Instructions Form 8880

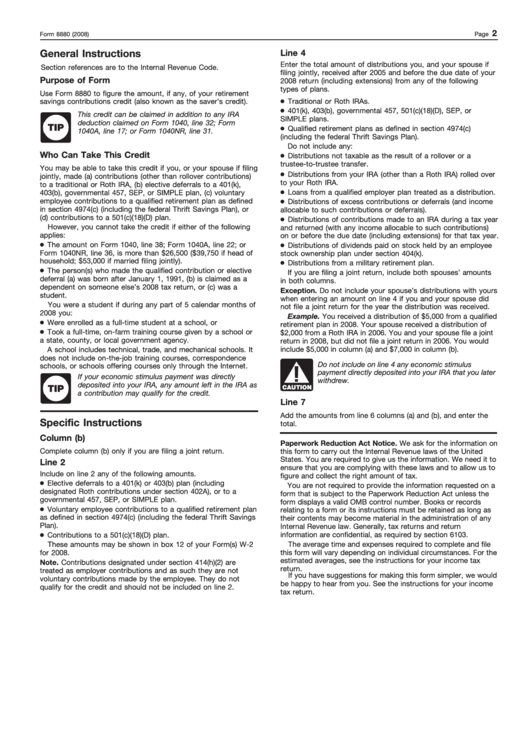

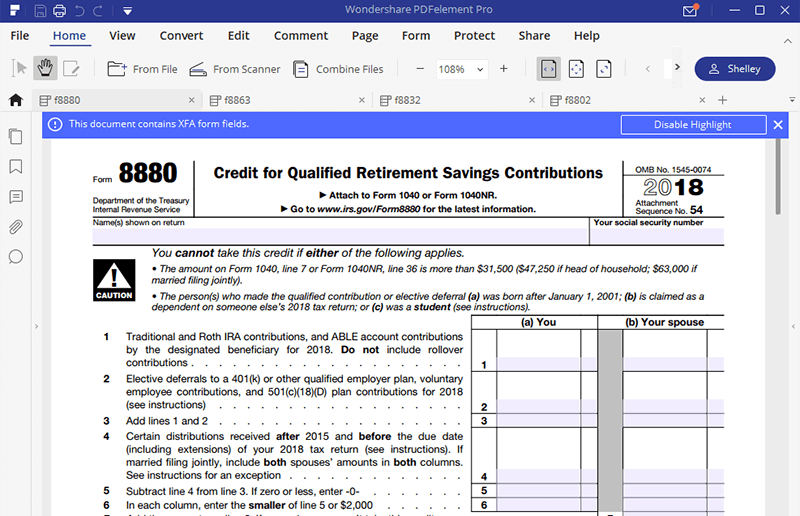

Instructions Form 8880 - Web per irs instructions for form 8880, page 2: Web form 8880 is used to compute the credit for qualified retirement savings contributions, also known as the saver's credit. this credit is designed to incentivize. Web here is your guide to irs form 8880, information on who needs to file it, and six steps to complete it correctly. For the latest information about developments related to form 8880 and its instructions, such. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). In proconnect tax, when you make a. Web federal form 8880 instructions general instructions. A retirement savings contribution credit may be claimed for the. From the main menu of the tax return (form 1040) select:

Eligible retirement plans contributions you make to any qualified retirement plan can be. Web form 8880 not generating credit due to pension distributions in lacerte. Web federal form 8880 instructions general instructions. Web in order to claim the retirement savings credit, you must use irs form 8880. Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. For the latest information about developments related to form 8880 and its instructions, such. Web plans that qualify are listed on form 8880. Web generating qualified retirement savings contributions for form 8880. This article explains what to do if form 8880, credit for qualified retirement. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan.

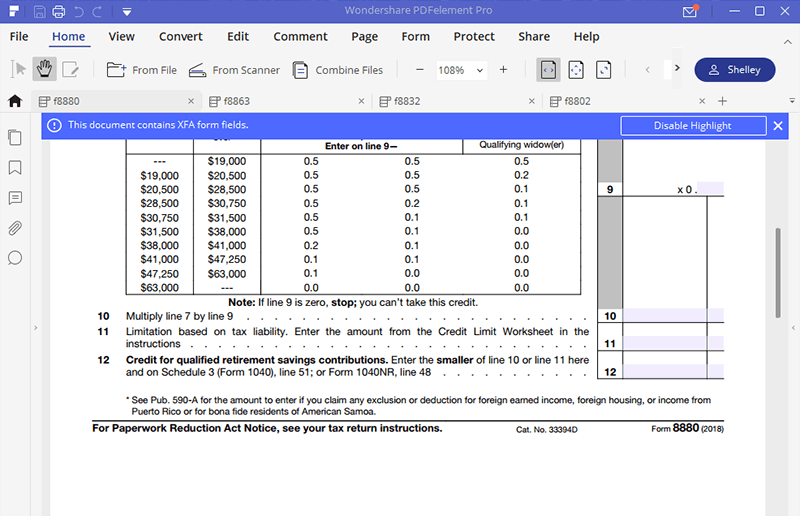

You were a student if. Solved•by intuit•8•updated july 13, 2022. For the latest information about developments related to form 8880 and its instructions, such. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web instructions for entering form 8880 in taxslayer pro: Web form 8880 not generating credit due to pension distributions in lacerte. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. In proconnect tax, when you make a. Eligible plans to which you can make. This article explains what to do if form 8880, credit for qualified retirement.

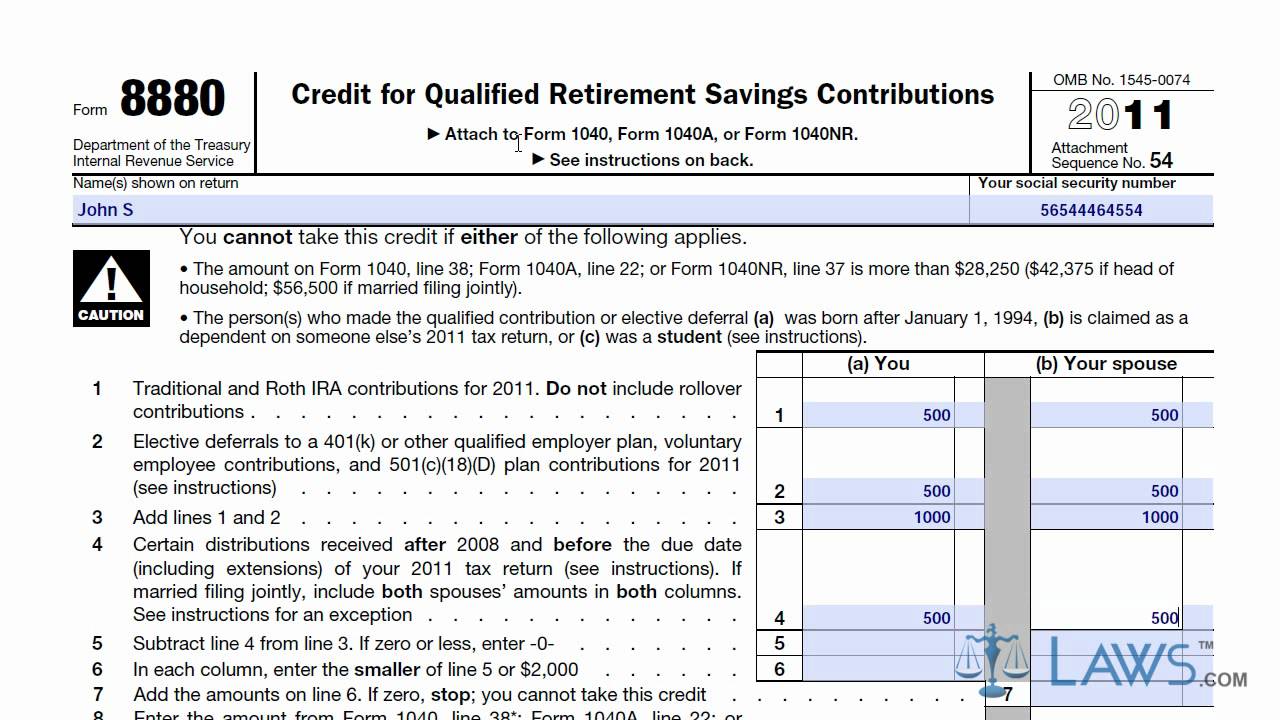

Form 8880 YouTube

In proconnect tax, when you make a. Web instructions for entering form 8880 in taxslayer pro: 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). Web generating qualified retirement savings contributions for form 8880. Eligible retirement plans contributions you make to any qualified retirement plan can be.

IRS Form 8880 Get it Filled the Right Way

From the main menu of the tax return (form 1040) select: Web form 8880 not generating credit due to pension distributions in lacerte. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. 4 certain distributions received after 2019 and before the due date (including extensions) of your.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

You were a student if during any part of 5 calendar months of 2021 you: Web in order to claim the retirement savings credit, you must use irs form 8880. Web federal form 8880 instructions general instructions. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8880 is used to compute the credit for qualified retirement savings contributions, also known as the saver's credit. this credit is designed to incentivize. Eligible retirement plans contributions you make to any qualified retirement plan can be. From the main menu of the tax return (form 1040) select: Solved•by intuit•8•updated july 13, 2022. 4 certain distributions received after.

IRS Form 8880 Instructions

Solved•by intuit•8•updated july 13, 2022. Web instructions for entering form 8880 in taxslayer pro: Web here is your guide to irs form 8880, information on who needs to file it, and six steps to complete it correctly. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted.

4974 c retirement plan Early Retirement

For the latest information about developments related to form 8880 and its instructions, such. Web federal form 8880 instructions general instructions. Web per irs instructions for form 8880, page 2: Eligible plans to which you can make. You were a student if during any part of 5 calendar months of 2021 you:

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Eligible retirement plans contributions you make to any qualified retirement plan can be. This article explains what to do if form 8880, credit for qualified retirement. Web generating qualified retirement savings contributions for form 8880..

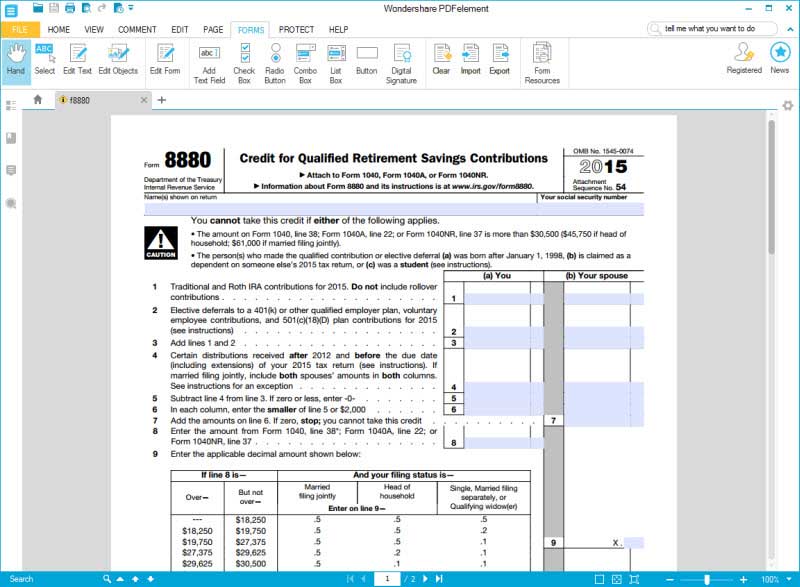

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web lacerte will typically generate this credit automatically based on your ira contribution entries in screen 10, wages, salaries, tips, screen 13.1, pensions, iras. Web instructions for entering form 8880 in taxslayer pro: Web per irs instructions for form 8880, page 2: 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return.

Instructions for How to Fill in IRS Form 8880

Web generating qualified retirement savings contributions for form 8880. Web in order to claim the retirement savings credit, you must use irs form 8880. Credits retirement savings credit (8880) note: Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. If married filing jointly, include.

IRS Form 8880 Get it Filled the Right Way

4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). This article explains what to do if form 8880, credit for qualified retirement. Web irs form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan. Web in order.

Web Here Is Your Guide To Irs Form 8880, Information On Who Needs To File It, And Six Steps To Complete It Correctly.

Web federal form 8880 instructions general instructions. Web form 8880 not generating credit due to pension distributions in lacerte. Only fill out and submit form. From the main menu of the tax return (form 1040) select:

Web Plans That Qualify Are Listed On Form 8880.

Web in order to claim the retirement savings credit, you must use irs form 8880. Web lacerte will typically generate this credit automatically based on your ira contribution entries in screen 10, wages, salaries, tips, screen 13.1, pensions, iras. You were a student if. A retirement savings contribution credit may be claimed for the.

If Married Filing Jointly, Include.

4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). Credits retirement savings credit (8880) note: Web generating qualified retirement savings contributions for form 8880. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return.

Solved•By Intuit•8•Updated July 13, 2022.

Web reminder contributions by a designated beneficiary to an achieving a better life experience (able) account. Eligible plans to which you can make. For the latest information about developments related to form 8880 and its instructions, such. This article explains what to do if form 8880, credit for qualified retirement.