Llc Business Tax Extension Form

Llc Business Tax Extension Form - Just remember that you’re only getting an. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web a limited liability company (llc) is a business structure allowed by state statute. Web use form ftb 3537, payment for automatic extension for llcs, only if both of the following apply: Ad top 5 llc services online (2023). Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Complete, edit or print tax forms instantly. The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. Create an account in expressextensin or log in to your existing. Ad taxact makes it easy to quickly send an income tax extension online in minutes for free.

Web extensions of business taxes for llcs are available by filing irs form 7004 at least 45 days before the end of the tax period. Web what is form 7004? Web for calendar year partnerships, the due date is march 15. Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. And you are not enclosing a payment use this address and you are enclosing a payment. Ad top 5 llc services online (2023). Filing your tax extension just became easier! Not going to make the filing deadline? The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. If your llc files on an extension, refer to payment for automatic extension for llcs.

You can apply for an extension completely online. Web form 4868 addresses for taxpayers and tax professionals; Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. Web how to apply for a tax extension. The llc cannot file form 568 by the original due date. Create an account in expressextensin or log in to your existing. Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web what is form 7004? Filing your tax extension just became easier!

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Web to file an extension for your llc through expressextension, follow the steps below: Web extensions of business taxes for llcs are available by filing irs form 7004 at least 45 days before the end of the tax period. Application for automatic extension of time to file certain business income tax information, and other returns. Web form 4868 addresses for.

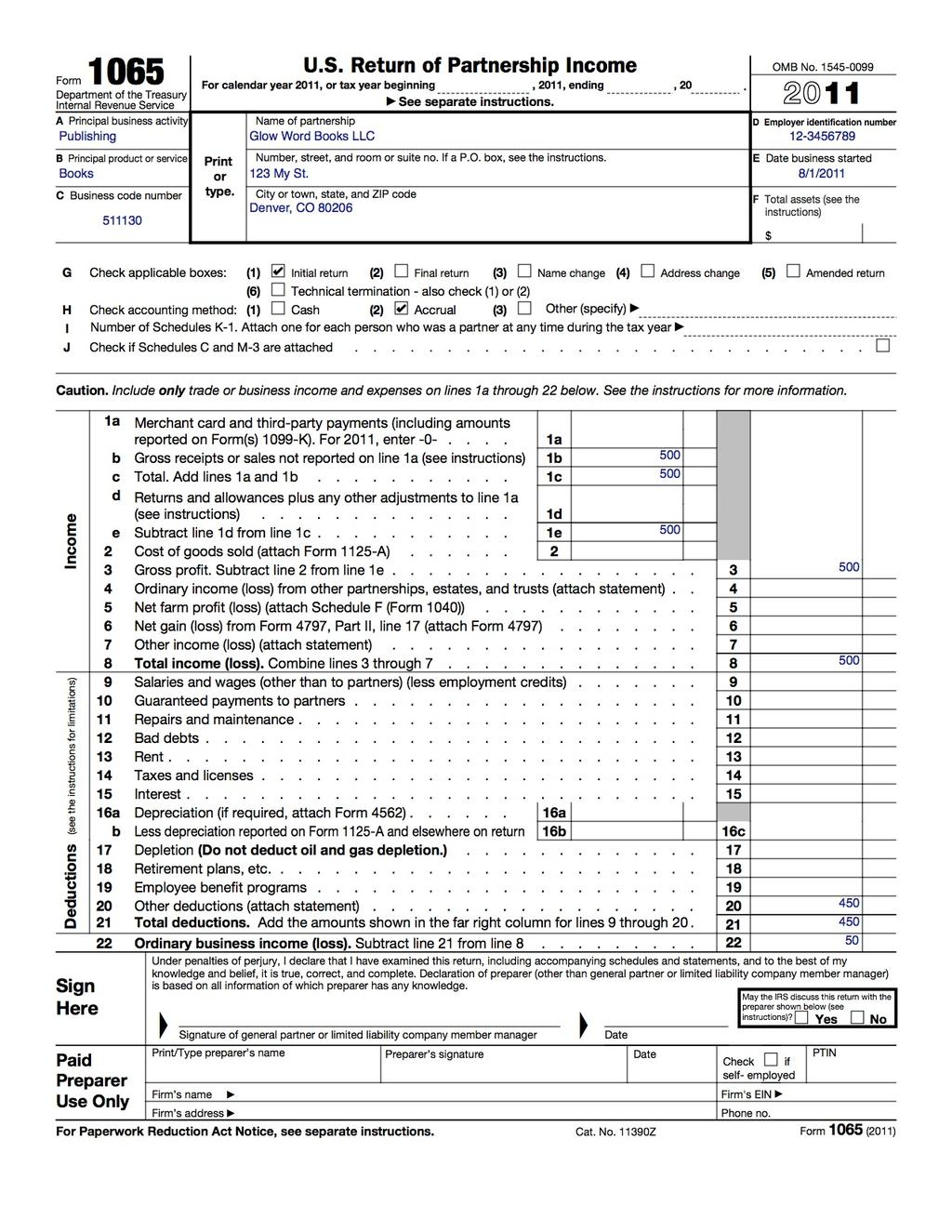

Llc Capital Account Spreadsheet Within How To Fill Out An Llc 1065 Irs

Create an account in expressextensin or log in to your existing. Not going to make the filing deadline? Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Application for automatic extension of time to file certain business income.

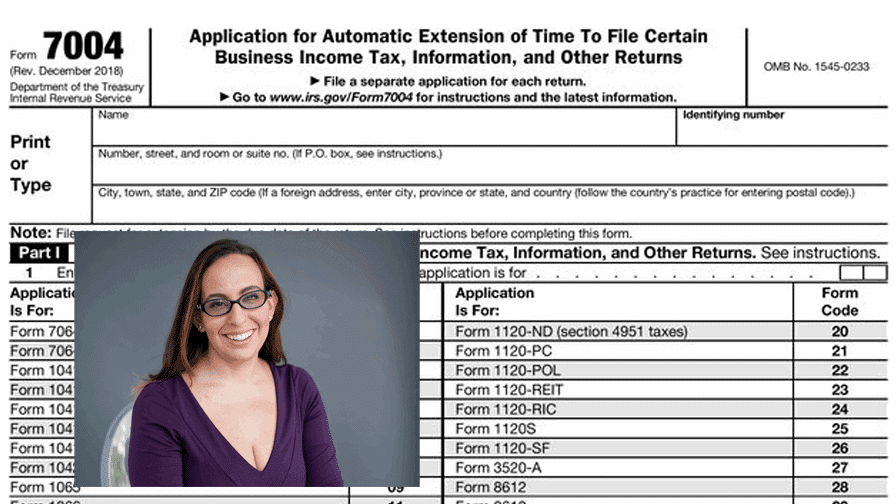

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web to file for an llc extension, file form 7004: Web to file an extension for your llc through expressextension, follow the steps below: Web extensions of business taxes for llcs are available by filing irs form 7004 at least 45.

Today is the Deadline to File your Business Tax Extension! Blog

You can apply for an extension completely online. Web to file an extension for your llc through expressextension, follow the steps below: Web there are several ways to submit form 4868. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web 4.

File Form 7004 Online 2023 Business Tax Extension Form

The llc cannot file form 568 by the original due date. Web use form ftb 3537, payment for automatic extension for llcs, only if both of the following apply: Web for calendar year partnerships, the due date is march 15. Complete, edit or print tax forms instantly. Web to extend the llc's filing date by six (6) months, file a.

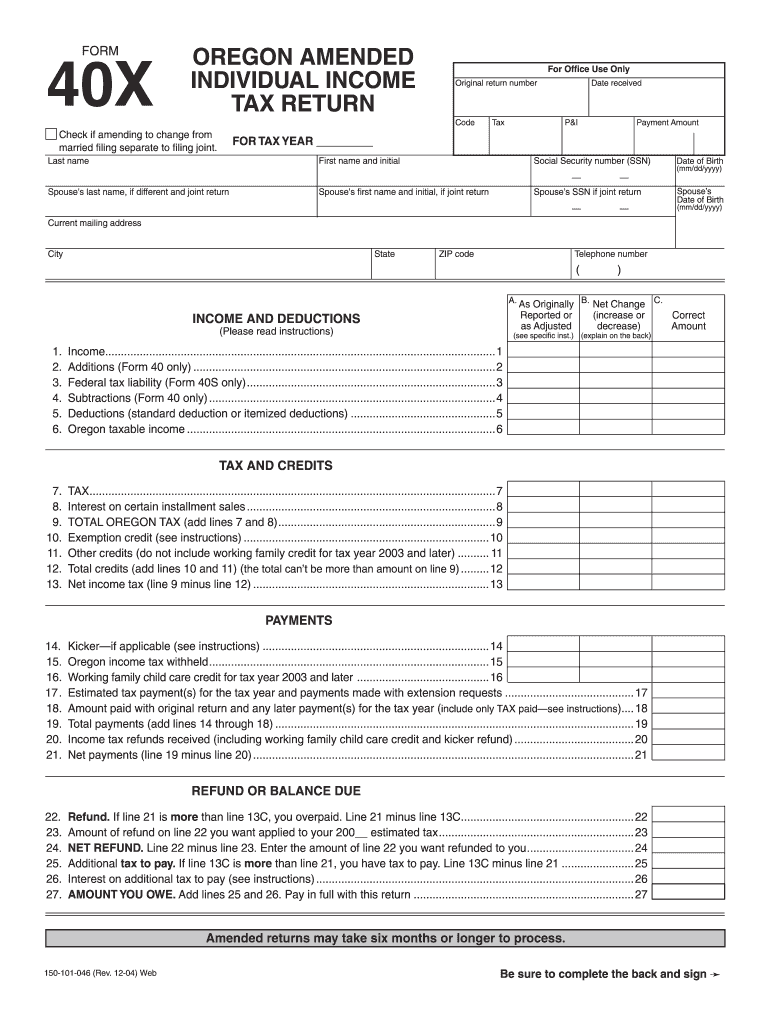

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Filing your tax extension just became easier! Web a limited liability company (llc) is a business structure allowed by state statute. The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. Web how to apply for a tax extension. Ad taxact makes it easy to quickly send an.

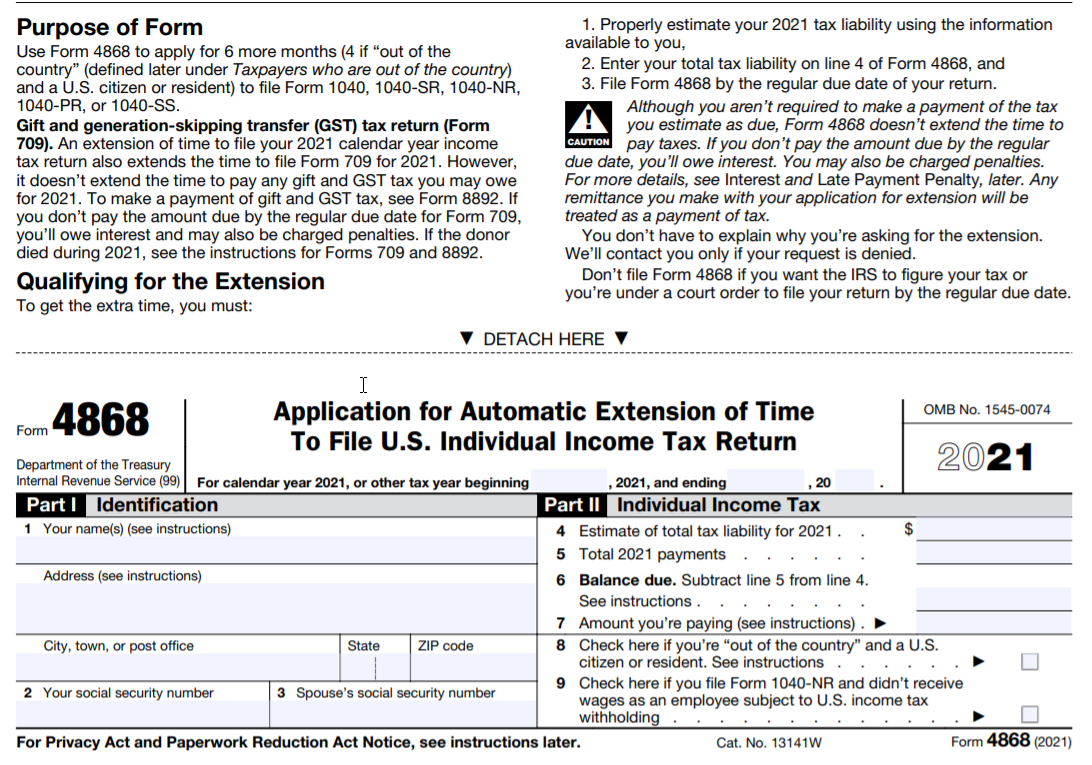

File Personal Tax Extension 2021 IRS Form 4868 Online

Web use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. You can apply for an extension completely online..

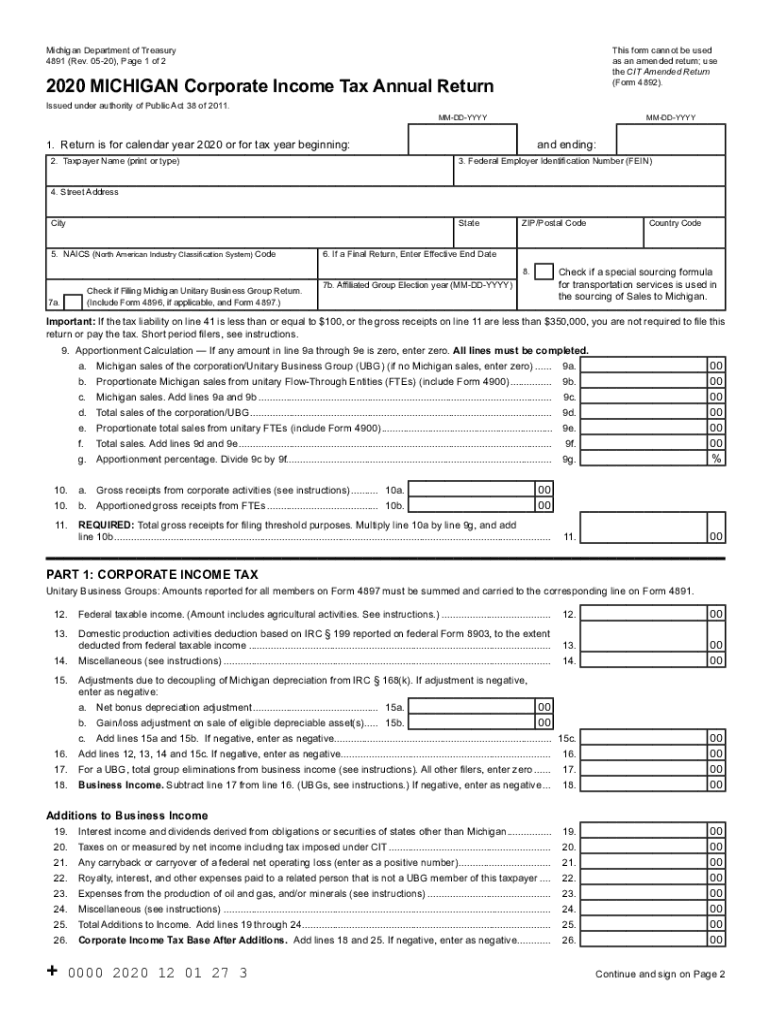

MI DoT 4891 20202021 Fill out Tax Template Online US Legal Forms

The form 7004 is a business extension form. Web there are several ways to submit form 4868. Ad taxact makes it easy to quickly send an income tax extension online in minutes for free. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and.

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

Web how to apply for a tax extension. The llc cannot file form 568 by the original due date. Web a limited liability company (llc) is a business structure allowed by state statute. And you are not enclosing a payment use this address and you are enclosing a payment. Web use form ftb 3537, payment for automatic extension for llcs,.

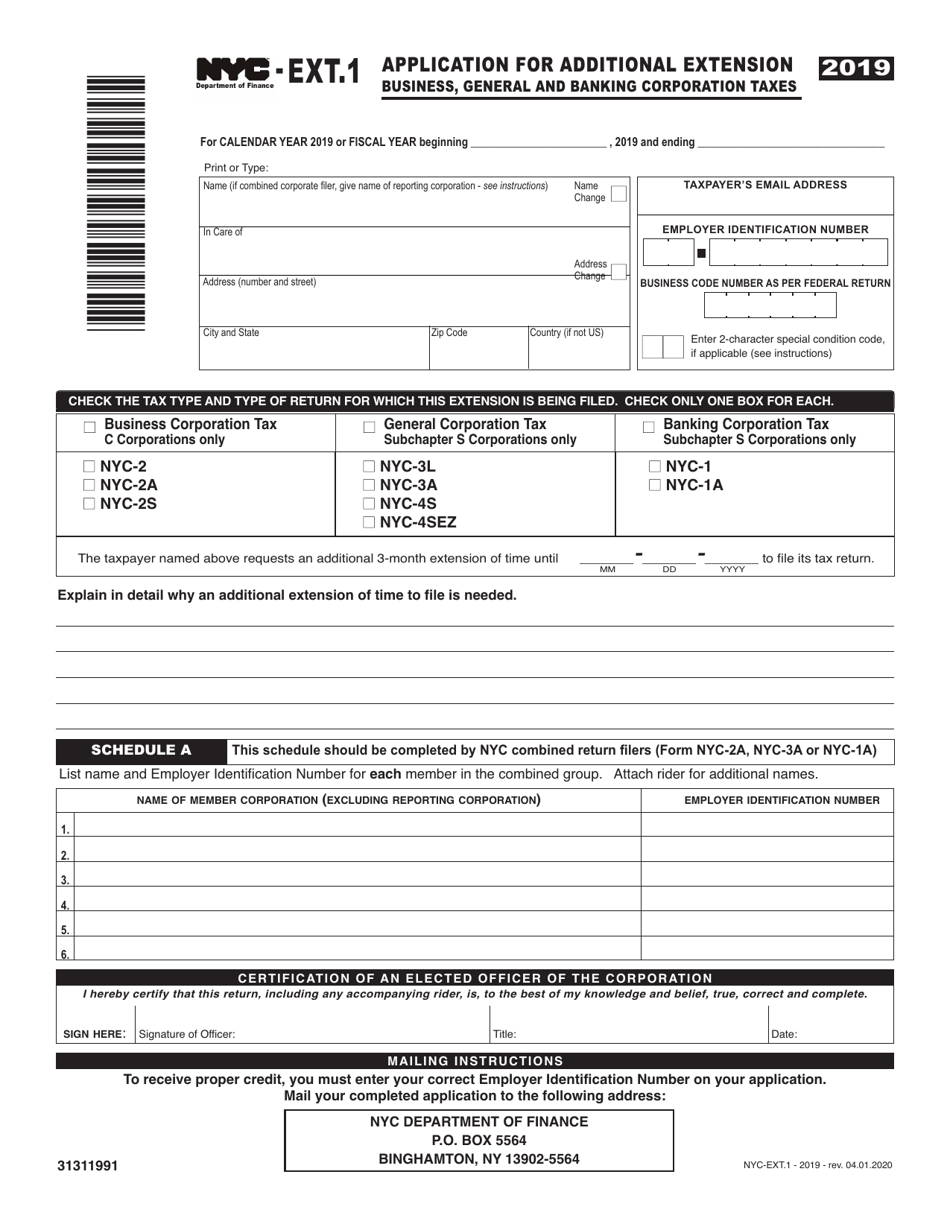

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Not going to make the filing deadline? Web to file for an llc extension, file form 7004: The partnership may choose to file for an automatic six month extension by filing form 7004.

Just Remember That You’re Only Getting An.

Ad taxact makes it easy to quickly send an income tax extension online in minutes for free. You can apply for an extension completely online. And you are not enclosing a payment use this address and you are enclosing a payment. The form 7004 is a business extension form.

Complete, Edit Or Print Tax Forms Instantly.

Filing your tax extension just became easier! Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Web 4 rows instead of filing by april 15, a tax extension moves your small business tax return due date.

Web Use Form 7004 To Request An Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns.

The llc cannot file form 568 by the original due date. Complete, edit or print tax forms instantly. Each state may use different regulations, you should check with your state if you. Web for calendar year partnerships, the due date is march 15.

If Your Llc Files On An Extension, Refer To Payment For Automatic Extension For Llcs.

Web to file for an llc extension, file form 7004: Web extensions of business taxes for llcs are available by filing irs form 7004 at least 45 days before the end of the tax period. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web there are several ways to submit form 4868.