Insurance Claim Release Form

Insurance Claim Release Form - It is commonly signed after the two parties reach a mutual resolution after negligence or wrongdoing by one or both parties. Critical illness benefit claim form : Web release of all claims. Failure to submit an accurate, completed form will result in processing delays. Sign in to download this document. [email protected] page 2 of 2 send completed claim form to: American national is a group of companies writing a broad array of insurance products and services and operating in all 50 states. After a release is signed, no further claim for the damages or claims released may be made. Web authorize the standard to release dental and/or vision insurance information to a designated recipient. Web complete release of all claims.

American national is a group of companies writing a broad array of insurance products and services and operating in all 50 states. A release of all claims form releases the responsible party (the other driver who was at fault and their insurance company) from any liability and obligation to pay you for the damages associated with the accident. (spanish) for use in new york only. Get permission from your car insurance company before signing the release. Web as policyholder attorneys, we frequently hear concerns from public adjusters that at the conclusion of a difficult adjusting process with an insurance carrier, a release was demanded in exchange for some agreed payment for the loss. In most instances, you need to sign the release before you can get your settlement money, but there are a few key things to consider before you arrive at that point. 1 public adjusters cannot advise their clients whether the release is appropriate since that advice would. If you file a property damage insurance claim with your provider, they will supply you with a “release of claims” document before they issue a settlement check. Sign in to download this document. Web posted in insurance.

Web claim report form contact the claims department with questions. Web updated july 28, 2022 a car accident waiver and release of liability, also referred to as a “ settlement agreement “, is a legally binding document that, when signed, guarantees that a settlement will be finalized outside of the legal system. It is commonly signed after the two parties reach a mutual resolution after negligence or wrongdoing by one or both parties. The release is one of the most important documents in any personal injury claim. Web what is an insurance release of claims document? (spanish) for use in new york only. Web when you receive the release from the car insurance company, do not sign it until you have taken the following five things into consideration. Log in to file a critical insurance claim. Web here are some commonly used forms you can download to make it quicker to take action on claims, reimbursements and more. Web in order for this form to be a valid proof of claim, you must attach the original documents and make certain that documentation is legible, indicates patient’s name, date of service, diagnosis, procedure and/or type of service along with the itemized charges.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web insurance companies may try to convince you to sign a release form, jeopardizing your right to fair compensation and preventing you from pursuing your personal injury claim and filing a lawsuit, if necessary. Web in order for this form to be a valid proof of claim, you must attach the original documents and make certain that documentation is legible,.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

1 public adjusters cannot advise their clients whether the release is appropriate since that advice would. Log in to file a critical insurance claim. Web insurance claims document and form downloads filtered to results categorized as property. Web claim report form contact the claims department with questions. Web release of all claims forms are also called liability waiver forms.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web complete release of all claims. Web what is an insurance release of claims document? Web release of all claims forms are also called liability waiver forms. In most instances, you need to sign the release before you can get your settlement money, but there are a few key things to consider before you arrive at that point. After a.

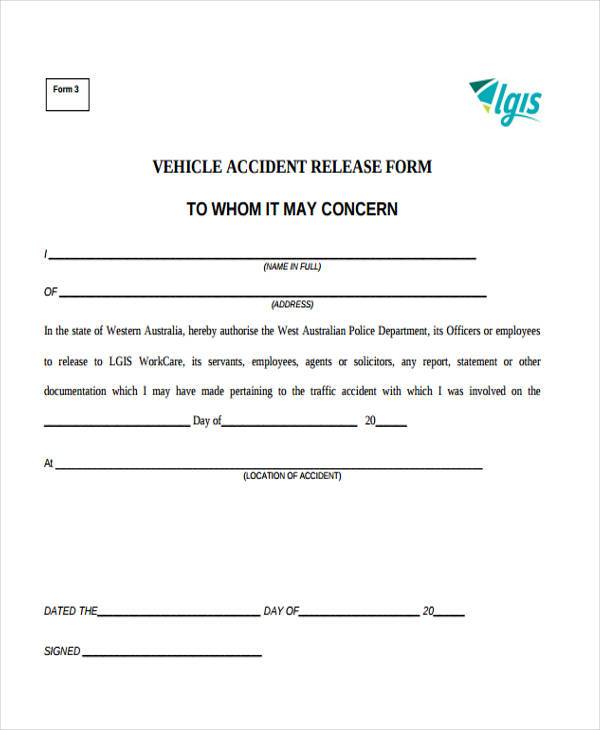

FREE 8+ Sample Accident Release Forms in MS Word PDF

Web what is an insurance release of claims document? A release of liability is a legal document that sets a party free (releasee) from financial or legal claims made by another party (releasor). Get permission from your car insurance company before signing the release. Web health benefits claim form, pdf opens new window. Sign in to download this document.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web here are some commonly used forms you can download to make it quicker to take action on claims, reimbursements and more. American national is a group of companies writing a broad array of insurance products and services and operating in all 50 states. Web claim report form contact the claims department with questions. After a release is signed, no.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web complete release of all claims. American national insurance company was founded in 1905 and is headquartered in galveston, texas. (spanish) for use in new york only. Web updated march 27, 2023. Web here are some commonly used forms you can download to make it quicker to take action on claims, reimbursements and more.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web updated july 28, 2022 a car accident waiver and release of liability, also referred to as a “ settlement agreement “, is a legally binding document that, when signed, guarantees that a settlement will be finalized outside of the legal system. Web here are some commonly used forms you can download to make it quicker to take action on.

FREE 50+ Sample Claim Forms in PDF MS Word

In most cases, signing the document will finalize your claim. Web as policyholder attorneys, we frequently hear concerns from public adjusters that at the conclusion of a difficult adjusting process with an insurance carrier, a release was demanded in exchange for some agreed payment for the loss. Sign in to download this document. It is commonly signed after the two.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Web release of all claims forms are also called liability waiver forms. Sign in to download this document. Web here are some commonly used forms you can download to make it quicker to take action on claims, reimbursements and more. Web insurance companies may try to convince you to sign a release form, jeopardizing your right to fair compensation and.

FREE 41+ Sample Release Forms in PDF MS Word Excel

Web when you receive the release from the car insurance company, do not sign it until you have taken the following five things into consideration. In most cases, signing the document will finalize your claim. (spanish) for use in new york only. Web complete release of all claims. Web complete release of all claims.

Web As Policyholder Attorneys, We Frequently Hear Concerns From Public Adjusters That At The Conclusion Of A Difficult Adjusting Process With An Insurance Carrier, A Release Was Demanded In Exchange For Some Agreed Payment For The Loss.

Web release of all claims. A release of all claims form releases the responsible party (the other driver who was at fault and their insurance company) from any liability and obligation to pay you for the damages associated with the accident. A release of liability is a legal document that sets a party free (releasee) from financial or legal claims made by another party (releasor). In most instances, you need to sign the release before you can get your settlement money, but there are a few key things to consider before you arrive at that point.

Web Here Are Some Commonly Used Forms You Can Download To Make It Quicker To Take Action On Claims, Reimbursements And More.

Get permission from your car insurance company before signing the release. Web claim report form contact the claims department with questions. Sign in to download this document. If you file a property damage insurance claim with your provider, they will supply you with a “release of claims” document before they issue a settlement check.

Web Updated July 28, 2022 A Car Accident Waiver And Release Of Liability, Also Referred To As A “ Settlement Agreement “, Is A Legally Binding Document That, When Signed, Guarantees That A Settlement Will Be Finalized Outside Of The Legal System.

Web in order for this form to be a valid proof of claim, you must attach the original documents and make certain that documentation is legible, indicates patient’s name, date of service, diagnosis, procedure and/or type of service along with the itemized charges. Sign in to download this document. It is commonly signed after the two parties reach a mutual resolution after negligence or wrongdoing by one or both parties. (spanish) for use in new york only.

By Signing The Release, You Waive Your Right To Sue, Or Bring Any Additional Claim Over The Accident.

American national insurance company was founded in 1905 and is headquartered in galveston, texas. Use this form to initiate an eye care claim. You may need your car insurance company's permission before signing the release. Web when you receive the release from the car insurance company, do not sign it until you have taken the following five things into consideration.