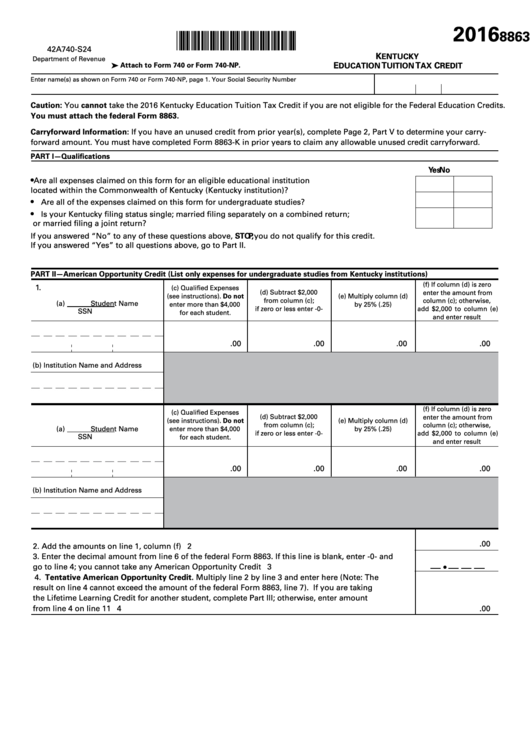

Kentucky Form 8863-K

Kentucky Form 8863-K - If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Total tentative credits for all students on line 2. Kentucky education tuition tax credit. Part i—qualifications ye sno are all expenses claimed on this form for. Part iii, lifetime learning credit—you must enter student’s. Web you must attach the federal form 8863. Web you must attach the federal form 8863. Web must attach the federal form 8863. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. 1720 kentucky tax forms and templates are collected for any of your needs.

The hope credit and the lifetime. 1720 kentucky tax forms and templates are collected for any of your needs. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. Web must attach the federal form 8863. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Web you must attach the federal form 8863. Part i—qualifications ye sno are all expenses claimed on this form for. Part iii, lifetime learning credit—you must enter student’s. Kentucky education tuition tax credit.

If you have an unused credit from prior year(s), complete part v to determine your carryforward amount. 1720 kentucky tax forms and templates are collected for any of your needs. This form is for income. Web you must attach the federal form 8863. The hope credit and the lifetime. Kentucky education tuition tax credit. The hope credit and the lifetime learning credit. Part i—qualifications ye sno are all expenses claimed on this form for. Part iii, lifetime learning credit—you must enter student’s. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses.

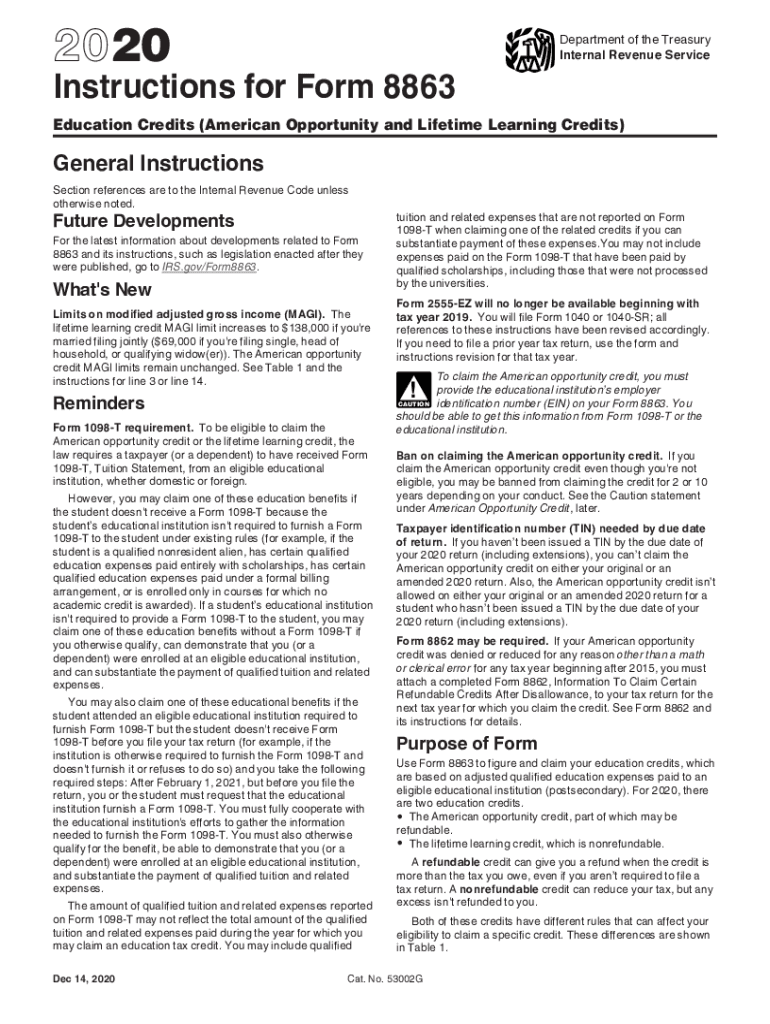

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Part i—qualifications ye sno are all expenses claimed on this form for. 2008 kentucky education tuition tax credit enter name(s) as. Web you must attach the federal form 8863. Kentucky education tuition tax credit. 1720 kentucky tax forms and templates are collected for any of your needs.

Form 886 A Worksheet Worksheet List

Kentucky education tuition tax credit. 2008 kentucky education tuition tax credit enter name(s) as. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Web you must attach the federal form 8863. Web you must attach the federal form 8863.

740 Packet—2008 Kentucky Individual Tax Booklet, Forms and Instructio…

Web you must attach the federal form 8863. 2008 kentucky education tuition tax credit enter name(s) as. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. This form is for income. If you have an unused credit from prior year(s), complete.

Form 8863K Kentucky Education Tax Credit 2016 printable pdf download

Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Web you must attach the federal form 8863. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. The hope credit and the lifetime learning credit..

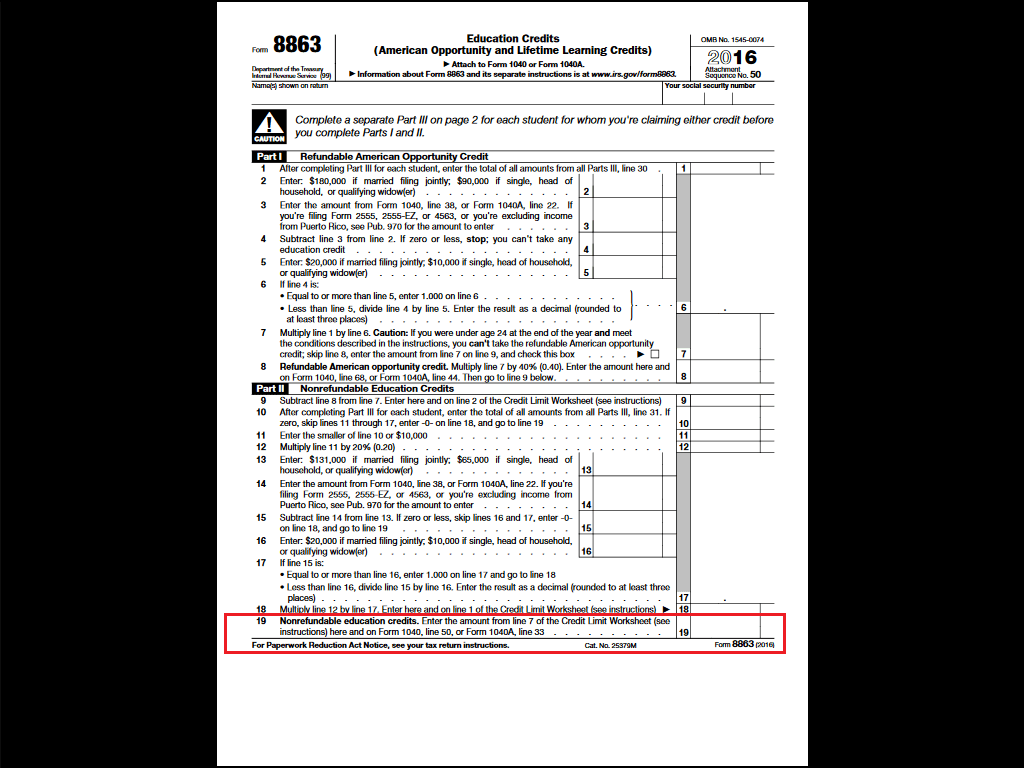

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

The hope credit and the lifetime. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Kentucky education tuition tax credit. 2008 kentucky education tuition tax credit enter name(s) as. Web you must attach the federal form 8863.

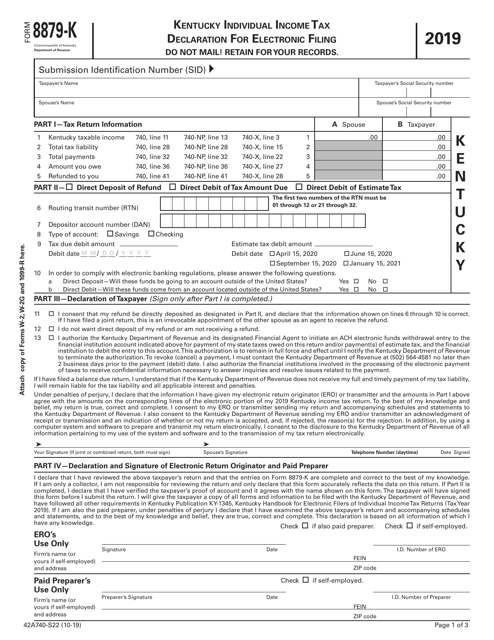

Form 8879K (42A740S22) Download Printable PDF or Fill Online Kentucky

Web must attach the federal form 8863. Web you must attach the federal form 8863. The hope credit and the lifetime learning credit. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863 k online editing your form online is quite effortless. Total tentative credits for all students on line 2.

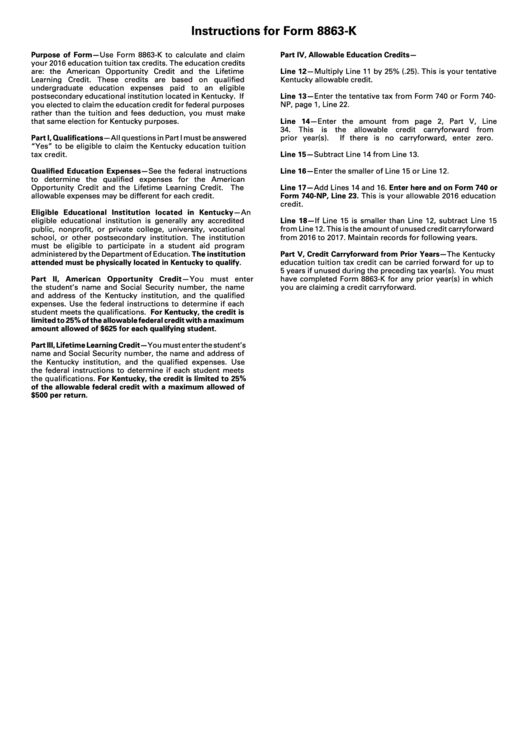

Instructions For Form 8863K Kentucky Education Tuition Tax Credit

The hope credit and the lifetime learning credit. 1720 kentucky tax forms and templates are collected for any of your needs. The hope credit and the lifetime. Web must attach the federal form 8863. This form is for income.

29 Kentucky Department Of Revenue Forms And Templates free to download

An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Total tentative credits for all students on line 2. The hope credit and the lifetime learning credit. This form is for income. Part iii, lifetime learning credit—you must enter student’s.

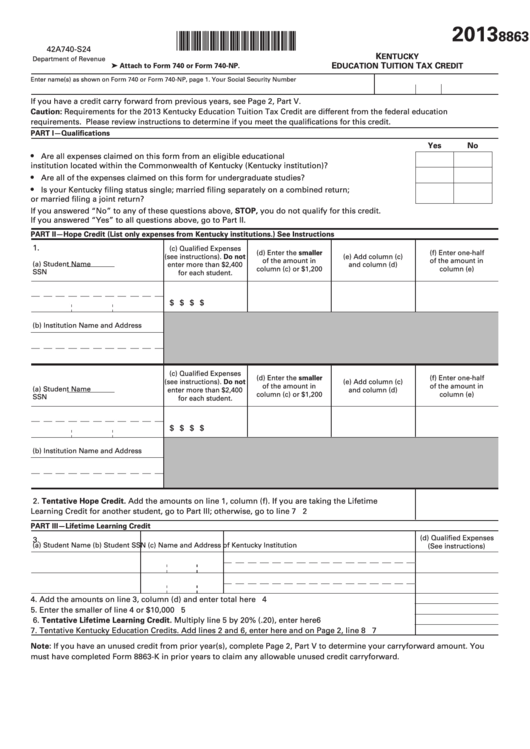

Form 8863K Kentucky Education Tuition Tax Credit 2013 printable

Kentucky education tuition tax credit. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Part i—qualifications ye sno are all expenses claimed on this form for. Web you must attach the federal form 8863. Web ky tax forms 2020 kentucky family size tax credit how to edit your pdf kentucky tax form 8863.

K Is For Key Letter K Template printable pdf download

Total tentative credits for all students on line 2. The hope credit and the lifetime. This form is for income. Web you must attach the federal form 8863. If you have an unused credit from prior year(s), complete part v to determine your carryforward amount.

If You Have An Unused Credit From Prior Year(S), Complete Part V To Determine Your Carryforward Amount.

Web must attach the federal form 8863. Total tentative credits for all students on line 2. Web you must attach the federal form 8863. Web you must attach the federal form 8863.

Kentucky Education Tuition Tax Credit.

The hope credit and the lifetime. The hope credit and the lifetime learning credit. 2008 kentucky education tuition tax credit enter name(s) as. 1720 kentucky tax forms and templates are collected for any of your needs.

Web Ky Tax Forms 2020 Kentucky Family Size Tax Credit How To Edit Your Pdf Kentucky Tax Form 8863 K Online Editing Your Form Online Is Quite Effortless.

Part i—qualifications ye sno are all expenses claimed on this form for. This form is for income. An update prevents reject drkparse on element qualifyingpersongrp for form ar2441, child and dependent care expenses. Part iii, lifetime learning credit—you must enter student’s.