Michigan Property Tax Exemption Form

Michigan Property Tax Exemption Form - Web there are multiple types of organizations that may qualify for a property tax exemption under michigan law. A completed michigan department of. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Form 632 (personal property tax statement) form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and. A completed and signed application for mcl 211.7u poverty. Notice of denial of principal residence exemption (local (city/township)) 2753. File this application with copies of documents listed on page two (2) of this form. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web application for exemption from property taxes instructions: Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills.

File this application with copies of documents listed on page two (2) of this form. Please see the city’s exemption application for a list of the most. Web to be considered for an exemption, the applicant is required to submit the following to the board of review: Web by paul arnold may 31, 2022. Property must be owned and used for. Batch cover sheet for principal. Web application for exemption from property taxes instructions: Web application for exemption from property taxes instructions: Web what are property tax exemptions? Notice of denial of principal residence exemption (local (city/township)) 2753.

You can fill out the form on. Other property tax exemptions in michigan Batch cover sheet for principal. Web the principal residence exemption (pre) affidavit, form 2368, and other principal residence exemption forms should be available from your local assessor or at. Prope1iy must be owned and used for. Web to be considered for an exemption, the applicant is required to submit the following to the board of review: Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web to apply, you need to fill out the michigan property tax poverty exemption form. A completed michigan department of. Web application for exemption from property taxes instructions:

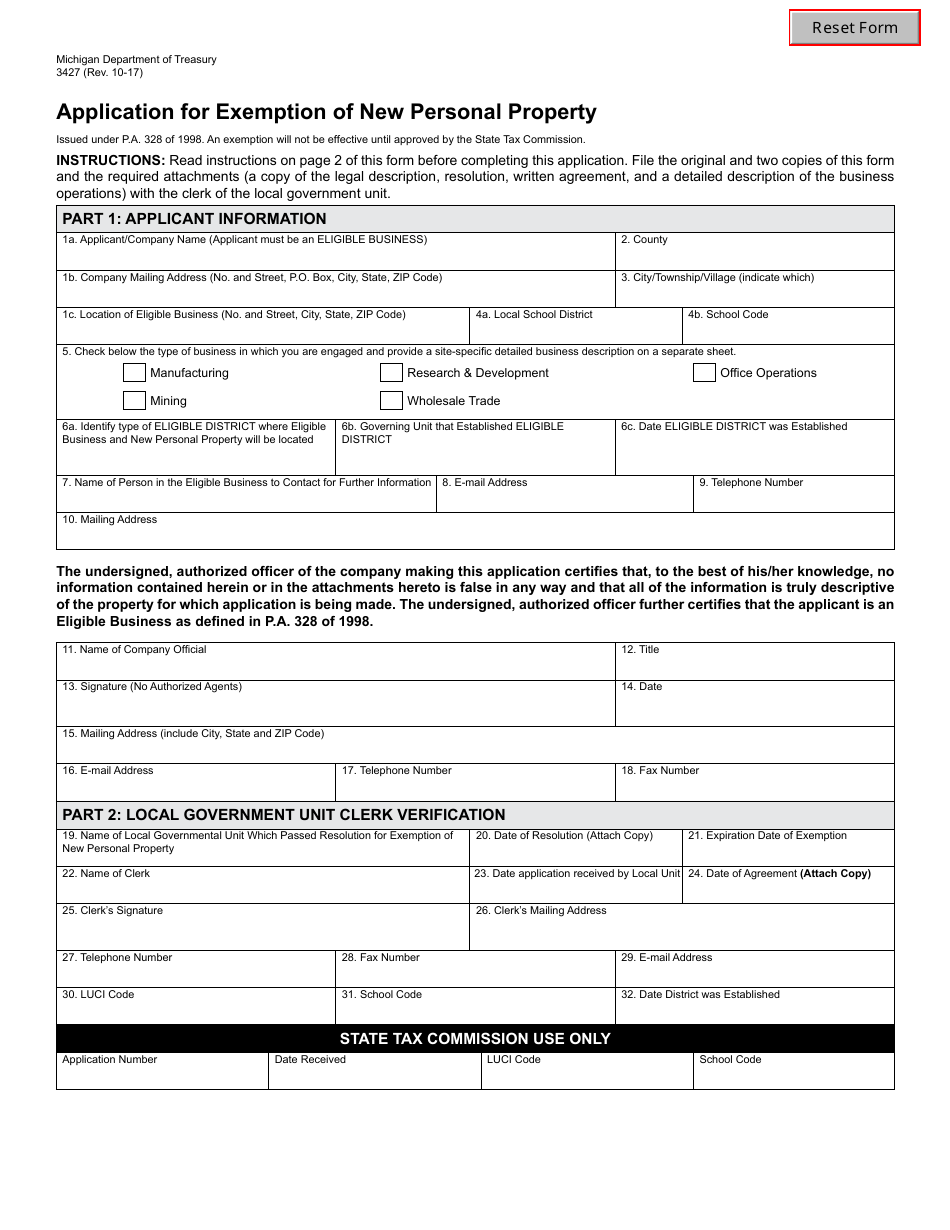

Form 3427 Download Fillable PDF or Fill Online Application for

Web by paul arnold may 31, 2022. Property must be owned and used for. File this application with copies of documents listed on page two (2) of this form. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Web michigan department of.

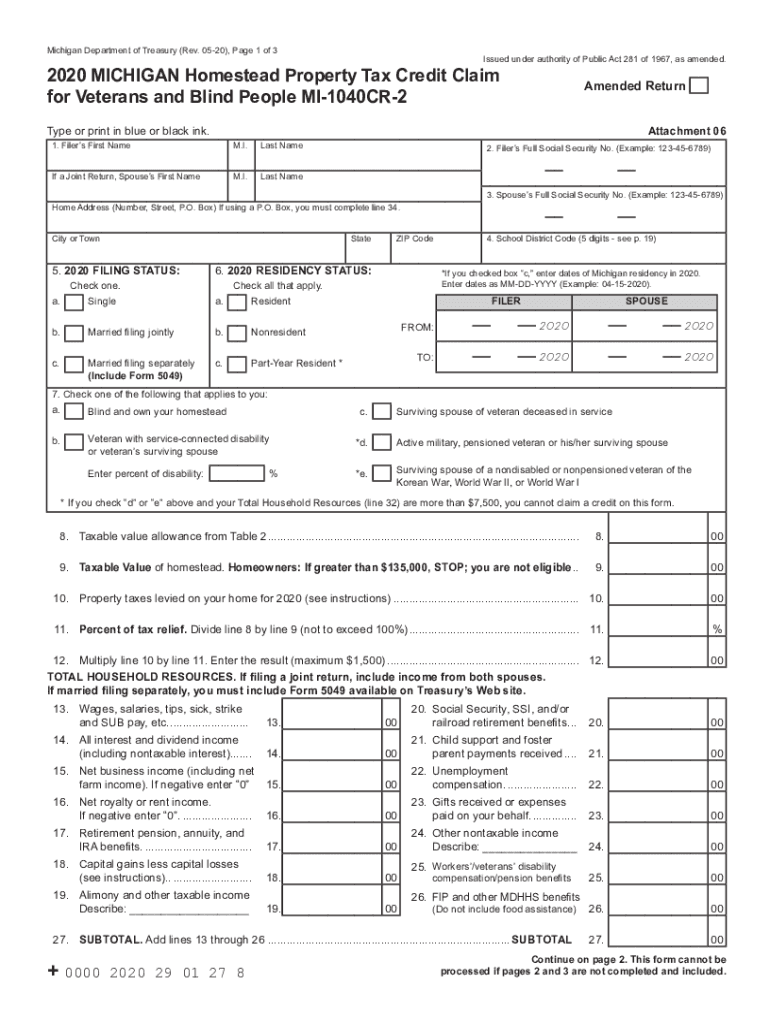

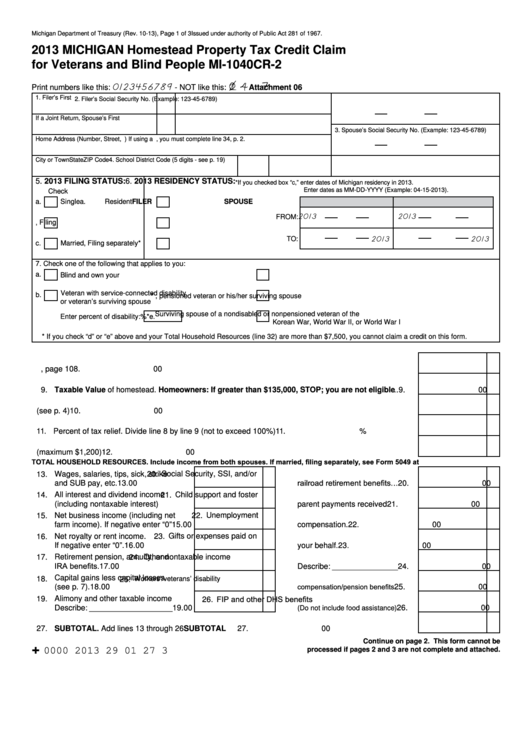

MI DoT MI1040CR2 20202021 Fill out Tax Template Online US Legal

Please see the city’s exemption application for a list of the most. Property must be owned and used for. Web to apply, you need to fill out the michigan property tax poverty exemption form. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and.

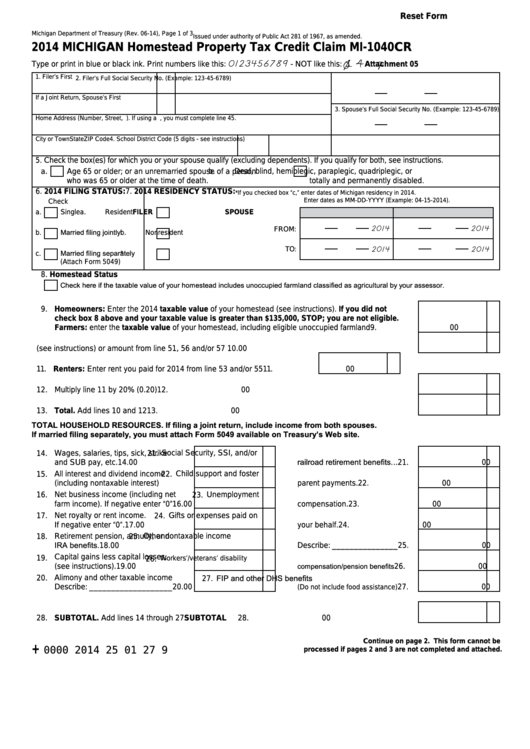

Fillable Form Mi1040cr Michigan Homestead Property Tax Credit Claim

Pursuant to mcl 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to. Web application for exemption from property taxes instructions: File this application with copies of documents listed on page two (2) of this form. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household.

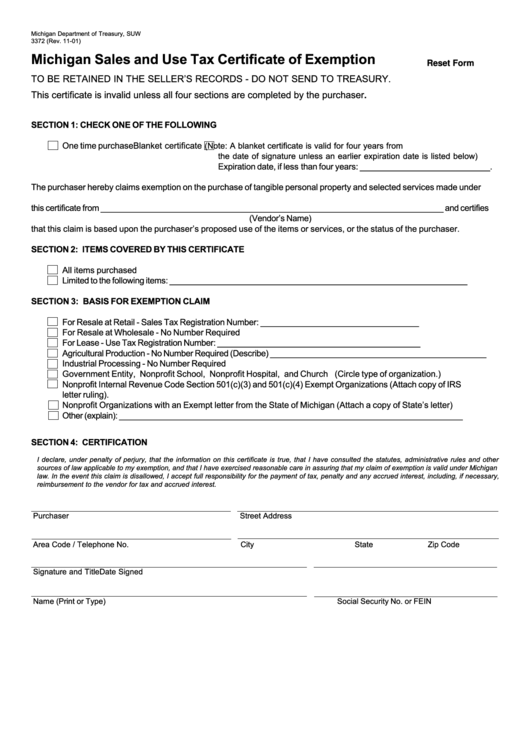

michigan sales tax exemption number Jodie Mccord

Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Web request to rescind principal residence exemption. File this application with copies of documents listed on page two (2) of this form. Prope1iy must be owned and used for. Web there are multiple.

Property Tax Exemption For Seniors In Michigan PRORFETY

File this application with copies of documents listed on page two (2) of this form. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills..

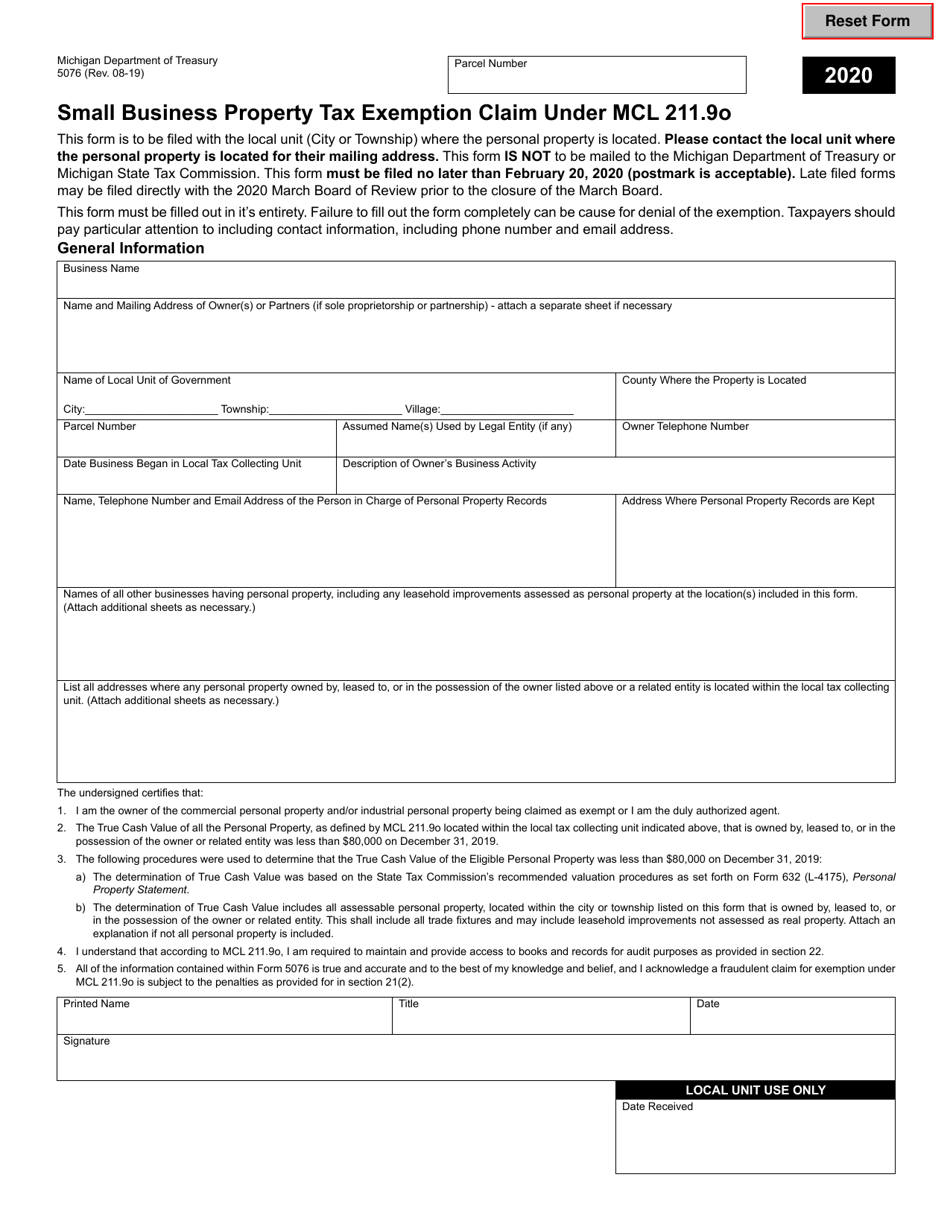

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Web to apply, you need to fill out the michigan property tax poverty exemption form. File this application with copies of documents listed on page two (2) of this form. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web the charitable nonprofit.

How to get a Certificate of Exemption in Michigan

Web to be considered for an exemption, the applicant is required to submit the following to the board of review: Notice of denial of principal residence exemption (local (city/township)) 2753. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web application for exemption.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Web to be considered for an exemption, the applicant is required to submit the following to the board of review: Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web property tax exemptions poverty exemption mcl 211.7u provides for a property tax exemption,.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web application for exemption from property taxes instructions: File this application with copies of documents listed on page two (2) of this form. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Web michigan department of treasury 5076 (rev. Web by paul.

Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit

Web there are multiple types of organizations that may qualify for a property tax exemption under michigan law. Web to apply, you need to fill out the michigan property tax poverty exemption form. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web.

File This Application With Copies Of Documents Listed On Page Two (2) Of This Form.

Web what are property tax exemptions? Property must be owned and used for. Please see the city’s exemption application for a list of the most. File this application with copies of documents listed on page two (2) of this form.

A Completed And Signed Application For Mcl 211.7U Poverty.

Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills. Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web by paul arnold may 31, 2022.

Web Application For Exemption From Property Taxes Instructions:

Other property tax exemptions in michigan Form 632 (personal property tax statement) form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and. Notice of denial of principal residence exemption (local (city/township)) 2753. Batch cover sheet for principal.

Web Request To Rescind Principal Residence Exemption.

Web to be considered for an exemption on your property taxes, the applicant is required to submit the following to the board of review: Pursuant to mcl 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to. A completed michigan department of. Ad download or email form 2022 & more fillable forms, register and subscribe now!