Irs Form 6055

Irs Form 6055 - In addition, ales must also fulfill the requirements of section 6056 reporting. An ale is an employer that employed an average of at least. Web irc code section 6055 with respect to its own employees enrolled in one of the ppo plans. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Web irs forms 6055 and 6056 resources large employer (more than 50 employees) *ale (applicable large employer): Open it up with online editor and start editing. Web get the irs form 1055 you require. Under code section 6056, entities will. Individual income tax return created date: Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete.

Every person who provides minimum essential coverage to an individual during a calendar year shall, at such time. Web this document contains proposed amendments to 26 cfr parts 1 (income tax regulations) and 301 (procedure and administration regulations) under sections. Web irc code section 6055 with respect to its own employees enrolled in one of the ppo plans. Involved parties names, addresses and phone numbers etc. Web the forms that must be filed with the irs under section 6055 include: Web provides an extension for both furnishing 2015 information returns to individuals and filing with the internal revenue service under irc 6055 and for. An ale is an employer that employed an average of at least. Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Individual income tax return created date: Under code section 6056, entities will.

Involved parties names, addresses and phone numbers etc. An ale is an employer that employed an average of at least. Under code section 6056, entities will. Every person who provides minimum essential coverage to an individual during a calendar year shall, at such time. Open it up with online editor and start editing. Web provides an extension for both furnishing 2015 information returns to individuals and filing with the internal revenue service under irc 6055 and for. In addition, ales must also fulfill the requirements of section 6056 reporting. Web essential coverage under section 6055 of the internal revenue code (code), and the information reporting requirements for applicable large employers under section 6056 of. Web this document contains proposed amendments to 26 cfr parts 1 (income tax regulations) and 301 (procedure and administration regulations) under sections. Web get the irs form 1055 you require.

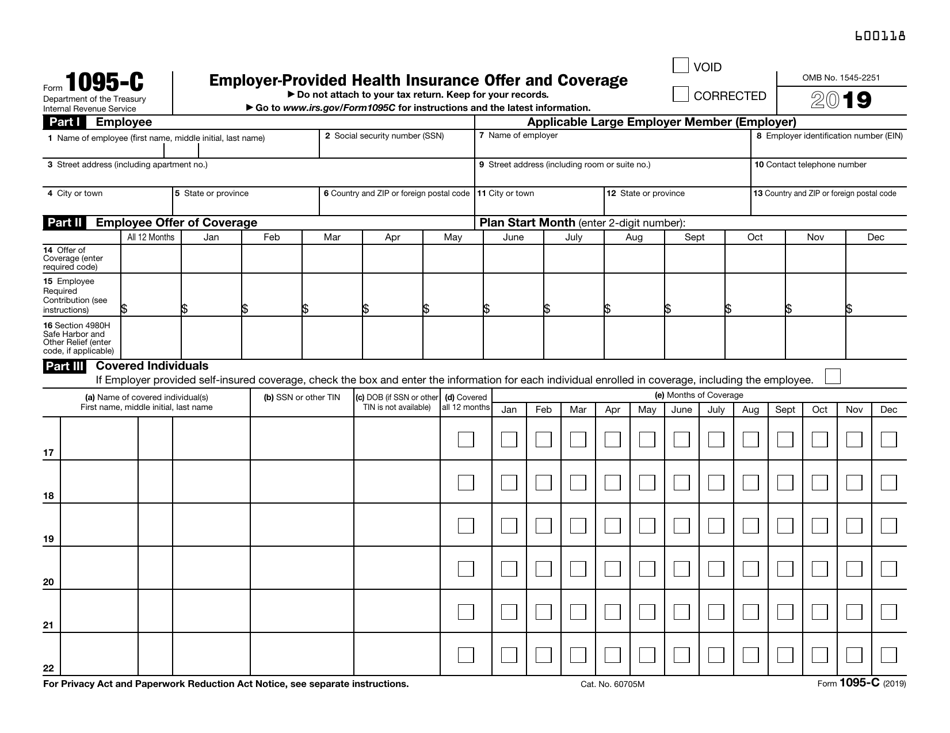

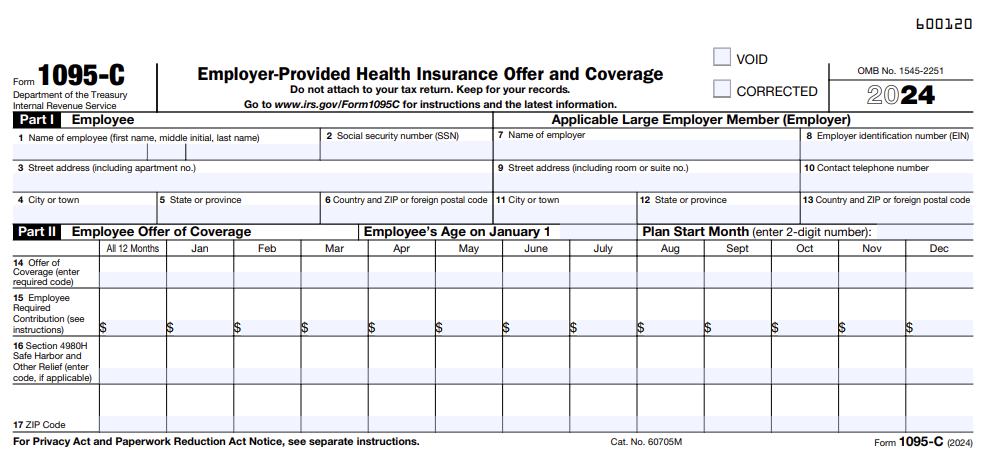

IRS Form 1095C Download Fillable PDF or Fill Online EmployerProvided

Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Open it up with online editor and start editing. In addition, ales must also fulfill the requirements of section 6056 reporting. Web irs forms 6055 and 6056 resources large employer (more than 50 employees).

IRS Reporting Requirement 6055 And 6056

Open it up with online editor and start editing. Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Web the forms that must be filed with the irs under section 6055 include: An ale is an employer that employed an average of at least. Individual income tax return.

Affordable Care Act (ACA) Reporting Requirements Forms 6055 and 6056

Web irs forms 6055 and 6056 resources large employer (more than 50 employees) *ale (applicable large employer): Web get the irs form 1055 you require. Web the forms that must be filed with the irs under section 6055 include: Web this document contains proposed amendments to 26 cfr parts 1 (income tax regulations) and 301 (procedure and administration regulations) under.

1095B and 6055 Reporting Requirements FAQ Millennium Medical

Involved parties names, addresses and phone numbers etc. Web irc code section 6055 with respect to its own employees enrolled in one of the ppo plans. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Web irs forms 6055 and 6056 resources large.

ACA IRS Reporting 6055 & 6056 Final Regulations Released

Open it up with online editor and start editing. Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Under code section 6056, entities will. Web this document contains proposed amendments to 26 cfr parts 1 (income tax regulations) and 301 (procedure and administration regulations) under sections. Web the.

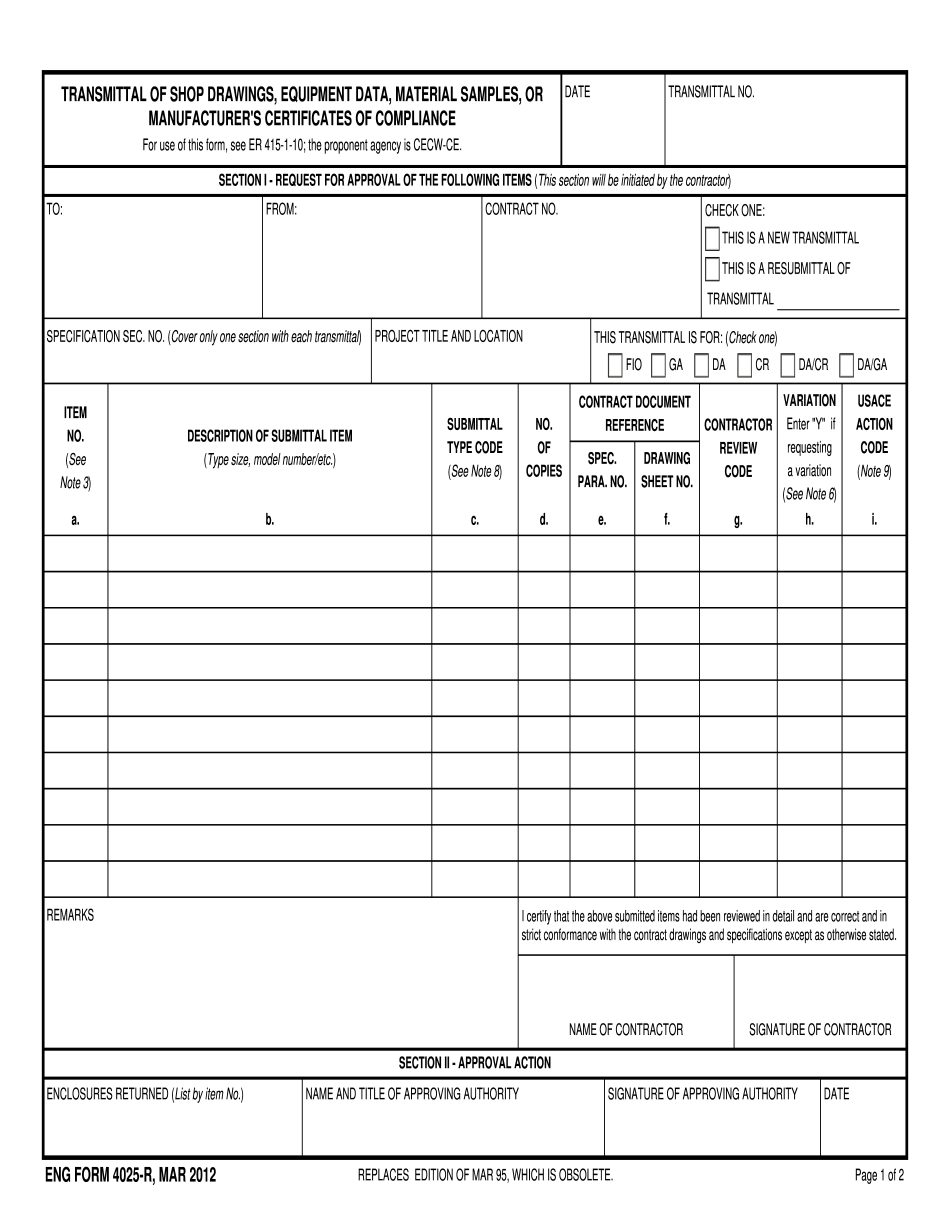

eng form 6055 Fill Online, Printable, Fillable Blank engform4025

Every person who provides minimum essential coverage to an individual during a calendar year shall, at such time. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Open it up with online editor and start editing. Web irs forms 6055 and 6056 resources.

Blog IRS Form 6055 and 6056

Web irc code section 6055 with respect to its own employees enrolled in one of the ppo plans. Web provides an extension for both furnishing 2015 information returns to individuals and filing with the internal revenue service under irc 6055 and for. In addition, ales must also fulfill the requirements of section 6056 reporting. Involved parties names, addresses and phone.

File IRS Form 1095C For 2022 Tax Year

Open it up with online editor and start editing. Web get the irs form 1055 you require. Every person who provides minimum essential coverage to an individual during a calendar year shall, at such time. Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Under code section 6056,.

ACA Filing Services 6055 Reporting Form 1094 C

Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Web irs forms 6055 and 6056 resources large employer (more than 50 employees) *ale (applicable large employer): Web provides an extension for both furnishing 2015 information returns to individuals and filing with the internal revenue service under irc 6055.

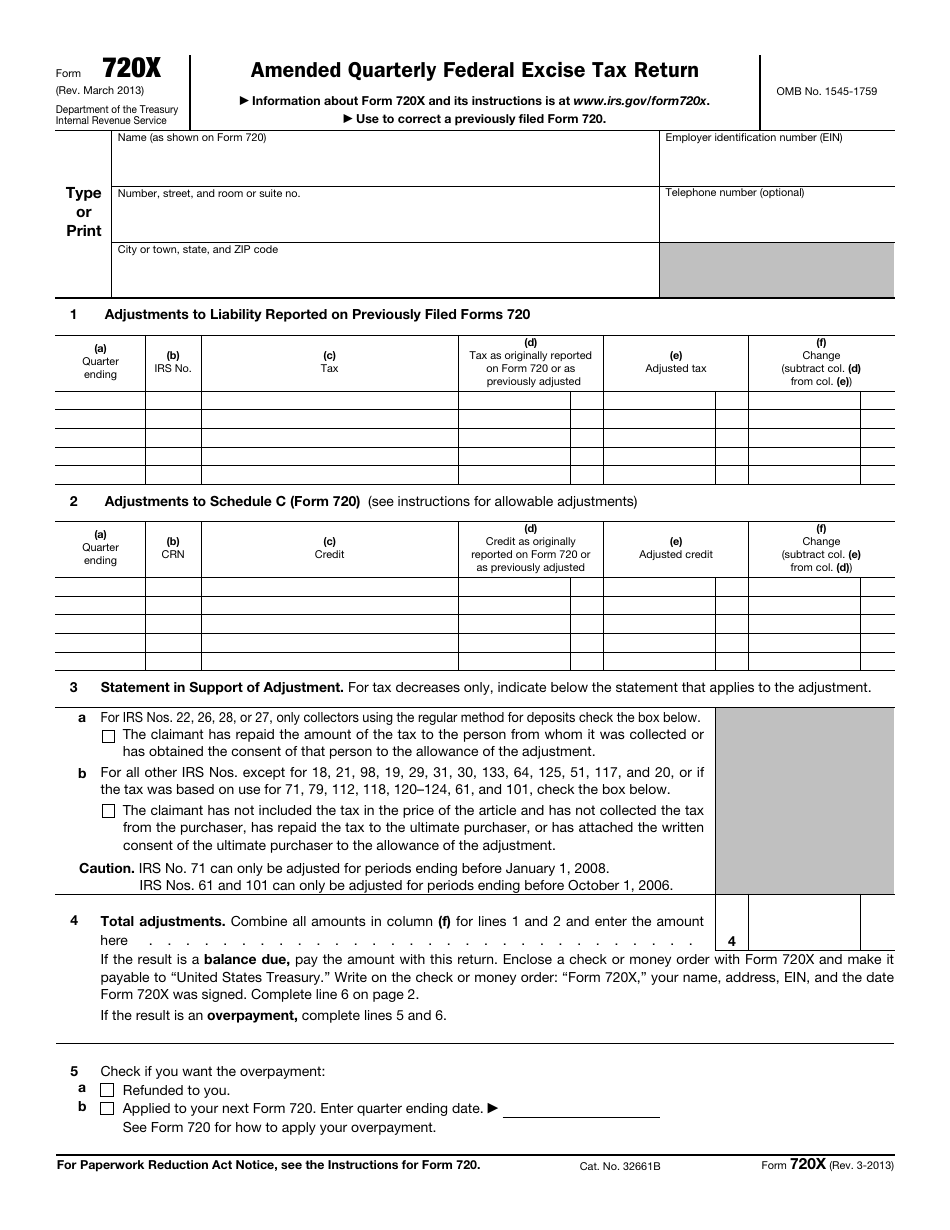

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

Involved parties names, addresses and phone numbers etc. Under code section 6056, entities will. Open it up with online editor and start editing. Web get the irs form 1055 you require. In addition, ales must also fulfill the requirements of section 6056 reporting.

Individual Income Tax Return Created Date:

Web irs forms 6055 and 6056 resources large employer (more than 50 employees) *ale (applicable large employer): Web essential coverage under section 6055 of the internal revenue code (code), and the information reporting requirements for applicable large employers under section 6056 of. Web irc code section 6055 with respect to its own employees enrolled in one of the ppo plans. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party.

Involved Parties Names, Addresses And Phone Numbers Etc.

Under code section 6056, entities will. An ale is an employer that employed an average of at least. Every person who provides minimum essential coverage to an individual during a calendar year shall, at such time. In addition, ales must also fulfill the requirements of section 6056 reporting.

Open It Up With Online Editor And Start Editing.

Web to simplify irs reporting requirements for small businesses, unitedhealthcare has made a 6055 membership report available for groups to complete. Web get the irs form 1055 you require. Web the forms that must be filed with the irs under section 6055 include: Web this document contains proposed amendments to 26 cfr parts 1 (income tax regulations) and 301 (procedure and administration regulations) under sections.