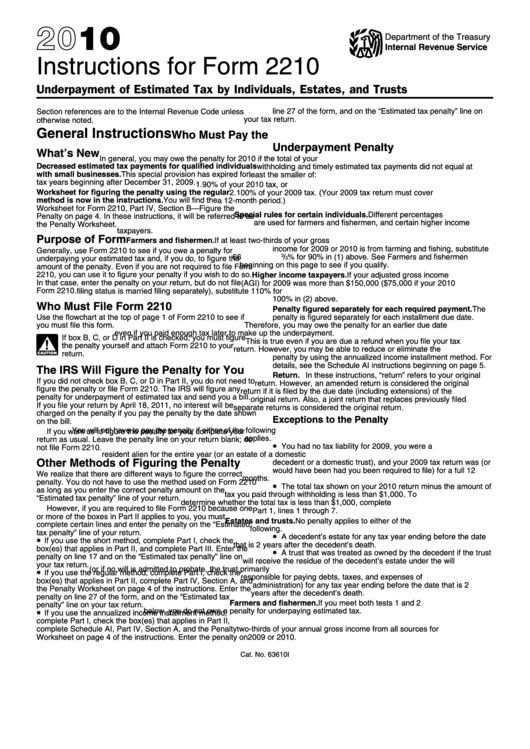

Instructions Form 2210

Instructions Form 2210 - Citizen or resident alien for the entire year (or an estate of a. You should figure out the amount of tax you have underpaid. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. You do not owe a. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. I know it's currently a draft, but the basic.

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Special rules for farmers and ranchers. Citizen or resident alien for the entire year (or an estate of a. Web instructions provided with the software. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Also, see the instructions for federal form 2210 for more information. The irs will generally figure your penalty for you and you should. I know it's currently a draft, but the basic. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2210.

Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. This form contains both a short. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2210. Web you file your return and pay the tax due by march 1, 2023. You owe underpayment penalties and are requesting a penalty waiver. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web instructions included on form: Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. Citizen or resident alien for the entire year (or an estate of a. You had no tax liability for 2021, you were a u.s.

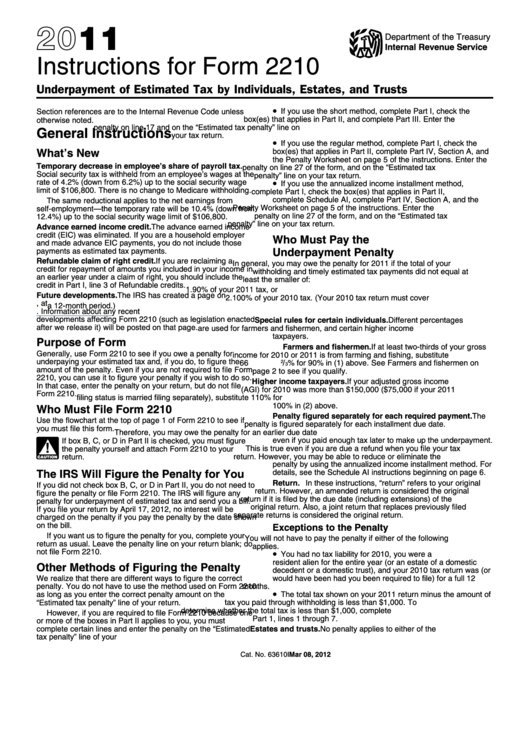

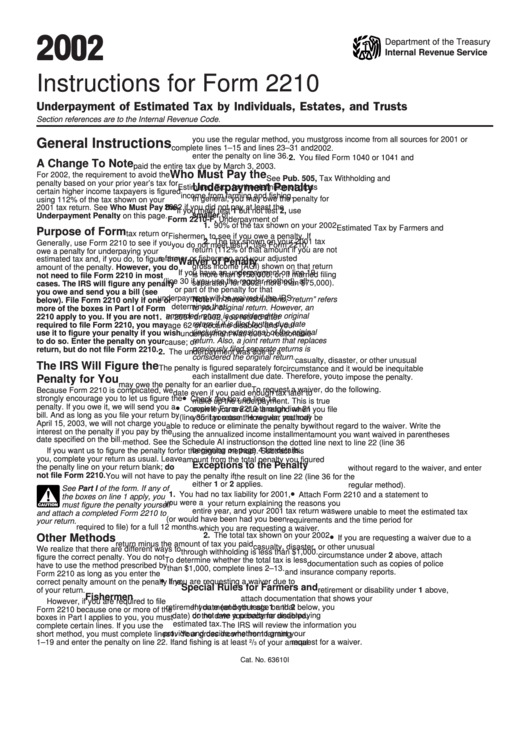

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. You do not owe a. Citizen or resident alien for the entire year (or an estate of a. Web purpose of form use form 2210 to see if you.

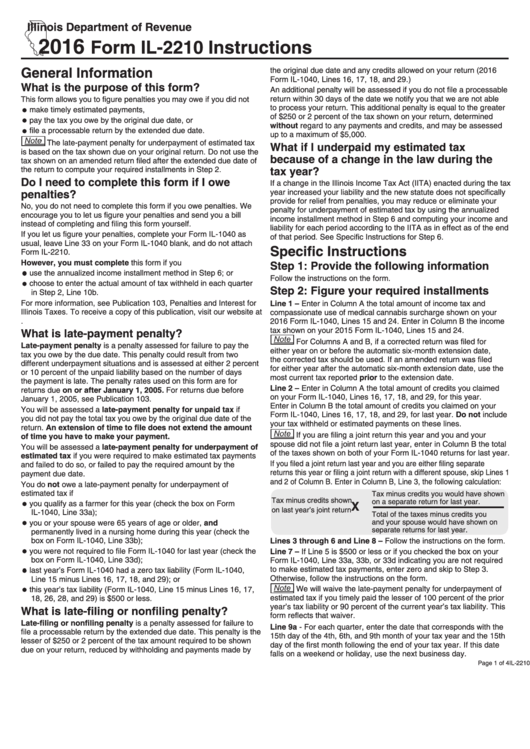

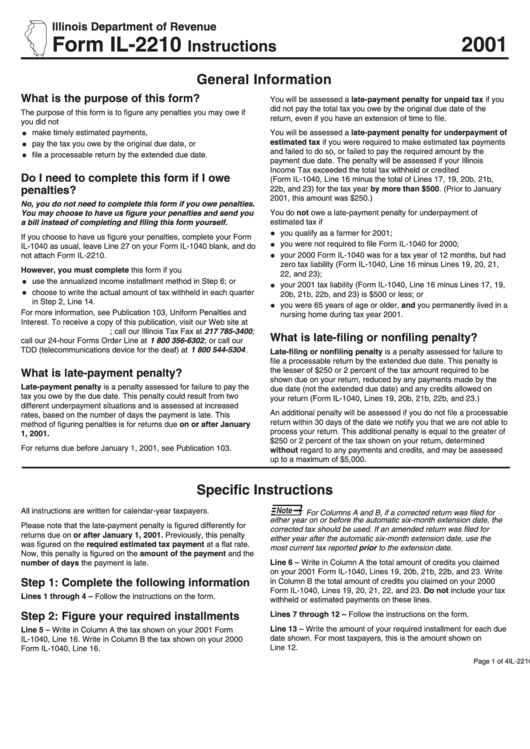

Form Il2210 Instructions 2016 printable pdf download

You do not owe a. This form contains both a short. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. You owe underpayment penalties and are requesting a penalty waiver.

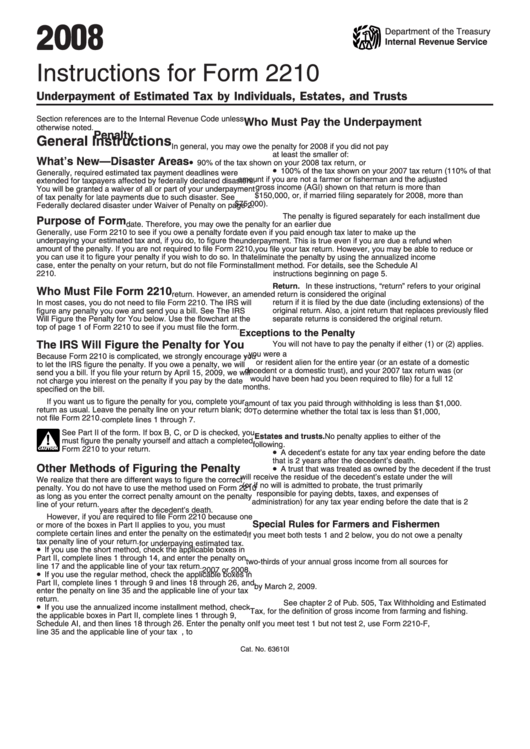

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

You should figure out the amount of tax you have underpaid. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Also, see the instructions for federal form 2210 for more information. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go.

Instructions For Form 2210 2008 printable pdf download

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2210. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Special rules for farmers and ranchers. Citizen or resident.

IRS Form 2210Fill it with the Best Form Filler

You owe underpayment penalties and are requesting a penalty waiver. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or 2019 form 1041me, line 6 minus any refundable tax credit included on form 1041me, line 7c.) if short year,.

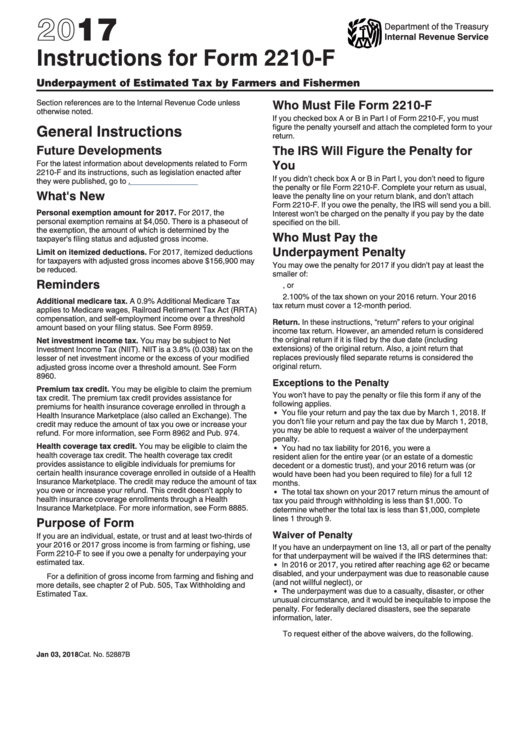

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

You do not owe a. Web you file your return and pay the tax due by march 1, 2023. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web for the latest.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web you file your return and pay the tax due by march 1, 2023. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or.

Instructions for Federal Tax Form 2210 Sapling

The irs will generally figure your penalty for you and you should. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Special rules for farmers and ranchers. Web you can use form 2210, underpayment of estimated.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. You should figure out the amount of tax you have underpaid. Web you file your return and pay the tax due by march 1, 2023. Web you can use form 2210, underpayment of estimated tax.

Form Il2210 Instructions 2001 printable pdf download

In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts,.

Web Purpose Of Form Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Special rules for farmers and ranchers. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. You do not owe a. This form contains both a short.

Underpayment Of Estimated Income Tax:

Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or 2019 form 1041me, line 6 minus any refundable tax credit included on form 1041me, line 7c.) if short year, enter. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2210. Web the irs will require you to complete form 2210 if any of the following situations apply: Web instructions provided with the software.

You Had No Tax Liability For 2021, You Were A U.s.

You owe underpayment penalties and are requesting a penalty waiver. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web you file your return and pay the tax due by march 1, 2023. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210.

Citizen Or Resident Alien For The Entire Year (Or An Estate Of A.

Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later.