Irs Form 8881

Irs Form 8881 - Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022. Plans covered under this credit would be any qualified plans that cover. Written comments should be received on or before. Web irs form 8881 (credit for small employer pension plan startup costs) is filed in conjunction with the employer’s tax return. Web form 8881 allows small businesses to claim tax credits created by the secure act. The irs will need to amend the form for the. Web irs form 8881 is typically used by small business owners in the following scenarios: Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web the irs has revised form 8881, credit for small employer pension plan startup costs.

Tax and payments total tax (schedule j, part i) total credits general business credits (form. Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. Web (irs form 8881, credit for small employer pension plan startup costs). Web irs form 8881 (credit for small employer pension plan startup costs) is filed in conjunction with the employer’s tax return. Written comments should be received on or before. Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022. Web irs form 8881 is typically used by small business owners in the following scenarios: Web the irs has revised form 8881, credit for small employer pension plan startup costs. The credits cover the costs of starting a new retirement plan and adding. If you’ve set up a new qualified pension plan for your employees, you can.

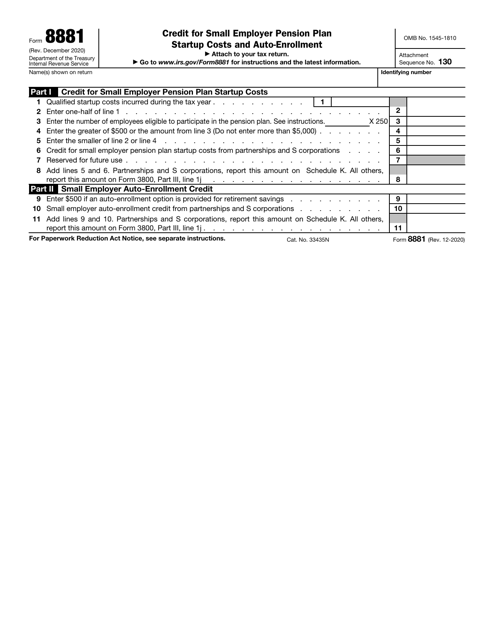

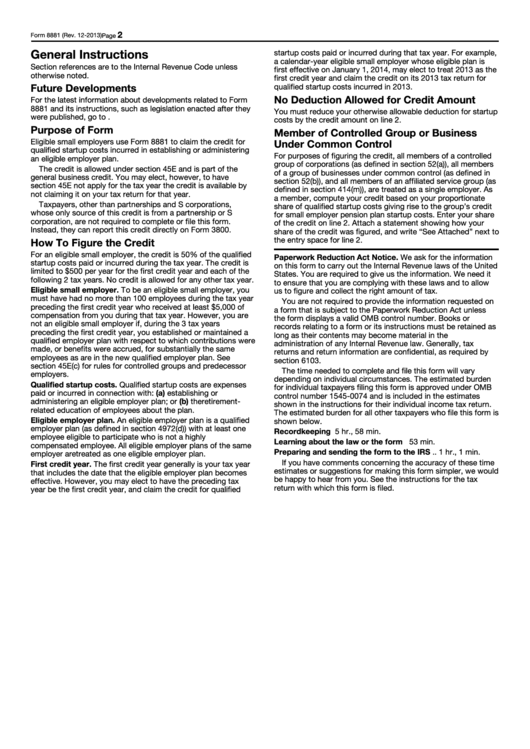

The irs will need to amend the form for the. Web irs form 8881 is typically used by small business owners in the following scenarios: Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web establish or administer a qualifying retirement plan, or educate employees about the plan. Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022. Written comments should be received on or before. Web (irs form 8881, credit for small employer pension plan startup costs). Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan. Plans covered under this credit would be any qualified plans that cover. You are not required to file annual financial reports.

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Web (irs form 8881, credit for small employer pension plan startup costs). If you’ve set up a new qualified pension plan for your employees, you can. Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. Web irs form 8881 (credit for small employer pension plan startup costs) is filed in conjunction with the.

Irs Form 2290 Printable Form Resume Examples

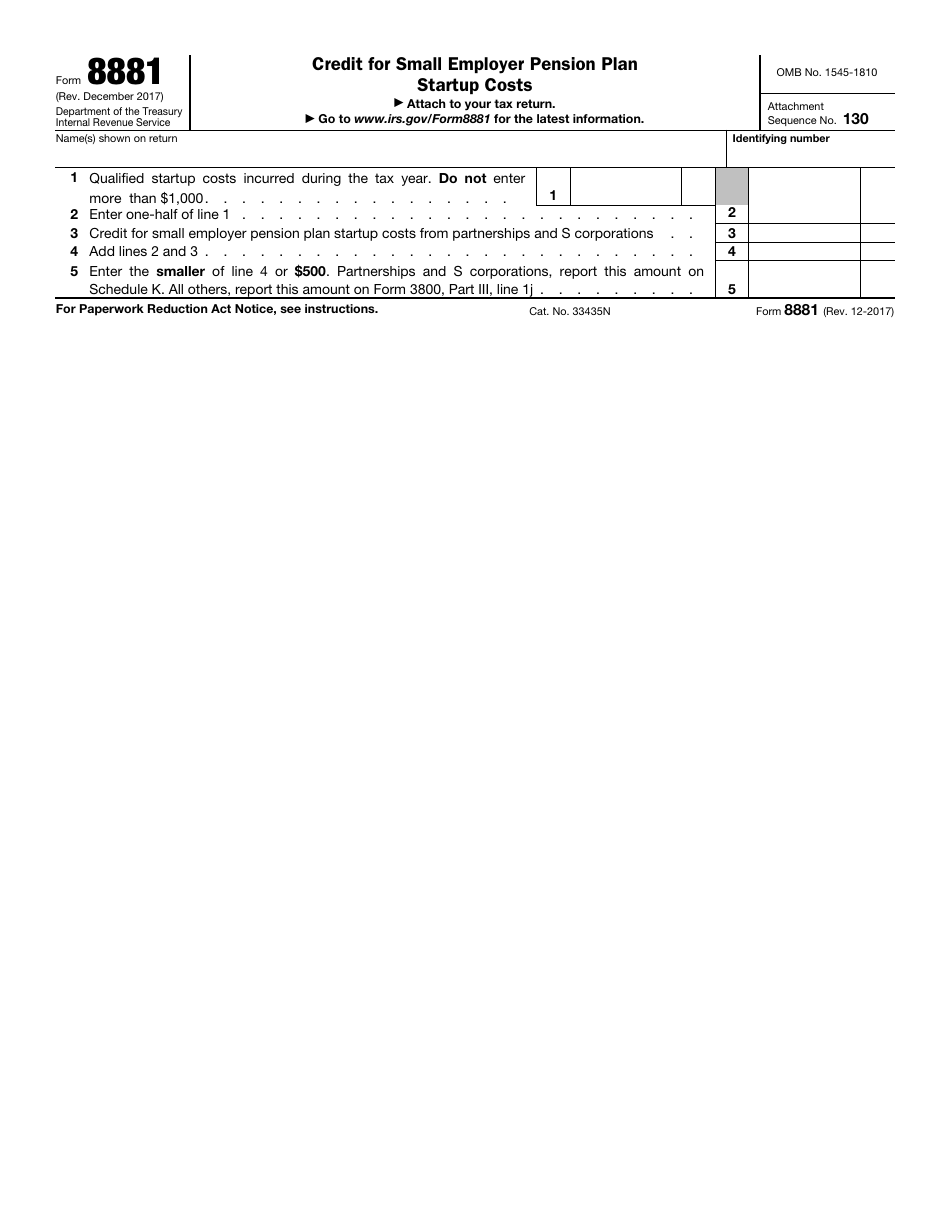

Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. The revision is effective in december 2017. Eligible employers you qualify to claim this. Web irs form 8881 is typically used by small business owners in the following scenarios: The irs will need to amend the form for the.

IRS Form 8821 (How to Give Tax Information Authorization to Another

Eligible employers you qualify to claim this. Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan. Web form 8881 allows small businesses to claim tax credits created by the secure act. You are not required to file annual financial reports..

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. If you’ve set up a new qualified pension plan for your employees, you can. Written comments should be received on or before. Web use form 8881 to claim this small business pension plan tax credit the credit is 50%.

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

If you’ve set up a new qualified pension plan for your employees, you can. September 2014) department of the treasury internal revenue service information return for publicly offered original issue discount instruments information. The credits cover the costs of starting a new retirement plan and adding. An eligible employer with 50 or fewer employees may claim a tax credit. You.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Eligible employers you qualify to claim this. An eligible employer with 50 or fewer employees may claim a tax credit. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the.

Instructions For Form 8881 Credit For Small Employer Pension Plan

Plans covered under this credit would be any qualified plans that cover. The irs will need to amend the form for the. Eligible employers you qualify to claim this. Web irs form 8881 is typically used by small business owners in the following scenarios: Web form 8881 allows small businesses to claim tax credits created by the secure act.

IRS FORM 8281 PDF

Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan startup costs, up to. Web irs form 8881 is typically used by small business owners in the following scenarios: Web if you qualify, you may claim the credit using form 8881, credit for small.

Irs 2290 Form 2016 To 2017 Universal Network

Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web establish or administer a qualifying retirement plan, or educate employees about the plan. Plans covered under this credit would be any qualified plans that cover. Web irs form 8881 is typically used by small.

Revisiting the consequences of a “covered expatriate” for

Web form 8881 allows small businesses to claim tax credits created by the secure act. Written comments should be received on or before. Web use form 8881 to claim this small business pension plan tax credit the credit is 50% of all of your eligible small employer pension plan startup costs, up to. Web if you qualify, you may claim.

Web Irs Form 8881 (Credit For Small Employer Pension Plan Startup Costs) Is Filed In Conjunction With The Employer’s Tax Return.

Web purpose of form eligible small employers use form 8881, part i, to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan. Tax and payments total tax (schedule j, part i) total credits general business credits (form. Web establish or administer a qualifying retirement plan, or educate employees about the plan. An eligible employer with 50 or fewer employees may claim a tax credit.

The Irs Will Need To Amend The Form For The.

Web we last updated the credit for small employer pension plan startup costs in february 2023, so this is the latest version of form 8881, fully updated for tax year 2022. Web form 8881 allows small businesses to claim tax credits created by the secure act. Web irs form 8881 is typically used by small business owners in the following scenarios: Web the irs has revised form 8881, credit for small employer pension plan startup costs.

You Are Not Required To File Annual Financial Reports.

Plans covered under this credit would be any qualified plans that cover. Web form 8881 from the main menu of the corporation tax return (form 1120) select: Web you may be eligible for a substantial tax credit on form 8881 to offset your plan costs. The revision is effective in december 2017.

Written Comments Should Be Received On Or Before.

Web small businesses may claim the qualified retirement plan startup costs tax credit using irs form 8881 for the first three years of the plan. Web irs is soliciting comments concerning form 8881, credit for small employer pension plan startup costs. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. If you’ve set up a new qualified pension plan for your employees, you can.