Irs Form 8950

Irs Form 8950 - Web 8950 application for voluntary omb no. Web the irs has issued revised instructions for 2022 of form 8950, application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs). Web information about form 8950, application for voluntary correction program (vcp), including recent updates, related forms and instructions on how to file. It must be filed using pay.gov as part of a the submission in order to request written approval from the irs for. However, if the form is not completed correctly it may not calculate the correct fee. Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep, or simple ira that has failed to comply with the applicable sep 27,. Web properly complete form 8950, application for voluntary correction program (vcp), located on pay.gov. Web use form 8950 to make a submission to the irs vcp program to fix problems with a business sponsored tax favored retirement plan and to pay the applicable user fee. File this form as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep or simple ira that has failed to. 172, updates and replaces rev.

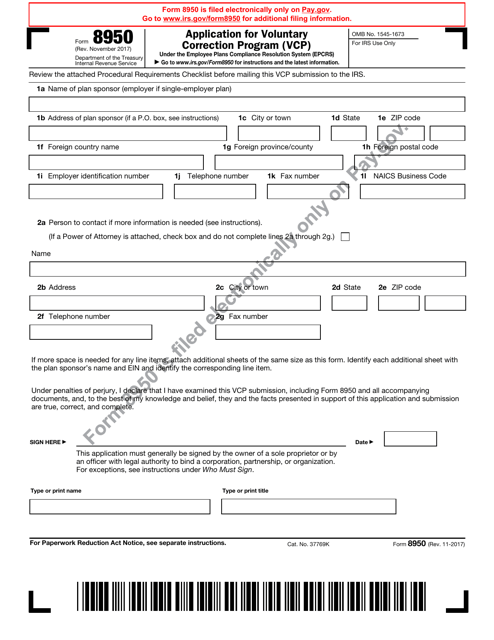

September 2015)department of the treasury internal revenue service application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs)information about form 8950 and its instructions is at www.irs.gov/form8950. Web information about form 8950, application for voluntary correction program (vcp), including recent updates, related forms and instructions on how to file. Form 8950 is part of a vcp submission. Web for the latest information about developments related to form 8950 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8950. File this form as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep or simple ira that has failed to. Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep, or simple ira that has failed to comply with the applicable sep 27,. 172, updates and replaces rev. Web the irs has issued revised instructions for 2022 of form 8950, application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs). November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal revenue service go to www.irs.gov/form8950 for instructions and the latest information. It must be filed using pay.gov as part of a the submission in order to request written approval from the irs for.

September 2015)department of the treasury internal revenue service application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs)information about form 8950 and its instructions is at www.irs.gov/form8950. However, if the form is not completed correctly it may not calculate the correct fee. Web for the latest information about developments related to form 8950 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8950. November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal revenue service go to www.irs.gov/form8950 for instructions and the latest information. Web properly complete form 8950, application for voluntary correction program (vcp), located on pay.gov. File this form as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep or simple ira that has failed to. Until that date, applicants may submit electronically using the new form or on paper using the 2017 revision of the form. The pay.gov form automatically computes the user fee while the user is completing the application. 172, updates and replaces rev. Form 8950 is part of a vcp submission.

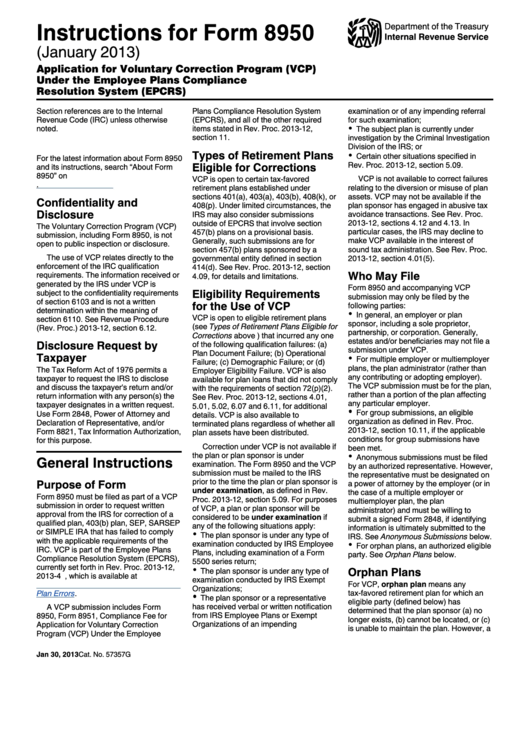

Form 8950 Instructions January 2013 printable pdf download

Form 8950 is part of a vcp submission. Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep, or simple ira that has failed to comply with the applicable sep 27,. September 2015)department of the treasury internal.

Fill Free fillable F8950 Form 8950 (Rev. November 2017) PDF form

Until that date, applicants may submit electronically using the new form or on paper using the 2017 revision of the form. Web 8950 application for voluntary omb no. Web properly complete form 8950, application for voluntary correction program (vcp), located on pay.gov. 172, updates and replaces rev. Web use form 8950 to make a submission to the irs vcp program.

Form 8950 Application for Voluntary Correction Program (VCP) (2015

Web use form 8950 to make a submission to the irs vcp program to fix problems with a business sponsored tax favored retirement plan and to pay the applicable user fee. Web the irs has issued revised instructions for 2022 of form 8950, application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs). Web form 8950.

Form 8950 Application for Voluntary Correction Program (VCP) (2015

Web information about form 8950, application for voluntary correction program (vcp), including recent updates, related forms and instructions on how to file. Web properly complete form 8950, application for voluntary correction program (vcp), located on pay.gov. Web the irs has issued revised instructions for 2022 of form 8950, application for voluntary correction program (vcp) under the employee plans compliance resolution.

Fill Free fillable F8950 Form 8950 (Rev. November 2017) PDF form

Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep, or simple ira that has failed to comply with the applicable sep 27,. November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal.

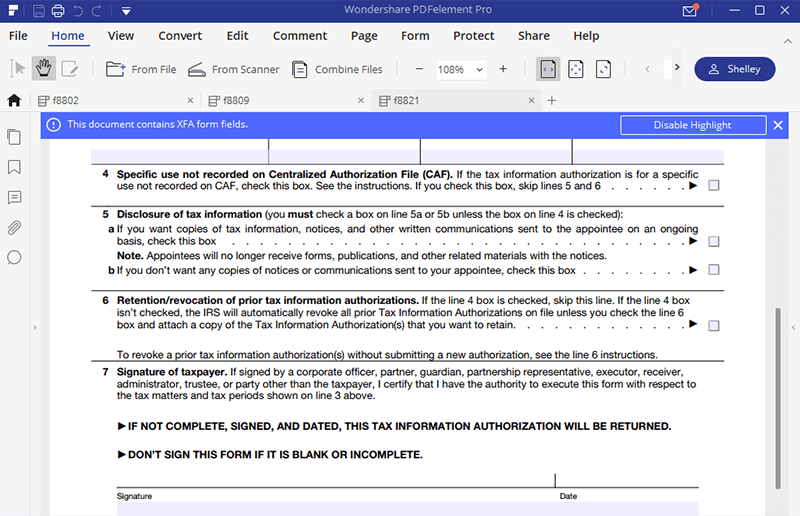

IRS Form 8821 Fill it out with the Best Program

172, updates and replaces rev. Web the irs has issued revised instructions for 2022 of form 8950, application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs). Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan,.

IRS Form 8950 Download Printable PDF or Fill Online Application for

It must be filed using pay.gov as part of a the submission in order to request written approval from the irs for. However, if the form is not completed correctly it may not calculate the correct fee. Until that date, applicants may submit electronically using the new form or on paper using the 2017 revision of the form. File this.

Revisiting the consequences of a “covered expatriate” for

Form 8950 is part of a vcp submission. November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal revenue service go to www.irs.gov/form8950 for instructions and the latest information. Web information about form 8950, application for voluntary correction program (vcp), including recent updates, related forms and instructions on how to file. Web 8950 application for voluntary.

Form 8950 Instructions Fill Online, Printable, Fillable, Blank

Web form 8950 must be filed using pay.gov as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep, or simple ira that has failed to comply with the applicable sep 27,. 172, updates and replaces rev. November 2017) under the employee plans compliance resolution system.

IRS FORM 12257 PDF

November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal revenue service go to www.irs.gov/form8950 for instructions and the latest information. 172, updates and replaces rev. Web use form 8950 to make a submission to the irs vcp program to fix problems with a business sponsored tax favored retirement plan and to pay the applicable user.

Web The Irs Has Issued Revised Instructions For 2022 Of Form 8950, Application For Voluntary Correction Program (Vcp) Under The Employee Plans Compliance Resolution System (Epcrs).

Web properly complete form 8950, application for voluntary correction program (vcp), located on pay.gov. File this form as part of a vcp submission in order to request written approval from the irs for correction of a qualified plan, 403(b) plan, sep, sarsep or simple ira that has failed to. Until that date, applicants may submit electronically using the new form or on paper using the 2017 revision of the form. Web use form 8950 to make a submission to the irs vcp program to fix problems with a business sponsored tax favored retirement plan and to pay the applicable user fee.

Web Form 8950 Must Be Filed Using Pay.gov As Part Of A Vcp Submission In Order To Request Written Approval From The Irs For Correction Of A Qualified Plan, 403(B) Plan, Sep, Sarsep, Or Simple Ira That Has Failed To Comply With The Applicable Sep 27,.

September 2015)department of the treasury internal revenue service application for voluntary correction program (vcp) under the employee plans compliance resolution system (epcrs)information about form 8950 and its instructions is at www.irs.gov/form8950. Web information about form 8950, application for voluntary correction program (vcp), including recent updates, related forms and instructions on how to file. However, if the form is not completed correctly it may not calculate the correct fee. Web 8950 application for voluntary omb no.

Form 8950 Is Part Of A Vcp Submission.

The pay.gov form automatically computes the user fee while the user is completing the application. 172, updates and replaces rev. November 2017) under the employee plans compliance resolution system (epcrs)department of the treasury internal revenue service go to www.irs.gov/form8950 for instructions and the latest information. Web for the latest information about developments related to form 8950 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8950.

.jpg)