Kansas Form K40

Kansas Form K40 - Complete, edit or print tax forms instantly. Exemptions enter the total exemptions for you, your. Web submit your information on the proper form. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: We last updated the individual. This form is for income earned. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Complete, edit or print tax forms instantly. Must have filed a kansas tax return in the last 3 years to be.

We last updated the individual. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Exemptions enter the total exemptions for you, your. Kansas tax form, send your request through email at. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Enter the total number of exemptions in the total kansas exemptions box. Web submit your information on the proper form. [email protected] or call our voice mail forms. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. [email protected] or call our voice mail forms. Web fill online, printable, fillable, blank form 2021: Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Complete, edit or print tax forms instantly. 1) you are required to file a federal income tax return; We last updated the individual.

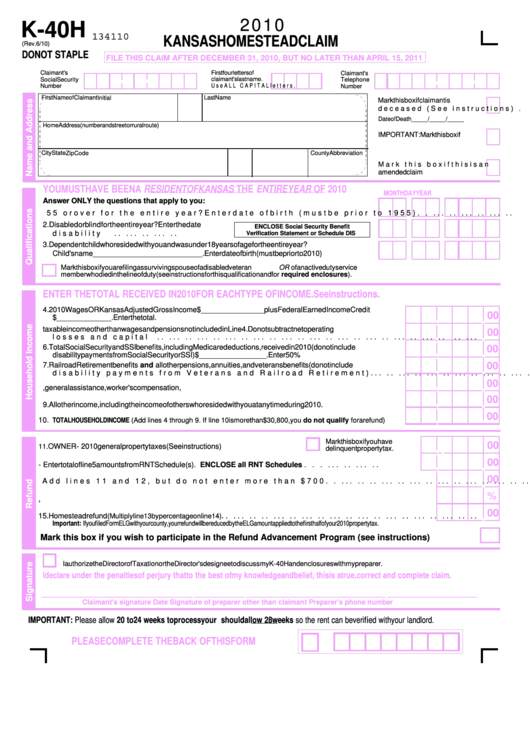

Form K40h Kansas Homestead Claim 2010 printable pdf download

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. 1) you are required to file a federal income tax return; Enter the total number of exemptions in the total kansas exemptions box. Web submit your information on.

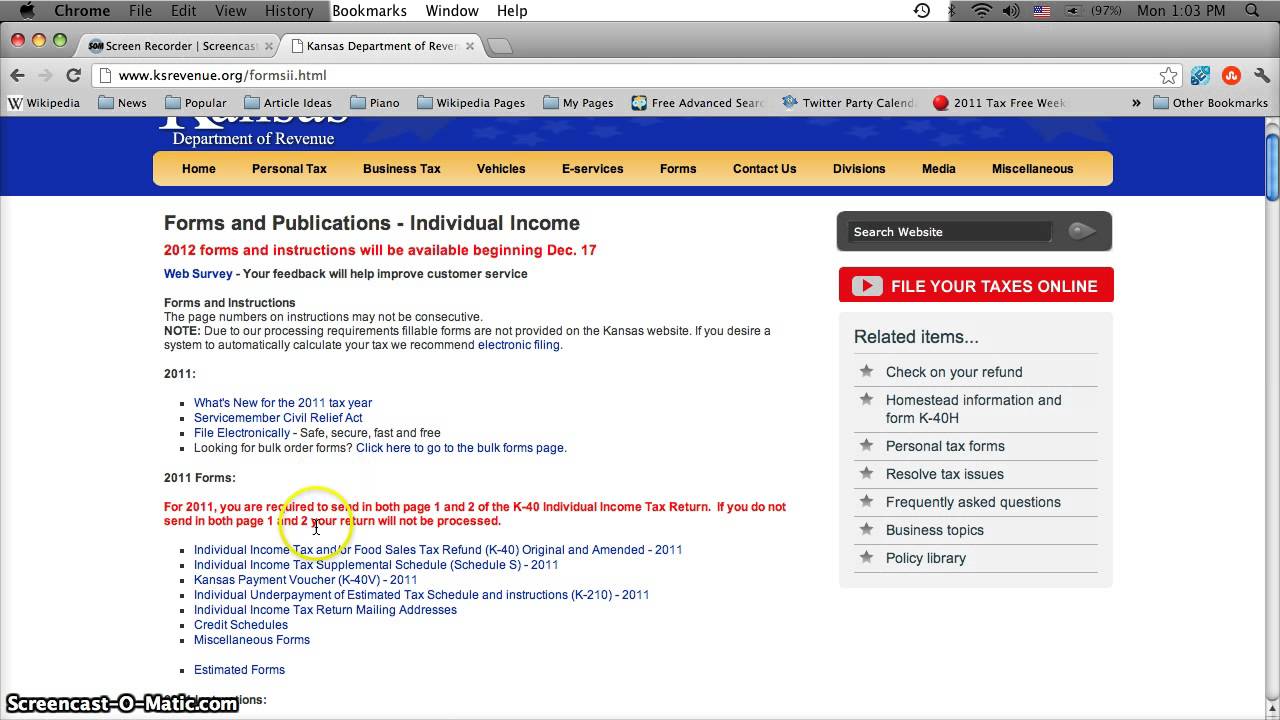

Kansas Printable Tax Forms 2012 Individual K40 Tax Forms

Exemptions enter the total exemptions for you, your. Web submit your information on the proper form. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. 1) you are required to file a federal income tax return; Kansas tax form, send your request through email at.

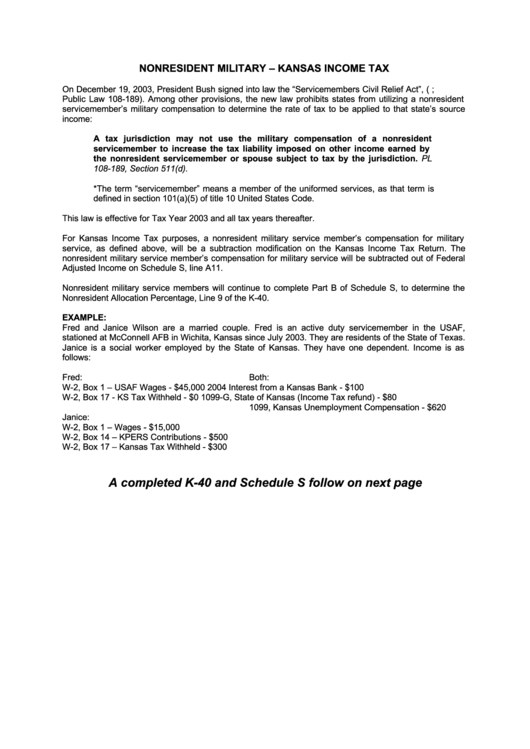

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Web submit your information on the proper form. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return.

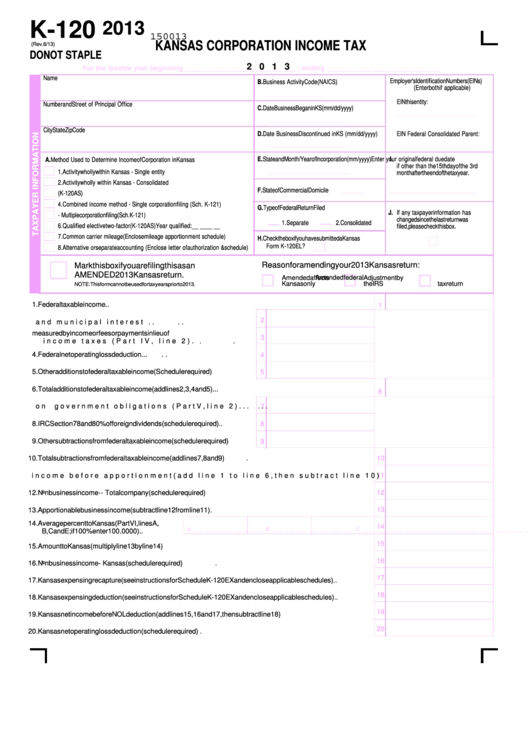

Fillable Form K120 Kansas Corporation Tax 2013 printable

Web fill online, printable, fillable, blank form 2021: 1) you are required to file a federal income tax return; Web submit your information on the proper form. Exemptions enter the total exemptions for you, your. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it.

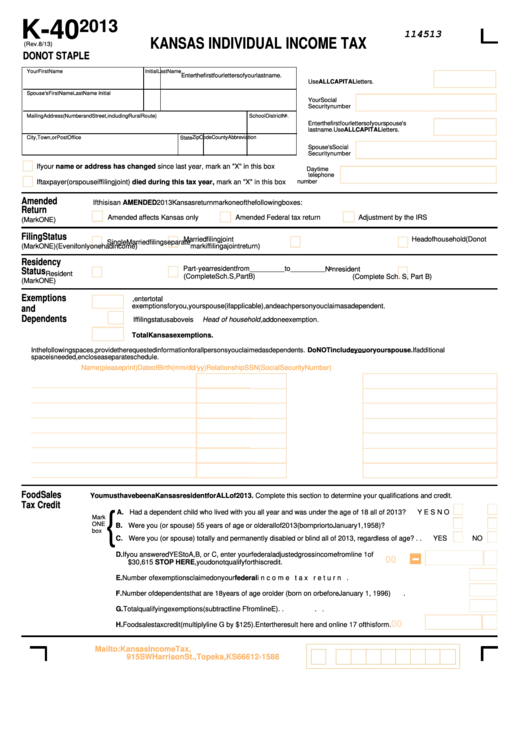

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Web submit your information on the proper form. Kansas tax form, send your request through email at. Complete, edit or print tax forms instantly. Web fill online, printable, fillable, blank form 2021:

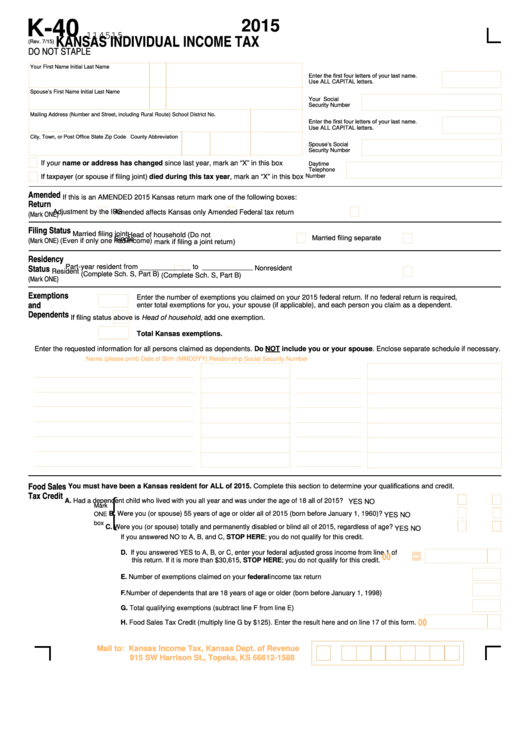

Fillable Form K40 Kansas Individual Tax Return 2015

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Kansas tax form, send your request through email at. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Exemptions enter the.

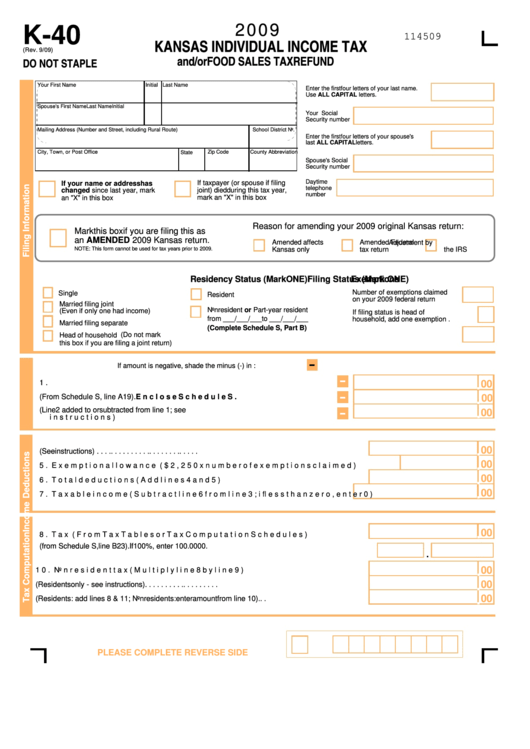

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

This form is for income earned. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account We last updated the individual. Kansas tax form, send your request through email at. Exemptions enter the total exemptions for you, your.

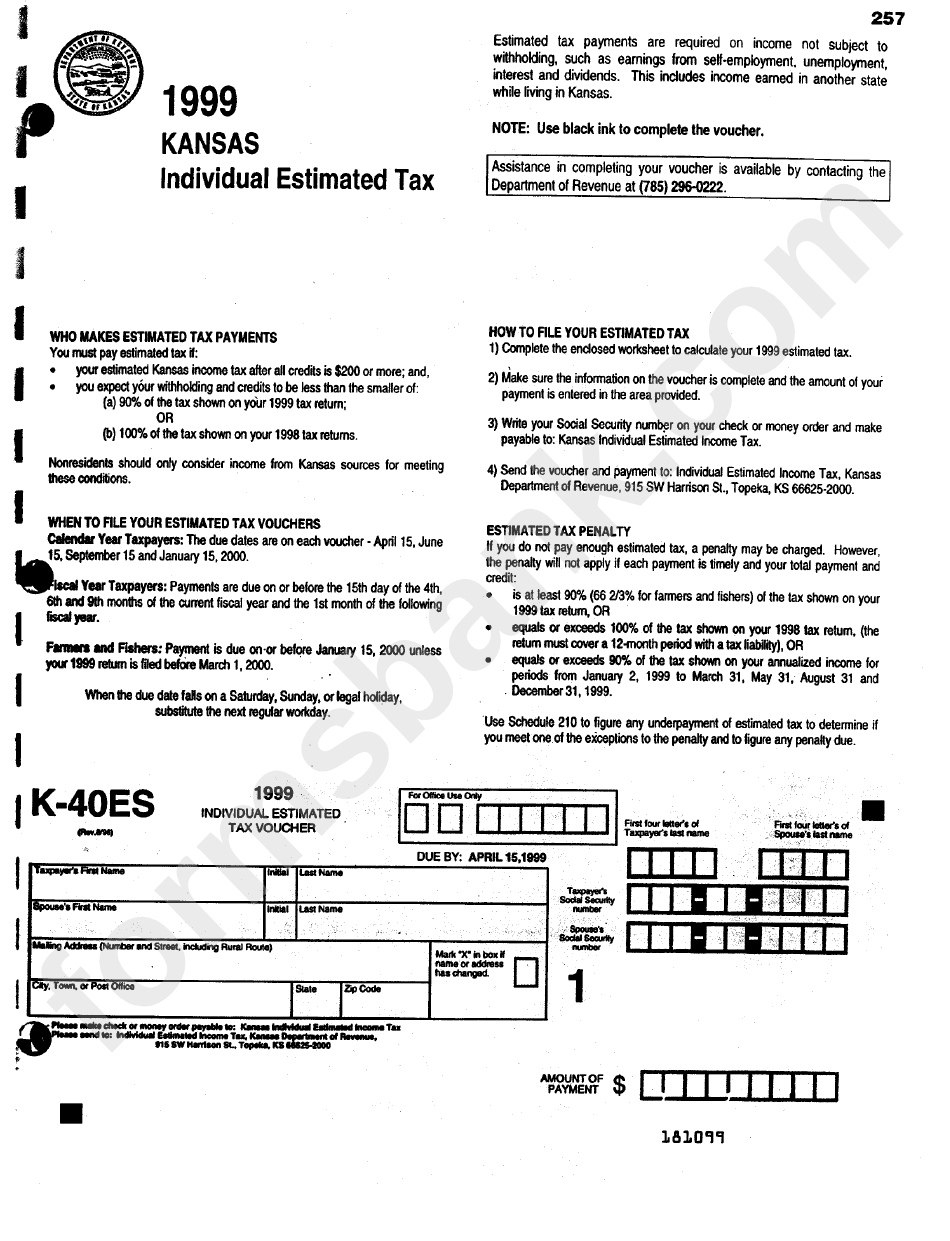

Fillable Form K40es Individual Estimated Tax Kansas Department Of

1) you are required to file a federal income tax return; Exemptions enter the total exemptions for you, your. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Enter the total number of exemptions in the total.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank PDFfiller

Exemptions enter the total exemptions for you, your. Complete, edit or print tax forms instantly. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Web kansas individual income tax 114519 enter the first four letters of your.

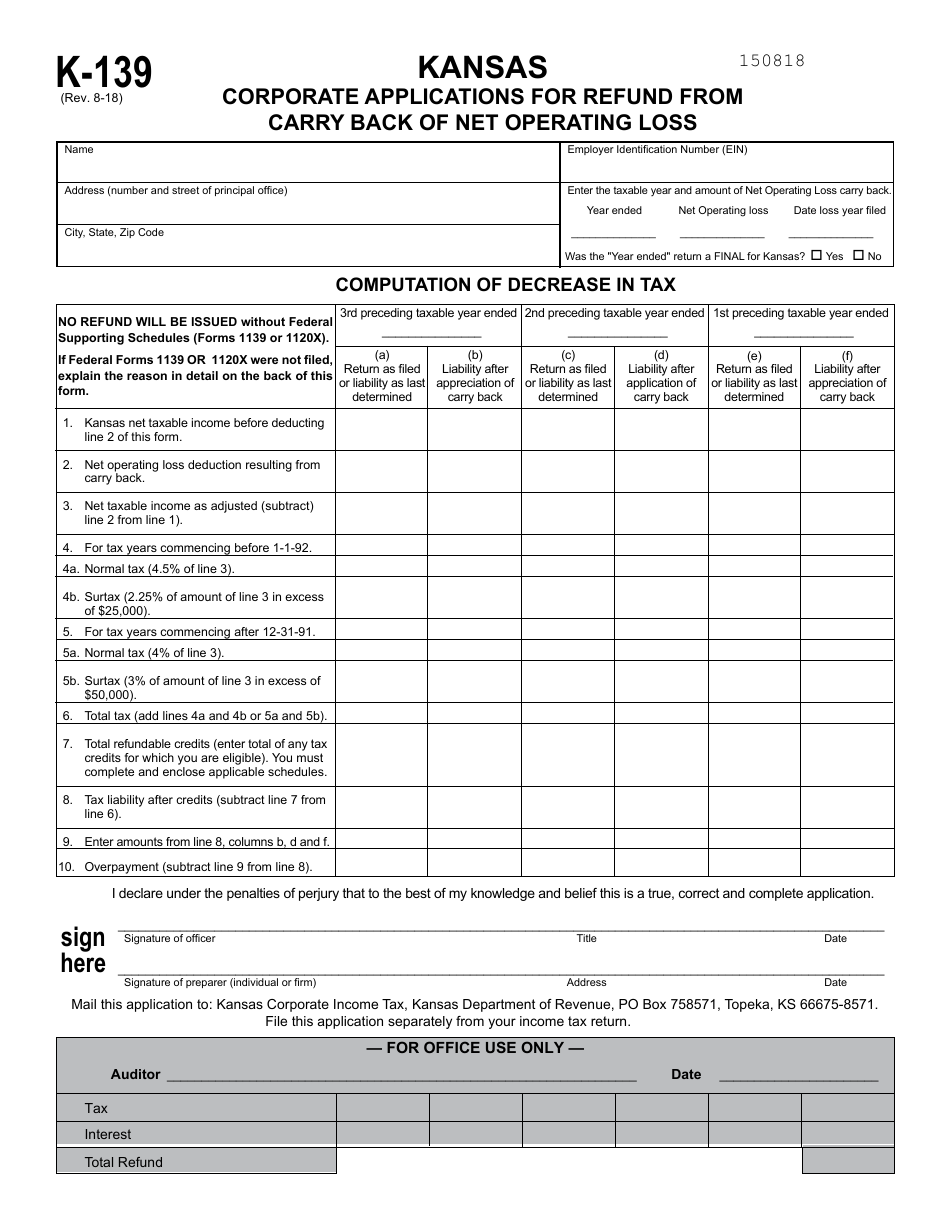

Form K139 Download Fillable PDF or Fill Online Kansas Corporate

Complete, edit or print tax forms instantly. Exemptions enter the total exemptions for you, your. Web fill online, printable, fillable, blank form 2021: Kansas tax form, send your request through email at. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters.

Web Submit Your Information On The Proper Form.

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Kansas tax form, send your request through email at. Complete, edit or print tax forms instantly. We last updated the individual.

Enter The Total Number Of Exemptions In The Total Kansas Exemptions Box.

You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. Must have filed a kansas tax return in the last 3 years to be. Complete, edit or print tax forms instantly. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the.

Web Fill Online, Printable, Fillable, Blank Form 2021:

Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: [email protected] or call our voice mail forms. Exemptions enter the total exemptions for you, your.

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The Revenue.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. 1) you are required to file a federal income tax return; This form is for income earned.