Ira Fair Market Value Tax Form

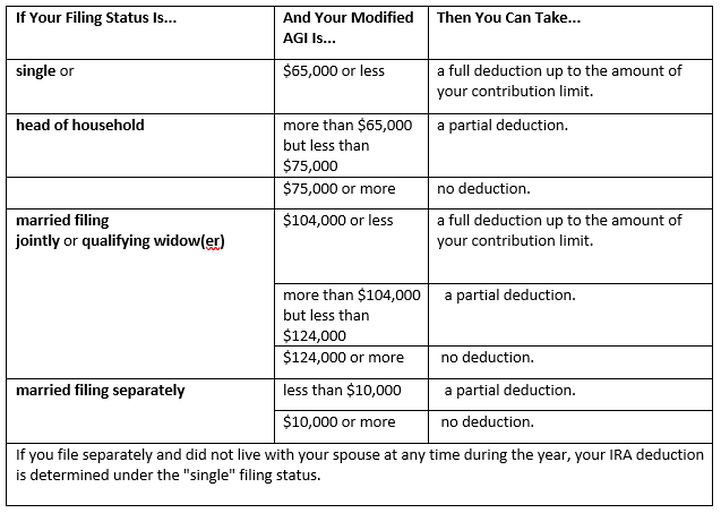

Ira Fair Market Value Tax Form - Use this form to assign or change the value of an asset. Web • the ira/ qp owner is responsible for returning the completed fair market valuation form • because these valuations are used to determine the fair market value of a particular. Web based on our custodial agreement, you as the account holder are required to provide a 2022 fair market value for each asset owned by your ira. Complete, sign, and date the valuation form. Web of goods sold is less than $500, form 8283 does not have to be filed: Web fair market value form. Web annual fair market valuation. An accurate assessment of fair market value is essential to. This form also includes the fair market value as of december 31. Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market.

Use this form to assign or change the value of an asset. Web the values must be assessed as of december 31 st of the reporting year. One form per ira club account number. Web valuation of plan assets at fair market value. Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market. This form also includes the fair market value as of december 31. Web • the ira/ qp owner is responsible for returning the completed fair market valuation form • because these valuations are used to determine the fair market value of a particular. Complete, sign, and date the valuation form. Plan assets must be valued at fair market value, not cost. Web annual fair market valuation.

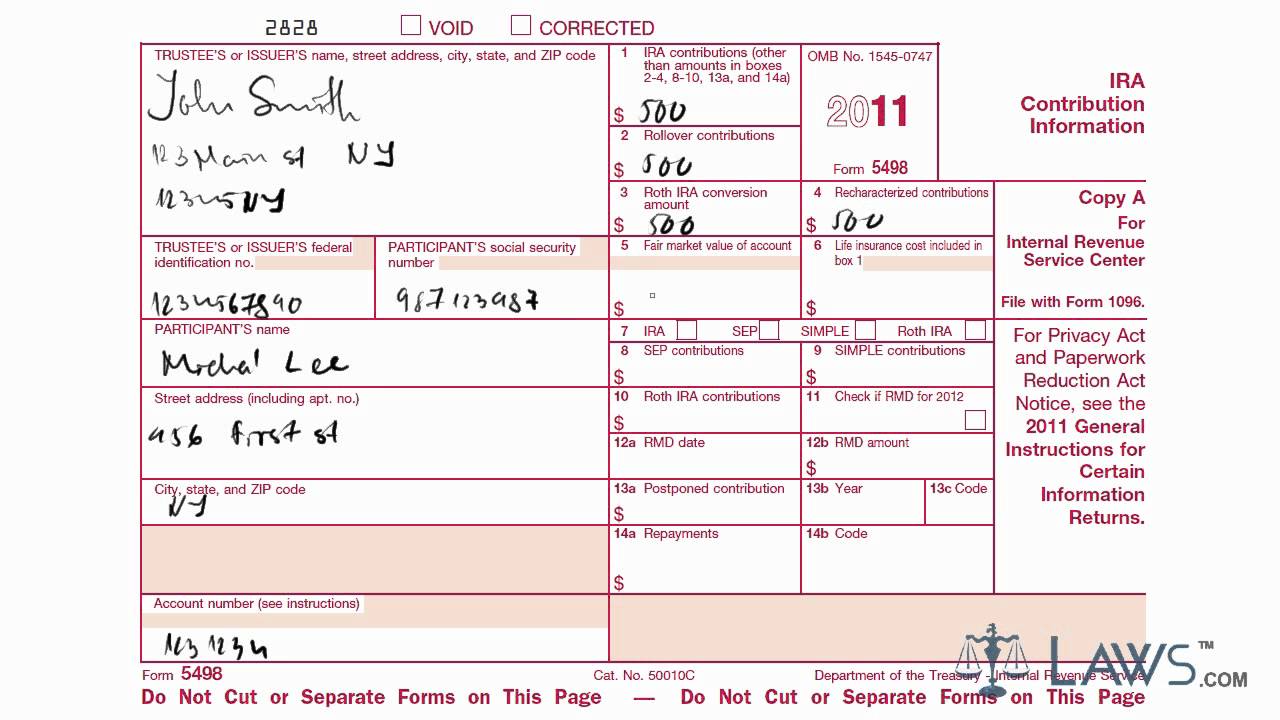

Do i need to include this. The worth of your asset (s) is assigned based on an estimate of market value—not on the cost of the. Web • the ira/ qp owner is responsible for returning the completed fair market valuation form • because these valuations are used to determine the fair market value of a particular. Web fair market value on your ira accounts is not reported on the tax return, keep that information (as well as form 5498 if you have one) for your records. This form also includes the fair market value as of december 31. Web reports contributions applied to traditional, roth, sep and simple iras. Web fair market value form. Web how do i file a 2022 ira fair market value and 2023 required minimum disctribution statement for my ira? Use this form to assign or change the value of an asset. Plan assets must be valued at fair market value, not cost.

How a Back Door Roth IRA Works

Do i need to include this. This form also includes the fair market value as of december 31. Complete, sign, and date the valuation form. Web fair market value on your ira accounts is not reported on the tax return, keep that information (as well as form 5498 if you have one) for your records. Use this form to assign.

What is Fair Market Value? Tax Smart Advisors LLC

One form per ira club account number. Plan assets must be valued at fair market value, not cost. Web annual fair market valuation. This form also includes the fair market value as of december 31. Web of goods sold is less than $500, form 8283 does not have to be filed:

Fair Market Value Appraising Alternative Assets in a SelfDirected IRA

One form per ira club account number. An accurate assessment of fair market value is essential to. Web annual fair market valuation. Web reports contributions applied to traditional, roth, sep and simple iras. Complete, sign, and date the valuation form.

SelfDirected IRA Fair Market Valuation Form Premier Trust

Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market. The worth of your asset (s) is assigned based on an estimate of market value—not on the cost of the. Plan assets must be valued at fair market value, not.

How Does Fair Market Value Apply To My SelfDirected IRA? » STRATA

Web the values must be assessed as of december 31 st of the reporting year. Web of goods sold is less than $500, form 8283 does not have to be filed: This form also includes the fair market value as of december 31. The worth of your asset (s) is assigned based on an estimate of market value—not on the.

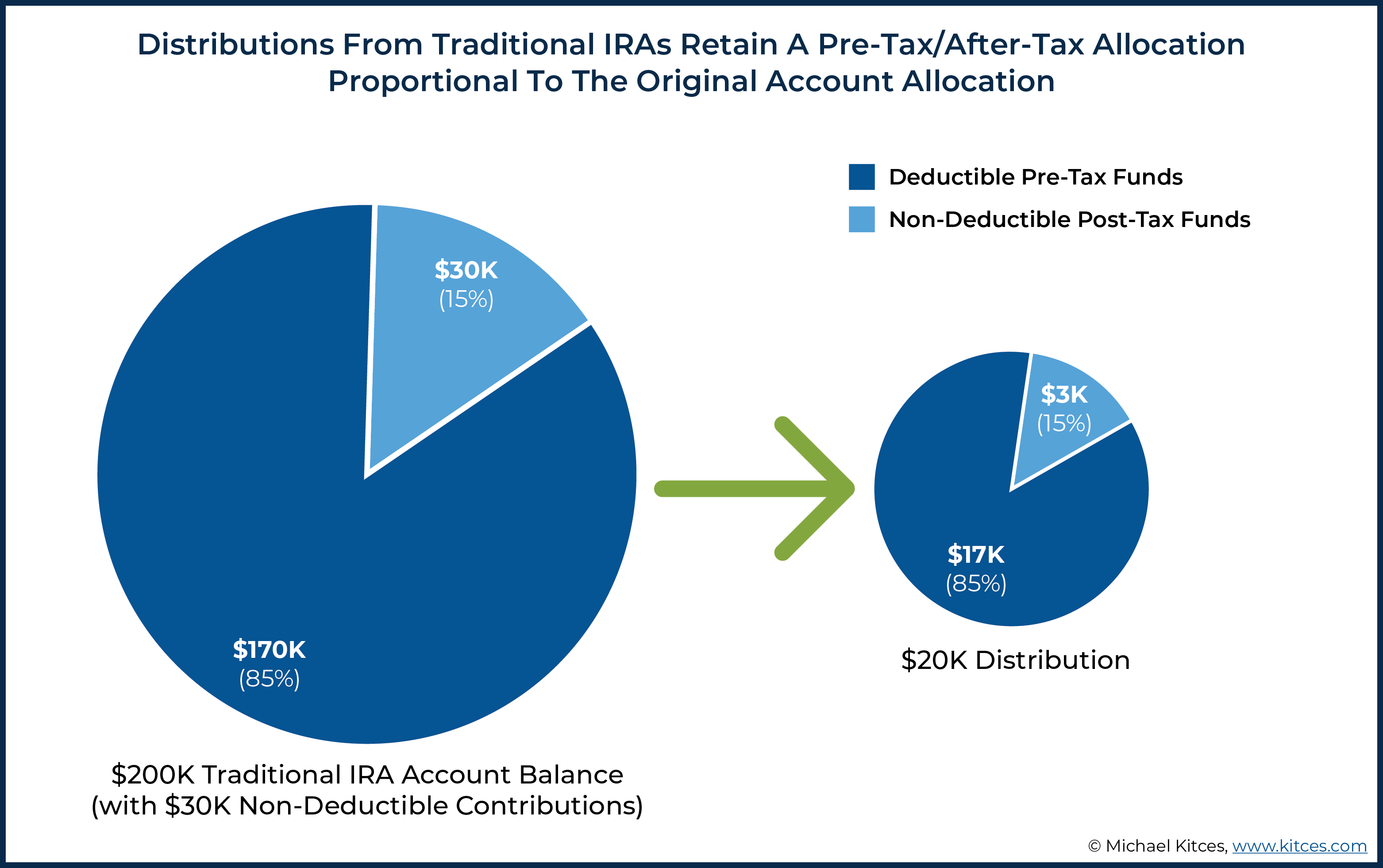

Isolating IRA Basis For Tax Efficient Roth IRA Conversions

Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market. Web annual fair market valuation. Web reports contributions applied to traditional, roth, sep and simple iras. Web how do i file a 2022 ira fair market value and 2023 required.

Learn How to Fill the Form 5498 Individual Retirement Account

Web how do i file a 2022 ira fair market value and 2023 required minimum disctribution statement for my ira? Web annual fair market valuation. Web of goods sold is less than $500, form 8283 does not have to be filed: Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup.

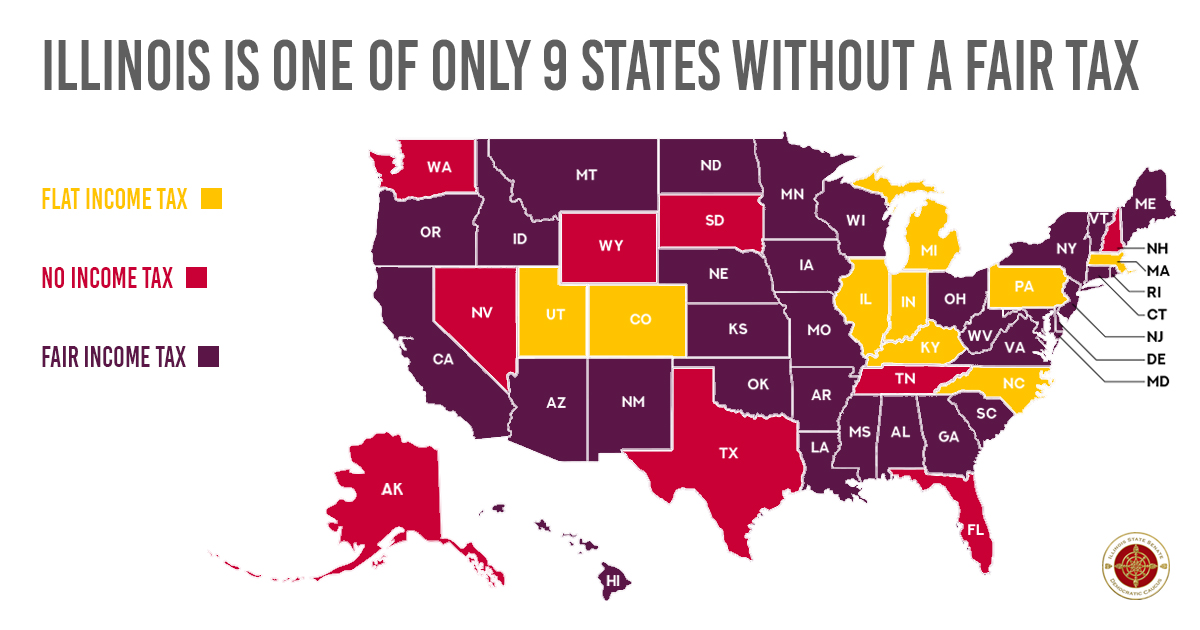

Murphy votes for a fair tax plan to protect the middle class

Web annual fair market valuation. Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market. Web fair market value form. Complete, sign, and date the valuation form. Web valuation of plan assets at fair market value.

IRA Valuations and the Closely Held Business Interest RIC Omaha

Web reports contributions applied to traditional, roth, sep and simple iras. One form per ira club account number. Web the values must be assessed as of december 31 st of the reporting year. Web fair market value on your ira accounts is not reported on the tax return, keep that information (as well as form 5498 if you have one).

Web Reports Contributions Applied To Traditional, Roth, Sep And Simple Iras.

Web the 83(b) election is a provision under the internal revenue code (irc) that gives an employee, or startup founder, the option to pay taxes on the total fair market. An accurate assessment of fair market value is essential to. Web valuation of plan assets at fair market value. Web • the ira/ qp owner is responsible for returning the completed fair market valuation form • because these valuations are used to determine the fair market value of a particular.

Web The Values Must Be Assessed As Of December 31 St Of The Reporting Year.

Web of goods sold is less than $500, form 8283 does not have to be filed: Do i need to include this. Use this form to assign or change the value of an asset. One form per ira club account number.

The Worth Of Your Asset (S) Is Assigned Based On An Estimate Of Market Value—Not On The Cost Of The.

Web based on our custodial agreement, you as the account holder are required to provide a 2022 fair market value for each asset owned by your ira. Complete, sign, and date the valuation form. Web fair market value on your ira accounts is not reported on the tax return, keep that information (as well as form 5498 if you have one) for your records. Web annual fair market valuation.

This Form Also Includes The Fair Market Value As Of December 31.

Web how do i file a 2022 ira fair market value and 2023 required minimum disctribution statement for my ira? Web fair market value form. Plan assets must be valued at fair market value, not cost.