Irs Form 3922

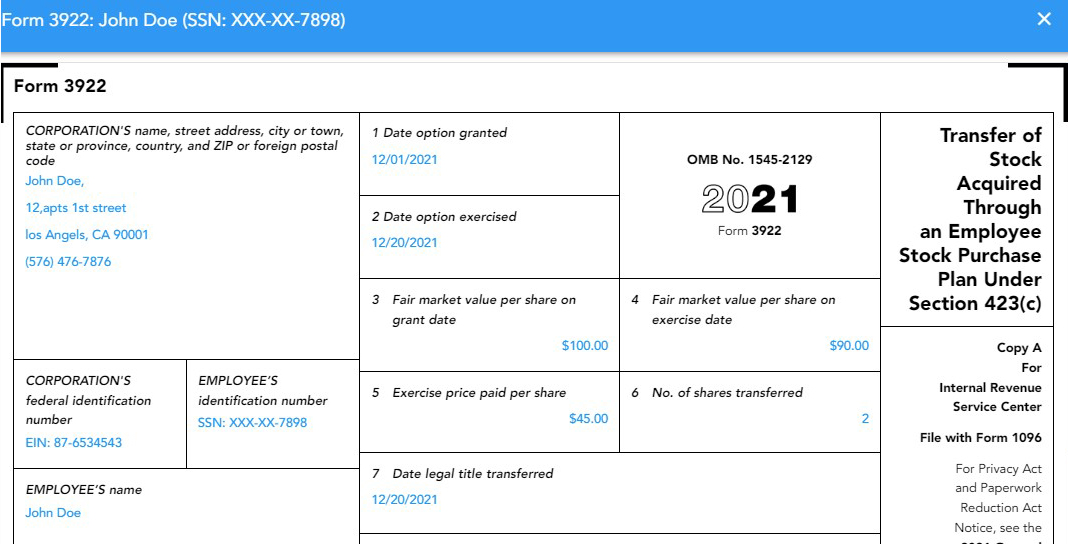

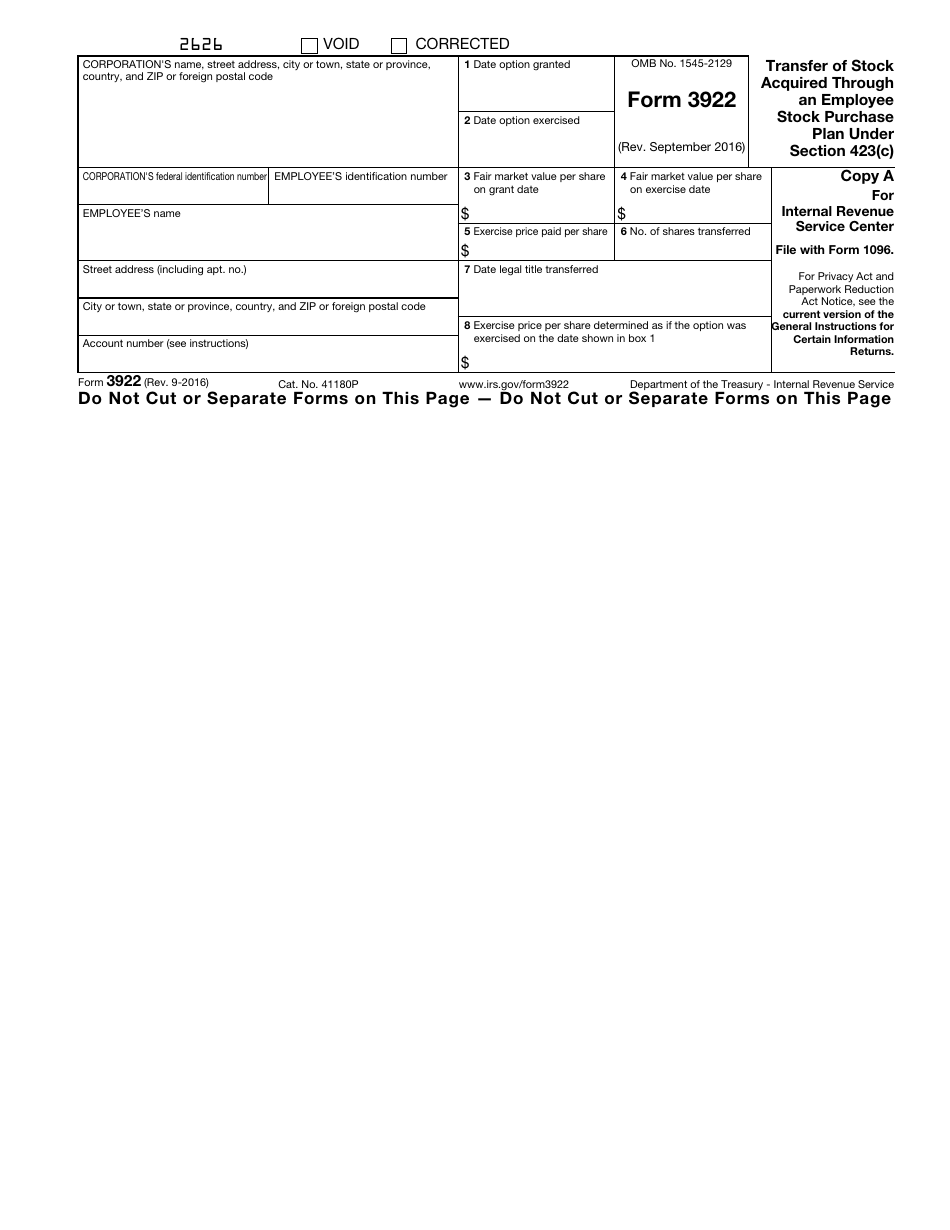

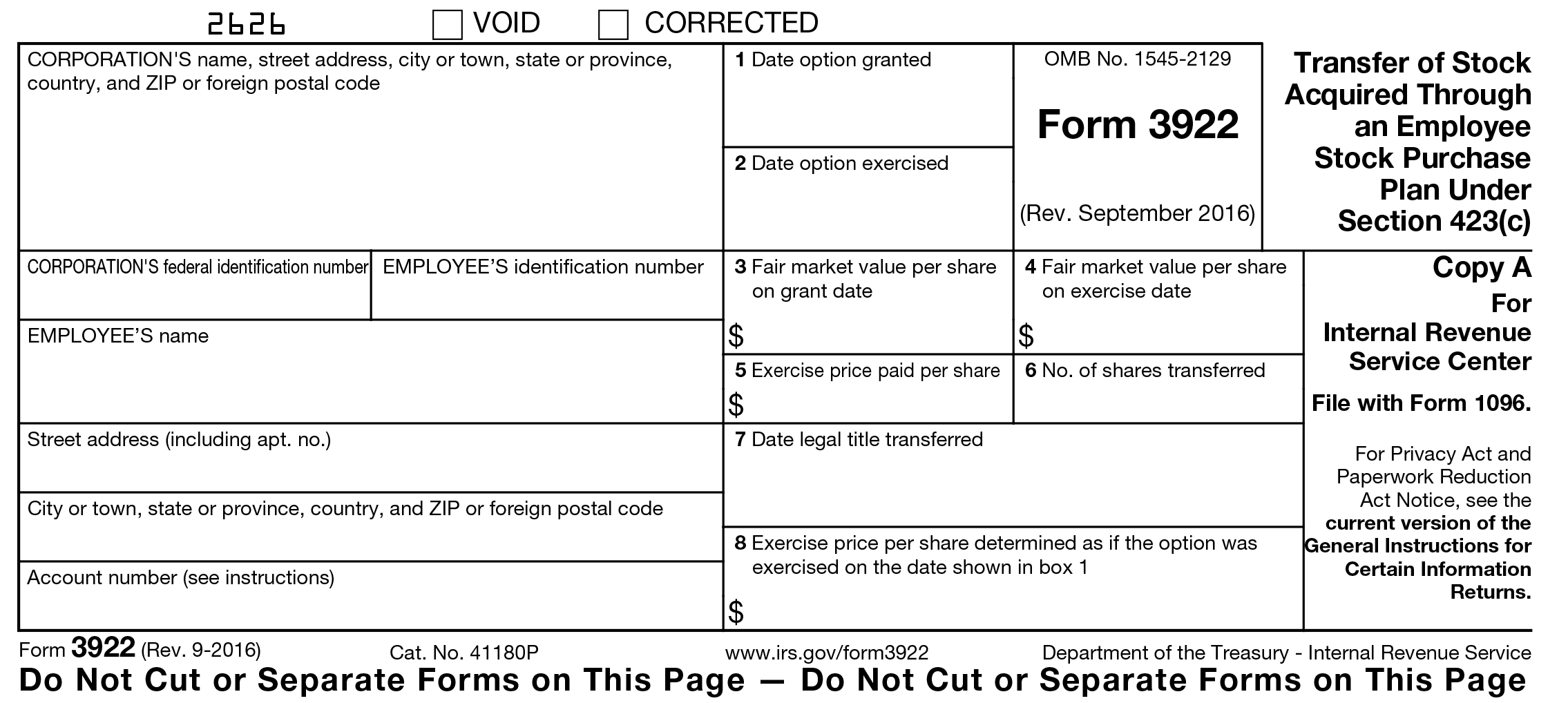

Irs Form 3922 - Specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422(b) must, for that calendar year, file form 3921 for each transfer made during that year. You will need the information reported on form 3922 to determine stock basis in the year the stock is sold. Corporations file form 3922 for each transfer of stock acquired by an employee stock purchase plan. Review and transmit it to the irs; Web what is irs form 3922? Web who must file. If you didn't sell any espp stock, don't enter anything from your 3922. For internal revenue service center. Web form 3922 is an informational statement and would not be entered into the tax return. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific details about the transfer of stock due to participation in an.

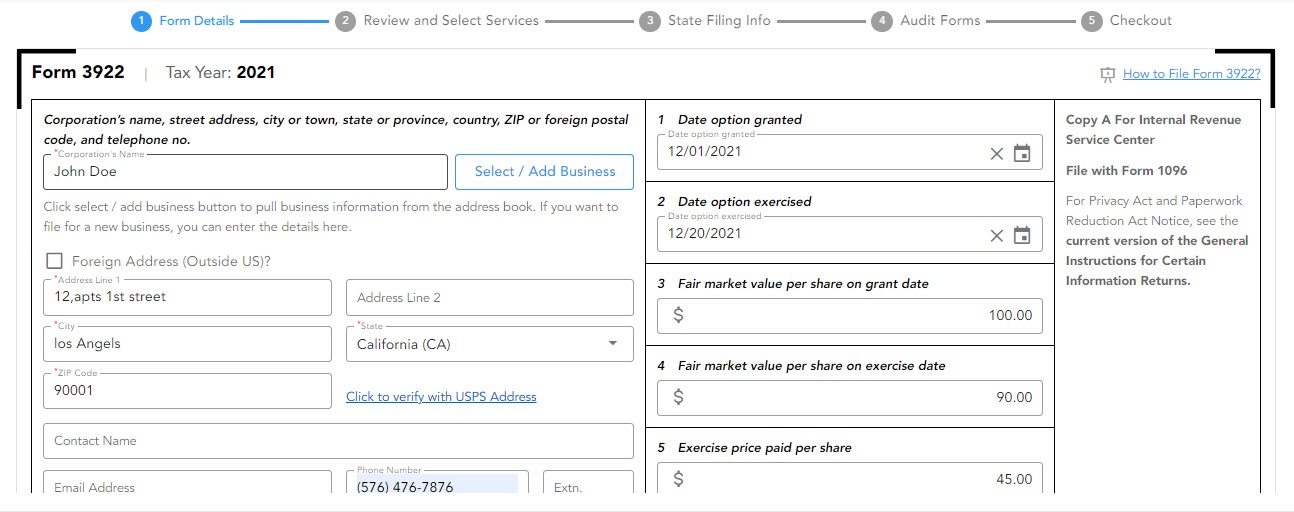

For internal revenue service center. If you didn't sell any espp stock, don't enter anything from your 3922. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock during the tax year. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. File form 3922 online with taxbandits to receive instant updates on the irs status of. Web form 3922 is an informational statement and would not be entered into the tax return. Web what is irs form 3922? Review and transmit it to the irs; Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for each transfer made during that year.

Corporations file form 3922 for each transfer of stock acquired by an employee stock purchase plan. For internal revenue service center. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Review and transmit it to the irs; Since the form records your capital gains and losses, you need to report it. Web form 3922 is an informational statement and would not be entered into the tax return. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock during the tax year. File form 3922 online with taxbandits to receive instant updates on the irs status of. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the exercise price was less than 100 percent of the value of the stock on the date shown in box 1 or was not. Web what is irs form 3922?

3922 2020 Public Documents 1099 Pro Wiki

Web what is irs form 3922? Web form 3922 is an informational statement and would not be entered into the tax return. You will need the information reported on form 3922 to determine stock basis in the year the stock is sold. For internal revenue service center. Corporations file form 3922 for each transfer of stock acquired by an employee.

Instructions for IRS Form 1096, Form 1097, Form 1098, Form 1099, Form

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related forms, and instructions on how to file. Corporations file form 3922 for each transfer of stock acquired by an employee stock purchase plan. If you didn't sell any espp stock, don't enter anything from your 3922. You will.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the exercise price was less than 100 percent of the value of the stock on the date shown.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the exercise price was less than 100 percent of the value of the stock on the date shown.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Review and transmit it to the irs; Specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422(b) must, for that calendar year, file form 3921 for each transfer made during that year. Web.

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

If you didn't sell any espp stock, don't enter anything from your 3922. Web who must file. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the.

What Is IRS Form 3922?

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific details about the transfer of stock due to participation in an. Web who must file. You will need the information reported on form 3922 to determine stock basis in the year the stock is sold. Since the form records your capital gains.

File IRS Form 3922 Online EFile Form 3922 for 2022

Per the form 3922 irs instructions: If you didn't sell any espp stock, don't enter anything from your 3922. Since the form records your capital gains and losses, you need to report it. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web who must file.

IRS Form 3922 Software 289 eFile 3922 Software

Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the exercise price was less than 100 percent of the value of the stock on the date shown.

IRS Form 3922

Web who must file. Web form 3922 is an informational statement and would not be entered into the tax return. File form 3922 online with taxbandits to receive instant updates on the irs status of. Specific instructions for form 3921 who must file every corporation which in any calendar year transfers to any person a share of stock pursuant to.

Web Information About Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Including Recent Updates, Related Forms, And Instructions On How To File.

Review and transmit it to the irs; For internal revenue service center. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option granted under an employee stock purchase plan and (2) the exercise price was less than 100 percent of the value of the stock on the date shown in box 1 or was not. Web form 3922 is an informational statement and would not be entered into the tax return.

Web Who Must File.

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific details about the transfer of stock due to participation in an. Web what is irs form 3922? File form 3922 online with taxbandits to receive instant updates on the irs status of. Web form 3922 is the form your employer sends you if you haven’t yet sold the stocks.

Specific Instructions For Form 3921 Who Must File Every Corporation Which In Any Calendar Year Transfers To Any Person A Share Of Stock Pursuant To That Person's Exercise Of An Incentive Stock Option Described In Section 422(B) Must, For That Calendar Year, File Form 3921 For Each Transfer Made During That Year.

If you didn't sell any espp stock, don't enter anything from your 3922. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for each transfer made during that year. You will need the information reported on form 3922 to determine stock basis in the year the stock is sold. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock during the tax year.

Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Copy A.

Corporations file form 3922 for each transfer of stock acquired by an employee stock purchase plan. Per the form 3922 irs instructions: Since the form records your capital gains and losses, you need to report it.