Lansing Mi City Tax Form

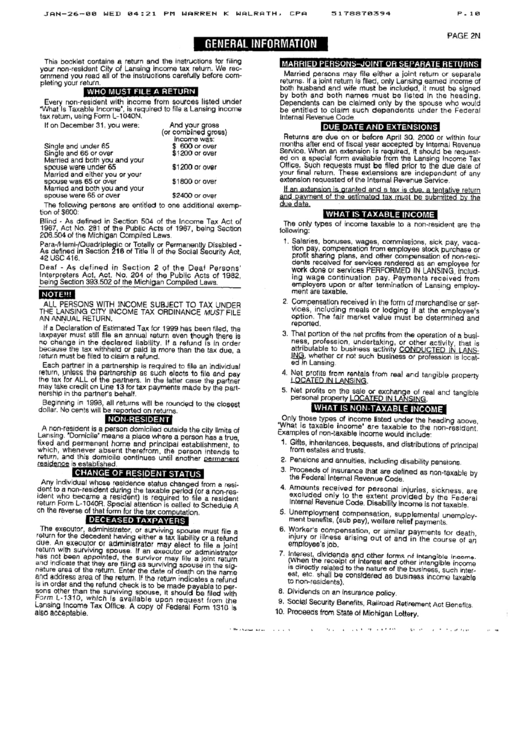

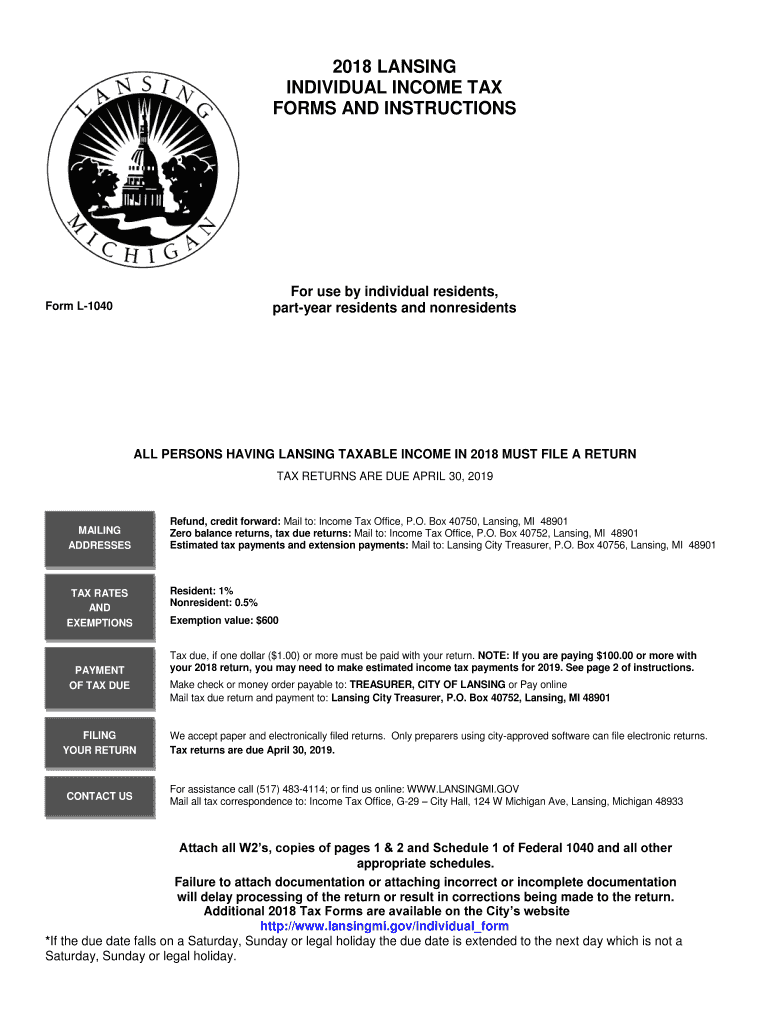

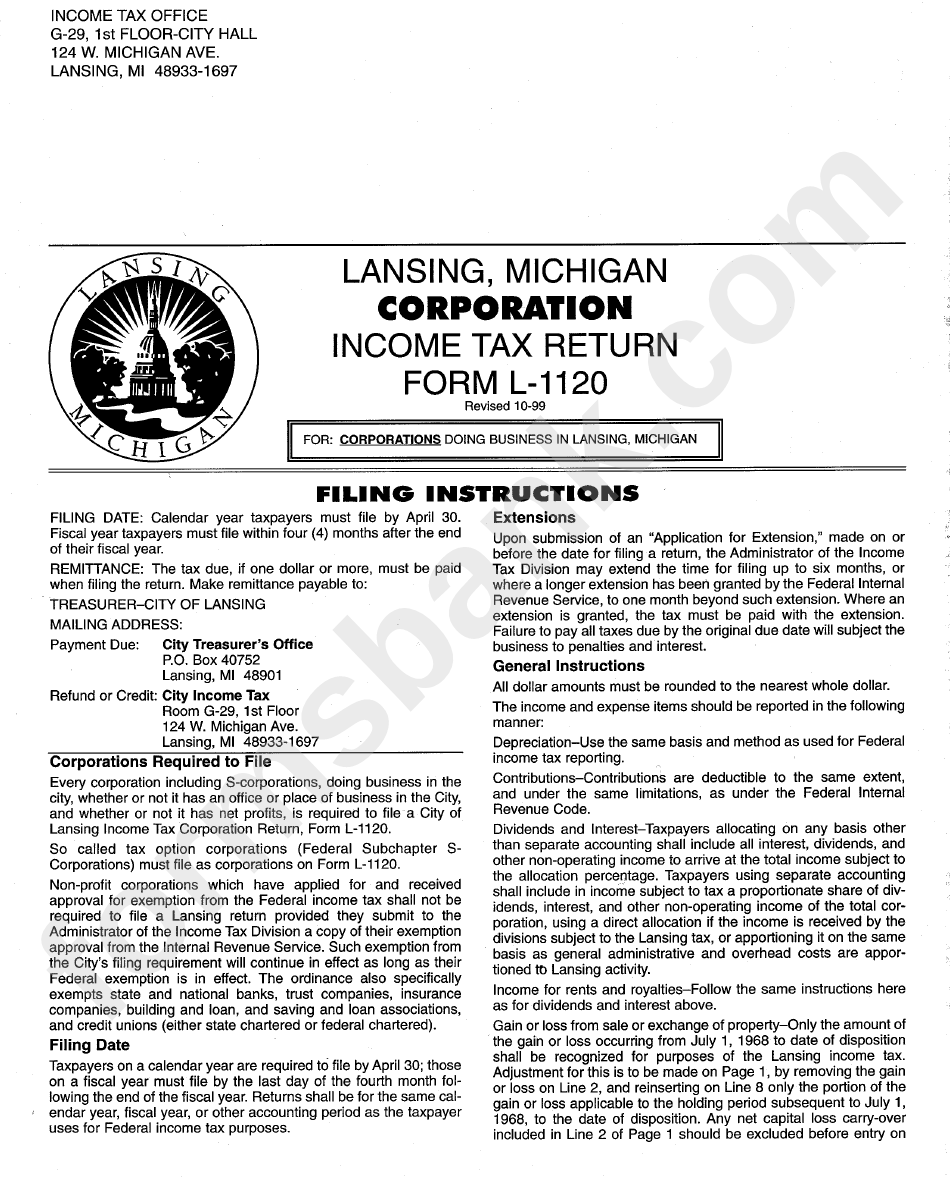

Lansing Mi City Tax Form - Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well as other treasury related services. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. The remaining estimated tax is due in three. Handy tips for filling out l 1040. Web follow the simple instructions below: Web see options to pay tax and applicable tax rates. The city of east lansing will also accept the common form versions of these. Open the pdf blank in the editor. City estimated individual income tax voucher.

Refer to the outlined fillable fields. All lansing income tax forms are available on the city’s website, www.lansingmi.gov. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Web see options to pay tax and applicable tax rates. The remaining estimated tax is due in three. These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. Get ready for tax season deadlines by completing any required tax forms today. Web find forms and resources for the city of lansing city assessor regarding personal property, property transfers and more.

Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well as other treasury related services. This is where to insert your data. Web find forms and resources for the city of lansing city assessor regarding personal property, property transfers and more. The city of east lansing will also accept the common form versions of these. All lansing income tax forms are available on the city’s website, www.lansingmi.gov. Get ready for tax season deadlines by completing any required tax forms today. Web follow the simple instructions below: Complete, edit or print tax forms instantly. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to.

Lansing MI City Vector Road Map Blue Text Digital Art by Frank Ramspott

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. Web here you can find all the different ways to submit.

City of East Lansing needs tax, including MSU employees

Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. City estimated individual income tax voucher. Get ready for tax season deadlines by completing any required tax forms today. Web see options to pay tax and applicable tax rates. All lansing income tax forms are available on the city’s website, www.lansingmi.gov.

Top 7 City Of Lansing Tax Forms And Templates free to download in PDF

Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Click the city name to access the appropriate. Web this page is an attempt to give you all the information you may need about floodplain permit requirements in the city of lansing. Open the pdf.

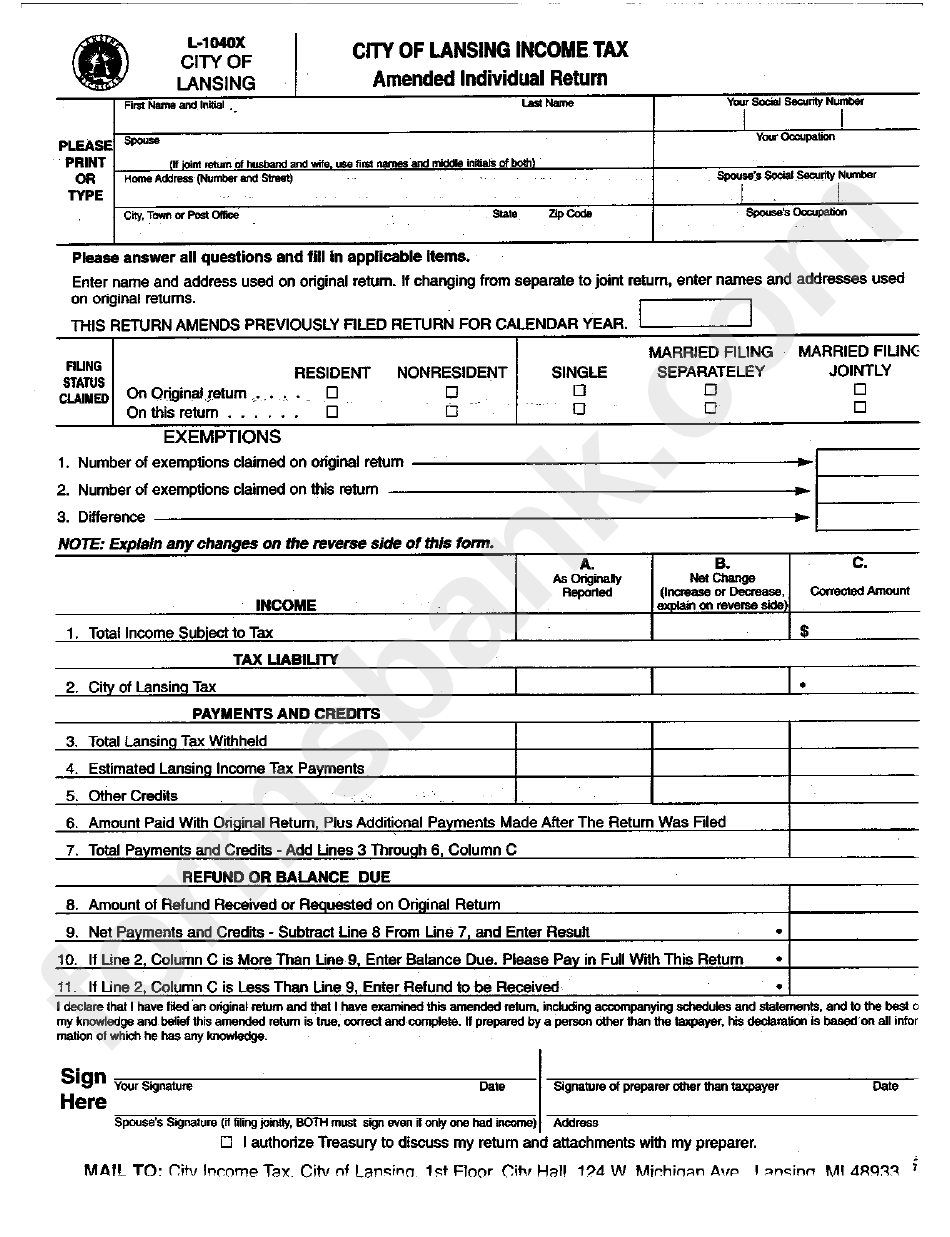

Form L1040x City Of Lansing Tax Amended Individual Return

Web learn about property tax, income tax, employer withholding, false alarm system registration and invoice payments as well as other treasury related services. This is where to insert your data. Web filling out the city of lansing tax forms 2021 with signnow will give better confidence that the output template will be legally binding and safeguarded. Open the pdf blank.

Lansing Tax Form Fill Out and Sign Printable PDF Template

Get ready for tax season deadlines by completing any required tax forms today. Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. This is where to insert your data. These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. Web see options to pay tax.

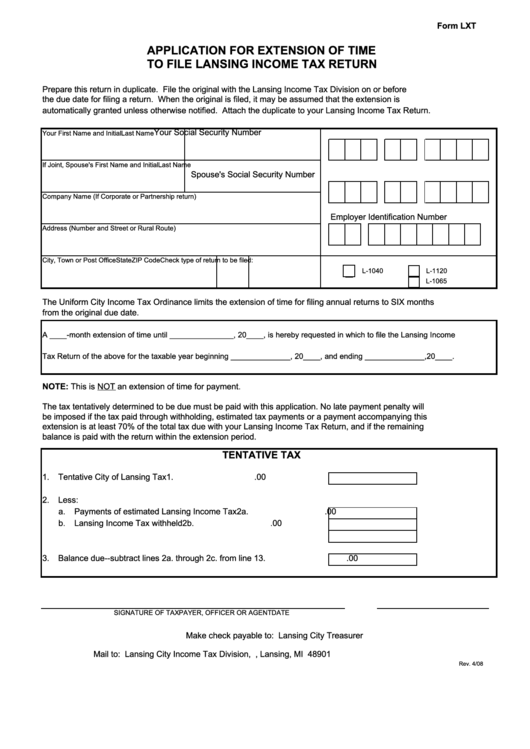

Fillable Form Lxt Application For Extension Of Time To File Lansing

Refer to the outlined fillable fields. Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. Web city income tax return application for extension of time to file. City estimated individual income tax voucher. Handy tips for filling out l 1040.

Lansing, Michigan (MI) map, earnings map, and wages data

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web here you can find all the different ways to submit your city of lansing income taxes. The city of east lansing will also accept the.

Pin on Ministry Connections

Web this page is an attempt to give you all the information you may need about floodplain permit requirements in the city of lansing. Web city income tax forms. Open the pdf blank in the editor. All lansing income tax forms are available on the city’s website, www.lansingmi.gov. City estimated individual income tax voucher.

Cca Form Tax Fill Out and Sign Printable PDF Template signNow

Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Refer to the outlined fillable fields. Web if you live or work in a taxing city listed below, you are required to complete and submit the.

Form L1120 Lansing, Michigan Corporation Tax Return printable

Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web the east lansing income tax forms for employers, individuals, partnerships and corporations are below. These days, most americans prefer to do their own taxes and, furthermore, to fill in forms electronically. Refer to the outlined fillable fields. Web welcome to the city of lansing income tax online office, where you can find resources on federal, state, and local income tax information.

Web Learn About Property Tax, Income Tax, Employer Withholding, False Alarm System Registration And Invoice Payments As Well As Other Treasury Related Services.

The city of east lansing will also accept the common form versions of these. Tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to. Web tax at {tax rate} (multiply line 22 by lansing resident tax rate of 1.% (0.01) or nonresident tax rate of 0.5% (0.005) and enter tax on line 23b, or if using schedule tc to compute. Web city income tax forms.

Tax At {Tax Rate} (Multiply Line 22 By Lansing Resident Tax Rate Of 1.% (0.01) Or Nonresident Tax Rate Of 0.5% (0.005) And Enter Tax On Line 23B, Or If Using Schedule Tc To.

City estimated individual income tax voucher. This is where to insert your data. Web city tax information and assistance for city individual income tax and city business and fiduciary taxes. Web if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form.

Web Here You Can Find All The Different Ways To Submit Your City Of Lansing Income Taxes.

Open the pdf blank in the editor. Handy tips for filling out l 1040. Web find forms and resources for the city of lansing city assessor regarding personal property, property transfers and more. Click the city name to access the appropriate.