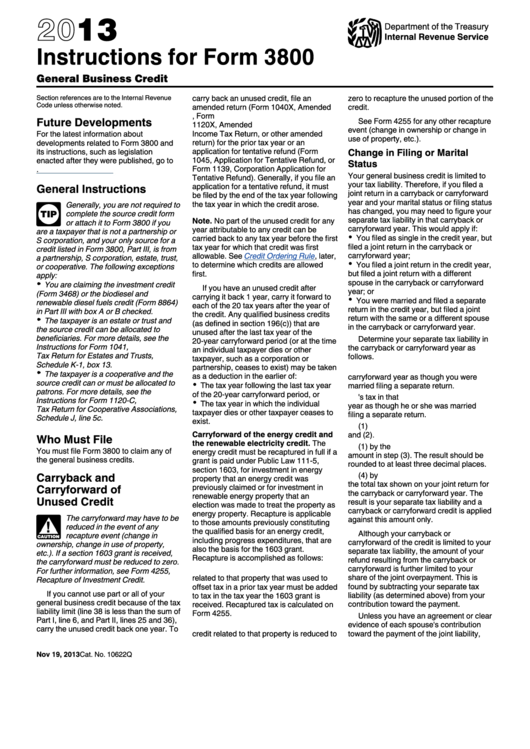

Instructions Form 3800

Instructions Form 3800 - Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Attach ps form 3811 to your mailpiece; All other filers whose only source for a credit. Web for paperwork reduction act notice, see separate instructions. 3800 (2018) form 3800 (2018) page. Web see the instructions for part iii, line 1j. Web more about the federal form 3800 corporate income tax tax credit ty 2022. Save this receipt for your records. Web parent’s rate if the parent’s rate is higher. The credit claimed is subject to a.

Web parent’s rate if the parent’s rate is higher. Save this receipt for your records. Ultimate guide 1 0 the tax form 3800 is crucial if you own or run a small business. File form 3800 to claim any of the general business credits. All other filers whose only source for a credit. Web 7441203 ftb 3800 2020 taxable year 2020 tax computation for certain children with unearned income california form 3800 attach only to the child’s form 540 or. Web june 29th, 2023 read in 10 minutes form 3800, general business credit: Web a qualified small business must complete form 3800 before completing section d of irs form 6765 if claiming the payroll tax credit. Complete form ftb 3800 if all of. Web for paperwork reduction act notice, see separate instructions.

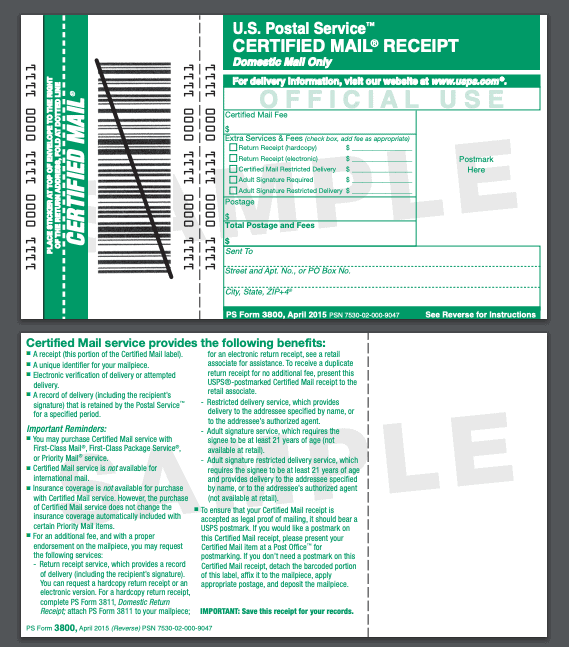

Web see the instructions for part iii, line 1j. Attach ps form 3811 to your mailpiece; File form 3800 to claim any of the general business credits. Web complete ps form 3811, domestic return receipt; Web june 29th, 2023 read in 10 minutes form 3800, general business credit: Web 7441203 ftb 3800 2020 taxable year 2020 tax computation for certain children with unearned income california form 3800 attach only to the child’s form 540 or. Also check the box labeled “ftb 3800’’ on. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Web more about the federal form 3800 corporate income tax tax credit ty 2022. Save this receipt for your records.

Irs form 3800 instructions

Future developments for the latest information. Complete form ftb 3800 if all of. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. All other filers whose only source for a credit. File form 3800 to claim any of the general business credits.

Instructions For Form 3800 General Business Credit Internal Revenue

Complete form ftb 3800 if all of. Web more about the federal form 3800 corporate income tax tax credit ty 2022. 3800 (2018) form 3800 (2018) page. Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. 2 part ii allowable credit (continued) note:

Instructions For Form 3800 General Business Credit Internal Revenue

All other filers whose only source for a credit. Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Web 7441203 ftb 3800 2020 taxable year 2020 tax computation for certain children with unearned income california form 3800 attach only to the child’s form 540.

Instructions For Form 3800 General Business Credit Internal Revenue

Enter the amount from form ftb 3800, line 4 find the tax for the amount on line a, by using the tax table or tax rate schedules in the 2020 instructions. Web more about the federal form 3800 corporate income tax tax credit ty 2022. General instructions partnerships and s corporations must always complete the source credit form. General instructions.

Irs form 3800 instructions

Web a qualified small business must complete form 3800 before completing section d of irs form 6765 if claiming the payroll tax credit. Use form ftb 3800, tax computation for certain children with unearned income, to igure the child’s tax. The credit claimed is subject to a. Web complete ps form 3811, domestic return receipt; Web for paperwork reduction act.

Domestic Mail Manual S912 Certified Mail

3800 (2018) form 3800 (2018) page. Complete form ftb 3800 if all of. Web parent’s rate if the parent’s rate is higher. General instructions partnerships and s corporations must always complete the source credit form. Save this receipt for your records.

Instructions For Form 3800 General Business Credit 2017 printable

Web when carrying a credit forward or back and the taxpayer's filing status changed between the two years, the allowable credit must be calculated differently. Enter the amount from form ftb 3800, line 4 find the tax for the amount on line a, by using the tax table or tax rate schedules in the 2020 instructions. Web a qualified small.

Instructions For Form 3800 2013 printable pdf download

Use form ftb 3800, tax computation for certain children with unearned income, to igure the child’s tax. File form 3800 to claim any of the general business credits. 3800 (2018) form 3800 (2018) page. Enter the larger of the two amounts here and on the child’s form 540, 00 00 00 line 31. Web complete ps form 3811, domestic return.

Guide to USPS Certified Mail Red Stag Fulfillment

Complete form ftb 3800 if all of. Web more about the federal form 3800 corporate income tax tax credit ty 2022. Enter the larger of the two amounts here and on the child’s form 540, 00 00 00 line 31. Use form ftb 3800, tax computation for certain children with unearned income, to igure the child’s tax. Web see the.

Instructions for IRS Form 3800 General Business Credit Download

Web complete ps form 3811, domestic return receipt; Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Web for paperwork reduction act notice, see separate instructions. Web see the instructions for part iii, line 1j. All other filers whose only source for a credit.

Web 18 Compare The Amounts On Line 16 And Line 17.

Web parent’s rate if the parent’s rate is higher. 3800 (2018) form 3800 (2018) page. Web more about the federal form 3800 corporate income tax tax credit ty 2022. Save this receipt for your records.

Web 7441203 Ftb 3800 2020 Taxable Year 2020 Tax Computation For Certain Children With Unearned Income California Form 3800 Attach Only To The Child’s Form 540 Or.

Ultimate guide 1 0 the tax form 3800 is crucial if you own or run a small business. Use form ftb 3800, tax computation for certain children with unearned income, to igure the child’s tax. General instructions partnerships and s corporations must always complete the source credit form. Enter the larger of the two amounts here and on the child’s form 540, 00 00 00 line 31.

Web Complete Ps Form 3811, Domestic Return Receipt;

Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. General instructions partnerships and s corporations must always complete the source credit form. Web see the instructions for line 1j. Web june 29th, 2023 read in 10 minutes form 3800, general business credit:

Complete Form Ftb 3800 If All Of.

Attach ps form 3811 to your mailpiece; File form 3800 to claim any of the general business credits. The credit claimed is subject to a. Web for paperwork reduction act notice, see separate instructions.