K-2 Tax Form

K-2 Tax Form - Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. File your form 2290 online & efile with the irs. Web there are three primary ways to file withholding information electronically: Tax or certain withholding tax or reporting obligations of its partners under the. Web any partnership required to file form 1065 that has items relevant to the determination of the u.s. Get ready for tax season deadlines by completing any required tax forms today. With respect to form 1065, the following are the different. Get irs approved instant schedule 1 copy.

401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Persons filing form 8865, return of u.s. File your form 2290 online & efile with the irs. Get irs approved instant schedule 1 copy. Tax or certain withholding tax or reporting obligations of its partners under the. Persons with respect to certain foreign partnerships. The amount of tax withheld should be reviewed each year and new. Do not file draft forms. With respect to form 1065, the following are the different. File your form 2290 today avoid the rush.

Do not file draft forms. File your form 2290 online & efile with the irs. Persons with respect to certain foreign partnerships. Tax or certain withholding tax or reporting obligations of its partners under the. Shareholders’ pro rata share items—international. Get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation form 8865, return of u.s. File your form 2290 today avoid the rush. The amount of tax withheld should be reviewed each year and new. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to.

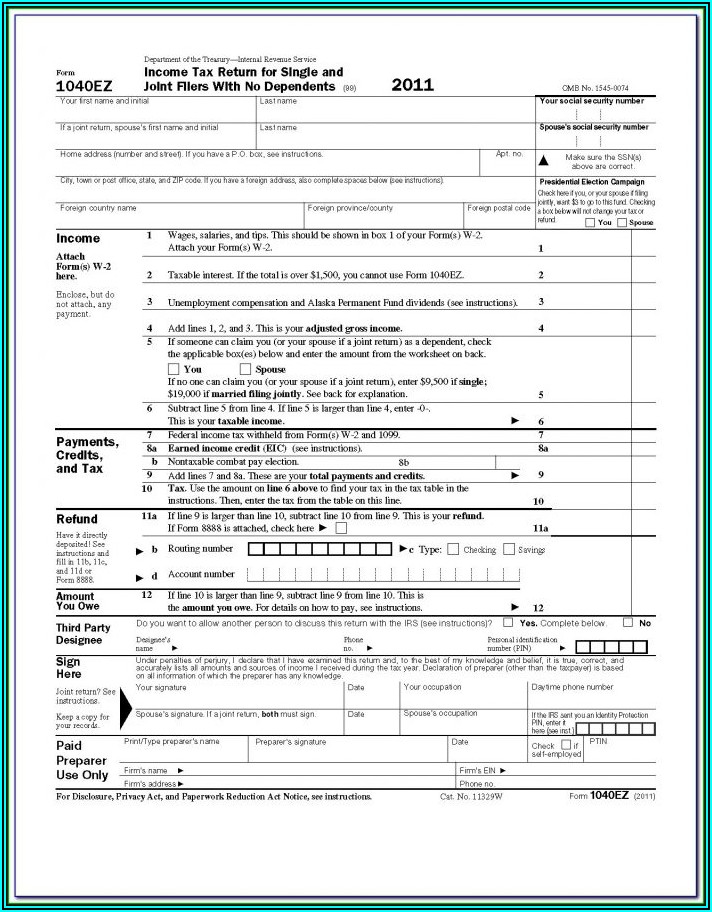

Irs Tax Form 1040ez 2020 Form Resume Examples qeYzgN5V8X

Income tax return for an s corporation form 8865, return of u.s. Shareholders’ pro rata share items—international. Persons with respect to certain foreign partnerships. Web yes, if income received in missouri or earned in missouri was greater than $600 for a nonresident or $1,200 for a resident. File your form 2290 online & efile with the irs.

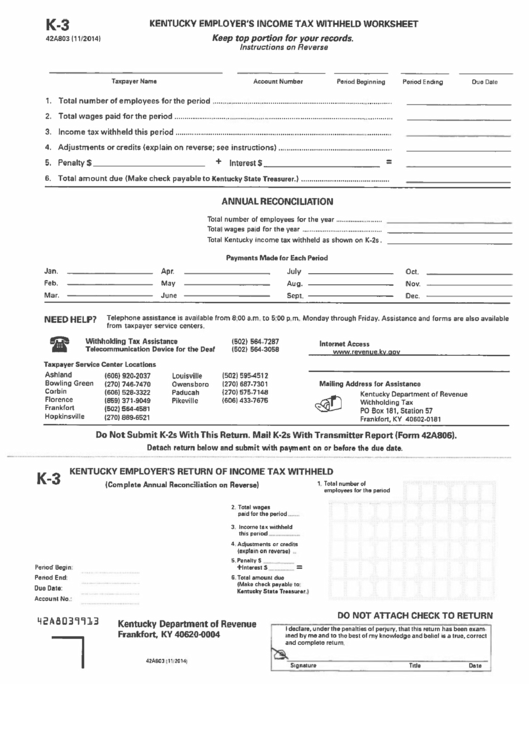

Form K3 Employer'S Tax Withheld Worksheet Department Of

Web human resources kansas state university 111 dykstra hall 1628 claflin road manhattan, ks 66506. Get irs approved instant schedule 1 copy. With respect to form 1065, the following are the different. Get ready for tax season deadlines by completing any required tax forms today. Web this is an early release draft of an irs tax form, instructions, or publication,.

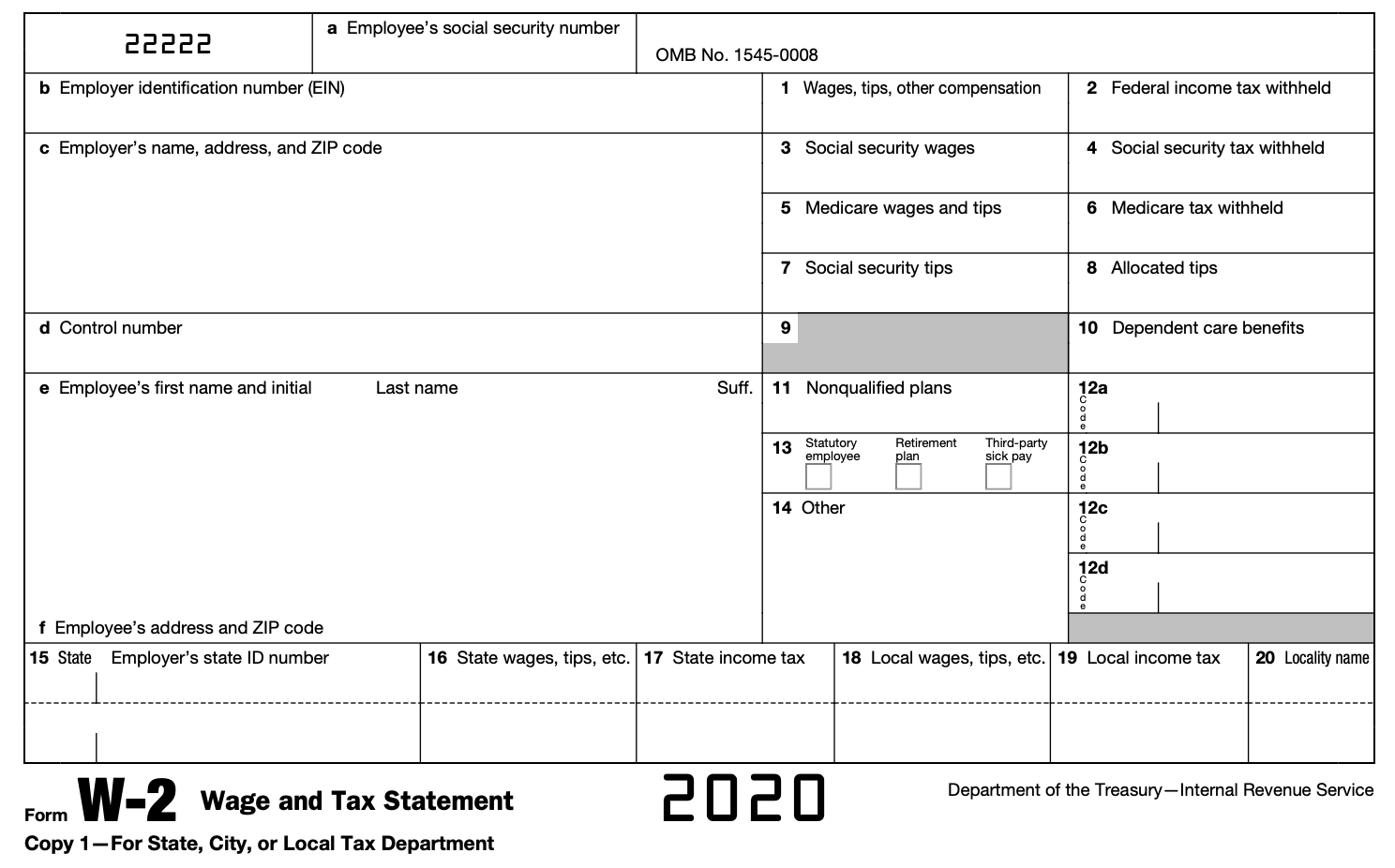

W2 Tax Form Stock Photo Download Image Now Tax Form, Tax

Persons filing form 8865, return of u.s. Web there are three primary ways to file withholding information electronically: Ad don't leave it to the last minute. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. File your form 2290 today avoid the rush.

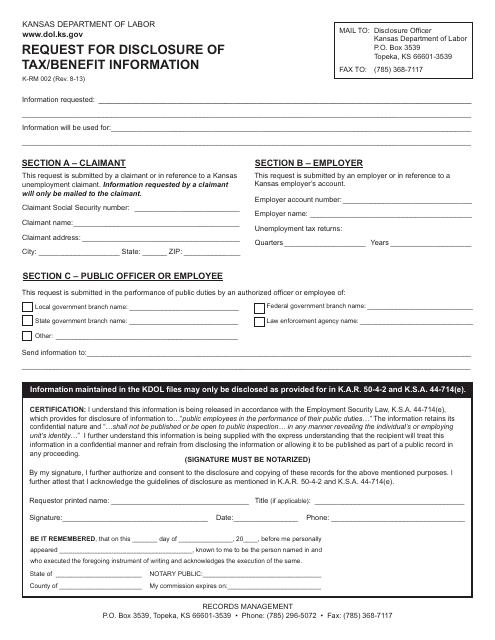

Form KRM002 Download Fillable PDF or Fill Online Request for

Do not file draft forms. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Shareholders’ pro rata share items—international. Income tax return for an s corporation form 8865, return of u.s. File your form 2290 online & efile with the irs.

When Do You Have To Fill In A Tax Return

Web human resources kansas state university 111 dykstra hall 1628 claflin road manhattan, ks 66506. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Income tax return for an s corporation form 8865, return of u.s. Get irs approved instant schedule 1 copy. Ad don't leave.

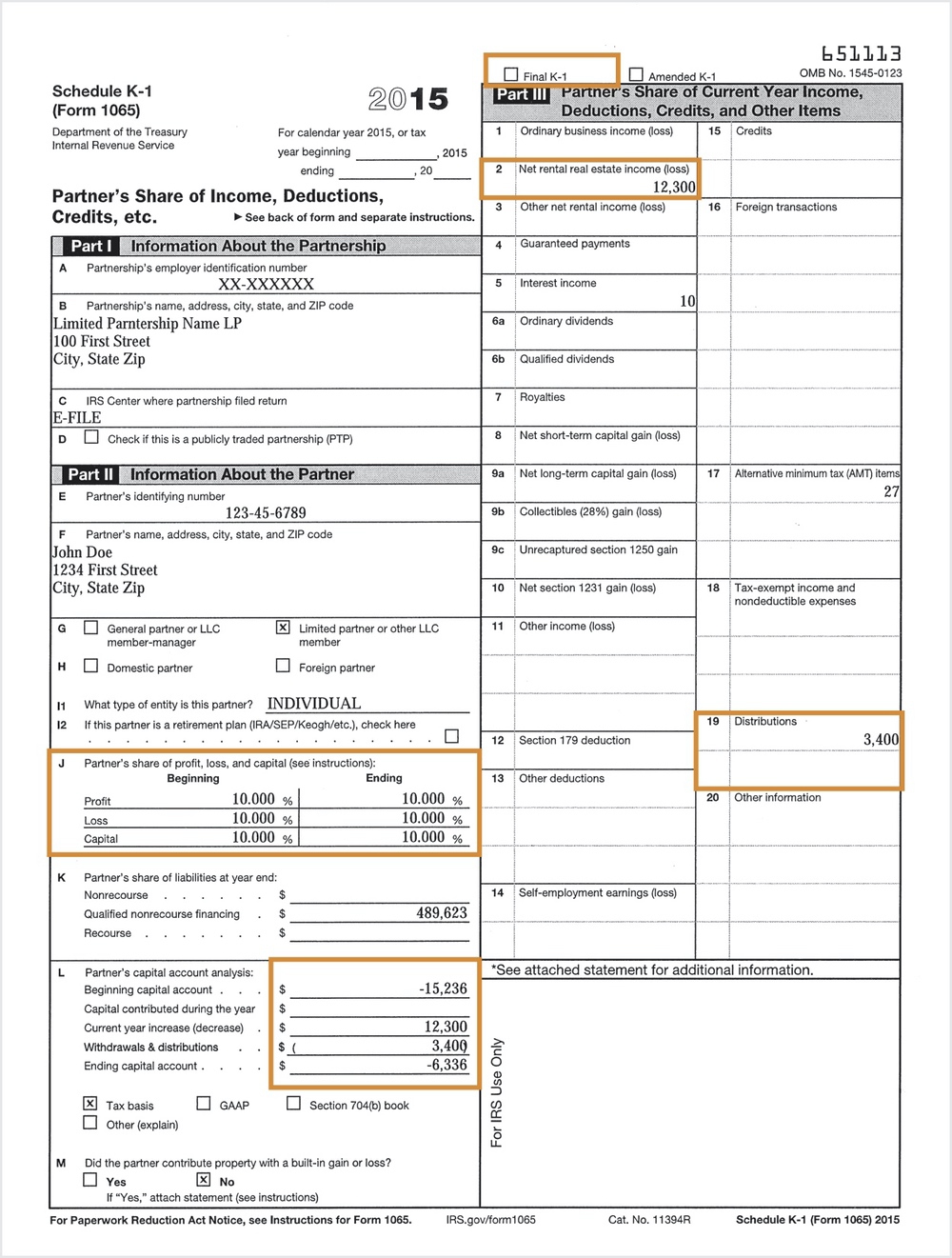

Barbara Johnson Blog Schedule K1 Tax Form What Is It and Who Needs

The amount of tax withheld should be reviewed each year and new. Ad don't leave it to the last minute. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web any partnership required to file form 1065 that has items relevant to the determination of the.

Schedule K1 / 1065 Tax Form Guide LP Equity

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web human resources kansas state university 111 dykstra hall 1628 claflin road manhattan, ks 66506. Web there are three primary ways to file withholding information electronically: File your form 2290 today avoid the rush. 401(k).

Understanding Key Tax Forms What investors need to know about Schedule

With respect to form 1065, the following are the different. The amount of tax withheld should be reviewed each year and new. Ad don't leave it to the last minute. File your form 2290 today avoid the rush. Web human resources kansas state university 111 dykstra hall 1628 claflin road manhattan, ks 66506.

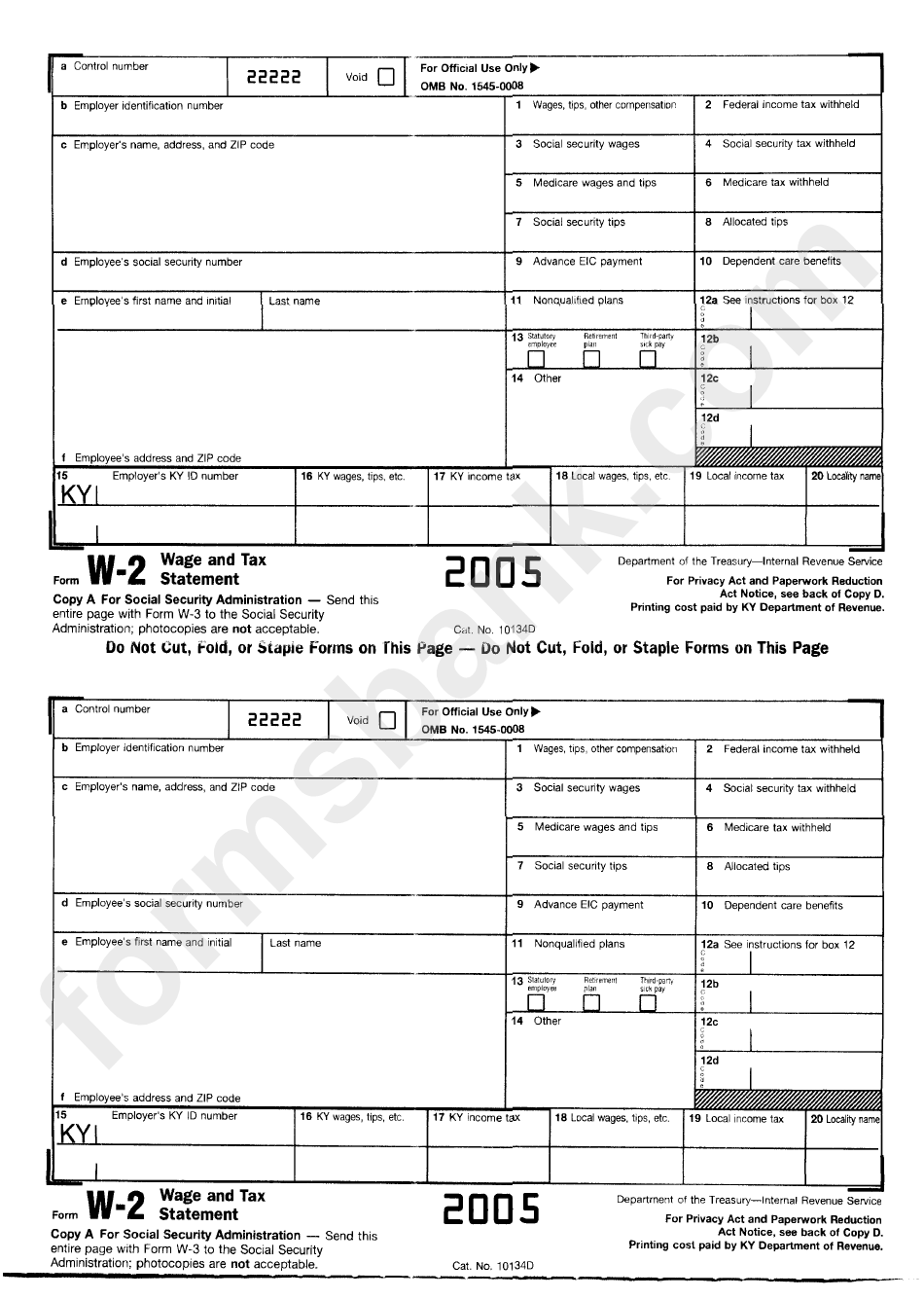

Form K2 Wage And Tax Statement Form printable pdf download

Income tax return for an s corporation form 8865, return of u.s. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. With respect to form 1065, the following are the different. 401(k) contributions are one of the most popular tax deductions, but you have.

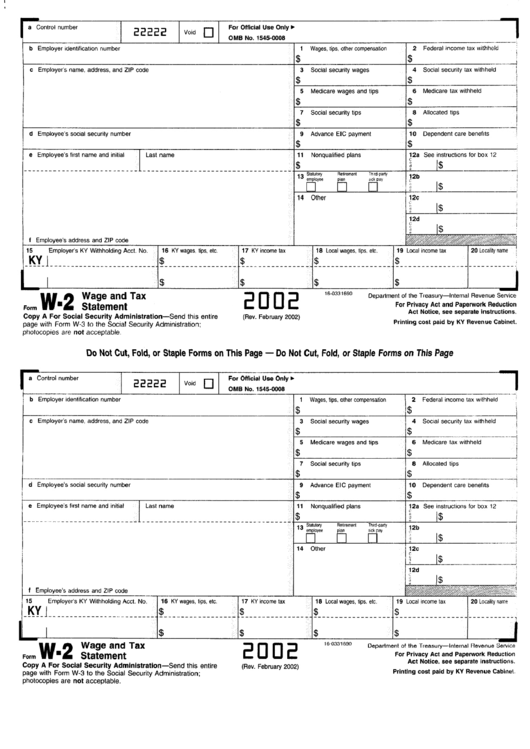

Form W2 Wage And Tax Statement 2002, Form K2 Wage And Tax

Get irs approved instant schedule 1 copy. Income tax return for an s corporation form 8865, return of u.s. Persons filing form 8865, return of u.s. Web there are three primary ways to file withholding information electronically: Get ready for tax season deadlines by completing any required tax forms today.

Persons With Respect To Certain Foreign Partnerships.

Tax or certain withholding tax or reporting obligations of its partners under the. File your form 2290 today avoid the rush. Get ready for tax season deadlines by completing any required tax forms today. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com.

With Respect To Form 1065, The Following Are The Different.

Income tax return for an s corporation form 8865, return of u.s. Do not file draft forms. Web any partnership required to file form 1065 that has items relevant to the determination of the u.s. Final day for 401(k) contribution is april 15th, 2024.

The Amount Of Tax Withheld Should Be Reviewed Each Year And New.

Web human resources kansas state university 111 dykstra hall 1628 claflin road manhattan, ks 66506. 401(k) contributions are one of the most popular tax deductions, but you have to make sure to play by the rules in order to. Web there are three primary ways to file withholding information electronically: Web yes, if income received in missouri or earned in missouri was greater than $600 for a nonresident or $1,200 for a resident.

Shareholders’ Pro Rata Share Items—International.

Ad don't leave it to the last minute. Persons filing form 8865, return of u.s. Get irs approved instant schedule 1 copy. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information.