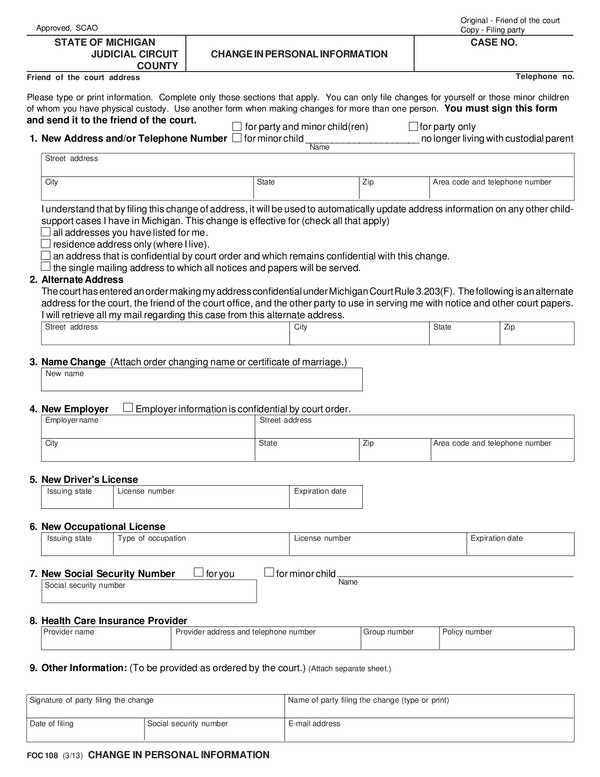

Michigan Withholding Form

Michigan Withholding Form - Web instructions included on form: If you fail or refuse to submit. Keep a copy of this form for your. Web to send an income withholding notice directly to a supp payer’orts michigan employer. If you fail or refuse to submit. After receiving the order, the employer must: Use the applicable monthly withholding table from either the pension. Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year. Web 2020 sales, use and withholding taxes annual return: A) treat a notice that appears proper as if it.

Mto is free and provides secure 24/7 online access. 2020 sales, use and withholding. A) treat a notice that appears proper as if it. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. After receiving the order, the employer must: 2020 sales, use and withholding taxes amended annual return: Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. • if the tax is more than $5,400 and paid by the 20th,. Web 2021 sales, use and withholding taxes annual return: 2021 sales, use and withholding taxes amended annual return:

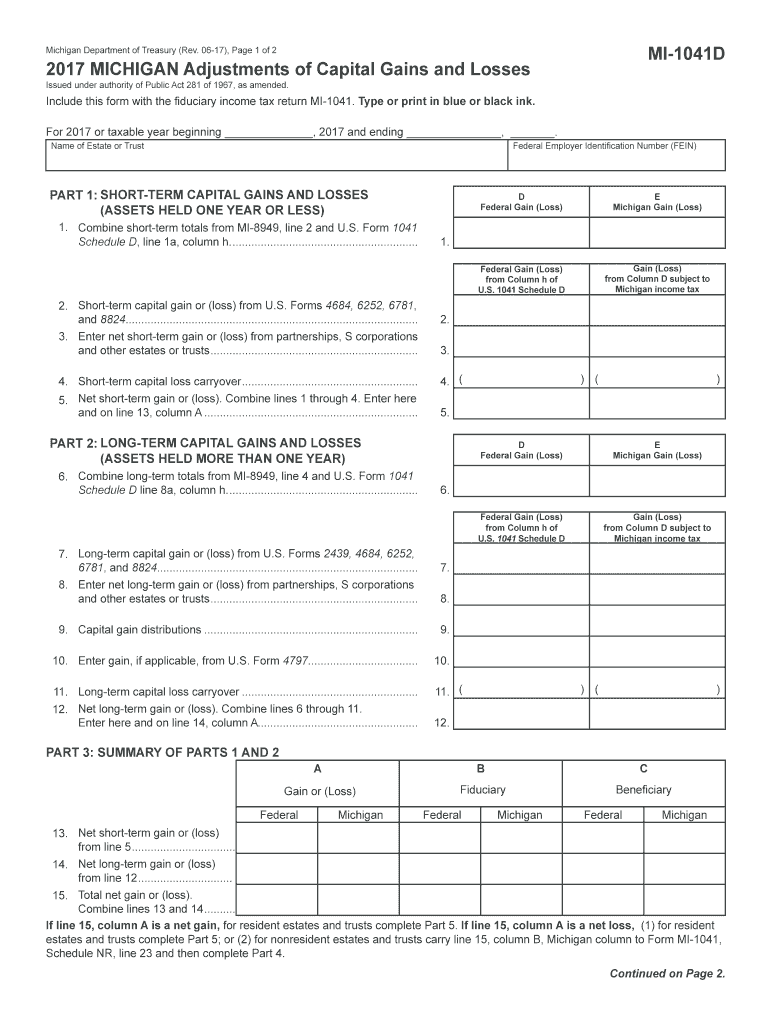

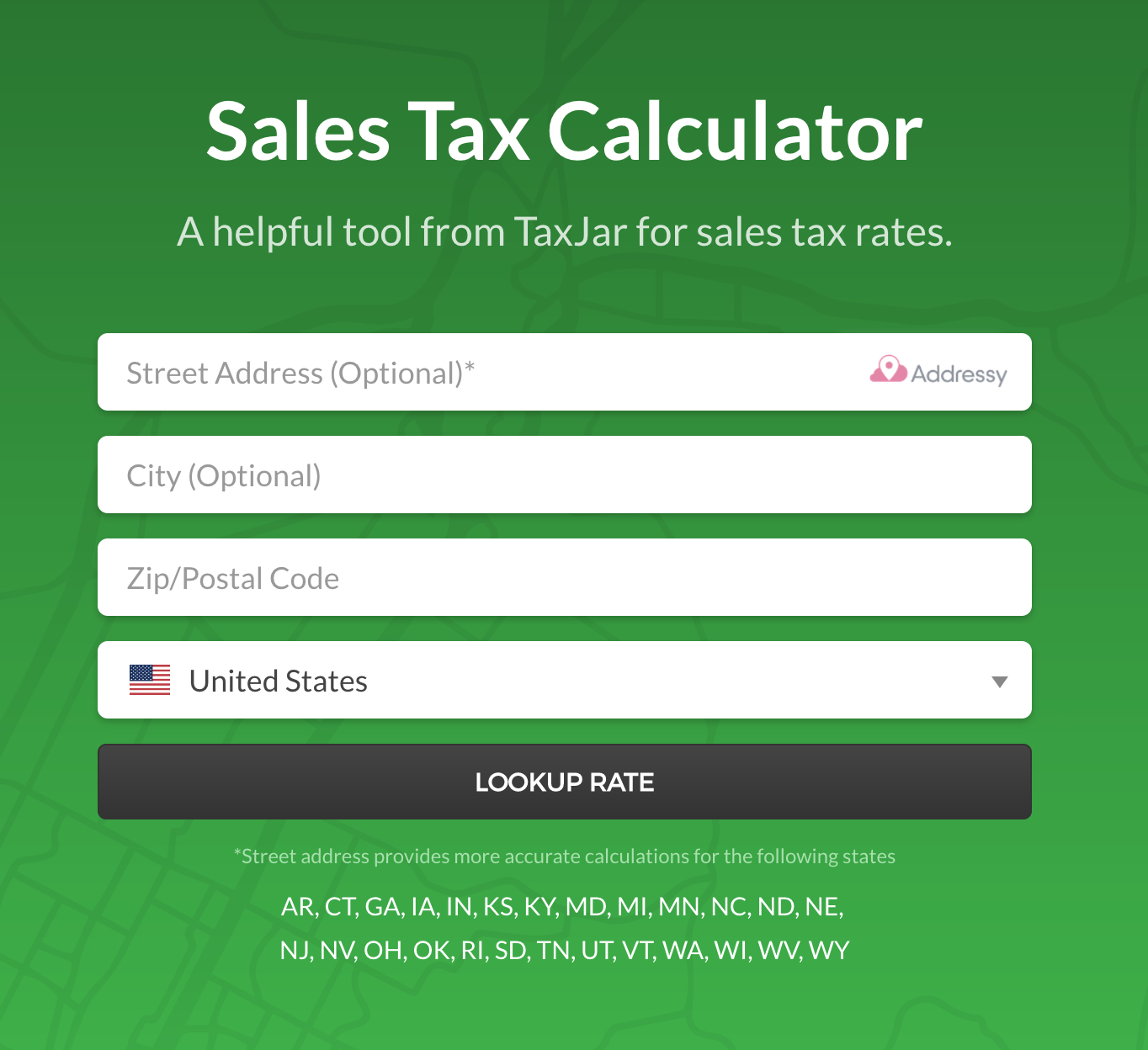

Sales and other dispositions of capital assets: Web michigan department of treasury 4924 (rev. Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Mto is free and provides secure 24/7 online access. Use the applicable monthly withholding table from either the pension. The biden administration is blocking funding for elementary and secondary schools with hunting or archery programs under its interpretation of a recent. Web instructions included on form: Web mto is the michigan department of treasury's web portal to many business taxes. 2021 sales, use and withholding taxes amended annual return:

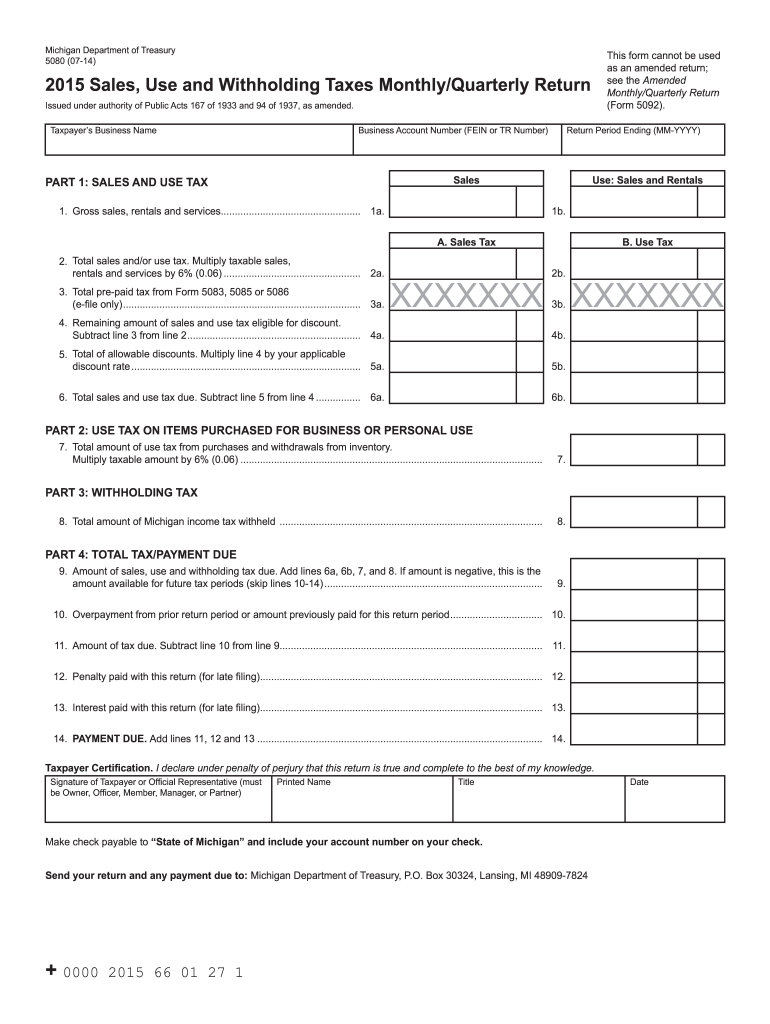

Michigan Sales Use And Withholding Tax Form 5081

If you fail or refuse to submit. 2020 sales, use and withholding. Web mto is the michigan department of treasury's web portal to many business taxes. Sales and other dispositions of capital assets: Change or discontinuance (form 163).

2022 Michigan Withholding Tax Form

Sales and other dispositions of capital assets: 2021 sales, use and withholding taxes amended annual return: Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year. 2020 sales, use and withholding taxes amended annual return: Change or discontinuance (form 163).

Michigan Tax Withholding Form 2021 2022 W4 Form

Web 2021 sales, use and withholding taxes annual return: 2020 sales, use and withholding. 2021 sales, use and withholding. Web michigan department of treasury 4924 (rev. 2020 sales, use and withholding taxes amended annual return:

Michigan Employee Withholding Form 2022 2023

Web 2021 sales, use and withholding taxes annual return: 2020 sales, use and withholding taxes amended annual return: Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. 2021 sales, use and withholding taxes amended annual return: A) treat a notice that appears proper as.

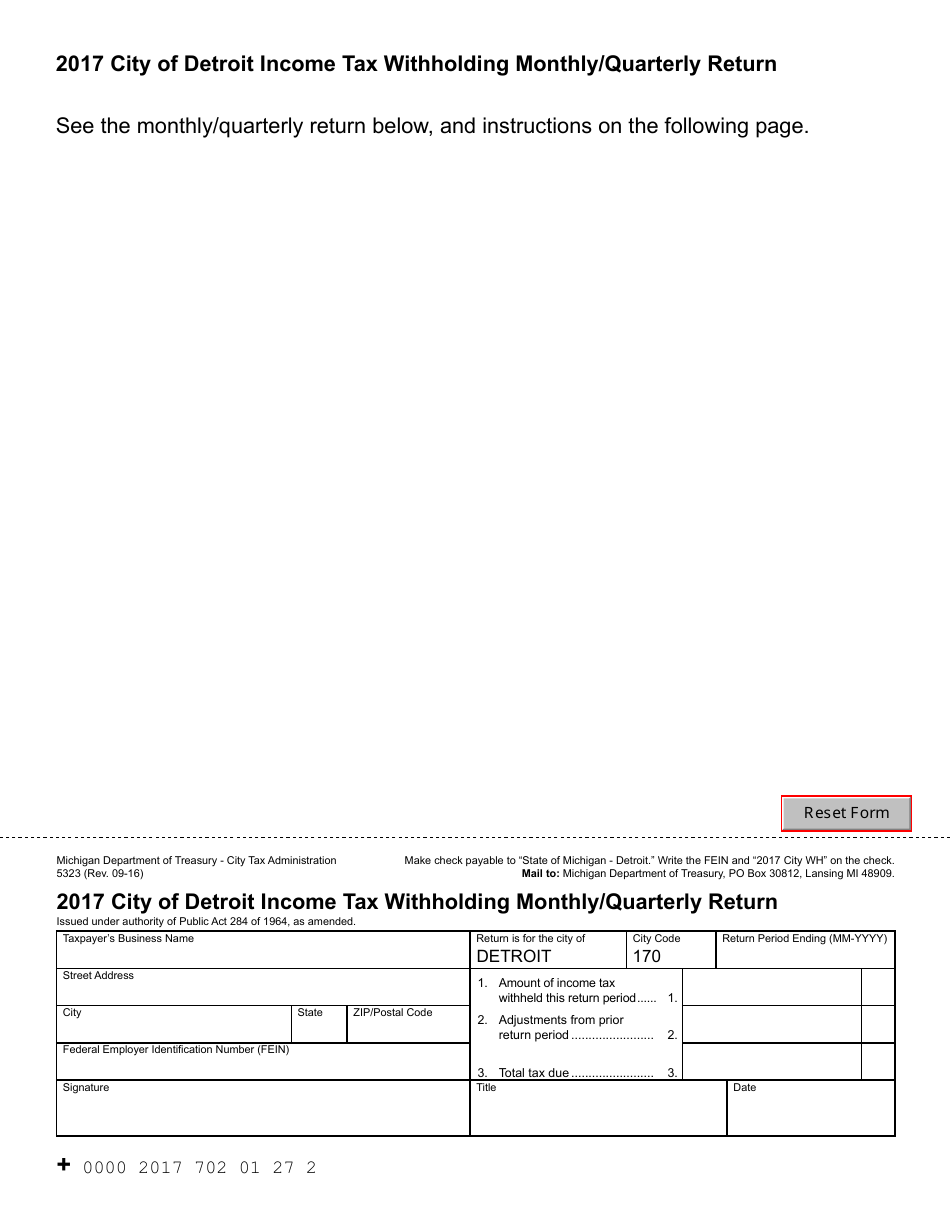

Form 5323 Download Fillable PDF or Fill Online City of Detroit

Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. Mto is free and provides secure 24/7 online access. If you fail or refuse to submit. • if the tax is more than $5,400 and paid by the 20th,. A) treat a notice that appears proper as if it.

2022 Michigan Michigan Withholding Tax Form

A) treat a notice that appears proper as if it. 2020 sales, use and withholding. Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. Web to send an income withholding notice directly to a supp payer’orts michigan employer. Web michigan income tax withholding tables weekly payroll period effective january 1,.

by Carrollton Public

Sales and other dispositions of capital assets: If you fail or refuse to submit. Mto is free and provides secure 24/7 online access. The biden administration is blocking funding for elementary and secondary schools with hunting or archery programs under its interpretation of a recent. Web if you fail or refuse to file this form, your employer must withhold michigan.

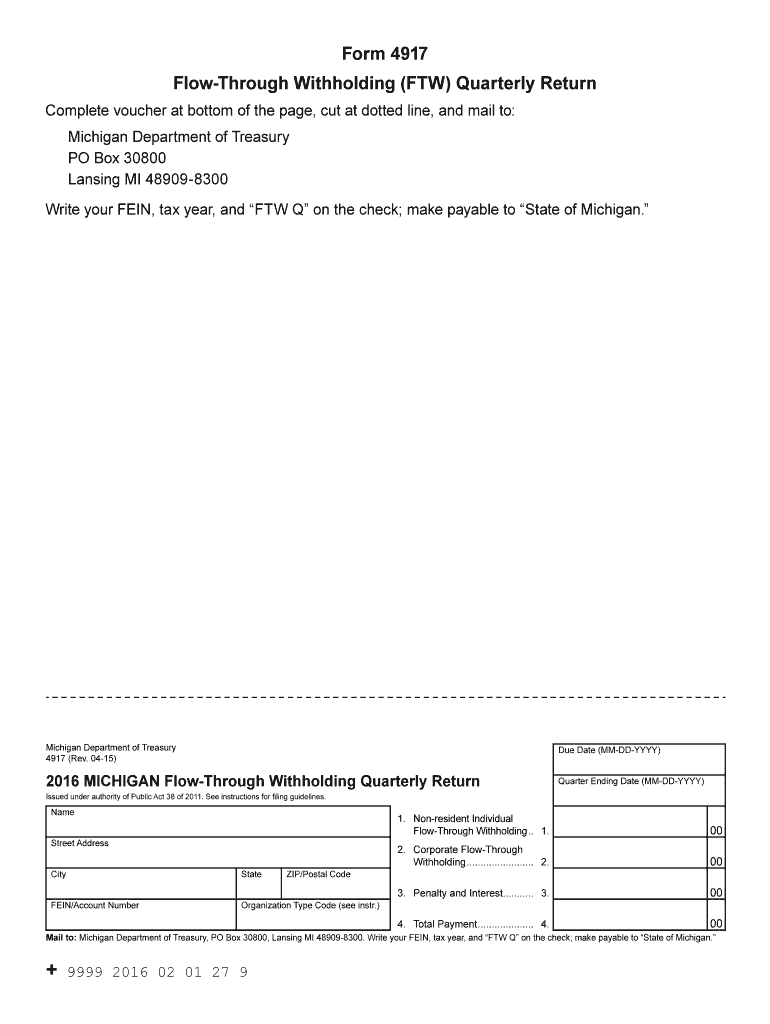

20162021 Form MI DoT 4917 Fill Online, Printable, Fillable, Blank

2020 sales, use and withholding taxes amended annual return: If you fail or refuse to submit. Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year. Treasury is committed to protecting sensitive taxpayer information while providing. Change or discontinuance (form 163).

State Of Michigan Withholding And Sales Tax Payment Forms 2022

Change or discontinuance (form 163). 2021 sales, use and withholding. If you fail or refuse to submit. Web to send an income withholding notice directly to a supp payer’orts michigan employer. Sales and other dispositions of capital assets:

Michigan Sales Tax And Withholding Form 2022

A) treat a notice that appears proper as if it. 2021 sales, use and withholding. Web michigan department of treasury 4924 (rev. Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. 2021 sales, use and withholding taxes amended annual return:

After Receiving The Order, The Employer Must:

• if the tax is more than $5,400 and paid by the 20th,. Web 2020 sales, use and withholding taxes annual return: 2020 sales, use and withholding taxes amended annual return: A) treat a notice that appears proper as if it.

2021 Sales, Use And Withholding Taxes Amended Annual Return:

2021 sales, use and withholding. Web 2021 sales, use and withholding taxes annual return: Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. If you fail or refuse to submit.

Use The Applicable Monthly Withholding Table From Either The Pension.

Keep a copy of this form for your. Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. If you fail or refuse to submit. Mto is free and provides secure 24/7 online access.

Web Michigan Income Tax Withholding Tables Weekly Payroll Period Effective January 1, 2022 4.25% Of Gross Pay Should Be Withheld If No Exemptions Are Claimed.

2020 sales, use and withholding. The biden administration is blocking funding for elementary and secondary schools with hunting or archery programs under its interpretation of a recent. Web michigan department of treasury 4924 (rev. Web to send an income withholding notice directly to a supp payer’orts michigan employer.