Merchant Services Chargeback Response Form

Merchant Services Chargeback Response Form - What is a chargeback response? Web chargeback response template for product or services not as described chargeback. A chargeback response is called for when the details of a dispute don’t match transaction. Did not receive a product or service. Expect to respond within 10 to 30 days, but don’t delay. Do not recognize the charge or payee on their statement. This category of fraudulent chargebacks is represented with the following reason codes: This process is called representment, and it involves submitting several items, including a chargeback form template commonly referred to as a rebuttal. It is one component of a dispute response package, which also includes a completed chargeback adjustment reversal request form, along with compelling evidence to support your case. Web your customer may have filed a dispute because they:

Web when a credit card transaction is disputed by either your customer or by a customer’s credit card issuer, you may receive a chargeback. Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most draft retrievals will be for visa accounts, but our process is the same for retrieval stage on both mastercard and visa. Believe the product or service was defective, damaged or not as it was described. This process is called representment, and it involves submitting several items, including a chargeback form template commonly referred to as a rebuttal. Web the chargeback cycle generally takes place in four basic phases: Did not receive a product or service. It is one component of a dispute response package, which also includes a completed chargeback adjustment reversal request form, along with compelling evidence to support your case. Web chargeback response template for product or services not as described chargeback. This category of fraudulent chargebacks is represented with the following reason codes: If a chargeback occurs, the amount of the original sale will be deducted from the checking account on file with your merchant account.

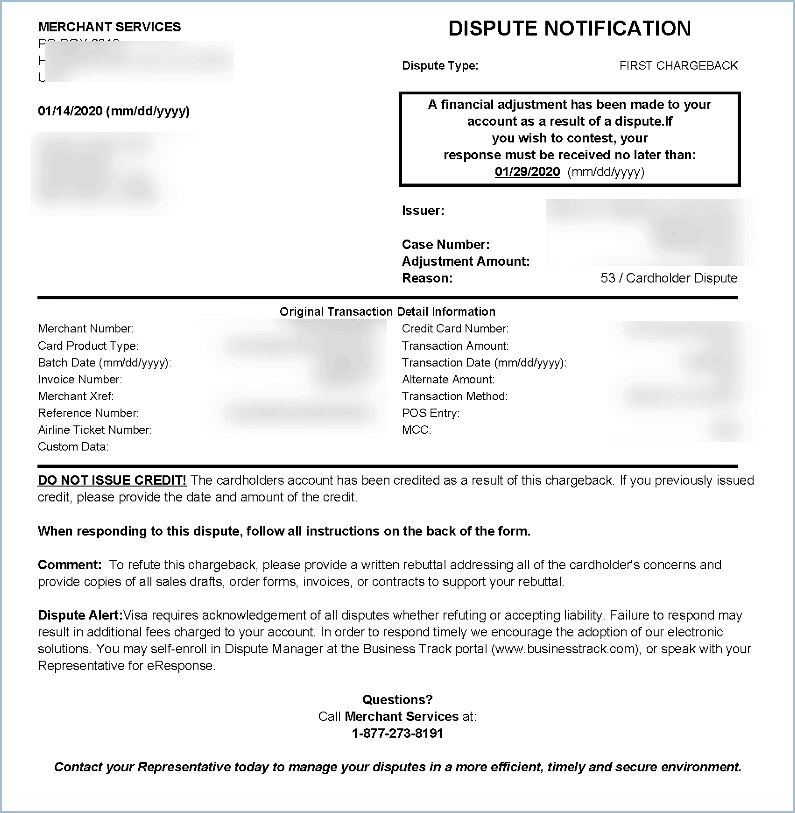

Expect to respond within 10 to 30 days, but don’t delay. The quicker you respond, the more time you allow for resolving questions. Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most draft retrievals will be for visa accounts, but our process is the same for retrieval stage on both mastercard and visa. Web your customer may have filed a dispute because they: Web your quick response is critical to winning chargeback challenges. Web the chargeback cycle generally takes place in four basic phases: A chargeback response is called for when the details of a dispute don’t match transaction. If a chargeback occurs, the amount of the original sale will be deducted from the checking account on file with your merchant account. Web if you decide to contest the adjustment, you will be required to provide all specified information requested on the dispute response form. Believe the product or service was defective, damaged or not as it was described.

Chargeback Rebuttal Letters Sample & Template Midigator

Web chargeback response template for product or services not as described chargeback. Web your customer may have filed a dispute because they: What is a chargeback response? Web chargeback form templates: This process is called representment, and it involves submitting several items, including a chargeback form template commonly referred to as a rebuttal.

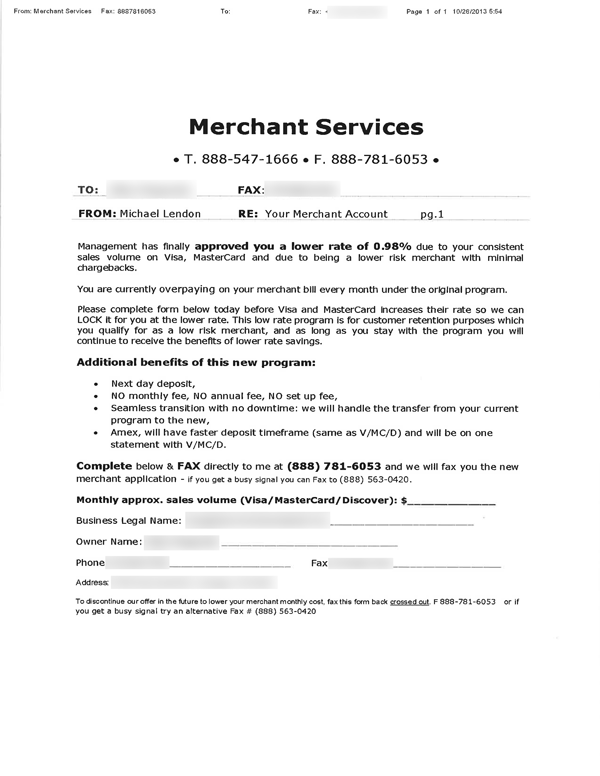

marketing fax scam The Merchant Account Blog

Did not receive a product or service. Timeframes for submitting documentation vary by payment brand. Building a better chargeback response as a merchant, you have the option to submit a response and try to recover your funds any time you receive a chargeback. Web the chargeback cycle generally takes place in four basic phases: Web if you decide to contest.

What To Do When Customers Force Refunds Through Their Banks in 2020

Do not recognize the charge or payee on their statement. Web your customer may have filed a dispute because they: Expect to respond within 10 to 30 days, but don’t delay. Web the chargeback cycle generally takes place in four basic phases: Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most.

How a Merchant Can Protect Themselves Against a Chargeback

Web if you decide to contest the adjustment, you will be required to provide all specified information requested on the dispute response form. This category of fraudulent chargebacks is represented with the following reason codes: It is one component of a dispute response package, which also includes a completed chargeback adjustment reversal request form, along with compelling evidence to support.

What To Do When Customers Force Refunds Through Their Banks in 2020

This category of fraudulent chargebacks is represented with the following reason codes: Expect to respond within 10 to 30 days, but don’t delay. What is a chargeback response? Web the chargeback cycle generally takes place in four basic phases: Web chargeback form templates:

Winning Chargebacks Unveiling the Process & Tips

Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most draft retrievals will be for visa accounts, but our process is the same for retrieval stage on both mastercard and visa. Web if you decide to contest the adjustment, you will be required to provide all specified information requested on the dispute.

Chargeback reduction plan for merchant

Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most draft retrievals will be for visa accounts, but our process is the same for retrieval stage on both mastercard and visa. Timeframes for submitting documentation vary by payment brand. This process is called representment, and it involves submitting several items, including a.

Merchant Chargebacks Chargeback Advocates

If a chargeback occurs, the amount of the original sale will be deducted from the checking account on file with your merchant account. Web the chargeback cycle generally takes place in four basic phases: Expect to respond within 10 to 30 days, but don’t delay. Web if you decide to contest the adjustment, you will be required to provide all.

Chargeback Form Sbi Fill Out and Sign Printable PDF Template signNow

It is one component of a dispute response package, which also includes a completed chargeback adjustment reversal request form, along with compelling evidence to support your case. Building a better chargeback response as a merchant, you have the option to submit a response and try to recover your funds any time you receive a chargeback. What is a chargeback response?.

Chargeback Reversal Agreement (Standard) Corporate credit card

Web your customer may have filed a dispute because they: If a chargeback occurs, the amount of the original sale will be deducted from the checking account on file with your merchant account. Web if you decide to contest the adjustment, you will be required to provide all specified information requested on the dispute response form. Web chargeback response template.

Web If You Decide To Contest The Adjustment, You Will Be Required To Provide All Specified Information Requested On The Dispute Response Form.

What is a chargeback response? A chargeback response is called for when the details of a dispute don’t match transaction. This process is called representment, and it involves submitting several items, including a chargeback form template commonly referred to as a rebuttal. Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) typically most draft retrievals will be for visa accounts, but our process is the same for retrieval stage on both mastercard and visa.

Believe The Product Or Service Was Defective, Damaged Or Not As It Was Described.

It is one component of a dispute response package, which also includes a completed chargeback adjustment reversal request form, along with compelling evidence to support your case. Web a chargeback response is the process through which a merchant attempts to fight and overturn a chargeback. The quicker you respond, the more time you allow for resolving questions. Web when a credit card transaction is disputed by either your customer or by a customer’s credit card issuer, you may receive a chargeback.

Do Not Recognize The Charge Or Payee On Their Statement.

If a chargeback occurs, the amount of the original sale will be deducted from the checking account on file with your merchant account. This category of fraudulent chargebacks is represented with the following reason codes: Did not receive a product or service. Web chargeback response template for product or services not as described chargeback.

Web Your Quick Response Is Critical To Winning Chargeback Challenges.

Building a better chargeback response as a merchant, you have the option to submit a response and try to recover your funds any time you receive a chargeback. Web the chargeback cycle generally takes place in four basic phases: Web chargeback form templates: Expect to respond within 10 to 30 days, but don’t delay.