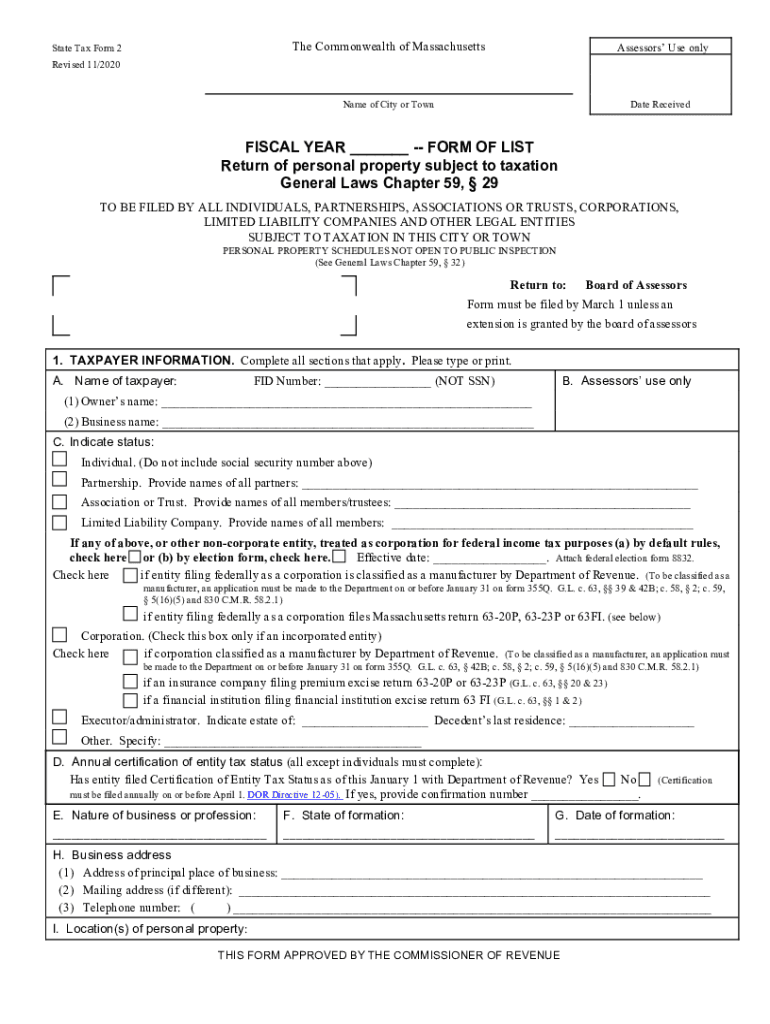

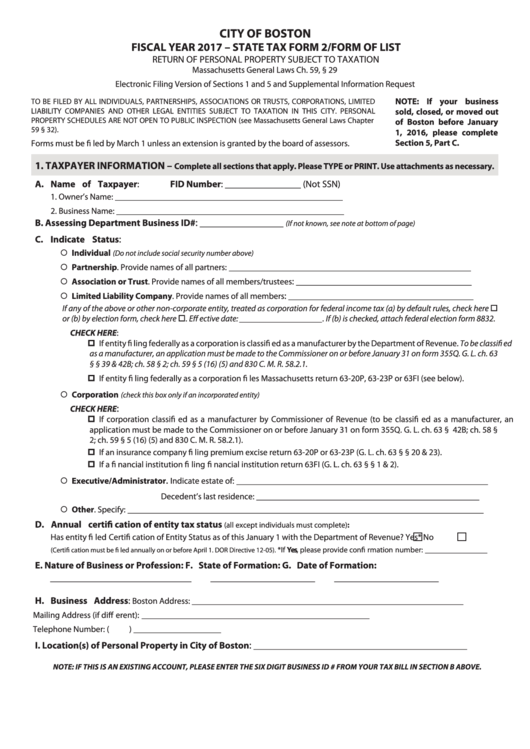

Ma State Tax Form 2

Ma State Tax Form 2 - Sign & fill out legal forms online on any device. Web click the get form button to begin modifying. However, with our preconfigured online templates, things get simpler. Edit your state tax form 2 online type text, add images, blackout confidential details, add comments, highlights and more. Amend a massachusetts individual or business tax return. Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Web file an extension for massachusetts personal income or fiduciary tax. Web offered by massachusetts department of revenue massachusetts personal income tax forms and instructions dor has released its 2022 massachusetts. Web we last updated massachusetts form 2 in january 2023 from the massachusetts department of revenue. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 2, fully updated for tax year 2022.

Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Web follow the simple instructions below: This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. You can download or print current or. This form is for income earned in tax year 2022, with tax. It added income limits, price caps and. Fill out every fillable field. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. You may file by mail on paper forms or online. Web we last updated massachusetts form 2 in january 2023 from the massachusetts department of revenue.

Fill out every fillable field. You may file by mail on paper forms or online. Web how it works upload the massachusetts form 2 edit & sign ma state form 2 from anywhere save your changes and share massachusetts state form 2 rate the state. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 2, fully updated for tax year 2022. It added income limits, price caps and. Sign it in a few clicks draw your signature, type. Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Web we last updated massachusetts form 2 in january 2023 from the massachusetts department of revenue. Web follow the simple instructions below: Web offered by massachusetts department of revenue massachusetts personal income tax forms and instructions dor has released its 2022 massachusetts.

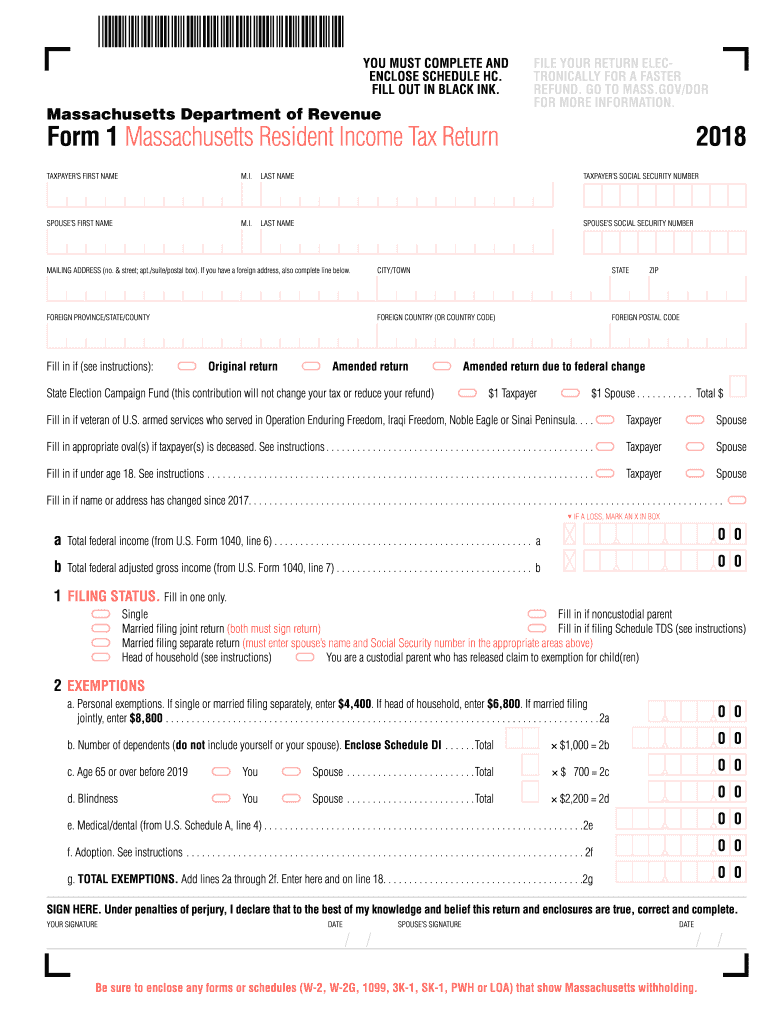

Form 1 Massachusetts Resident Tax Return YouTube

This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. However, with our preconfigured online templates, things get simpler. Who must file a return. Web the 2023 chevrolet bolt. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations,.

20202022 MA State Tax Form 2 Fill Online, Printable, Fillable, Blank

All tangible personal property is assessed in the city or. This form is for income earned in tax year 2022, with tax. It added income limits, price caps and. Fiscal year filers enter appropriate. Web to get a paper copy of the state tax form 2/form of list, you need to show us that you have a hardship that prevents.

Fillable State Tax Form 2/form Of List Return Of Personal Property

Web to get a paper copy of the state tax form 2/form of list, you need to show us that you have a hardship that prevents you from filing electronically. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web follow the simple instructions below: Web the 2023 chevrolet bolt..

Ma state tax form 128 122000 Fill out & sign online DocHub

Because of the observance of emancipation day in washington d.c. Web state tax form 2/form of list “tangible” — or physical — property that you can move easily is personal property. Web how it works upload the massachusetts form 2 edit & sign ma state form 2 from anywhere save your changes and share massachusetts state form 2 rate the.

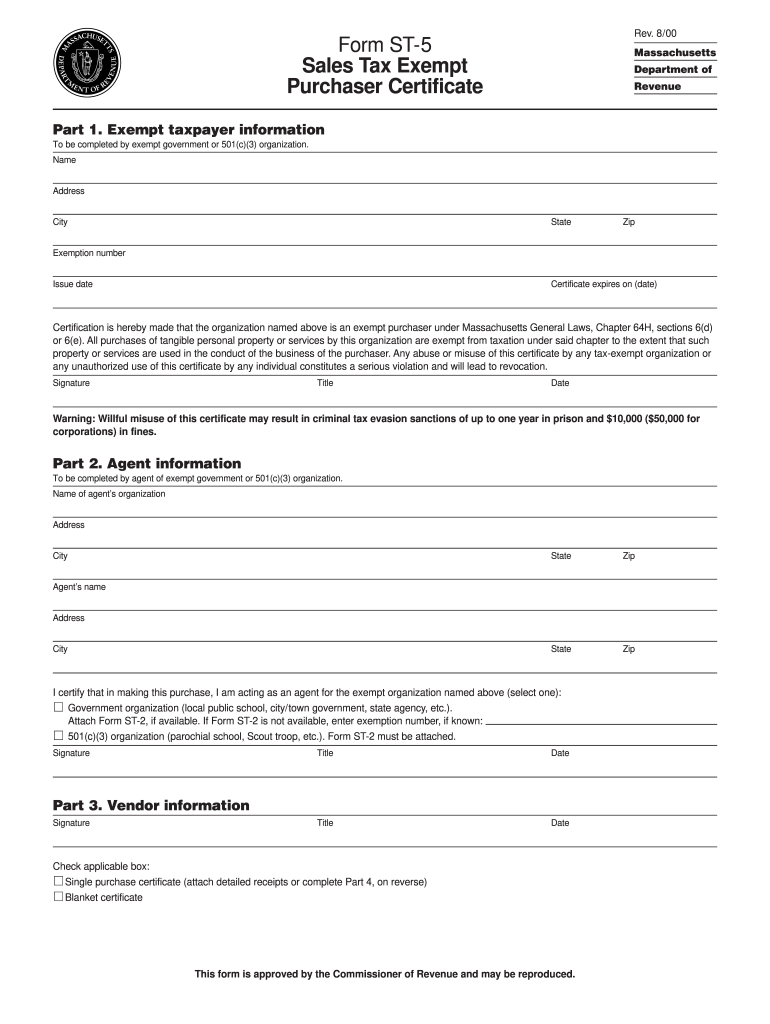

Massachusetts St 5 Fillable Form Fill Out and Sign Printable PDF

Dor, po box 7018, boston, ma 02204; You can download or print current or. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities. Web follow the simple instructions below: Sign it in a few clicks draw your signature, type.

New MA State Tax Deduction for 529 Contributions — Woodside Wealth

Dor, po box 7017, boston, ma 02204; Because of the observance of emancipation day in washington d.c. Web we last updated massachusetts form 2 in january 2023 from the massachusetts department of revenue. Web follow the simple instructions below: Fill out every fillable field.

Ma Form Fill Out and Sign Printable PDF Template signNow

It added income limits, price caps and. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Ensure the details you fill.

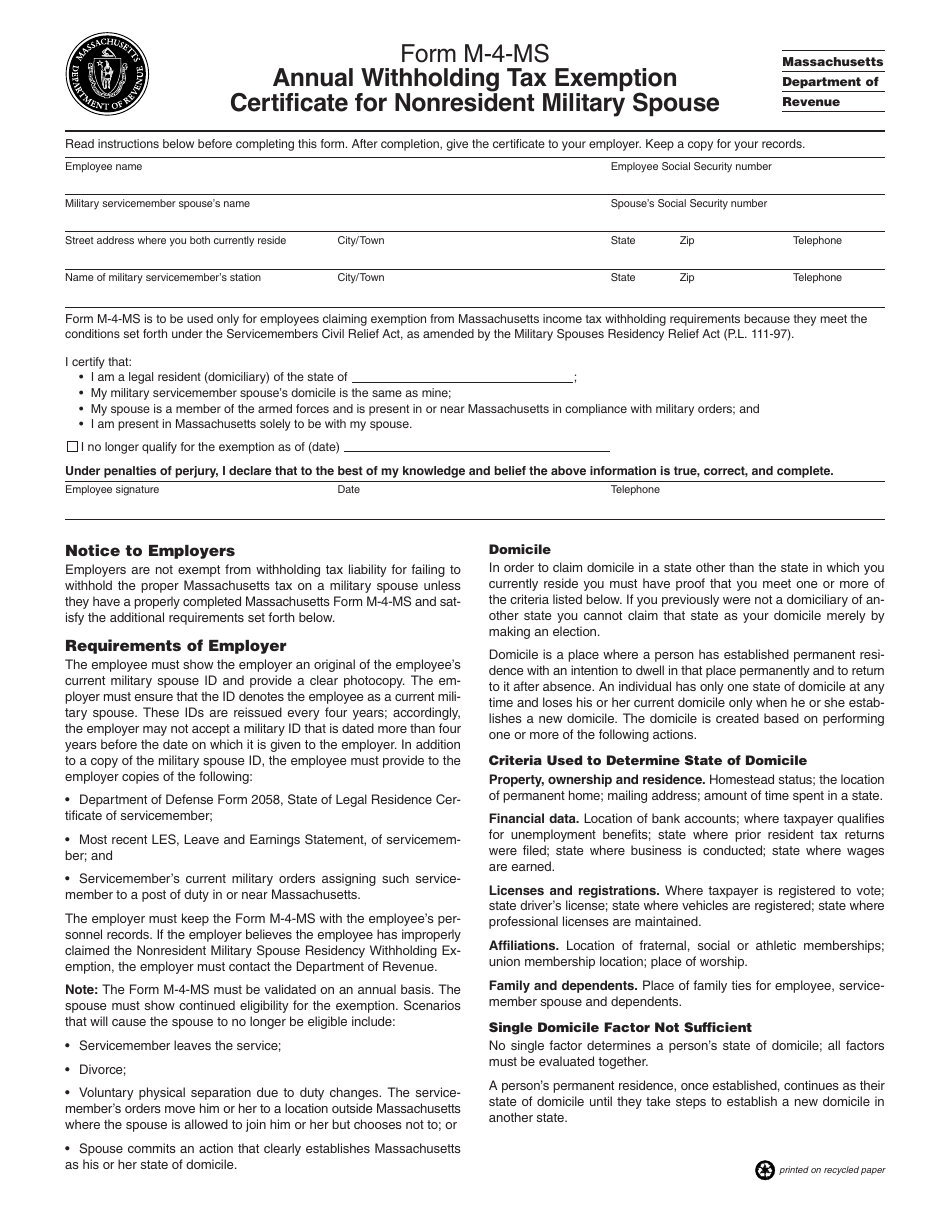

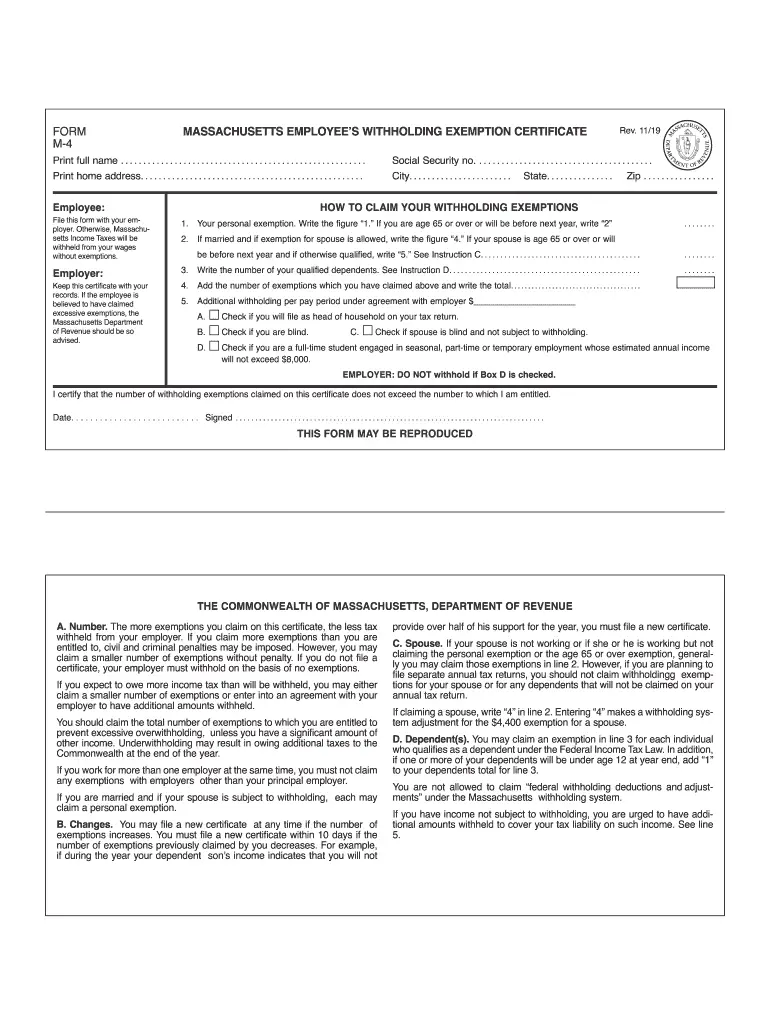

Form M4MS Download Printable PDF or Fill Online Annual Withholding

Ensure the details you fill in. Because of the observance of emancipation day in washington d.c. Web offered by massachusetts department of revenue massachusetts personal income tax forms and instructions dor has released its 2022 massachusetts. Who must file a return. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other legal entities.

Certificates of Business Swampscott MA

Web follow the simple instructions below: Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal. Because of the observance of emancipation day in washington d.c. Web to be filed by all individuals, partnerships, associations or trusts, corporations, limited liability companies and other.

How Much Are Payroll Taxes In Massachusetts

This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 2, fully updated for tax year 2022. Web the 2023 chevrolet bolt. It added income limits, price caps.

Fill Out Every Fillable Field.

This form is for income earned in tax year 2022, with tax. Activate the wizard mode in the top toolbar to have extra recommendations. It added income limits, price caps and. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 2, fully updated for tax year 2022.

Web Follow The Simple Instructions Below:

Web to get a paper copy of the state tax form 2/form of list, you need to show us that you have a hardship that prevents you from filing electronically. Because of the observance of emancipation day in washington d.c. Web file an extension for massachusetts personal income or fiduciary tax. Sign & fill out legal forms online on any device.

Who Must File A Return.

Web generally, the owner of taxable personal property situated in any community must file a return, known as the form of list or state tax form 2, with the local board of assessors. Web state tax form 2/form of list “tangible” — or physical — property that you can move easily is personal property. Edit your state tax form 2 online type text, add images, blackout confidential details, add comments, highlights and more. This form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability.

Sign It In A Few Clicks Draw Your Signature, Type.

However, with our preconfigured online templates, things get simpler. Amend a massachusetts individual or business tax return. All tangible personal property is assessed in the city or. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal.