Instructions Form 8995

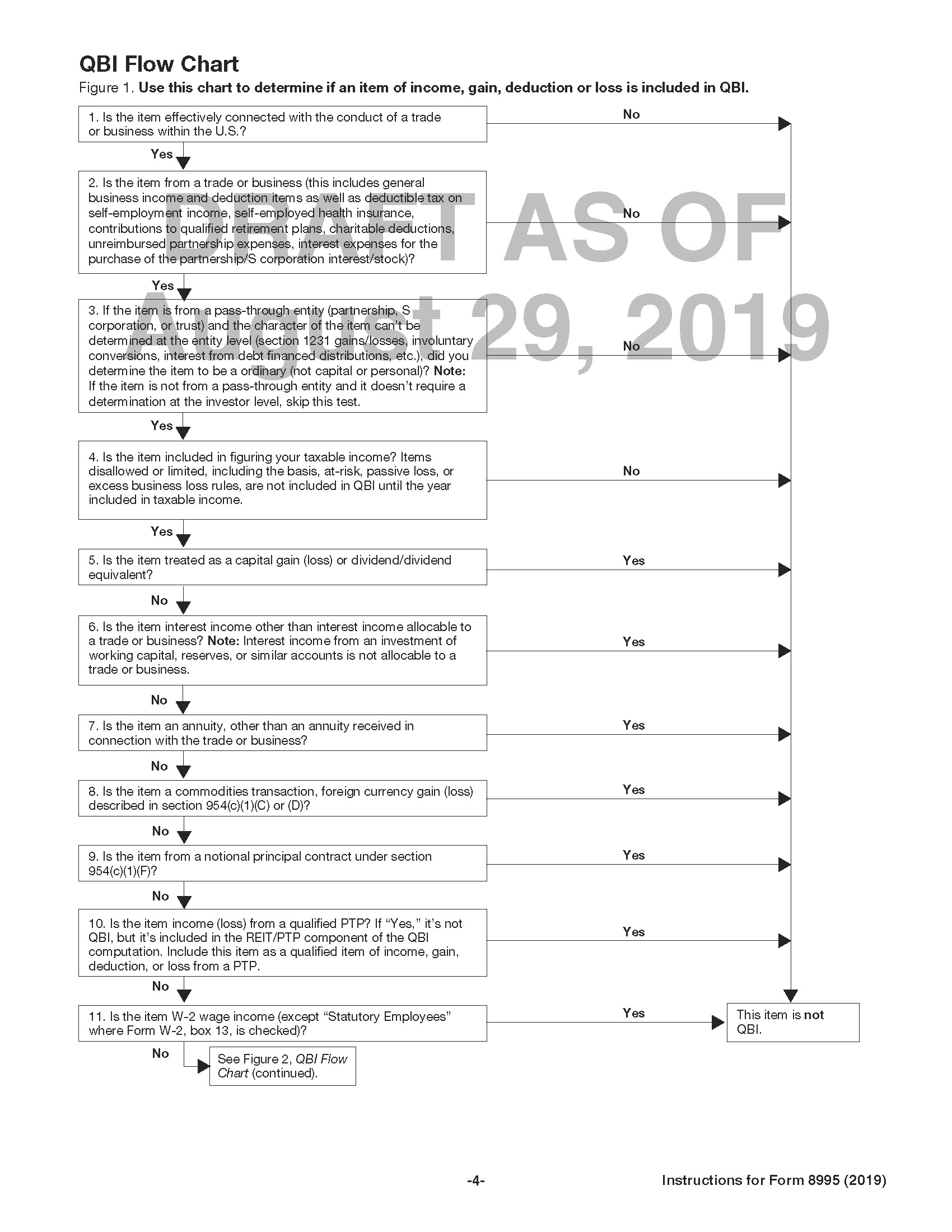

Instructions Form 8995 - Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web what is form 8995? Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Fear not, for i am. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by.

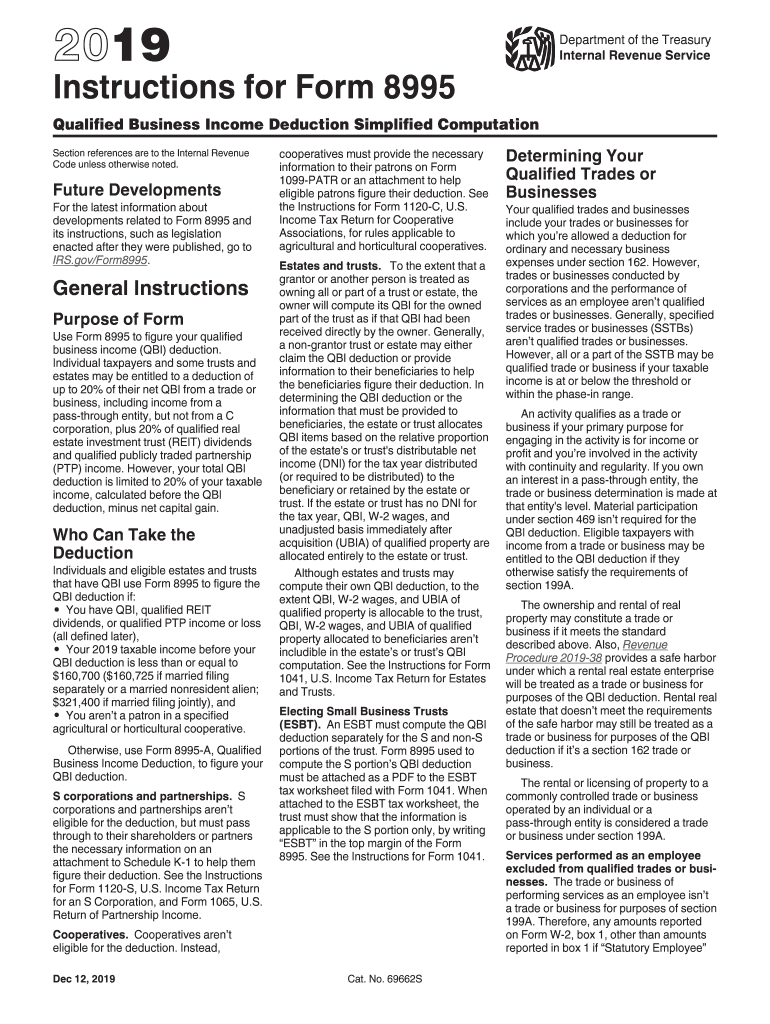

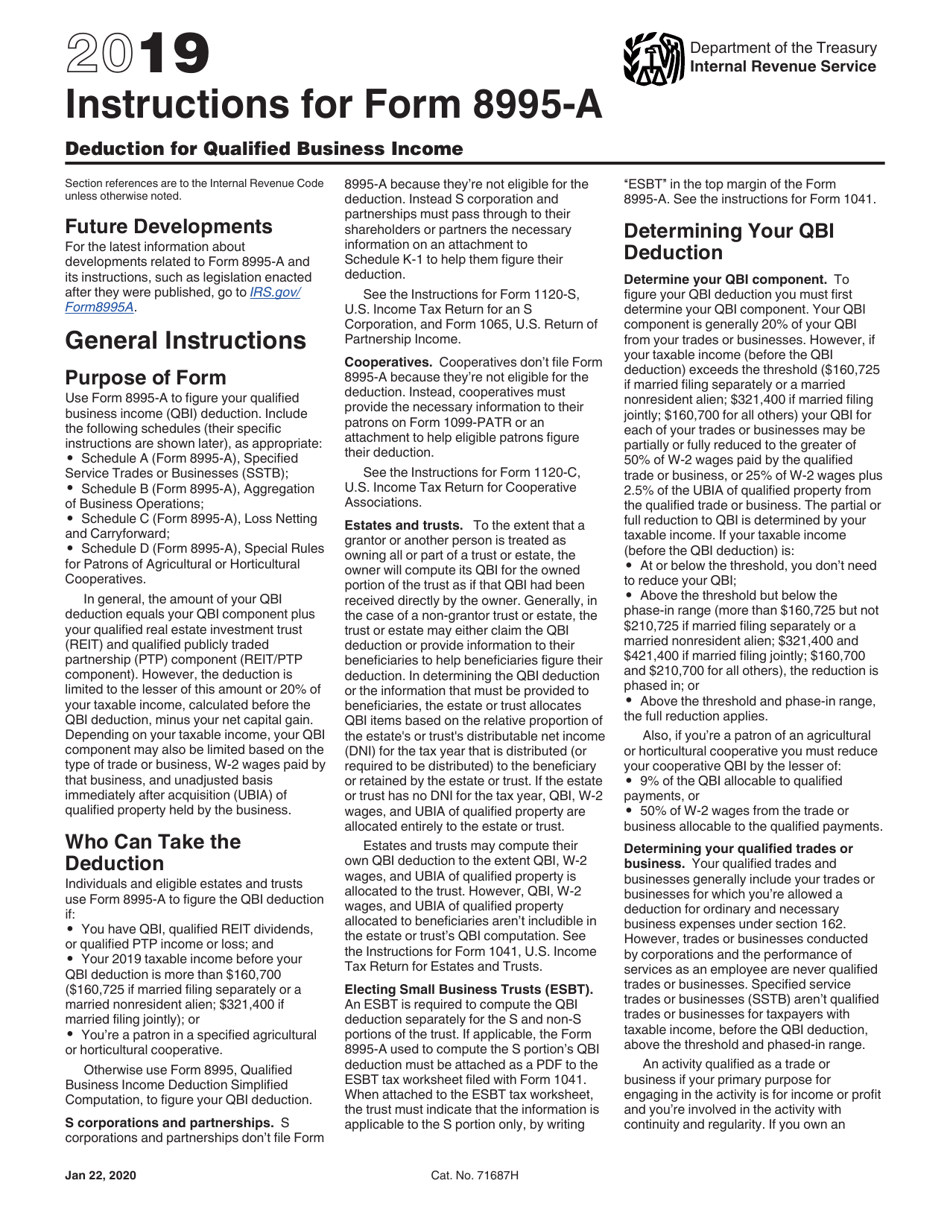

Include the following schedules (their specific instructions are shown later), as. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Use this form if your. Web instructions for form 8995. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. The qbi deduction will flow to line 10 of form. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation. Web what is form 8995?

Web what is form 8995? Web what is form 8995? Fear not, for i am. The qbi deduction will flow to line 10 of form. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation aattach to your tax return. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Include the following schedules (their specific instructions are shown later), as. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted.

Form 8995 Basics & Beyond

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Use this form if your. The qbi deduction will flow to line 10 of form. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Fear not, for i.

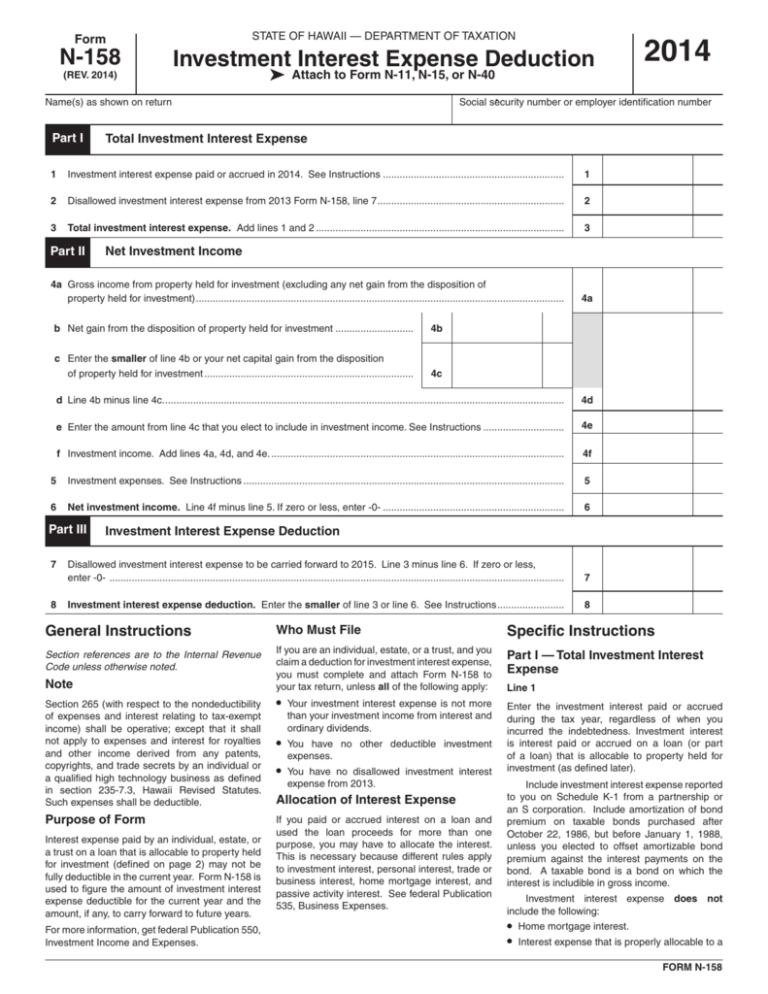

N158 Investment Interest Expense Deduction

For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Fear.

2020 Form IRS Instructions 8995 Fill Online, Printable, Fillable, Blank

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. Fear not, for i.

8995 Instructions 2021 2022 IRS Forms Zrivo

In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Fear not, for i am. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web instructions for form 8995 qualified business income.

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. The qbi deduction will flow to line 10 of form. Web form 8995 is a newly created tax form used to calculate the qualified business income.

IRS Form 8995 Instructions Your Simplified QBI Deduction

In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web instructions for form 8995. For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by. Web what is form 8995? Web form 8995 department of the treasury.

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by. Web what is form 8995? Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. In.

Instructions for Form 8995 (2019) Internal Revenue Service Small

Fear not, for i am. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web instructions for form 8995. For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à.

8995 Fill out & sign online DocHub

Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Fear not, for i am. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation. Web form 8995 is a newly created tax form used.

Download Instructions for IRS Form 8995A Deduction for Qualified

Use this form if your. Web instructions for form 8995. The qbi deduction will flow to line 10 of form. Fear not, for i am. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer.

Web What Is Form 8995?

In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web instructions for form 8995. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease.

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Aattach To Your Tax Return.

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Fear not, for i am. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. The qbi deduction will flow to line 10 of form.

Web What Is Form 8995?

Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a. Use this form if your. For the allocation to qbi, multiply the remaining losses (after step 1), up to the total suspended losses reported in column a, row 2, by. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation.

Include the following schedules (their specific instructions are shown later), as. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted.