It 201 Tax Form

It 201 Tax Form - It is analogous to the us form 1040, but it is four pages long, instead of two pages. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. If you need to obtain a federal form, you. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web you may be eligible for free file using one of the software providers below, if: Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Feb 25, 2022 — am i eligible to free file? Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Request for copy of tax return.

If you need to obtain a federal form, you. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Web to obtain tax forms: Private delivery services should not deliver returns to irs offices other than. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Feb 25, 2022 — am i eligible to free file? Do not sign this form unless all applicable lines have.

Web to obtain tax forms: Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. If you need to obtain a federal form, you. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Feb 25, 2022 — am i eligible to free file? Web you may be eligible for free file using one of the software providers below, if: Request for copy of tax return. Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need.

Ny State Tax Form It 201 Instructions Form Resume Examples 0g27j7XVPr

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web you may be eligible for.

Ny Department Of State Apostille Form Form Resume Examples GX3GDeD8xb

Feb 25, 2022 — am i eligible to free file? Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. If you need to obtain a federal form, you. Web to obtain tax forms: Your first name mi your last name (for a joint return , enter spouse’s name on line below).

Form IT201X (2010) (Fillin) Amended Resident Tax Return (long

Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Do not sign this form unless all applicable lines have. Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need. Electronic filing is the fastest, safest.

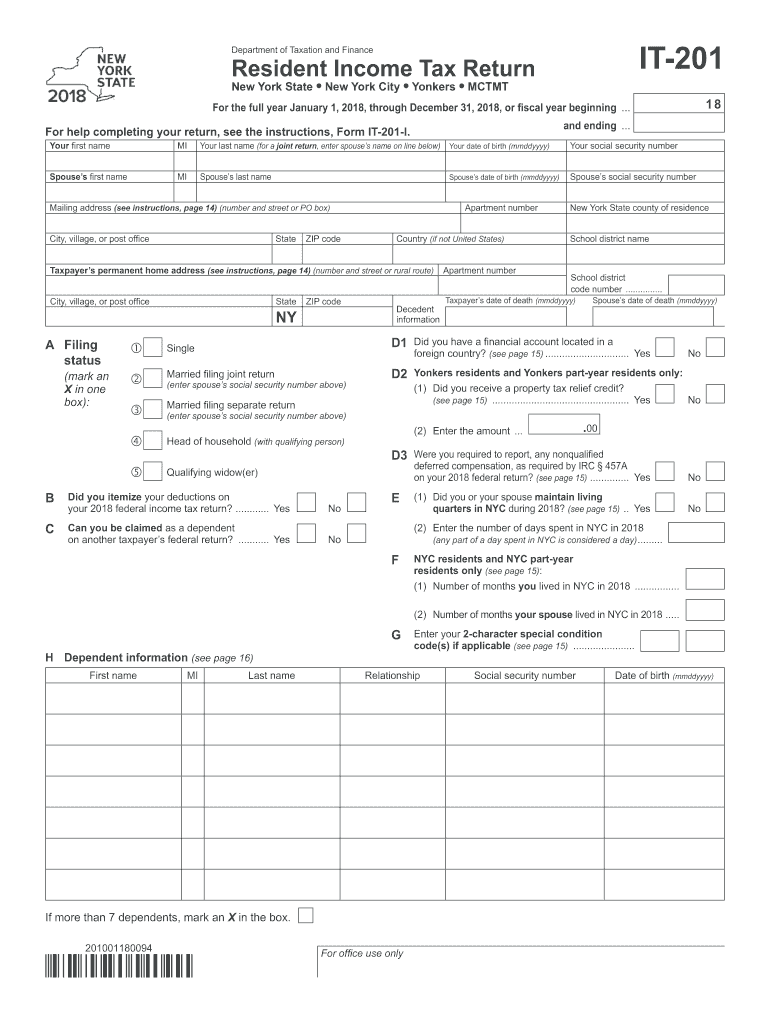

2018 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

Feb 25, 2022 — am i eligible to free file? Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. Do not sign this form unless all applicable lines have. Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need..

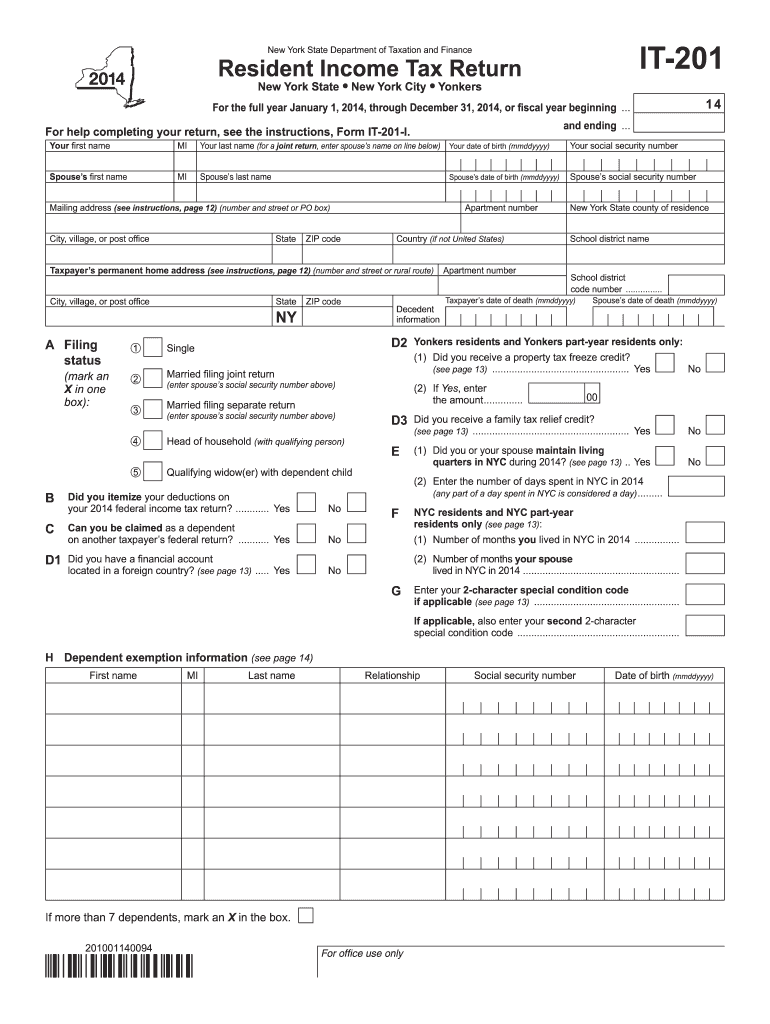

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Do not sign this form unless all applicable lines have. Web to obtain tax forms: Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Your first name mi your last name (for a.

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Private delivery services should not deliver returns to irs offices other than. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Visit the tax forms section of the website, to download forms, fill.

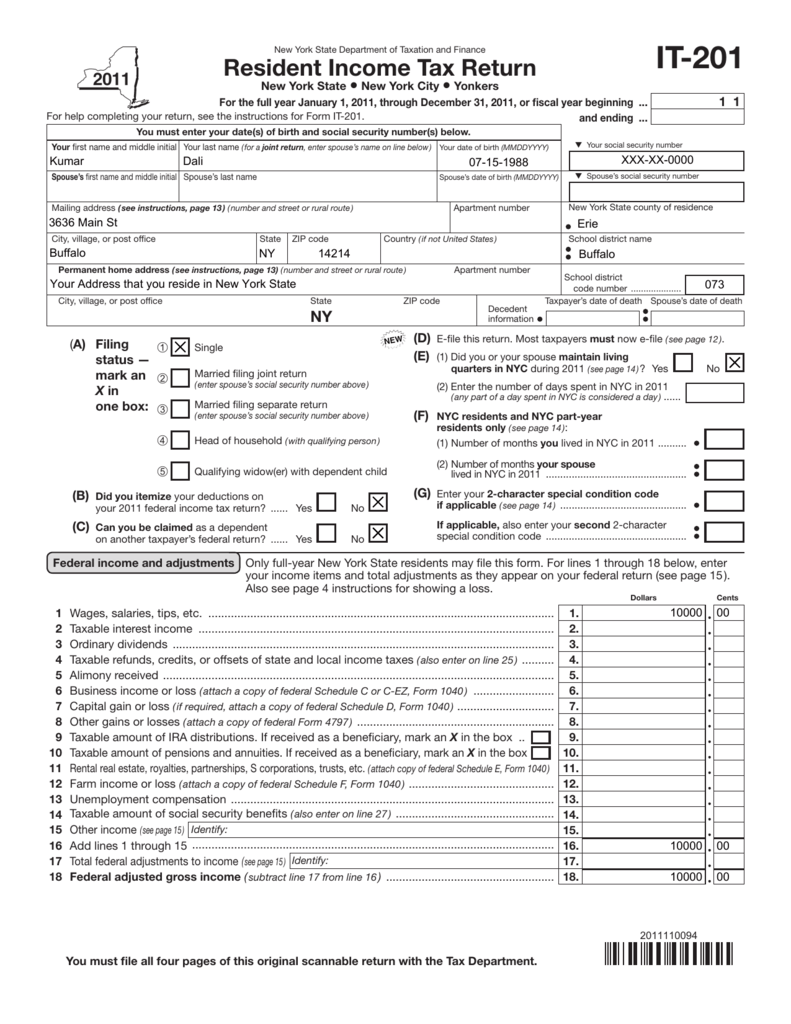

Form IT2012011Resident Tax ReturnIT201

Web to obtain tax forms: Web find irs addresses for private delivery of tax returns, extensions and payments. Web you may be eligible for free file using one of the software providers below, if: Web form 4506 (novmeber 2021) department of the treasury internal revenue service. It is analogous to the us form 1040, but it is four pages long,.

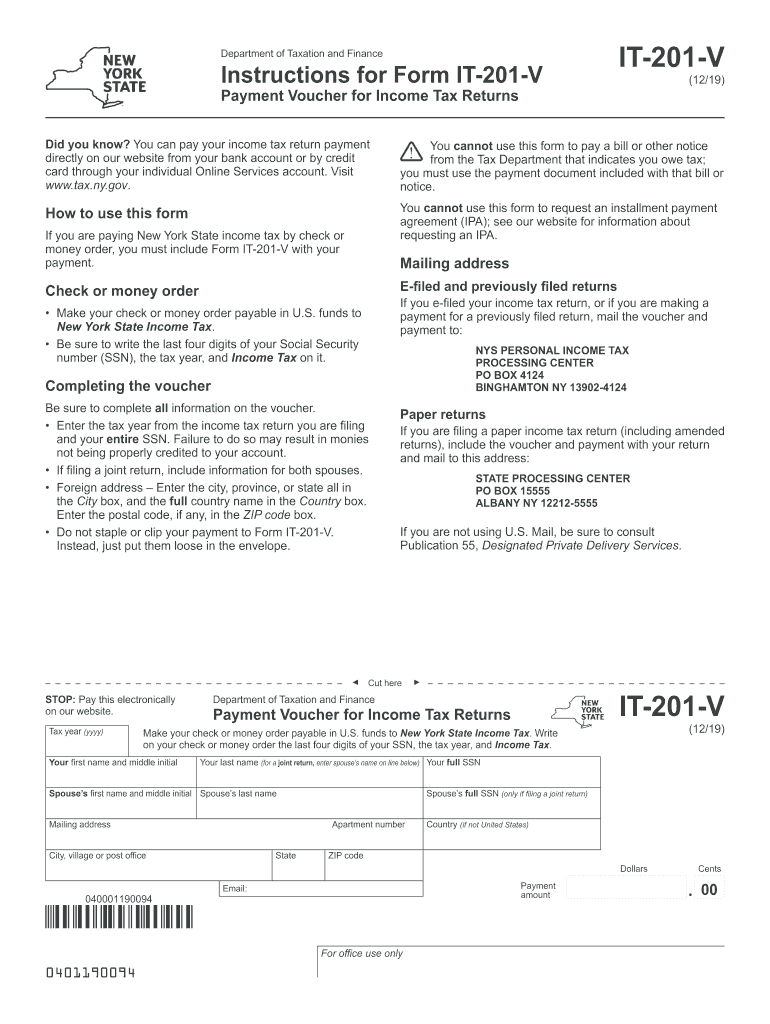

NY IT201V 2019 Fill out Tax Template Online US Legal Forms

Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need. Web to obtain tax forms: Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web form 4506 (novmeber 2021) department of the treasury internal revenue.

Form IT201X (2009) (Fillin) Amended Resident Tax Return (long

Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Request for copy of tax return. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web you may be eligible for free file using one of the software providers below, if: Your federal adjusted gross.

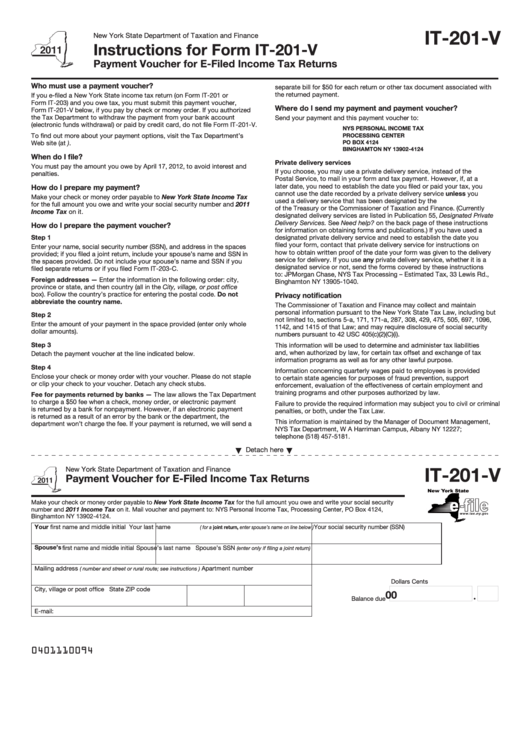

Fillable Form It201V (2011) Payment Voucher For EFiled Tax

Request for copy of tax return. If you need to obtain a federal form, you. Web find irs addresses for private delivery of tax returns, extensions and payments. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web you may be eligible for free file using one.

Private Delivery Services Should Not Deliver Returns To Irs Offices Other Than.

Web you may be eligible for free file using one of the software providers below, if: Web form 4506 (novmeber 2021) department of the treasury internal revenue service. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth.

Your Federal Adjusted Gross Income (Agi) Is $41,000 Or Less Regardless Of Age, Or.

If you need to obtain a federal form, you. Visit the tax forms section of the website, to download forms, fill in and print, or just print the forms you need. Do not sign this form unless all applicable lines have. Your ¿uvw qdph 0, Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web find irs addresses for private delivery of tax returns, extensions and payments. Request for copy of tax return.Feb 25, 2022 — Am I Eligible To Free File?

Web To Obtain Tax Forms: