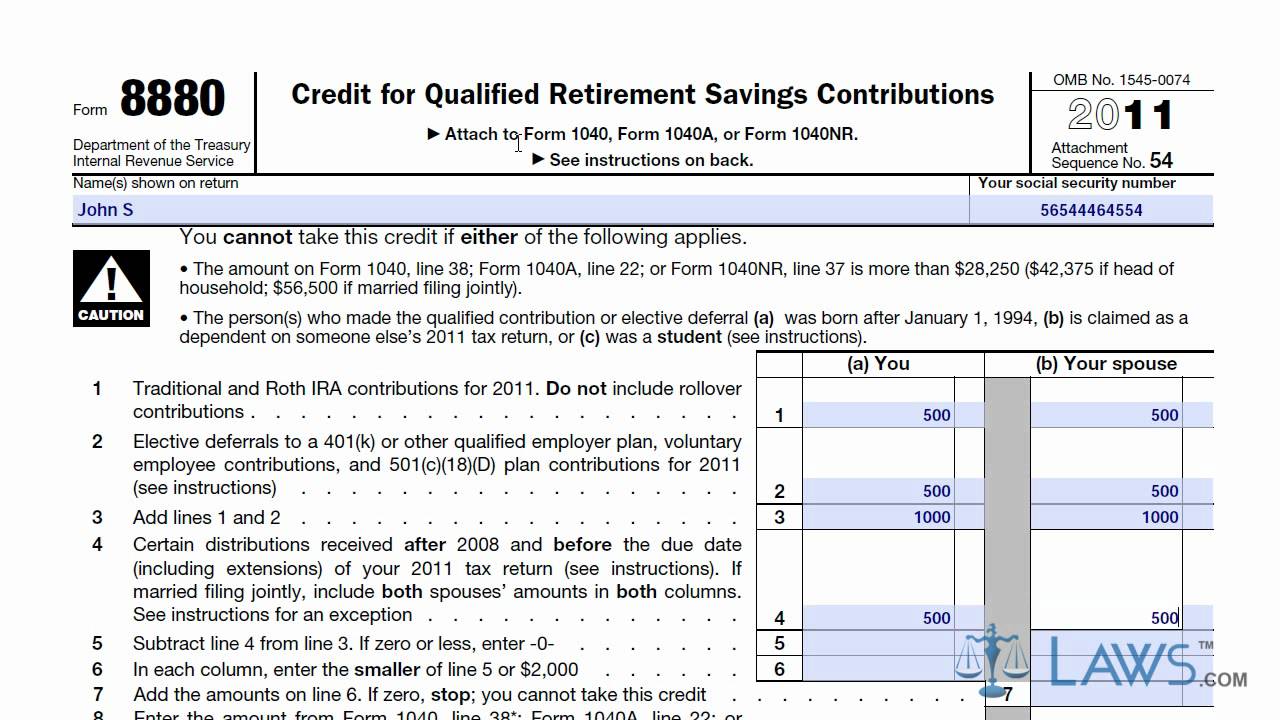

Instructions For Form 8880 - Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: $68,000 if married filing jointly). Solved•by intuit•8•updated july 13, 2022. Web 8880 you cannot take this credit if either of the following applies. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Uradu fact checked by yarilet perez what is irs form 8880? Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Caution • the person(s) who made the qualified contribution or elective draft as Web generating qualified retirement savings contributions for form 8880.

Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web in order to claim the retirement savings credit, you must use irs form 8880. Caution • the person(s) who made the qualified contribution or elective draft as Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Contributions you make to a traditional or roth ira, $68,000 if married filing jointly). Web future developments for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8880. Who can take this credit. Solved•by intuit•8•updated july 13, 2022. Web generating qualified retirement savings contributions for form 8880.

Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Irs form 8880 reports contributions made to qualified retirement savings accounts. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web future developments for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8880. Contributions you make to a traditional or roth ira, Uradu fact checked by yarilet perez what is irs form 8880? Who can take this credit. Web updated march 07, 2023 reviewed by lea d.

LEGO TECHNIC 8880 INSTRUCTIONS PDF

Caution • the person(s) who made the qualified contribution or elective draft as For the latest information about developments related to form 8880 and its instructions, such as. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Contributions you make to a traditional or roth ira, Who can take this credit.

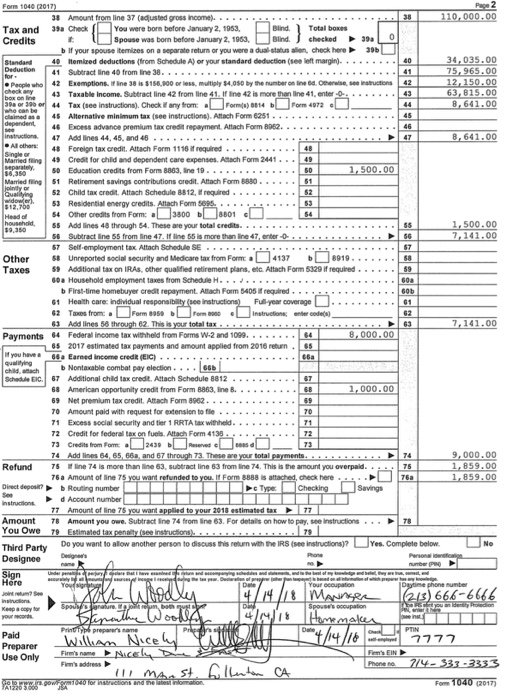

The first page is the 2 questions with facts. Use the

$68,000 if married filing jointly). Uradu fact checked by yarilet perez what is irs form 8880? Web updated march 07, 2023 reviewed by lea d. Solved•by intuit•8•updated july 13, 2022. If you contribute to a retirement account, you might qualify for a tax credit.

4974 c retirement plan Early Retirement

Only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. Irs form 8880 reports contributions made to qualified retirement savings accounts. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans. Web here is your guide to irs form 8880, information on who.

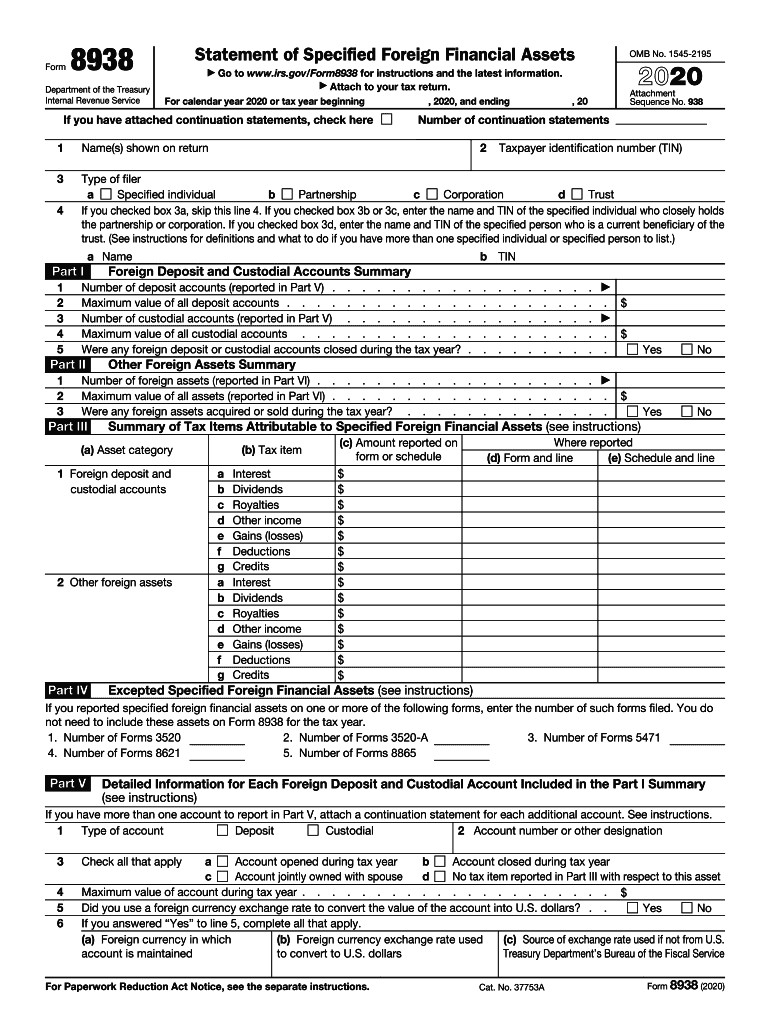

form 8938 Fill out & sign online DocHub

Reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. Web generating qualified retirement savings contributions for form 8880. Web in order to claim the retirement savings credit, you must use irs form 8880. There are important eligibility requirements to know before claiming the saver’s credit. If you contribute to a retirement account, you might.

Form 8880 Edit, Fill, Sign Online Handypdf

Only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. If you contribute to a retirement account, you might qualify for a tax credit. Contributions you make to a traditional or roth ira, You may be able to take this credit if you, or your spouse if filing jointly, made.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: If you contribute to a retirement account, you might qualify for a tax credit. Form 8880.

2022 irs form 945 instructions Fill Online, Printable, Fillable Blank

Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. If you contribute to a retirement account, you might qualify for a tax credit. Only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. Web updated march 07, 2023 reviewed by lea.

IRS Form 8880 Get it Filled the Right Way

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web future developments for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8880. Web here is your guide to irs form 8880, information on.

Form 8880 YouTube

Web federal form 8880 instructions general instructions. Contributions you make to a traditional or roth ira, Only fill out and submit form 8880 if you meet every guideline for your income and your retirement savings plan. There are important eligibility requirements to know before claiming the saver’s credit. Web here is your guide to irs form 8880, information on who.

2010 Federal Tax Form 1040 Instructions Form Resume Examples

Who can take this credit. Irs form 8880 reports contributions made to qualified retirement savings accounts. Solved•by intuit•8•updated july 13, 2022. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the.

There Are Important Eligibility Requirements To Know Before Claiming The Saver’s Credit.

If you contribute to a retirement account, you might qualify for a tax credit. Web updated march 07, 2023 reviewed by lea d. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Uradu fact checked by yarilet perez what is irs form 8880?

Web 8880 You Cannot Take This Credit If Either Of The Following Applies.

For the latest information about developments related to form 8880 and its instructions, such as. Web federal form 8880 instructions general instructions. Eligible retirement plans contributions you make to any qualified retirement plan can be used to satisfy the credit’s eligibility requirements. Web in order to claim the retirement savings credit, you must use irs form 8880.

Solved•By Intuit•8•Updated July 13, 2022.

Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. $68,000 if married filing jointly). Contributions you make to a traditional or roth ira, You may be able to take this credit if you, or your spouse if filing jointly, made (a).

Web Here Is Your Guide To Irs Form 8880, Information On Who Needs To File It, And Six Steps To Complete It Correctly.

Irs form 8880 reports contributions made to qualified retirement savings accounts. Caution • the person(s) who made the qualified contribution or elective draft as Web see form 8880, credit for qualified retirement savings contributions, for more information. Qualified retirement plans include traditional iras, roth iras, 401 (k) plans, 403 (b) plans and 457 plans.