Irs Form 5330

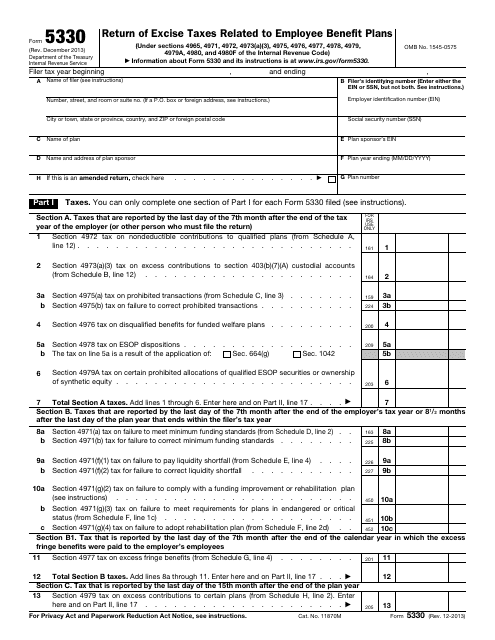

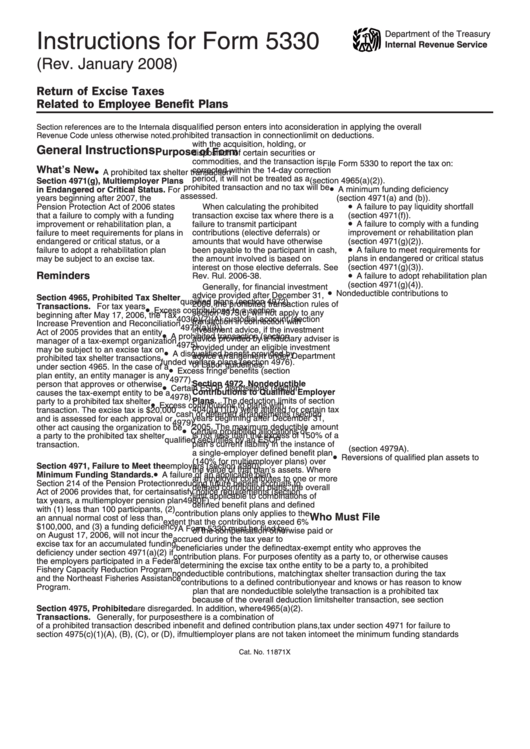

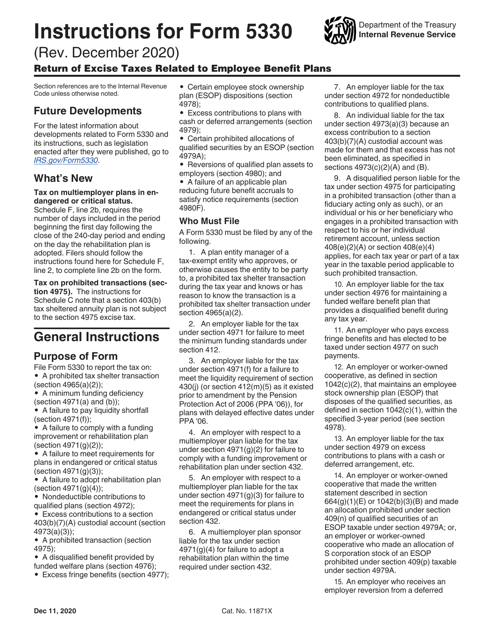

Irs Form 5330 - December 2022) return of excise taxes related to employee benefit plans. Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Instructions for form 5330 pdf; What kind of excise taxes? Web the internal revenue service (irs) expanded its individually designed determination letter program to include 403(b) retirement plans in november 2022, before which time 403(b). Web file form 5330 to report the tax on: Double check the plan number file separate form 5330s to report two or more excise taxes with different due dates Form 5300 is used to request a determination letter for initial qualification, while form 5310 is used to request a determination letter upon plan. Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) go to.

Web form 5330, return of excise taxes related to employee benefit plans pdf; Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Tips for preparing form 5330: Instructions for form 5330 pdf; If plan sponsors delay a 401(k) participant’s deposit so it interferes with investments and earnings, they’re required to pay an. Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. One of the most common of these is the excise tax on late deposits made while correcting through the department of labor’s voluntary fiduciary correction program (vfcp). A failure to comply with a funding improvement or rehabilitation plan (section 4971 (g) (2)); A minimum funding deficiency (section 4971 (a) and (b)); The form lists more than 20 different types of excise taxes that could come into play, but the most common ones are.

One of the most common of these is the excise tax on late deposits made while correcting through the department of labor’s voluntary fiduciary correction program (vfcp). April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. Irs form 5330 must be filed by the last day of the seventh month after the close of the plan year. Double check the plan number file separate form 5330s to report two or more excise taxes with different due dates Tips for preparing form 5330: A failure to pay liquidity shortfall (section 4971 (f)); Department of the treasury internal revenue service. Web form 5330, return of excise taxes related to employee benefit plans pdf; Web file form 5330 to report the tax on: Instructions for form 5330 pdf;

IRS Form 5330 Download Fillable PDF or Fill Online Return of Excise

Irs form 5330 must be filed by the last day of the seventh month after the close of the plan year. Form 5300 is used to request a determination letter for initial qualification, while form 5310 is used to request a determination letter upon plan. A failure to pay liquidity shortfall (section 4971 (f)); Double check the plan number file.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. Tips for preparing form 5330: What kind of excise taxes? Web file form 5330 to.

Instructions For Form 5330 Internal Revenue Service printable pdf

Web this form is used to report and pay the excise tax related to employee benefit plans. Form 5300 is used to request a determination letter for initial qualification, while form 5310 is used to request a determination letter upon plan. (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue.

2013 Form DHS CG5330 Fill Online, Printable, Fillable, Blank pdfFiller

If plan sponsors delay a 401(k) participant’s deposit so it interferes with investments and earnings, they’re required to pay an. A minimum funding deficiency (section 4971 (a) and (b)); Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. Web irs form 5330 is a reporting tool commonly used to report.

How do I call the IRS Phone Number Customer Service? 8335539895

December 2022) return of excise taxes related to employee benefit plans. Web file form 5330 to report the tax on: Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code).

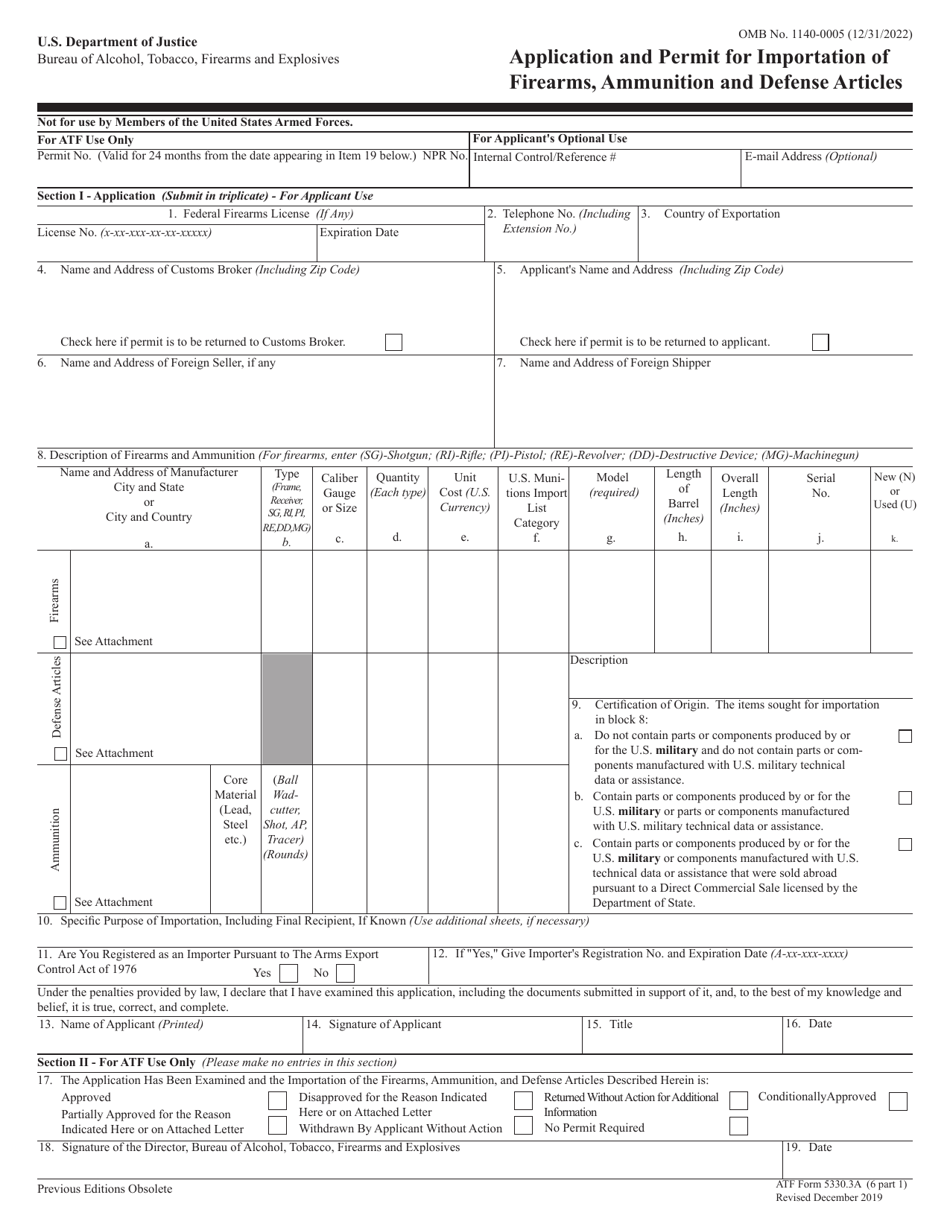

ATF Form 6 (5330.3A) Part 1 Download Fillable PDF or Fill Online

Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Irs form 5330 must be filed by the last day of the seventh month after the close of the plan year. Tips for preparing form 5330: Web this form is used to report and pay the excise tax related to.

The Plain English Guide to Form 5330

If plan sponsors delay a 401(k) participant’s deposit so it interferes with investments and earnings, they’re required to pay an. (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) go to. Tips for preparing form 5330: A minimum funding deficiency (section 4971 (a) and (b)); Web file form 5330.

The Plain English Guide to Form 5330

Web file form 5330 to report the tax on: Form 5300 is used to request a determination letter for initial qualification, while form 5310 is used to request a determination letter upon plan. Web form 5330, return of excise taxes related to employee benefit plans pdf; December 2022) return of excise taxes related to employee benefit plans. Web this form.

Download Instructions for IRS Form 5330 Return of Excise Taxes Related

Web the internal revenue service (irs) expanded its individually designed determination letter program to include 403(b) retirement plans in november 2022, before which time 403(b). Web form 5330, return of excise taxes related to employee benefit plans pdf; Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. Irs form 5330.

Fill Free fillable Form 5330 2013 Return of Excise Taxes PDF form

A failure to pay liquidity shortfall (section 4971 (f)); Web form 5330, return of excise taxes related to employee benefit plans pdf; Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. Web form 5330 omb no. Double check the plan number file separate form 5330s to report two or more.

Web This Form Is Used To Report And Pay The Excise Tax Related To Employee Benefit Plans.

Department of the treasury internal revenue service. Web irs form 5330 is a reporting tool commonly used to report excise taxes for 401(k) plans. Web form 5330 omb no. A failure to comply with a funding improvement or rehabilitation plan (section 4971 (g) (2));

A Failure To Pay Liquidity Shortfall (Section 4971 (F));

One of the most common of these is the excise tax on late deposits made while correcting through the department of labor’s voluntary fiduciary correction program (vfcp). Sign the form 5330 use the correct plan number do not leave plan number blank; Form 5300 is used to request a determination letter for initial qualification, while form 5310 is used to request a determination letter upon plan. (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) go to.

Irs Form 5330 Must Be Filed By The Last Day Of The Seventh Month After The Close Of The Plan Year.

A minimum funding deficiency (section 4971 (a) and (b)); Web file form 5330 to report the tax on: Instructions for form 5330 pdf; Web form 5330, return of excise taxes related to employee benefit plans pdf;

April 2009) Internal Revenue Service (Under Sections 4965, 4971, 4972, 4973(A)(3), 4975, 4976, 4977, 4978, 4979, 4979A, 4980, And 4980F Of The Internal Revenue Code) Filer Tax Year Beginning , And Ending , Name Of Filer (See Instructions) Number, Street, And Room Or Suite No.

Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans. December 2022) return of excise taxes related to employee benefit plans. Web the internal revenue service (irs) expanded its individually designed determination letter program to include 403(b) retirement plans in november 2022, before which time 403(b). Tips for preparing form 5330: