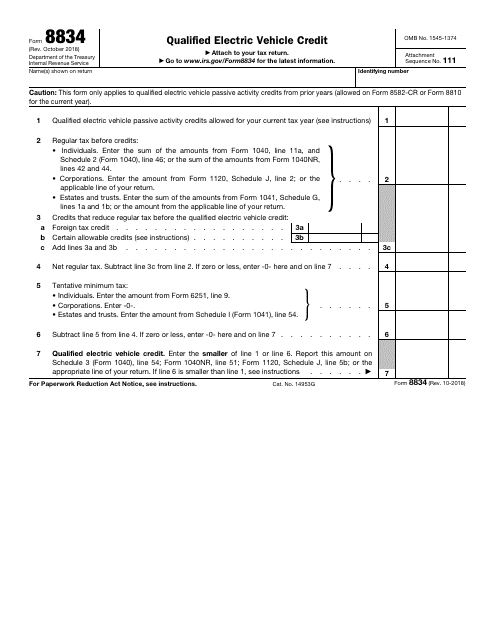

Irs Form 8834

Irs Form 8834 - Web are you sure that form 8834 is the one that you need? Deduct the sales tax paid on a new car. Web filing tax form 8936: • use this form to claim the credit. Web taxact does not support form 8834 qualified electric vehicle credit; Attach to your tax return. General instructions section references are to the internal revenue code. Attach to your tax return. Web the credit is limited to $4,000 for each vehicle. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022.

Web the credit is limited to $4,000 for each vehicle. October 2017) department of the treasury internal revenue service. In the list of federal individual forms available says that it it is, but. December 2019) department of the treasury internal revenue service. Attach to your tax return. Web there are several ways to submit form 4868. Web are you sure that form 8834 is the one that you need? Attach to your tax return. Web taxact does not support form 8834 qualified electric vehicle credit; The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax.

The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Attach to your tax return. October 2018) department of the treasury internal revenue service. Form 8834 (2009) page 3 if,. December 2019) department of the treasury internal revenue service. Web to access the qualified electric vehicle credit in taxslayer pro, from the main menu of the tax return (form 1040) select: Web the instructions for the applicable form for more information. General instructions section references are to the internal revenue code. October 2017) department of the treasury internal revenue service. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.

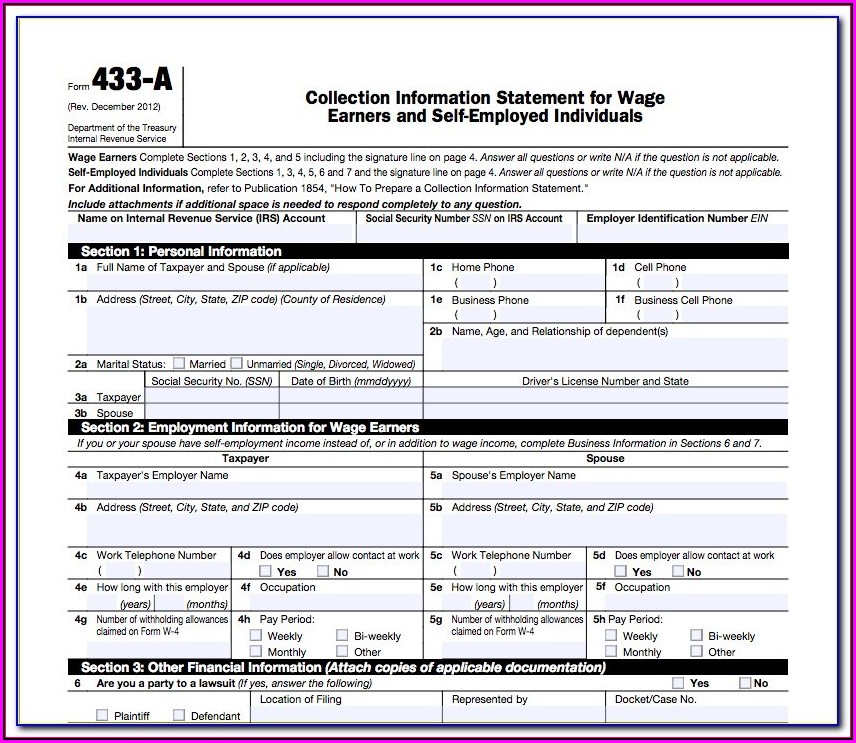

How to use form 9465 instructions for your irs payment plan Artofit

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web attach to your tax return. Attach to your tax return. Web you can use form 8834 to claim any qualified electric vehicle.

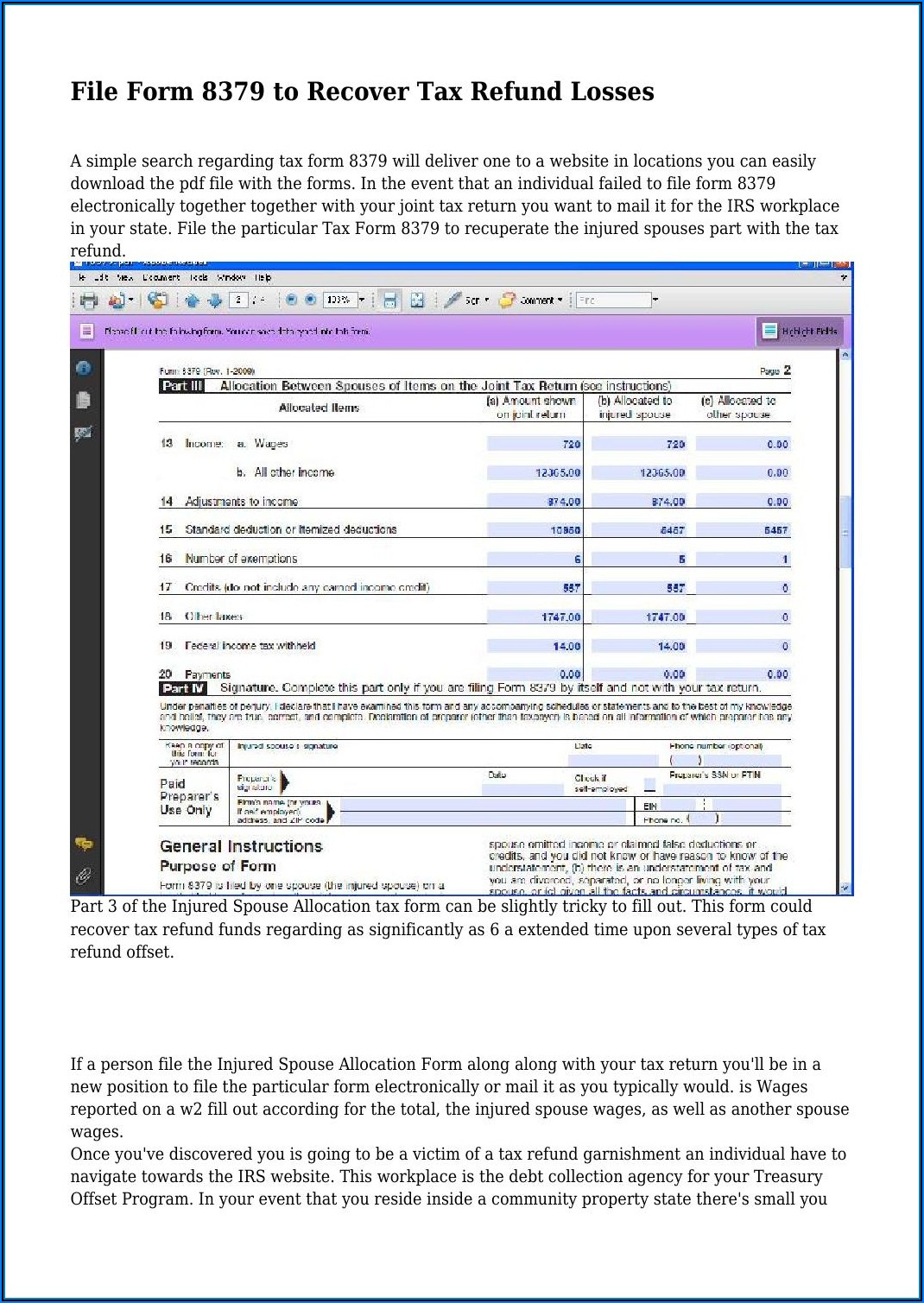

Irs Form 8379 Injured Spouse Allocation Form Resume Examples

Web filing tax form 8936: Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to. Form 8834 (2009) page 3 if,. The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Web taxact does.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

December 2019) department of the treasury internal revenue service. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. It is only used for carryovers of the qualified electric vehicle. Form 8834, qualified electric vehicle credit is not available yet in tt. You can download or print current.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Attach to your tax return. This form only applies to qualified electric. The total credit is limited to the excess of your regular tax liability, reduced by certain credits, over your tentative minimum tax. Attach to your tax return.

Form 8834 Qualified Electric Vehicle Credit (2014) Free Download

October 2018) department of the treasury internal revenue service. Web employer's quarterly federal tax return. Attach to your tax return. Purpose of form use form 8834 to claim. Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to.

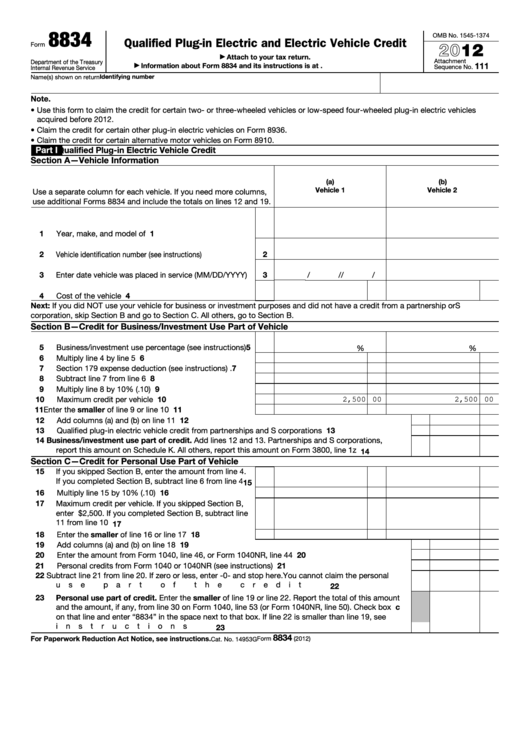

Fillable Form 8834 Qualified PlugIn Electric And Electric Vehicle

In the list of federal individual forms available says that it it is, but. Form 8834, qualified electric vehicle credit is not available yet in tt. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Attach to your tax return. Web the credit is limited to $4,000 for each vehicle.

Irs Form Section 1031 Universal Network

Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Web there are several ways to submit form 4868. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. October 2017) department of the treasury.

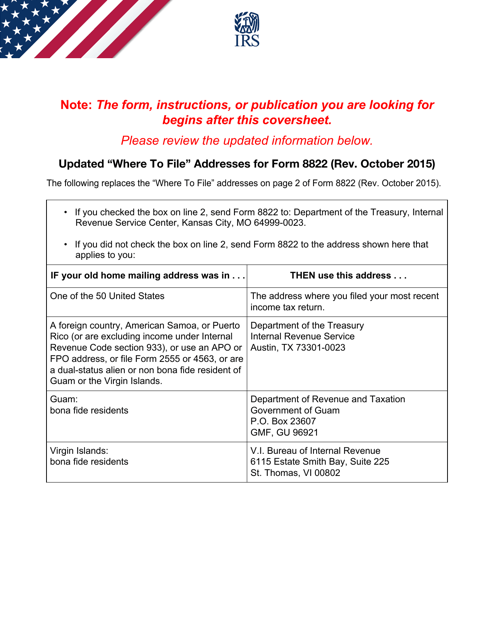

IRS Form 8822 Download Fillable PDF or Fill Online Change of Address

Web you can use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. It is only used for carryovers of the qualified electric vehicle. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web the instructions for the applicable form for more.

Printable Irs Form 8822 B Form Resume Examples X42M7drYkG

Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Form 8834 (2009) page 3 if,. October 2018) department of the treasury internal revenue service. Web to access the qualified electric vehicle credit in taxslayer pro, from the main menu of the tax.

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric

Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web taxact does not support form 8834 qualified electric vehicle credit; Attach to your tax.

Deduct The Sales Tax Paid On A New Car.

In the list of federal individual forms available says that it it is, but. October 2018) department of the treasury internal revenue service. Web filing tax form 8936: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Form 8834 (2009) Page 3 If,.

Attach to your tax return. It is only used for carryovers of the qualified electric vehicle. This form only applies to qualified electric. Web employer's quarterly federal tax return.

Attach To Your Tax Return.

General instructions section references are to the internal revenue code. • use this form to claim the credit. Form 8834, qualified electric vehicle credit is not available yet in tt. Web taxact does not support form 8834 qualified electric vehicle credit;

The Total Credit Is Limited To The Excess Of Your Regular Tax Liability, Reduced By Certain Credits, Over Your Tentative Minimum Tax.

Web for the latest information about developments related to form 8834 and its instructions, such as legislation enacted after they were published, go to. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. Web attach to your tax return. Web there are several ways to submit form 4868.