Instructions Form 8960

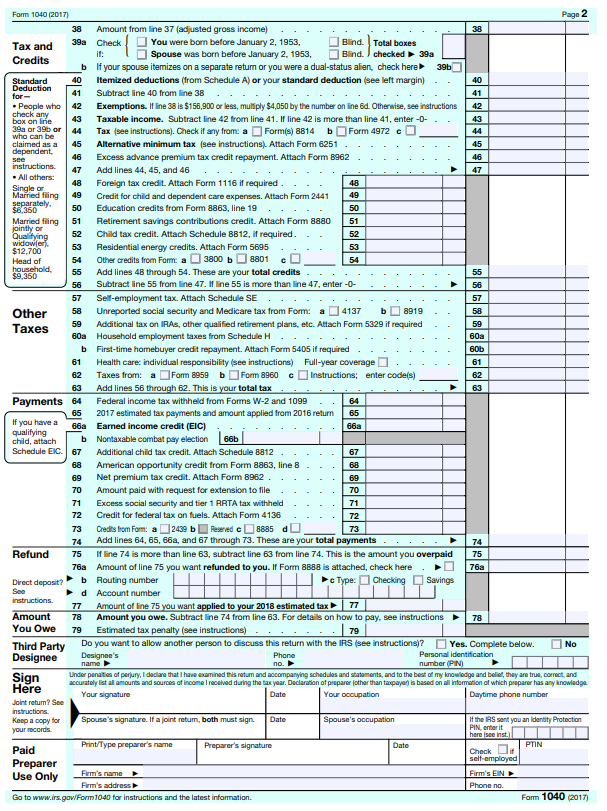

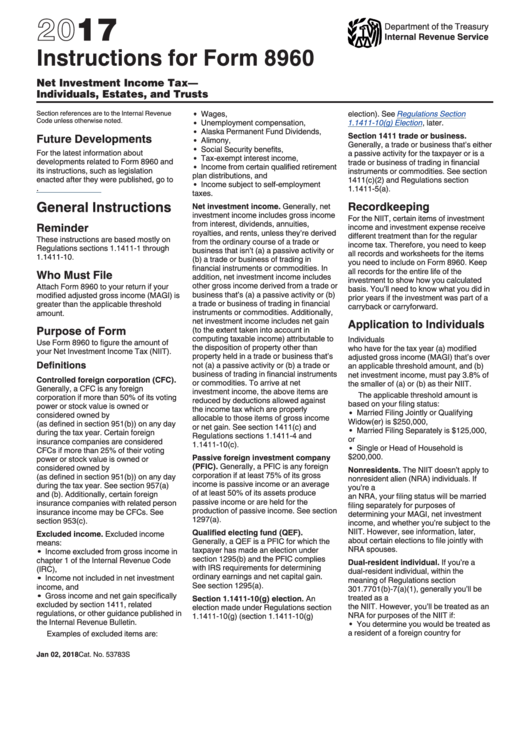

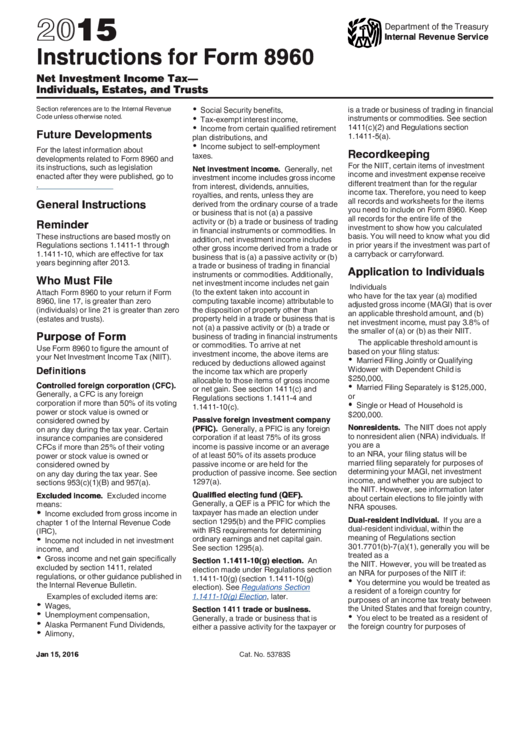

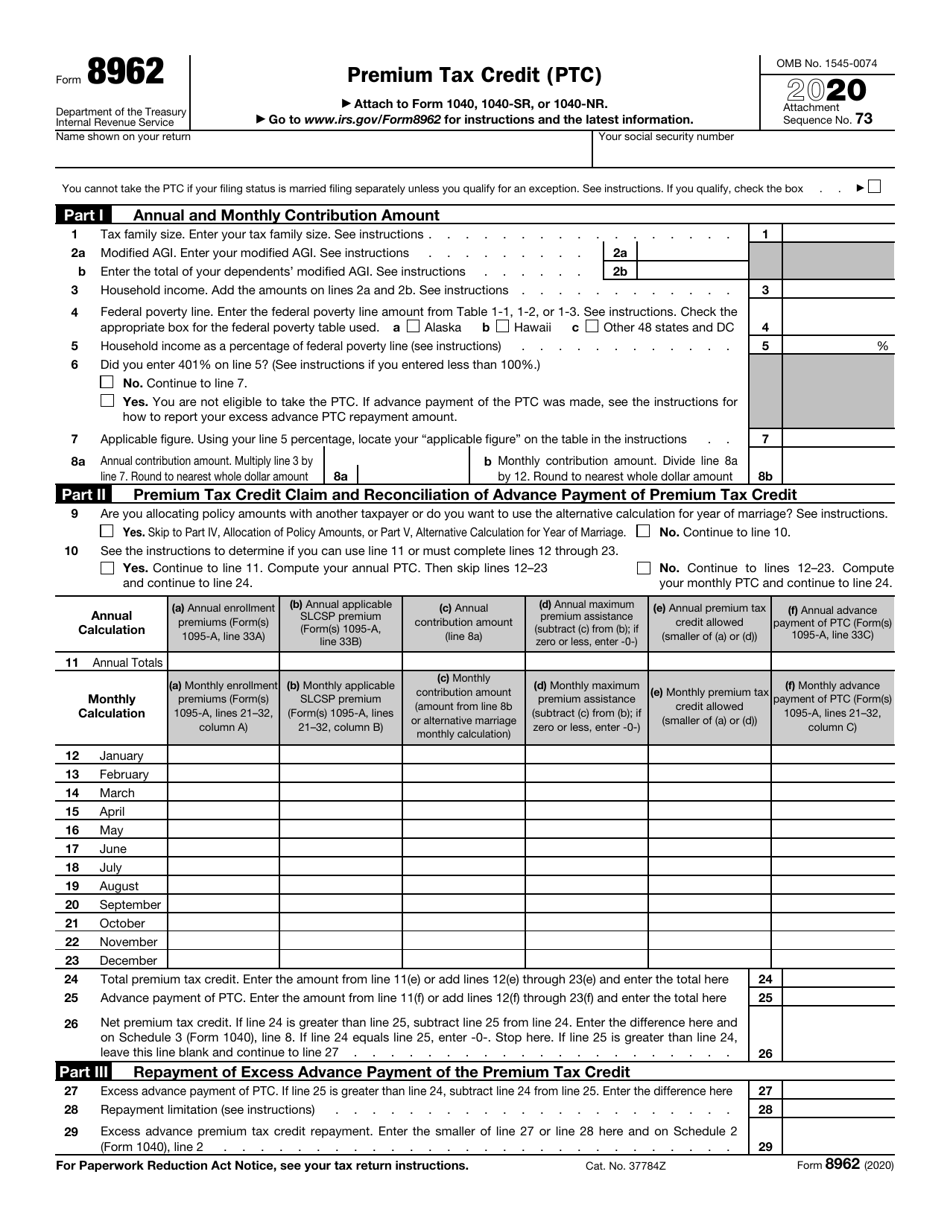

Instructions Form 8960 - Web form 8960 department of the treasury internal revenue service (99). It first appeared in tax year 2013. Web the form 8960 instructions clarify what happens when a taxpayer that had an installment sale of an interest in an s corporation or a partnership in a year before the net investment income tax took effect receives payments in a year. Web how do i prepare form 8960 in an individual return using worksheet view? Aattach to your tax return. Calculate your gross investment income. Who must file attach form 8960 to your return if form 8960, line 17, is greater than zero (individuals) or line 21 is greater than zero (estates and trusts). Web who must file form 8960? If a qft has one or more beneficiary contracts that have net investment income in excess of the threshold amount: Attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount.

Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. See the form 8960 line instructions and the note about real estate professionals (page 3) for details. Purpose of form use form 8960 to figure the amount of your net investment income. Web the form 8960 instructions clarify what happens when a taxpayer that had an installment sale of an interest in an s corporation or a partnership in a year before the net investment income tax took effect receives payments in a year. Web who must file form 8960? Web form 8960 department of the treasury internal revenue service (99). For paperwork reduction act notice, see your tax return instructions. To make the section 6013 (g) election, follow these steps. Who must file attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount.

For instructions and the latest information. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. To make the section 6013 (g) election, follow these steps. For paperwork reduction act notice, see your tax return instructions. Calculate your gross investment income. It first appeared in tax year 2013. However, for estates and trusts, it might be a little less clear. The applicable threshold amount depends partially on. Who must file attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. It first appeared in tax year 2013.

Solved Required information [The following information

If a qft has one or more beneficiary contracts that have net investment income in excess of the threshold amount: However, for estates and trusts, it might be a little less clear. Purpose of form use form 8960 to figure the amount of Who must file attach form 8960 to your return if form 8960, line 17, is greater than.

Instructions For Form 8960 Net Investment Tax Individuals

Web the software will default to carrying amounts to form 8960, however, adjustments may be needed on screen 8960 if the real estate income (including the sale of a rental property) is exempt from nii. For paperwork reduction act notice, see your tax return instructions. Go to the taxes > net investment income tax worksheet. Taxpayers whose modified adjusted gross.

HD 8960 Manuals Users Guides

Ago to www.irs.gov/form8960 for instructions and the latest information. However, for estates and trusts, it might be a little less clear. Purpose of form use form 8960 to figure the amount of If you have income from investments and your modified adjusted gross income (magi) exceeds $200,000 for individuals, $250,000 for spouses filing jointly, and. Purpose of form use form.

Instructions For Form 8960 (2015) printable pdf download

Purpose of form use form 8960 to figure the amount of your net. Calculate your gross investment income. If you have income from investments and your modified adjusted gross income (magi) exceeds $200,000 for individuals, $250,000 for spouses. Web form 8960 department of the treasury internal revenue service (99). If you have income from investments and your modified adjusted gross.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

Attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Net investment income tax individuals, estates, and trusts Web form 8960 department of the treasury internal revenue service (99). Web the form 8960 instructions clarify what happens when a taxpayer that had an installment sale of an interest in an.

Fill Free fillable F8960 2019 Form 8960 PDF form

What is the applicable threshold? Purpose of form use form 8960 to figure the amount of your net. Purpose of form use form 8960 to figure the amount of Web form 8960 department of the treasury internal revenue service (99). Purpose of form use form 8960 to figure the amount of your net investment income.

IRS Form 8962 Download Fillable PDF or Fill Online Premium Tax Credit

Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. For instructions and the latest information. For paperwork reduction act notice, see your tax return instructions. For individuals, this is fairly straightforward. For paperwork reduction act notice, see your tax return instructions.

Explore the New IRS Form for Net Investment Tax

To make the section 6013 (g) election, follow these steps. Purpose of form use form 8960 to figure the amount of your net investment income. For paperwork reduction act notice, see your tax return instructions. For instructions and the latest information. Net investment income tax individuals, estates, and trusts

What Is Form 8960? H&R Block

Complete one consolidated form 8960 for all beneficiary contracts subject to niit. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Web form 8960 department of the treasury internal revenue service (99). Web the form 8960 instructions.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

Web the form 8960 instructions clarify what happens when a taxpayer that had an installment sale of an interest in an s corporation or a partnership in a year before the net investment income tax took effect receives payments in a year. Complete one consolidated form 8960 for all beneficiary contracts subject to niit. Ago to www.irs.gov/form8960 for instructions and.

Go To The Taxes > Net Investment Income Tax Worksheet.

If you have income from investments and your modified adjusted gross income (magi) exceeds $200,000 for individuals, $250,000 for spouses filing jointly, and. For paperwork reduction act notice, see your tax return instructions. To make the section 6013 (g) election, follow these steps. Who must file attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount.

Ago To Www.irs.gov/Form8960 For Instructions And The Latest Information.

It first appeared in tax year 2013. Attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web the software will default to carrying amounts to form 8960, however, adjustments may be needed on screen 8960 if the real estate income (including the sale of a rental property) is exempt from nii. What is the applicable threshold?

Web Who Must File Form 8960?

Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Net investment income tax individuals, estates, and trusts Purpose of form use form 8960 to figure the amount of If you’re required to file form 8960, use the instructions to fill out the form.

Purpose Of Form Use Form 8960 To Figure The Amount Of Your Net.

See the form 8960 line instructions and the note about real estate professionals (page 3) for details. Purpose of form use form 8960 to figure the amount of your net investment income. For instructions and the latest information. If a qft has one or more beneficiary contracts that have net investment income in excess of the threshold amount: