Kentucky State Tax Form

Kentucky State Tax Form - The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The kentucky income tax rate for tax year 2022 is 5%. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Motor vehicle rental/ride share excise tax; Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Keep in mind that some states will not update their tax forms for 2023 until january 2024. (103 kar 18:150) to register and file online, please visit wraps.ky.gov. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690.

Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. (103 kar 18:150) to register and file online, please visit wraps.ky.gov. Choose one of these easy methods! Web corporation income and limited liability entity tax; The kentucky income tax rate for tax year 2022 is 5%. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a).

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. The kentucky income tax rate for tax year 2022 is 5%. Motor vehicle rental/ride share excise tax; Be sure to verify that the form you are downloading is for the correct year. Choose one of these easy methods! Web corporation income and limited liability entity tax; Insurance premiums tax and surcharge; (103 kar 18:150) to register and file online, please visit wraps.ky.gov.

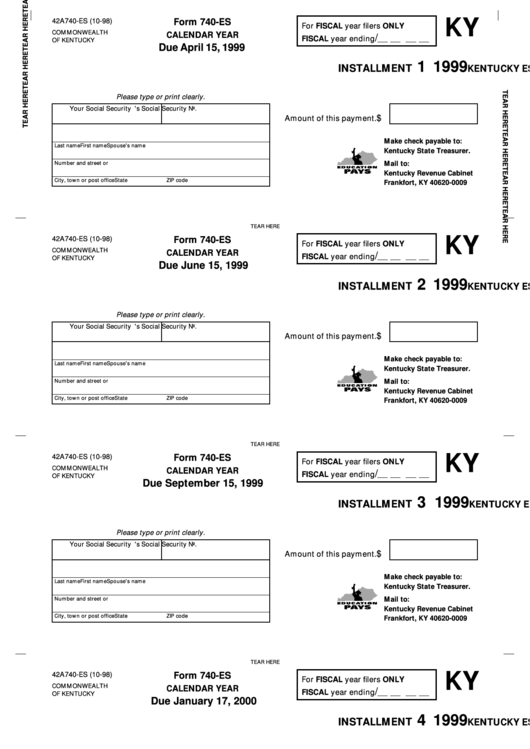

Fillable Form 740Es Kentucky Estimated Tax Voucher 1999 printable

Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Choose one of these easy methods! Web kentucky has a flat state income tax of 5%, which is.

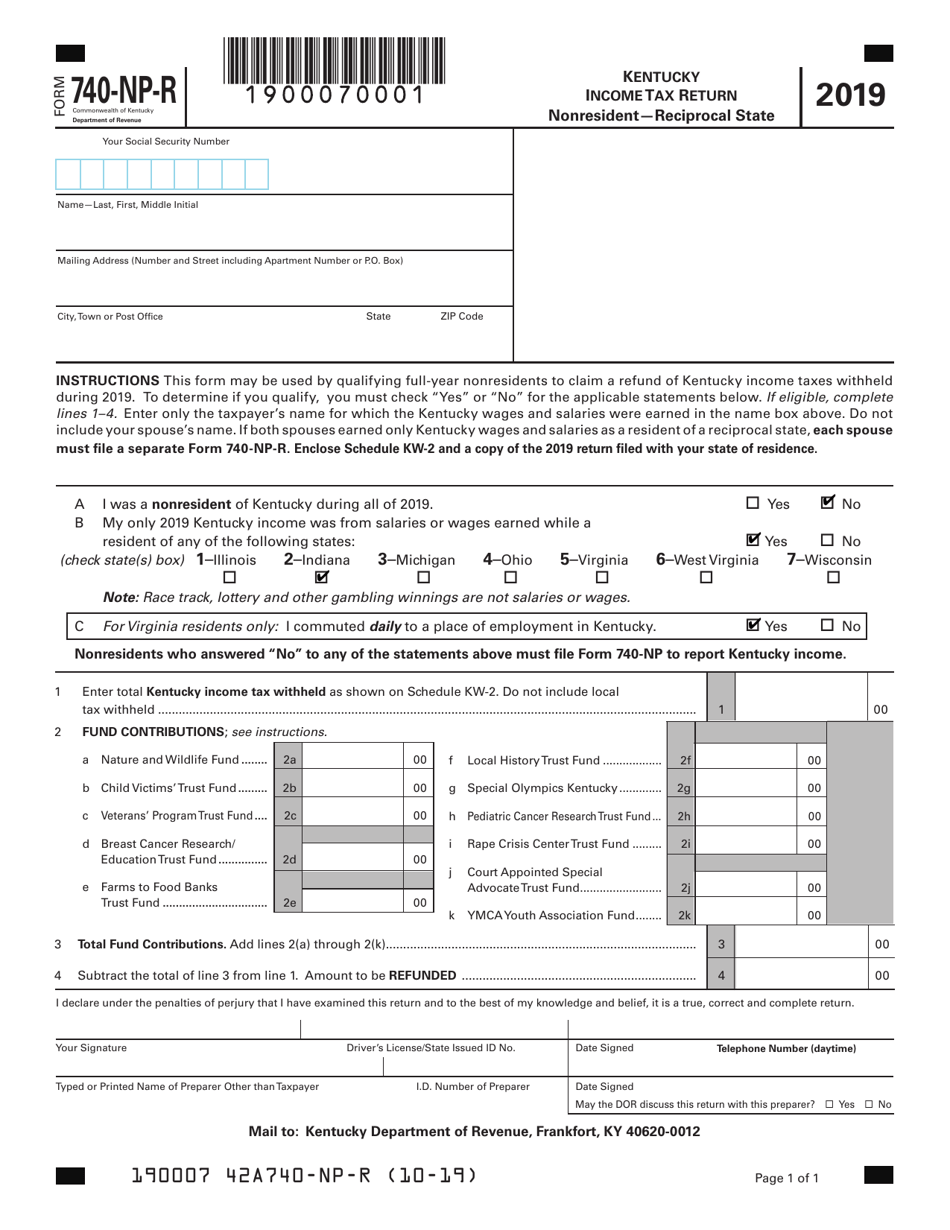

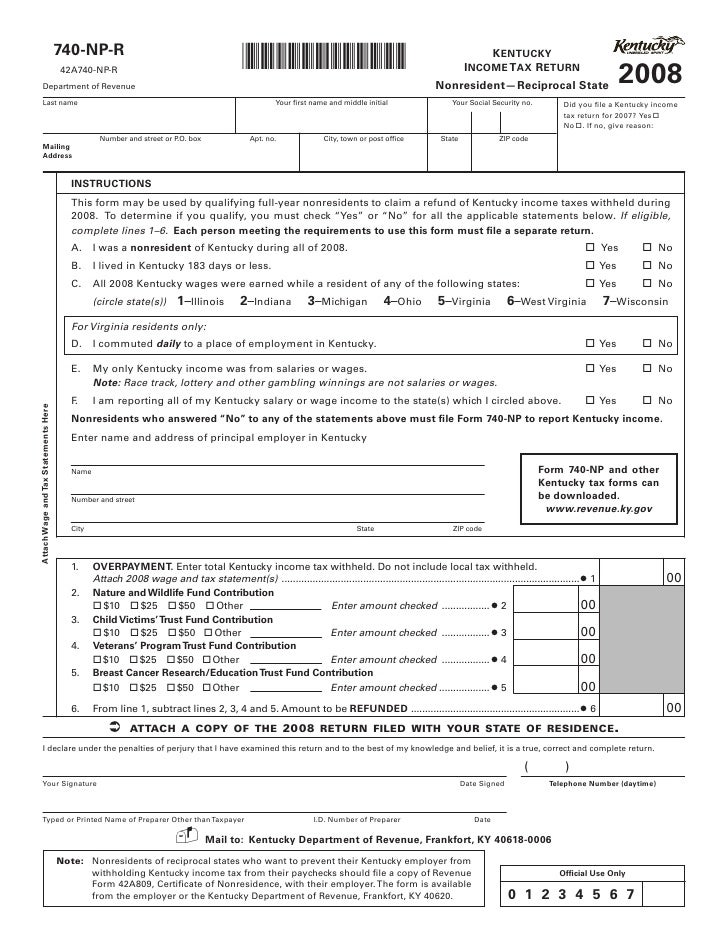

Form 740NPR Download Fillable PDF or Fill Online Kentucky Tax

The kentucky income tax rate for tax year 2022 is 5%. Choose one of these easy methods! Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Insurance premiums tax and surcharge;

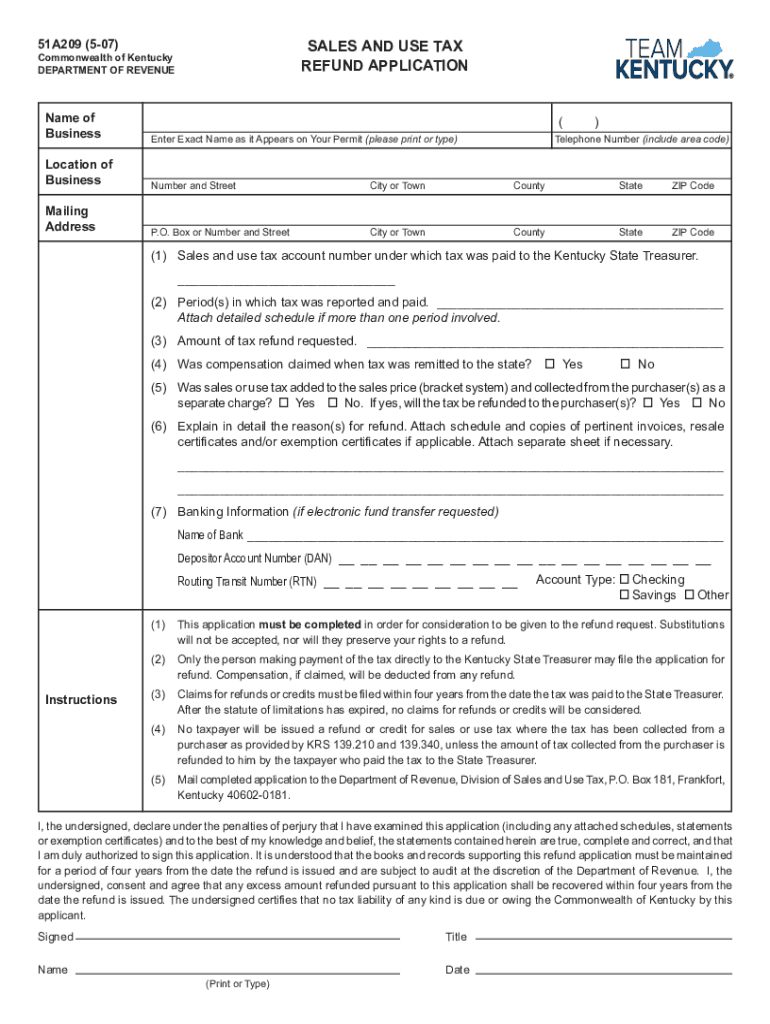

Refund Kentucky Form Fill Out and Sign Printable PDF Template signNow

Choose one of these easy methods! Insurance premiums tax and surcharge; The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Kentucky income tax liability is not expected this year (see instructions) ̈ 2.

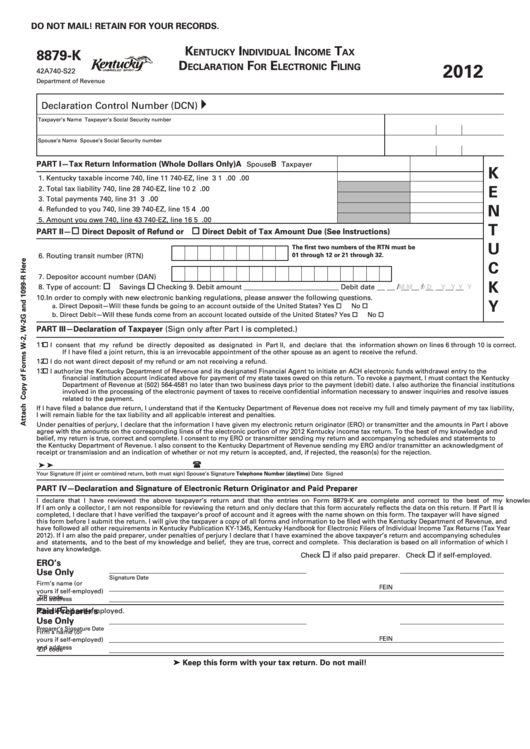

Form 8879, (State Form 42a740S22) Kentucky Individual Tax

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Motor vehicle rental/ride share excise tax; Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Web kentucky has.

740NPR Kentucky Tax Return NonresidentReciprocal State

Web corporation income and limited liability entity tax; The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Individual income tax laws are found in chapter 141 of the kentucky revised statutes. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Web kentucky has a.

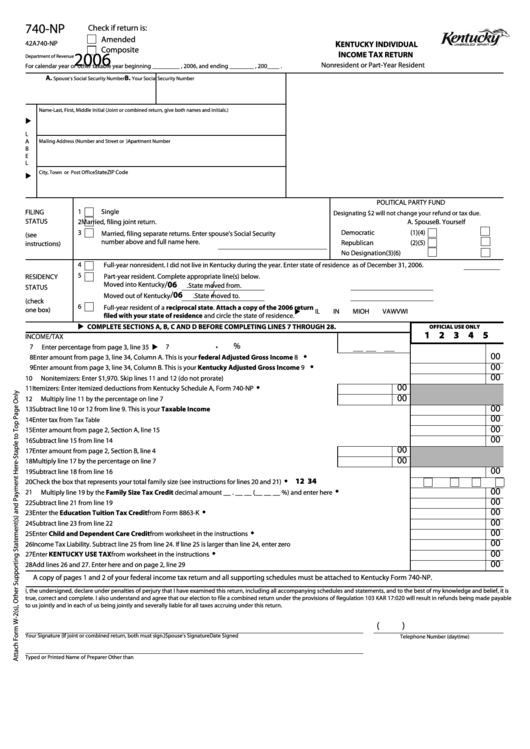

Fillable Form 740Np Kentucky Individual Tax Return

Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after.

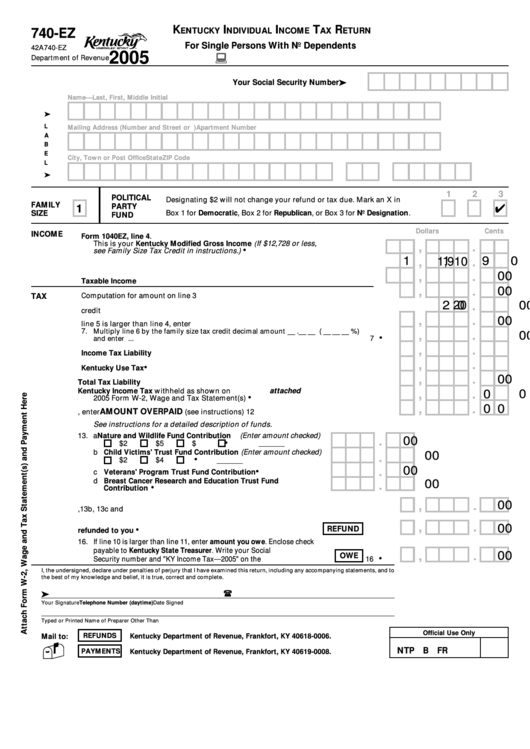

Fillable Form 740Ez Kentucky Individual Tax Return 2005

Be sure to verify that the form you are downloading is for the correct year. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). The current tax year is 2022, and most states will release updated tax forms between january and april of.

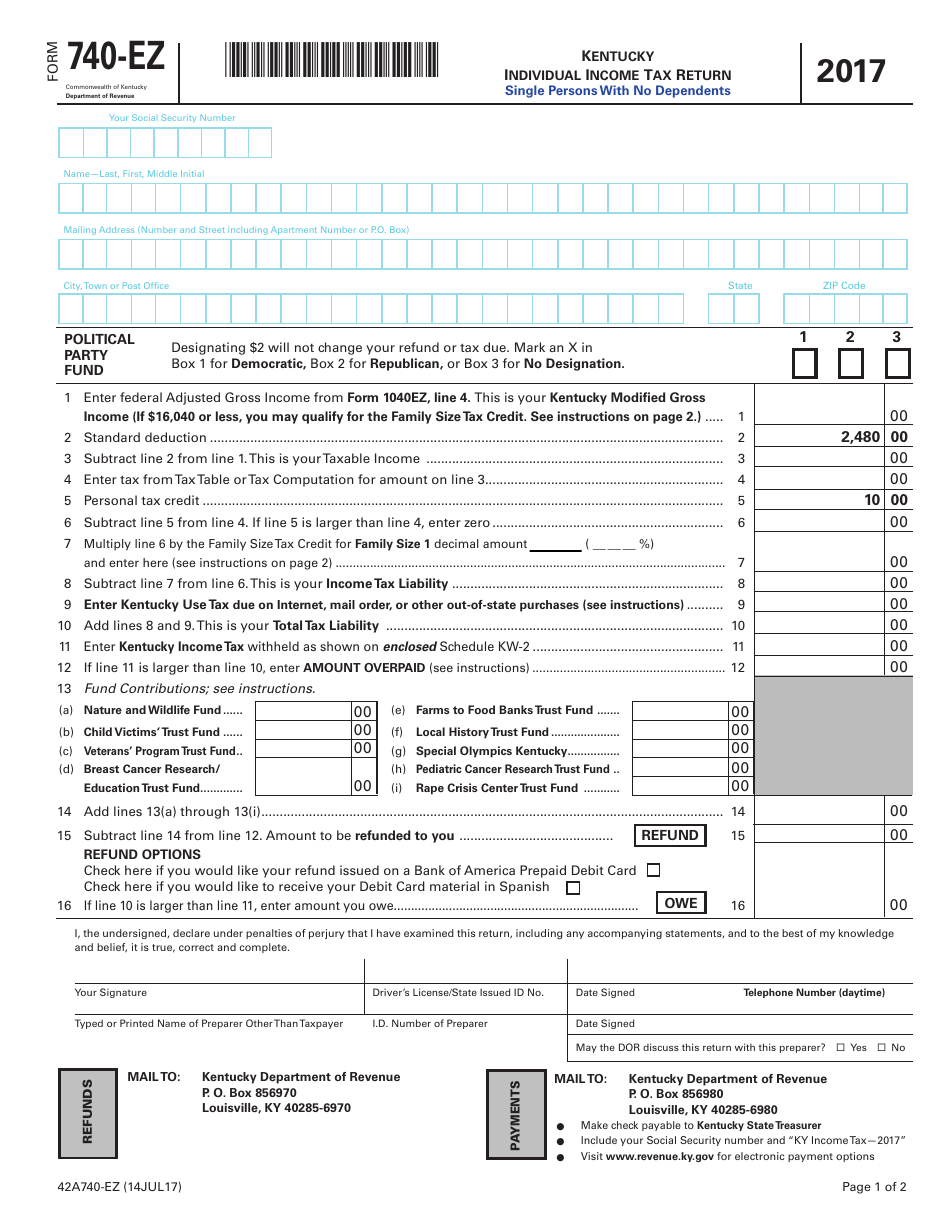

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Motor vehicle rental/ride share excise tax; Be sure to verify that the form you are downloading is for the correct year. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Choose one of these easy methods! Web corporation income and limited liability entity tax;

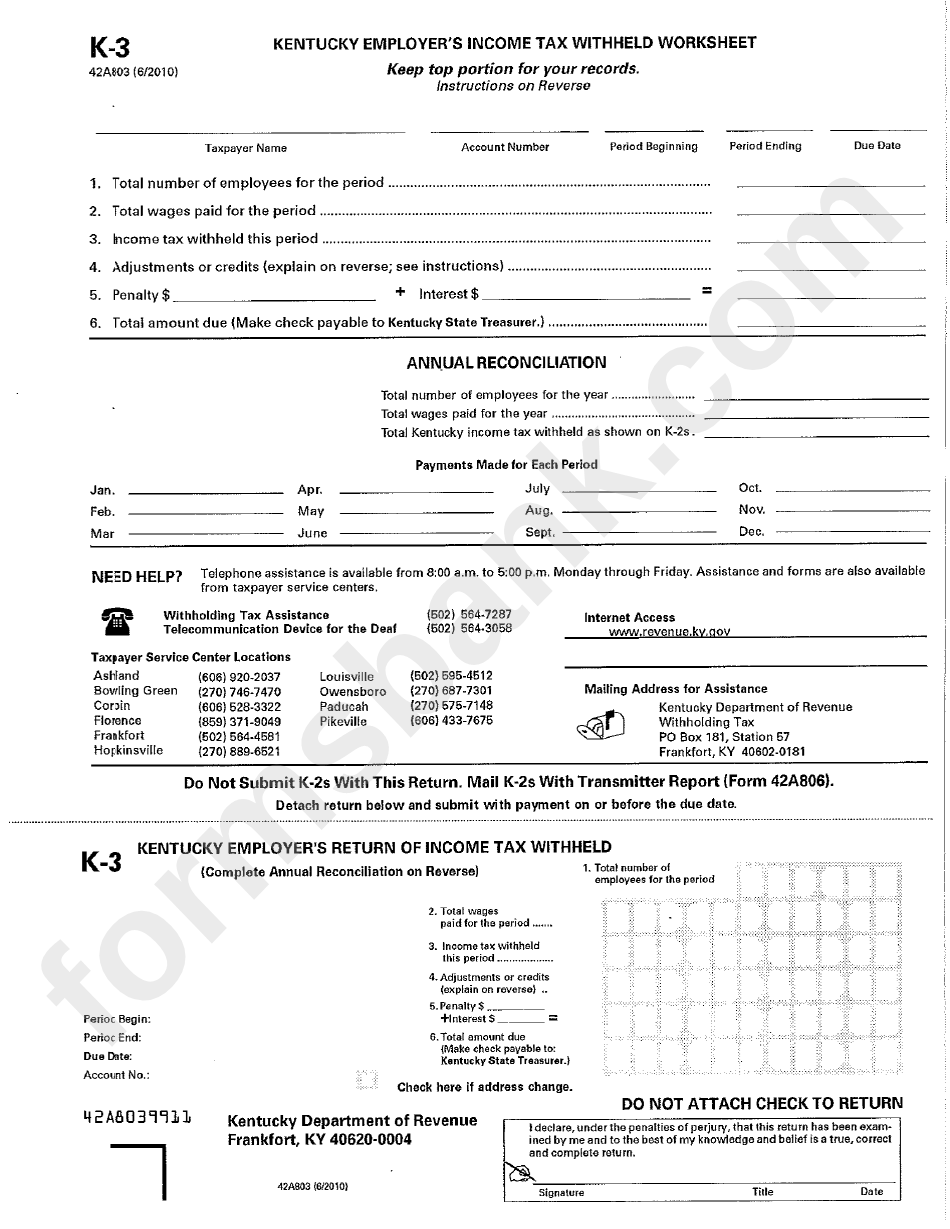

Form K3 Kentucky Employer'S Tax Withheld Worksheet printable

The kentucky income tax rate for tax year 2022 is 5%. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web effective may 5, 2020, kentucky's tax law requires employers filing on a.

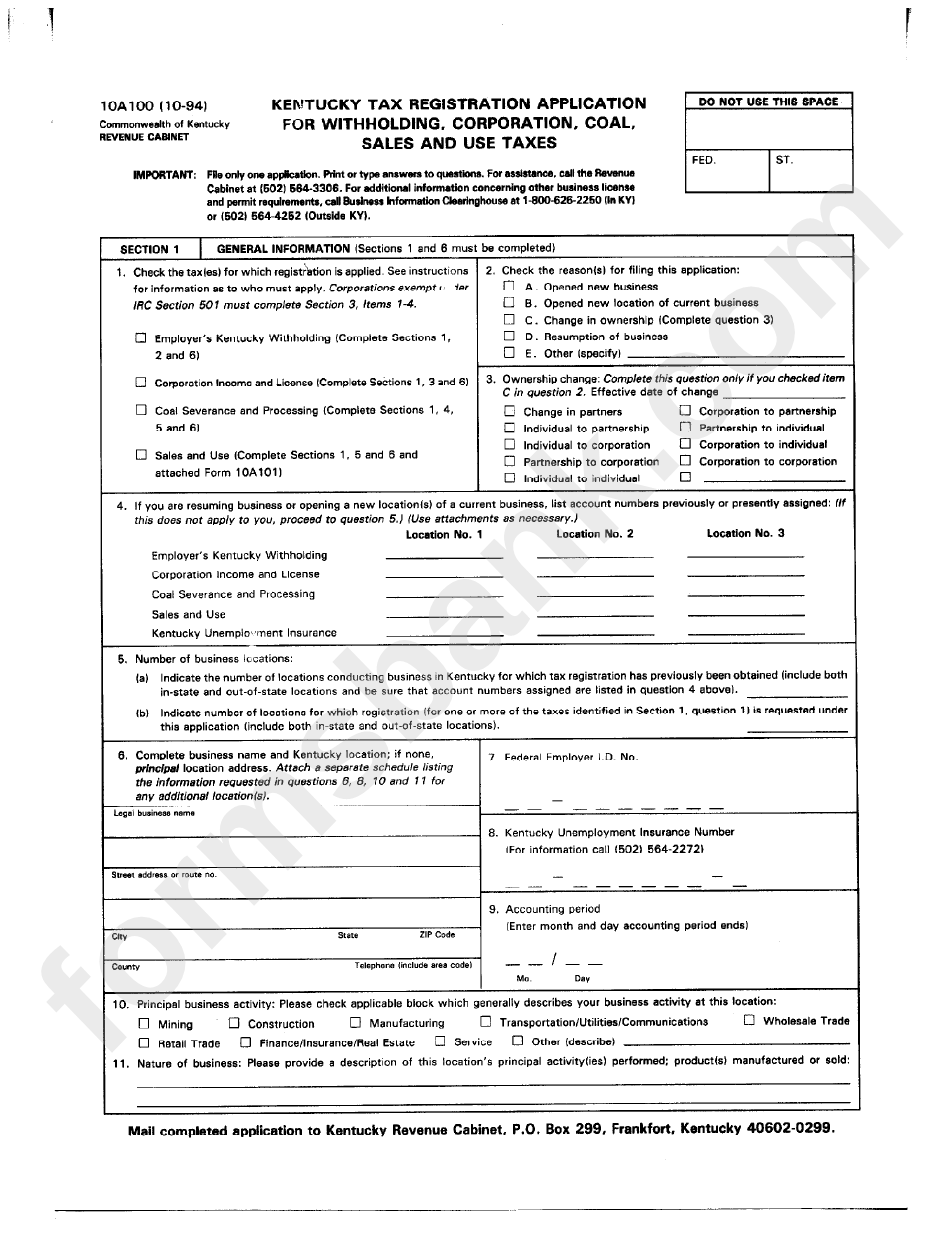

Form 10a100 Kentucky Tax Registration Application For Withholding

Be sure to verify that the form you are downloading is for the correct year. Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. The kentucky income tax rate for tax year 2022 is 5%. Keep in mind that some states will not update their tax forms.

Web State Zip Code All Kentucky Wage Earners Are Taxed At A Flat 5% Rate With A Standard Deduction Allowance Of $2,690.

The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Insurance premiums tax and surcharge; Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet.

(103 Kar 18:150) To Register And File Online, Please Visit Wraps.ky.gov.

The kentucky income tax rate for tax year 2022 is 5%. Motor vehicle rental/ride share excise tax; Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue.

Be Sure To Verify That The Form You Are Downloading Is For The Correct Year.

Web corporation income and limited liability entity tax; The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Keep in mind that some states will not update their tax forms for 2023 until january 2024.

Choose One Of These Easy Methods!

Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022.