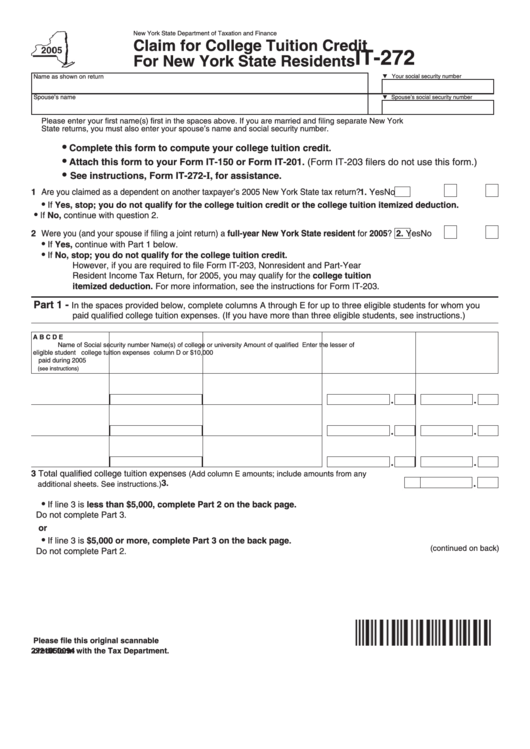

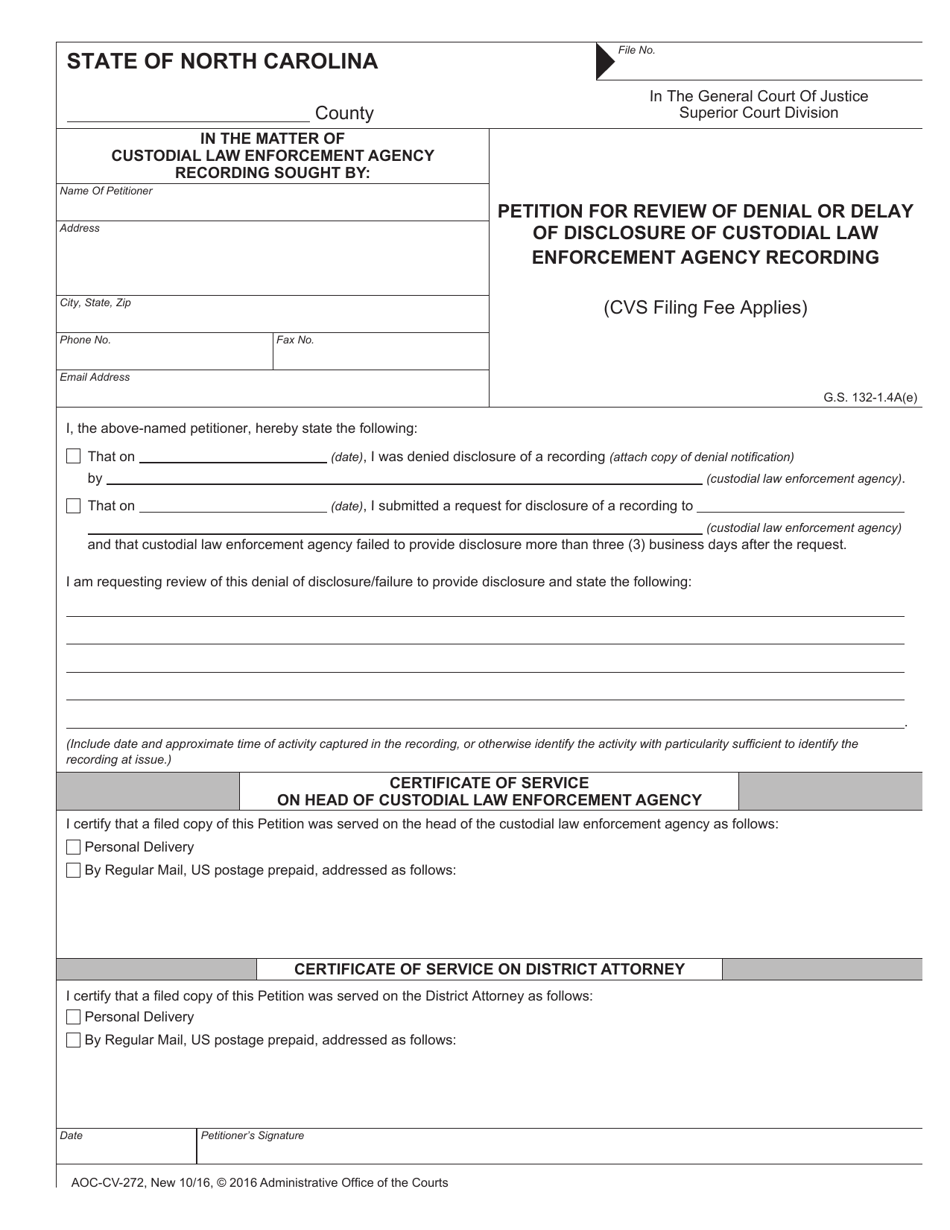

It-272 Form

It-272 Form - Information about the student and colleges attended is entered on federal. Web 3 years ago new york how do i enter ny screen 272 if the student attended more than one college? Part 3 is completed if line 3 is $5,0000 or more. Also see the instructions for lines 1 and 2. •you can complete the optional worksheet. Download the papers or print out your pdf version. Web 44 votes how to fill out and sign ein online? Web get the it 272 form accomplished. Easily fill out pdf blank, edit, and sign them. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2.

One spouse may claim the. Web 44 votes how to fill out and sign ein online? Simply click done to confirm the changes. Download the papers or print out your pdf version. Information about the student and colleges attended is entered on federal. The college's ein must follow one of the following formats: Part 3 is completed if line 3 is $5,0000 or more. Also see the instructions for lines 1 and 2. Web 3 years ago new york how do i enter ny screen 272 if the student attended more than one college? This form is for income earned in tax year 2022, with tax returns.

Web 3 years ago new york how do i enter ny screen 272 if the student attended more than one college? Calculated new york > credits:. Save or instantly send your ready documents. Start completing the fillable fields and carefully. This form is for income earned in tax year 2022, with tax returns. Get your online template and fill it in using progressive features. The college's ein must follow one of the following formats: Simply click done to confirm the changes. Web get the it 272 form accomplished. Also see the instructions for lines 1 and 2.

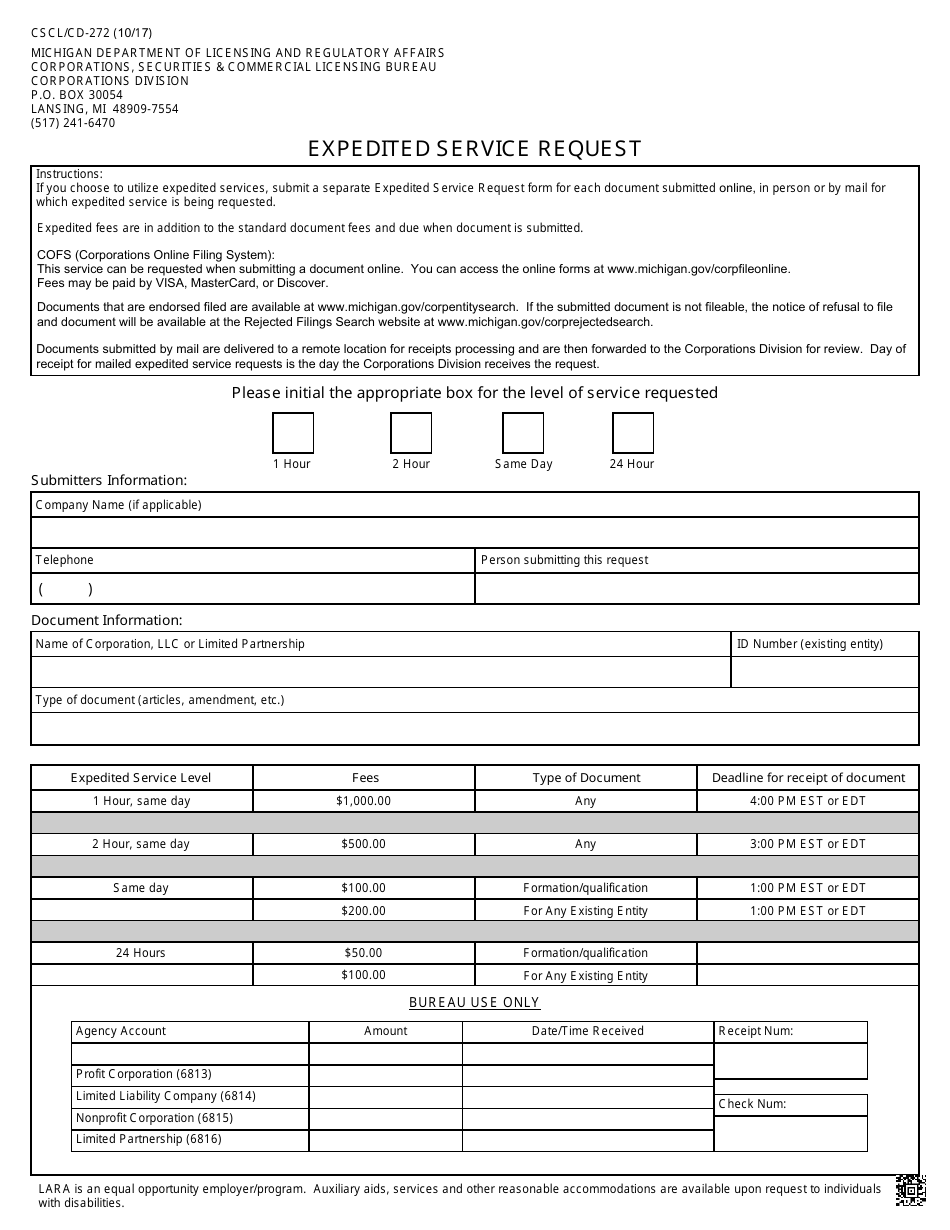

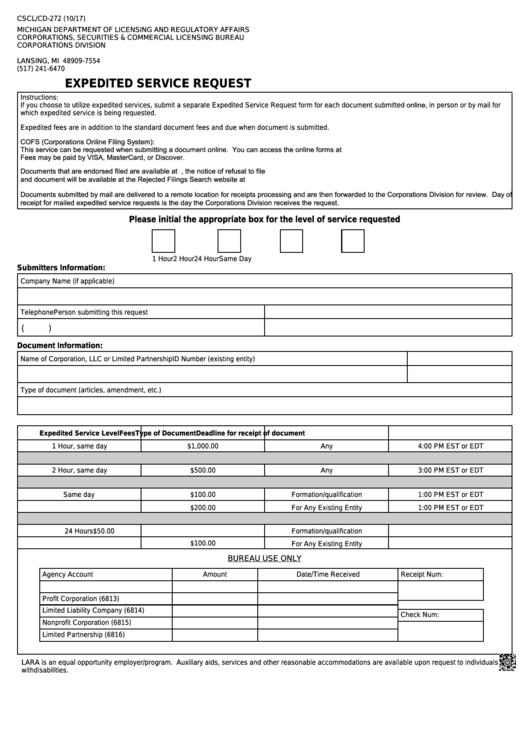

Form CSCL/CD272 Download Fillable PDF or Fill Online Expedited Service

Part 3 is completed if line 3 is $5,0000 or more. Information about the student and colleges attended is entered on federal. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns. Enjoy smart fillable fields and interactivity.

Fillable Form Cscl/cd272 Expedited Service Request printable pdf

Also see the instructions for lines 1 and 2. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link or as an. Web 44 votes how to fill out and sign ein online? Web get the it 272 form accomplished. Simply click done to confirm the.

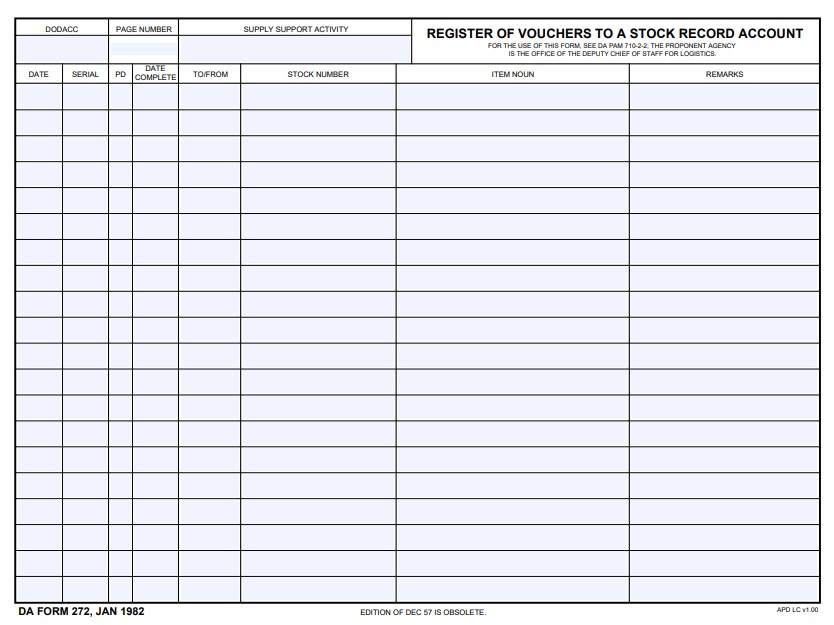

Download da 272 Fillable Form

Web 3 years ago new york how do i enter ny screen 272 if the student attended more than one college? One spouse may claim the. Web 44 votes how to fill out and sign ein online? Save or instantly send your ready documents. The college's ein must follow one of the following formats:

Fillable Form It272 Claim For College Tuition Credit For New York

Start completing the fillable fields and carefully. Web get the it 272 form accomplished. Web 44 votes how to fill out and sign ein online? Save or instantly send your ready documents. One spouse may claim the.

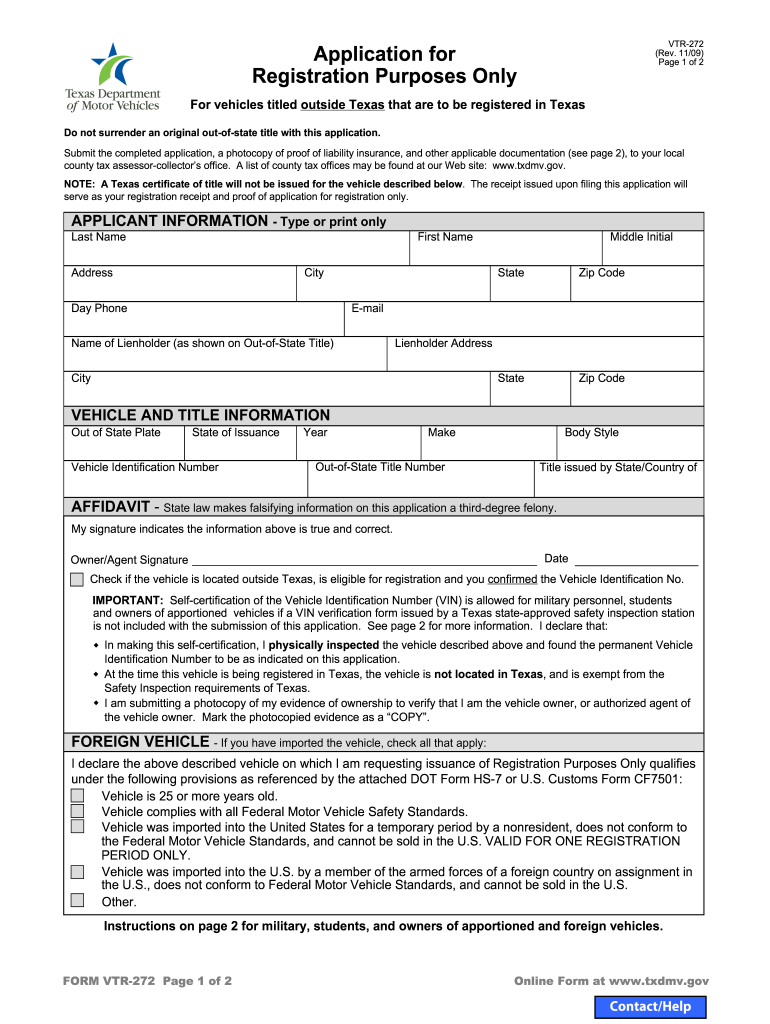

Vtr 272 Fill Out and Sign Printable PDF Template signNow

Part 3 is completed if line 3 is $5,0000 or more. Simply click done to confirm the changes. Calculated new york > credits:. Also see the instructions for lines 1 and 2. The college's ein must follow one of the following formats:

Vtr 272 Form ≡ Fill Out Printable PDF Forms Online

•you can complete the optional worksheet. This form is for income earned in tax year 2022, with tax returns. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Easily fill out pdf blank, edit, and sign them. Web get the it 272 form accomplished.

USM Form 272 and 272A Service Of Process Pleading

Part 3 is completed if line 3 is $5,0000 or more. •you can complete the optional worksheet. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2. Save or instantly send your ready documents. Start completing the fillable fields and carefully.

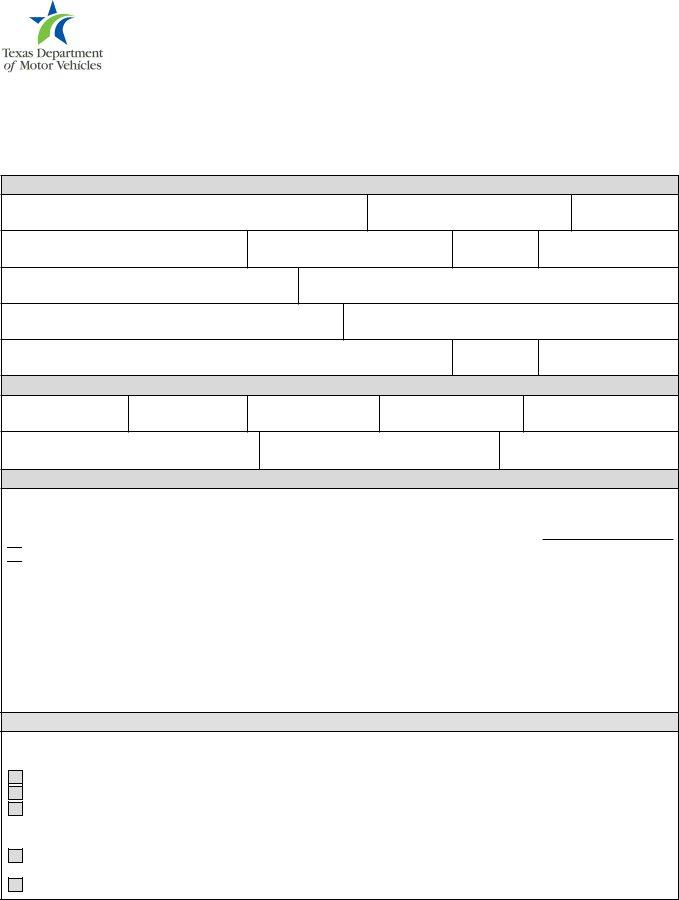

Form AOCCV272 Download Fillable PDF or Fill Online Petition for

Use get form or simply click on the template preview to open it in the editor. Enjoy smart fillable fields and interactivity. Start completing the fillable fields and carefully. Web get the it 272 form accomplished. •you can complete the optional worksheet.

Form IT272 Download Fillable PDF or Fill Online Claim for College

Simply click done to confirm the changes. Web get the it 272 form accomplished. Save or instantly send your ready documents. Get your online template and fill it in using progressive features. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2.

Form IT 272 College Tuition Credit Miller Financial Services

This form is for income earned in tax year 2022, with tax returns. Easily fill out pdf blank, edit, and sign them. Web 3 years ago new york how do i enter ny screen 272 if the student attended more than one college? The college's ein must follow one of the following formats: Save or instantly send your ready documents.

Enjoy Smart Fillable Fields And Interactivity.

Get your online template and fill it in using progressive features. •you can complete the optional worksheet. Also see the instructions for lines 1 and 2. Download the papers or print out your pdf version.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web get the it 272 form accomplished. Calculated new york > credits:. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants using a shareable link or as an. Web form 8027 must be completed, and you must enter an amount, even if zero, on lines 1 and 2.

Save Or Instantly Send Your Ready Documents.

Information about the student and colleges attended is entered on federal. Simply click done to confirm the changes. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully.

Part 3 Is Completed If Line 3 Is $5,0000 Or More.

One spouse may claim the. Web 44 votes how to fill out and sign ein online? The college's ein must follow one of the following formats: This form is for income earned in tax year 2022, with tax returns.