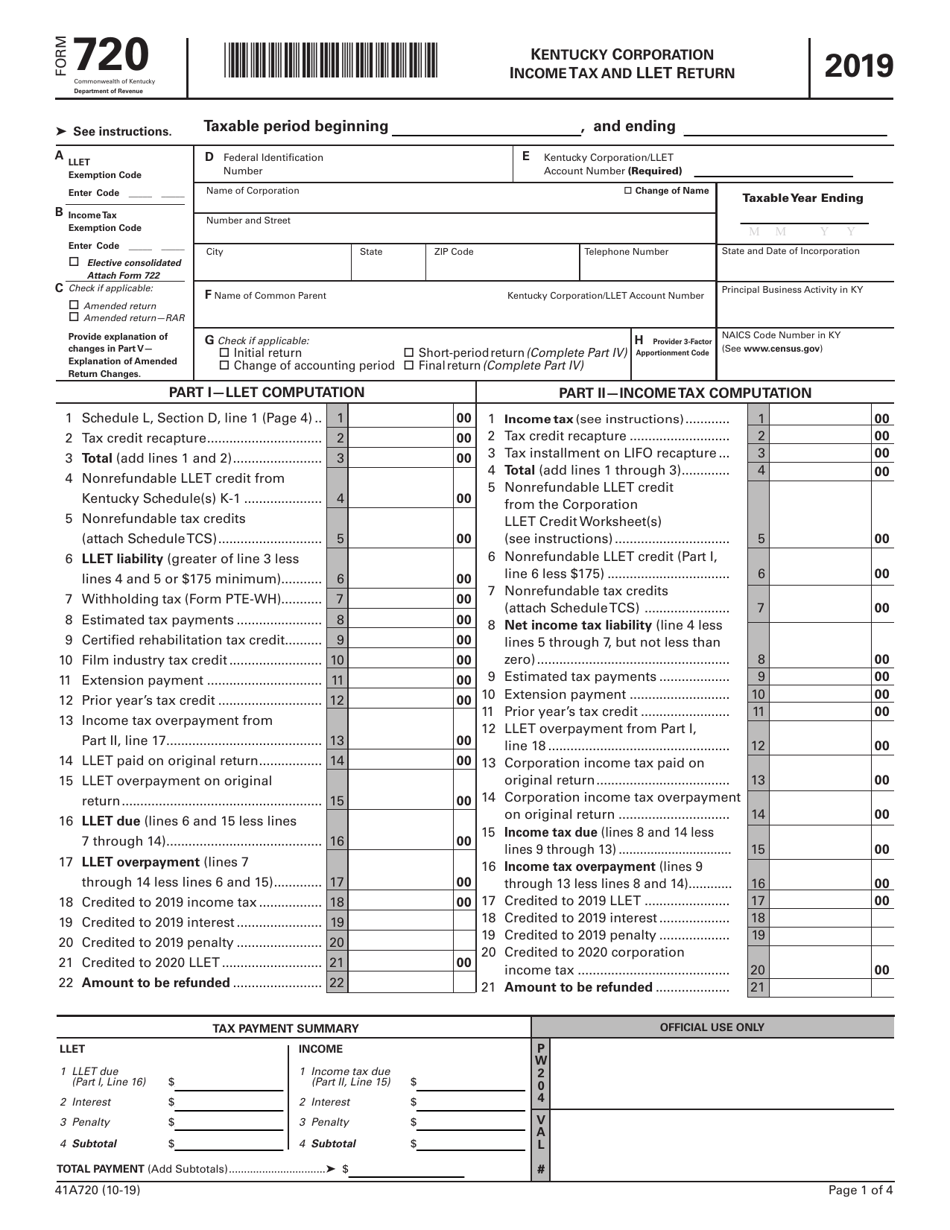

Kentucky Form 720

Kentucky Form 720 - Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky form 720 as you need. Web law to file a kentucky corporation income tax and llet return. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Form 720s is a kentucky corporate income tax form. Web you must file form 720 if: Web send form 720 to: Web law to file a kentucky corporation income tax and llet return. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue.

Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. This form is for income earned in tax year 2022, with tax returns due in april. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web law to file a kentucky corporation income tax and llet return. Web law to file a kentucky corporation income tax and llet return. Any corporation electing s corporation treatment in accordance with sections 1361(a) and 1362(a) of the internal. Web you must file form 720 if: Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue.

Web send form 720 to: Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or. Form 720 is used by taxpayers to report. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. If you aren't reporting a tax that you normally. Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky form 720 as you need. Web law to file a kentucky corporation income tax and llet return. Form 720s is a kentucky corporate income tax form. This form is for income earned in tax year 2022, with tax returns due in april. Web law to file a kentucky corporation income tax and llet return.

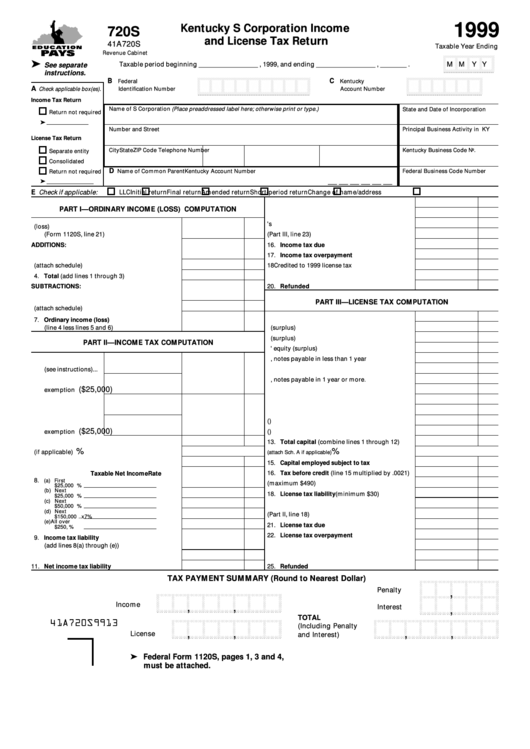

Form 720s Kentucky S Corporation And License Tax Return 1999

Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky form 720 as you need. Form 720s is a kentucky.

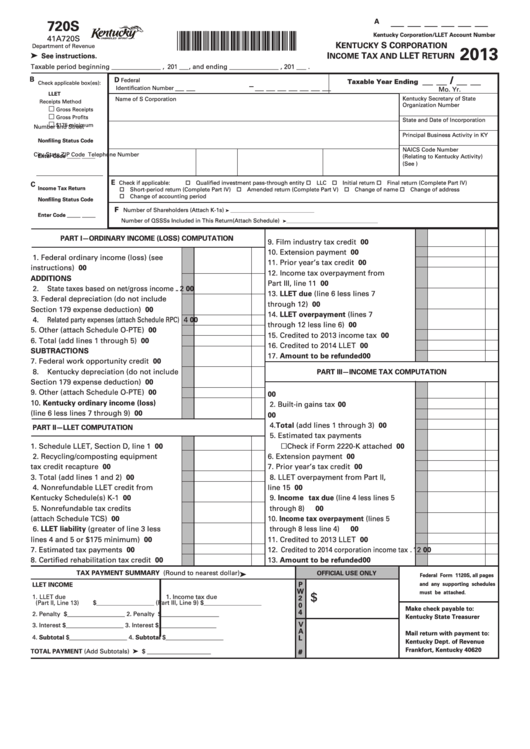

Form 720s Kentucky S Corporation Tax And Llet Return 2013

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web we last updated kentucky form 720s from the department of revenue in may 2021. This form is for income earned in tax year 2022, with tax returns due in april. Web file form 720 annually to report and pay the fee on the.

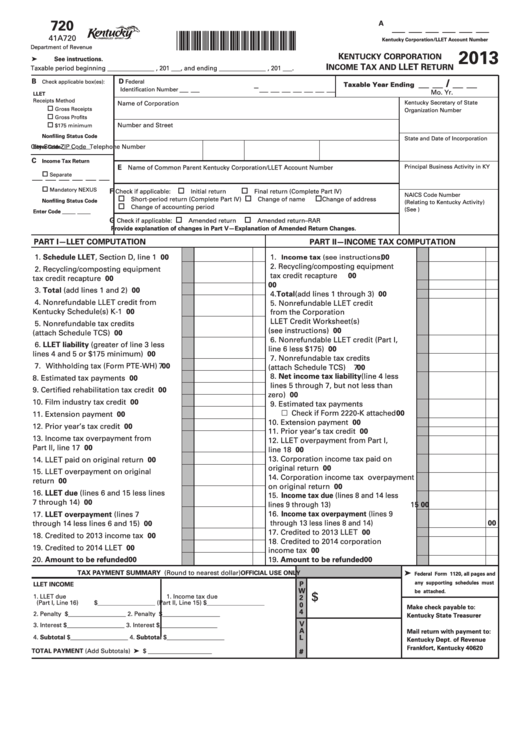

Form 720 Kentucky Corporation Tax And Llet Return 2013

Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Web top center of the form, and compute the kentucky capital gain from the disposal assets using kentucky basis. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a.

20162020 Form KY DoR 720S Fill Online, Printable, Fillable, Blank

Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Web law to file a kentucky corporation income tax and llet return. Web send form 720 to: Enter the capital gain from kentucky converted schedule d, line. If you aren't reporting a tax that you normally.

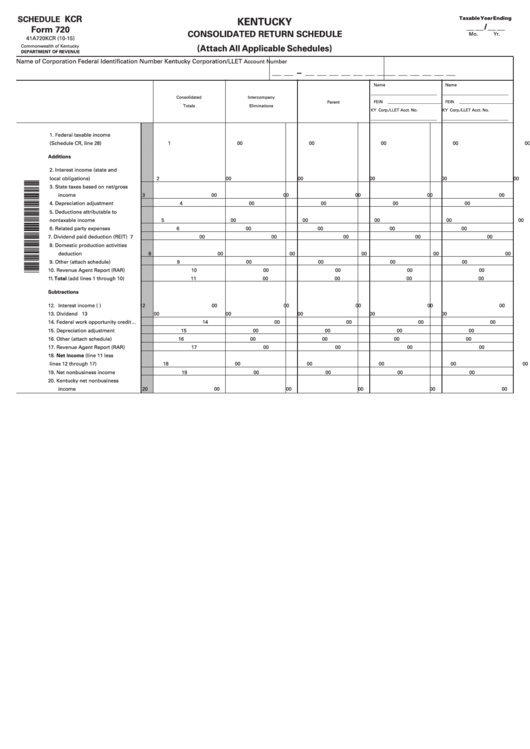

Fillable Schedule Kcr (Form 720) Kentucky Consolidated Return

Web law to file a kentucky corporation income tax and llet return. If you aren't reporting a tax that you normally. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web form 720 (2022) subtractions—continued 31 terminal railroad corporation.

Form 720 (41A720) Download Fillable PDF or Fill Online Kentucky

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. This form is for income earned in tax year 2022, with tax returns due in april. Web send form 720 to: Web law to file a kentucky corporation.

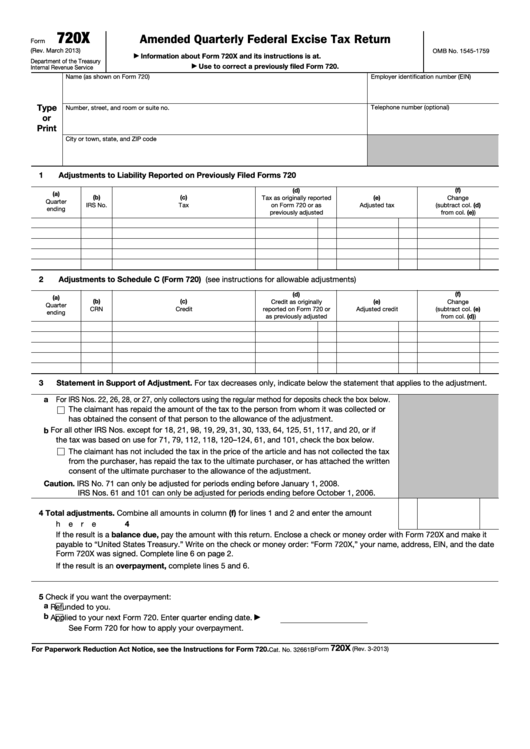

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Web send form 720 to: Web law to file a kentucky corporation income tax and llet return. If you aren't reporting a tax that you normally. Web top center of the form, and compute the kentucky capital gain from the disposal assets using kentucky basis. This form is for income earned in tax year 2022, with tax returns due in.

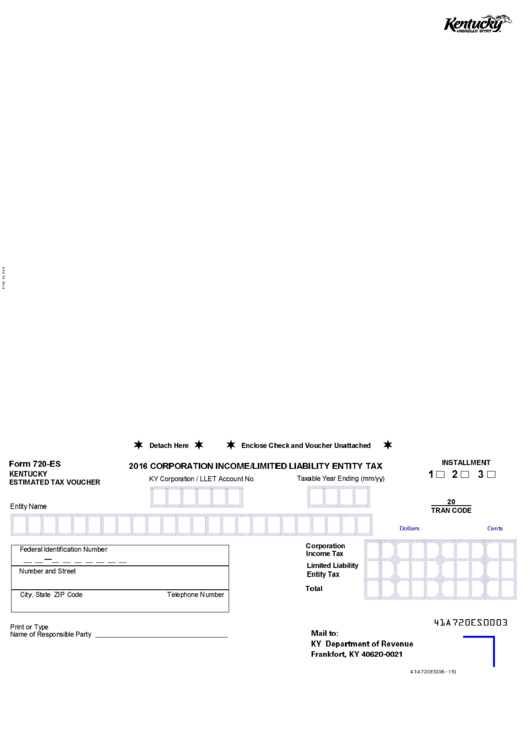

Fillable Form 720Es Kentucky Estimated Tax Voucher Corporation

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web searching for kentucky form 720 to fill? Web law to file a kentucky corporation income tax and llet return. Any corporation electing s corporation treatment in accordance.

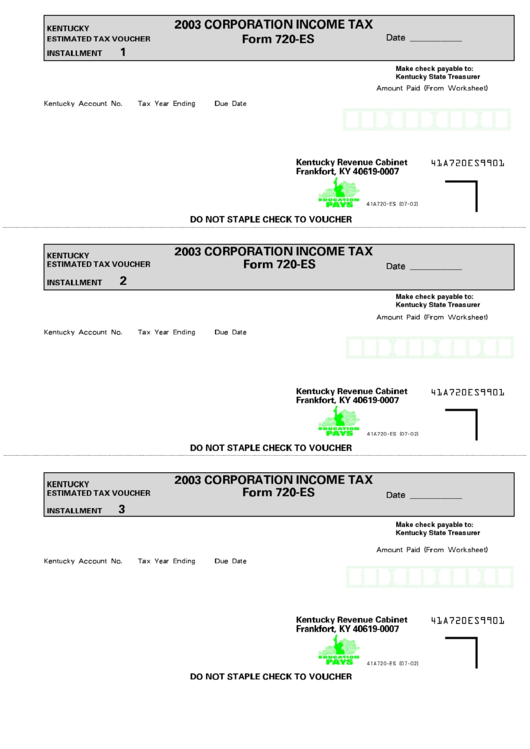

Form 720Es Corporation Tax 2003 printable pdf download

Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web law to file.

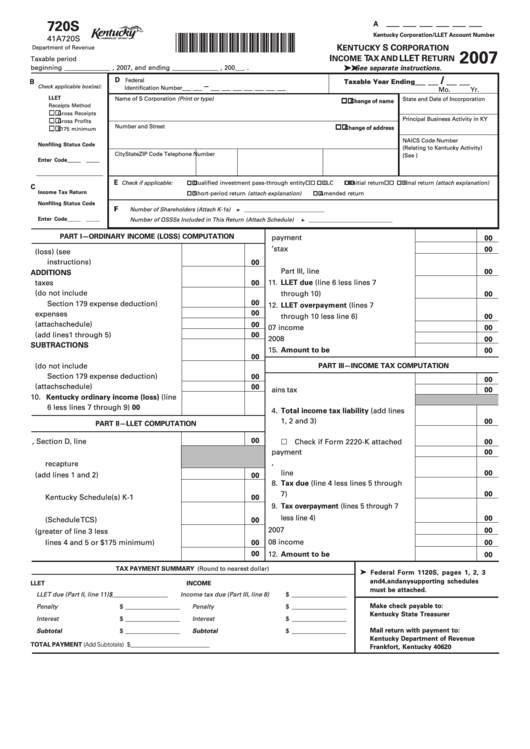

Form 720s Kentucky S Corporation Tax And Llet Return 2007

Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,.

While Most Taxpayers Have Income Taxes Automatically Withheld Every Pay Period By Their Employer, Taxpayers Who.

Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web send form 720 to:

Web Form 720 (2022) Subtractions—Continued 31 Terminal Railroad Corporation Adjustments 32 Kentucky Allowable Passive Activity Loss 33 Kentucky Allowable.

Web we last updated kentucky form 720s in may 2021 from the kentucky department of revenue. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. This form is for income earned in tax year 2022, with tax returns due in april. Enter the capital gain from kentucky converted schedule d, line.

Web Download The Taxpayer Bill Of Rights.

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Web you must file form 720 if: Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Form 720s is a kentucky corporate income tax form.

Web Law To File A Kentucky Corporation Income Tax And Llet Return.

This form is for income earned in tax year 2022, with tax returns due in april. If you aren't reporting a tax that you normally. Any corporation electing s corporation treatment in accordance with sections 1361(a) and 1362(a) of the internal. Web law to file a kentucky corporation income tax and llet return.