Instructions Form 990-Pf

Instructions Form 990-Pf - Try it for free now! If the organization follows a calendar tax year. Complete, edit or print tax forms instantly. Upload, modify or create forms. As required by section 3101 of the taxpayer first. Complete all applicable line items;. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Basic information about your organization the irs requires you to enter details about the corresponding tax year,. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

If the organization follows a calendar tax year. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue. • to figure the tax based on investment income, and • to report charitable distributions and activities. Generating/preparing a short year return;. Complete if the organization is a section 501(c)(3). Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Basic information about your organization the irs requires you to enter details about the corresponding tax year,. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

• to figure the tax based on investment income, and • to report charitable distributions and activities. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Generating/preparing a short year return;. If the organization follows a calendar tax year. Web go to www.irs.gov/form990pf for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Upload, modify or create forms.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

As required by section 3101 of the taxpayer first. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Web information about form 990, return of organization exempt from.

Form 990PF Return of Private Foundation (2014) Free Download

Schedule a (form 990) 2021 (all organizations must complete this part.) see. • to figure the tax based on investment income, and • to report charitable distributions and activities. Try it for free now! Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

If the organization follows a calendar tax year. Basic information about your organization the irs requires you to enter details about the corresponding tax year,. Complete if the organization is a section 501(c)(3). Ad get ready for tax season deadlines by completing any required tax forms today. Web information about form 990, return of organization exempt from income tax, including.

Form 990PF Return of Private Foundation (2014) Free Download

Complete all applicable line items;. Web go to www.irs.gov/form990pf for instructions and the latest information. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Try it for free now! Upload, modify or create forms.

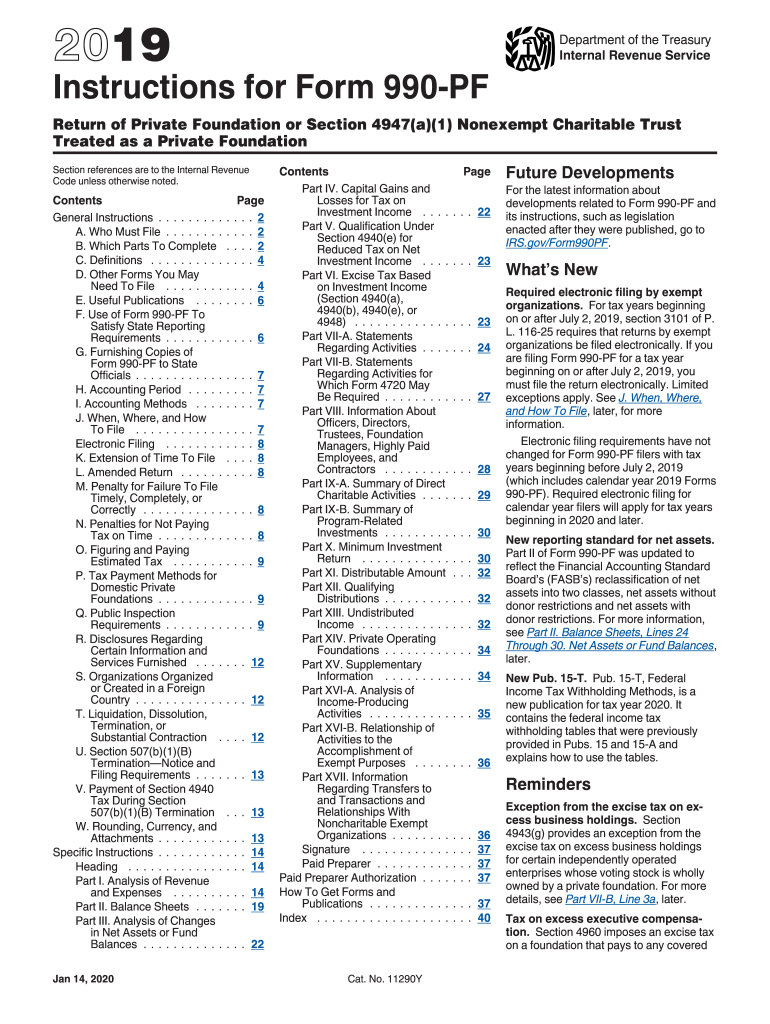

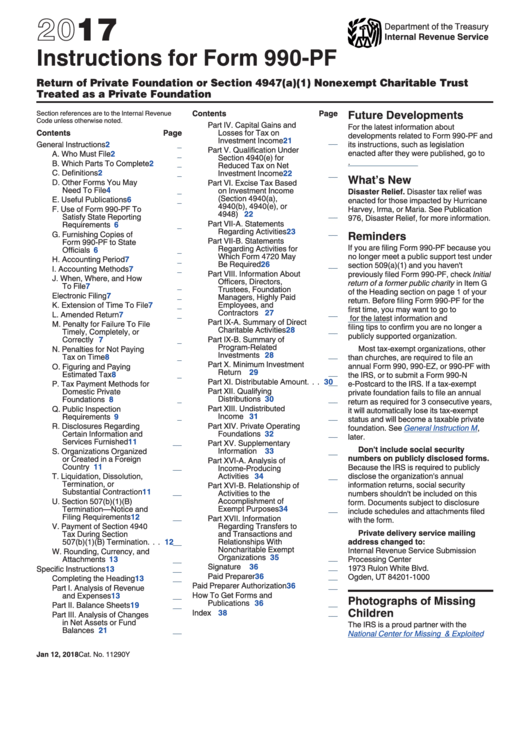

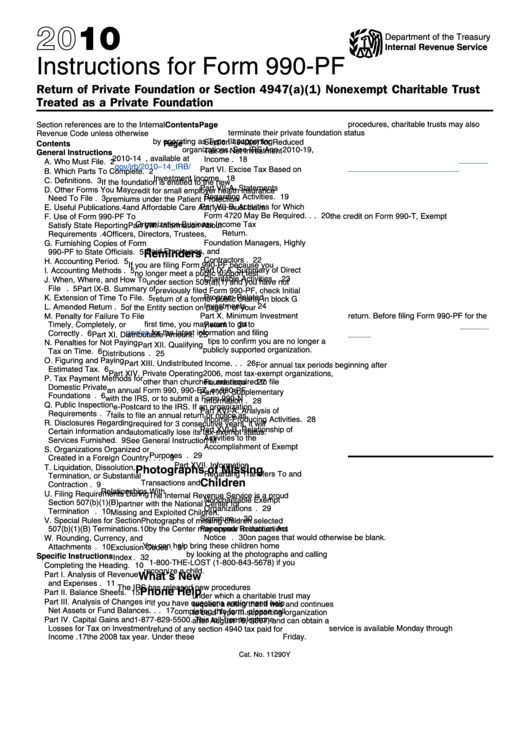

Instructions For Form 990Pf Return Of Private Foundation Or Section

Complete, edit or print tax forms instantly. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue. Basic information about your organization the irs requires you to enter details about the corresponding tax year,. Try it for free now!.

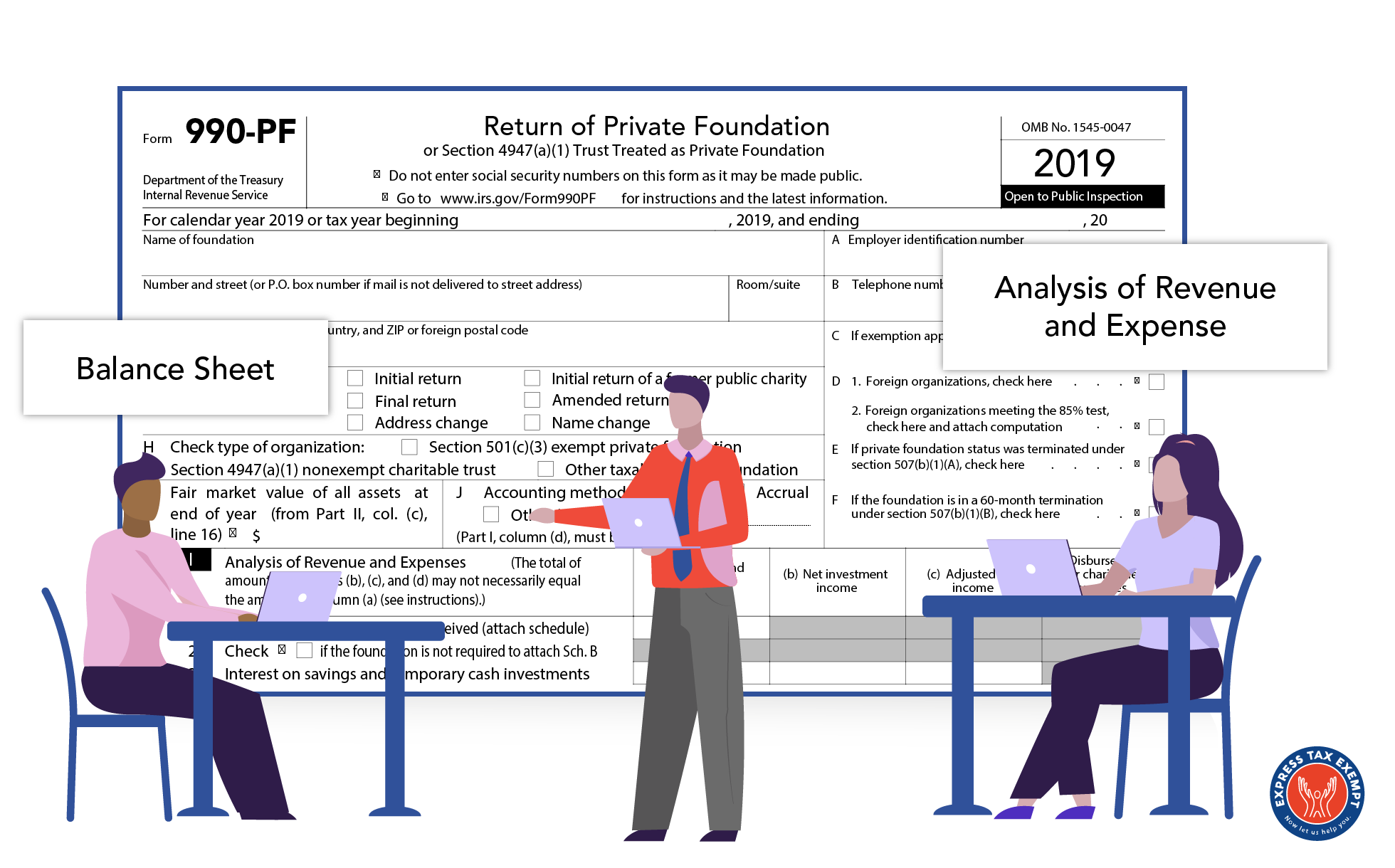

Instructions to file your Form 990PF A Complete Guide

Web go to www.irs.gov/form990pf for instructions and the latest information. Upload, modify or create forms. • to figure the tax based on investment income, and • to report charitable distributions and activities. Ad get ready for tax season deadlines by completing any required tax forms today. Web the 2020 form 990 instructions explain that ppp loans may be reported as.

Instructions For Form 990Pf Return Of Private Foundation Or Section

Ad get ready for tax season deadlines by completing any required tax forms today. As required by section 3101 of the taxpayer first. Complete all applicable line items;. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Web the 2020.

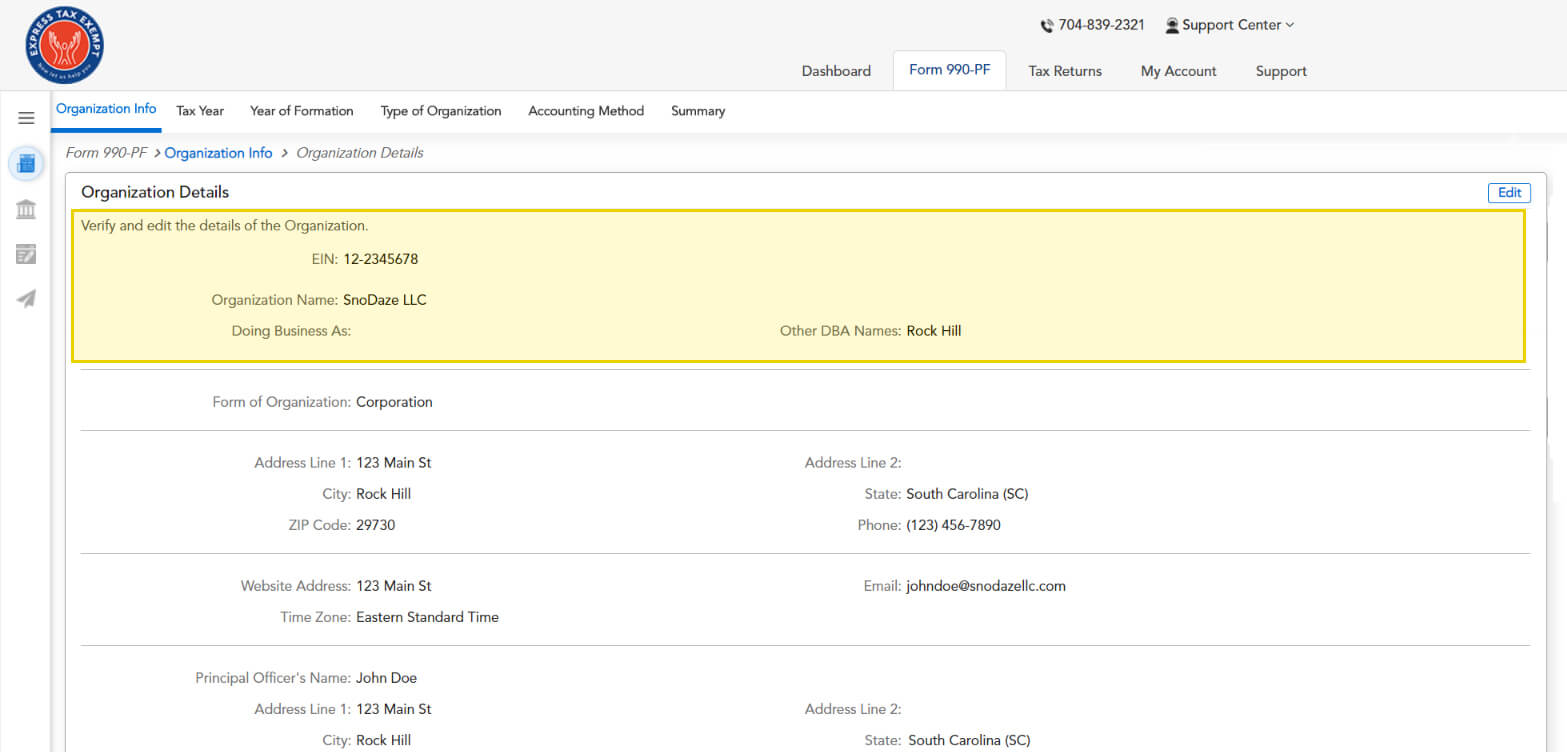

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Basic information about your organization the irs requires you to enter details about the corresponding tax year,. Web go to www.irs.gov/form990pf for instructions and the latest information. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Complete if the organization.

Form 990PF Return of Private Foundation (2014) Free Download

Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Web go to www.irs.gov/form990pf for instructions and the latest information. • to figure the tax based on investment income, and • to report charitable distributions and activities. Try it for free.

Form 990PF Return of Private Foundation (2014) Free Download

Complete, edit or print tax forms instantly. Generating/preparing a short year return;. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Complete if the organization is a section 501(c)(3). Ad get ready for tax season deadlines by completing any required.

Try It For Free Now!

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Complete all applicable line items;. Get ready for tax season deadlines by completing any required tax forms today. Complete if the organization is a section 501(c)(3).

Schedule A (Form 990) 2021 (All Organizations Must Complete This Part.) See.

• to figure the tax based on investment income, and • to report charitable distributions and activities. Web make sure it flows correctly to the filing instructions) excess distributions can be carried over for up to five years if foundation fails to make required distributions, need. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of the revenue. Complete, edit or print tax forms instantly.

Basic Information About Your Organization The Irs Requires You To Enter Details About The Corresponding Tax Year,.

Ad get ready for tax season deadlines by completing any required tax forms today. Web go to www.irs.gov/form990pf for instructions and the latest information. Upload, modify or create forms. If the organization follows a calendar tax year.

As Required By Section 3101 Of The Taxpayer First.

Generating/preparing a short year return;.