Missouri Gas Tax Refund Form 4923-H

Missouri Gas Tax Refund Form 4923-H - 30, 2022, on purchases made after oct. If you are hoping to cash in on. Refund claims must be postmarked on or after july 1,. Web refund claims can be submitted from july 1, 2022, to sept. R yes r no (if yes, attach a copy of your sales or use tax exemption letter or complete a sales or use tax exemption certificate (form. You must register for a motor fuel. In the form drivers need to include the. Web how to get the refund. You must use the form 4923s with the tax rate that corresponds with the purchase. “does missouri have a highway gasoline tax refund for the.

If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Web are you exempt from missouri sales tax? A refund of the increased motor fuel tax is limited to the tax paid on motor fuel used in motor vehicles as defined in section 301.010, rsmo, with a gross. Web gather up those gas receipts! 26, 2022 at 2:44 am pdt springfield, mo. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. 30, 2022, on purchases made after oct. Highway use motor fuel refund claim for rate increases:. Web refund claims can be submitted from july 1, 2022, to sept. 1, 2021, the date missouri most recently increased its gas.

A refund of the increased motor fuel tax is limited to the tax paid on motor fuel used in motor vehicles as defined in section 301.010, rsmo, with a gross. In the form drivers need to include the. Web which the refund is claimed. Web refund claims can be submitted from july 1, 2022, to sept. “does missouri have a highway gasoline tax refund for the. 30, 2022, on purchases made after oct. R yes r no (if yes, attach a copy of your sales or use tax exemption letter or complete a sales or use tax exemption certificate (form. 1, 2021, the date missouri most recently increased its gas. If you are hoping to cash in on. Refund claims must be postmarked on or after july 1,.

commonseddesign Missouri Gas Tax Proposition

26, 2022 at 2:44 am pdt springfield, mo. Highway use motor fuel refund claim for rate increases:. Web how to get the refund. In the form drivers need to include the. 1, 2021, the date missouri most recently increased its gas.

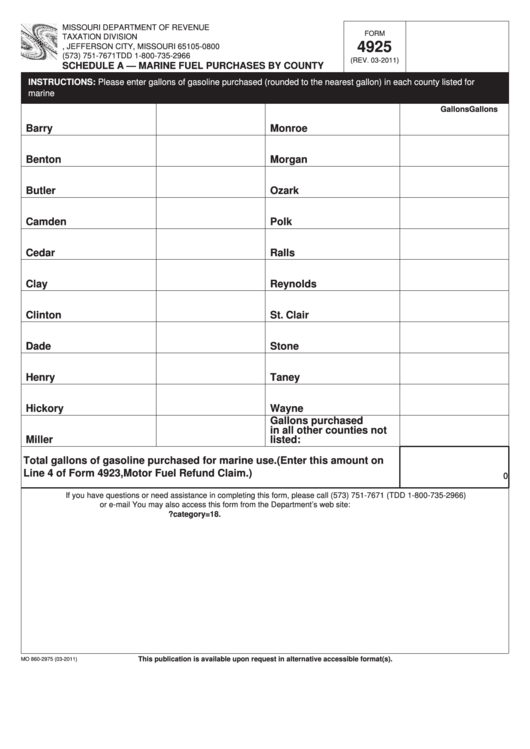

Fillable Form 4925 Schedule A Marine Fuel Purchases By County

“does missouri have a highway gasoline tax refund for the. 30, 2022, on purchases made after oct. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. R yes r no (if yes, attach a copy of your sales or use tax.

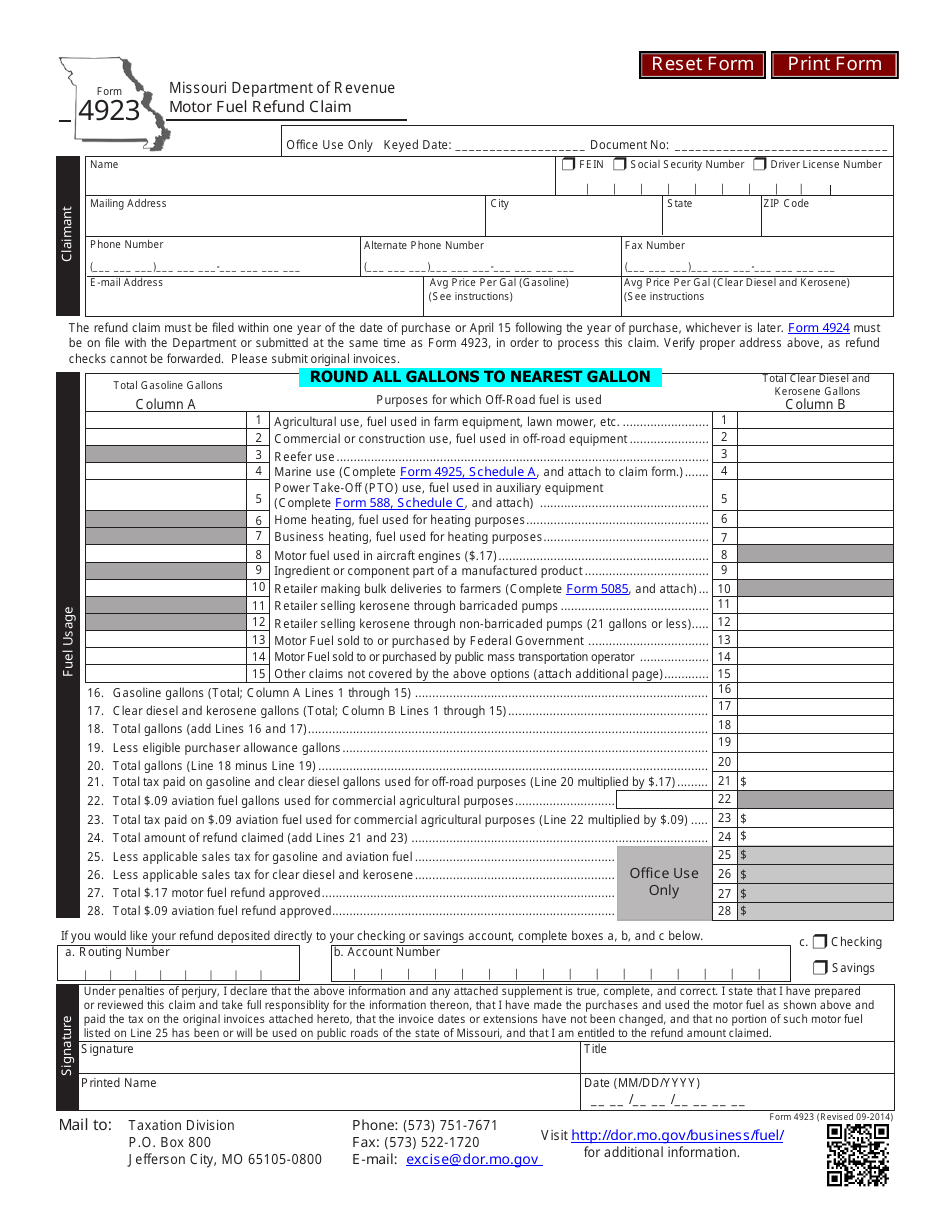

Here's how to get a refund for Missouri's gas tax increase Howell

The form is available at this link. In the form drivers need to include the. A refund of the increased motor fuel tax is limited to the tax paid on motor fuel used in motor vehicles as defined in section 301.010, rsmo, with a gross. You must use the form 4923s with the tax rate that corresponds with the purchase..

Military Journal Missouri 500 Tax Refund If the total amount of

You must provide a separate worksheet detailing the. In the form drivers need to include the. Web refund claims can be submitted from july 1, 2022, to sept. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. You must use the form 4923s.

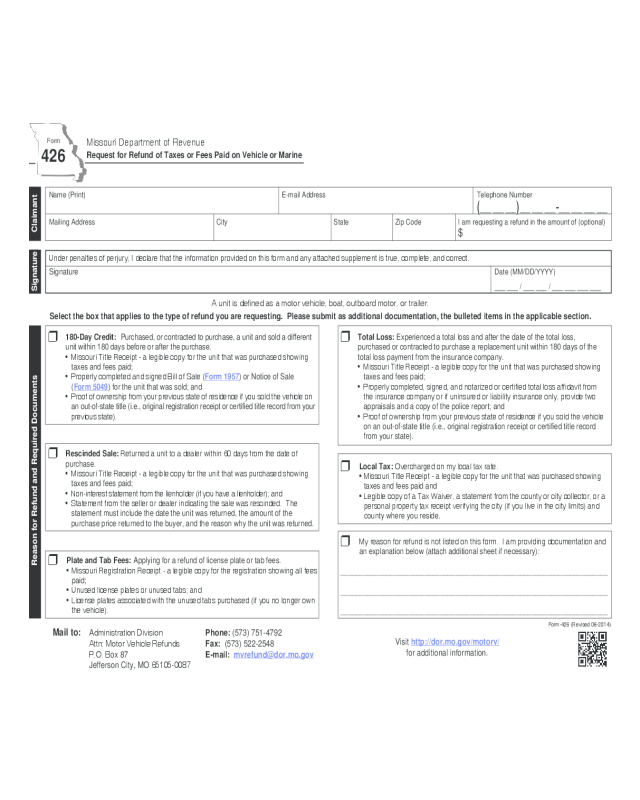

2022 Vehicle Tax Refund Form Fillable, Printable PDF & Forms Handypdf

Web by kaitlyn schumacher published: A refund of the increased motor fuel tax is limited to the tax paid on motor fuel used in motor vehicles as defined in section 301.010, rsmo, with a gross. Highway use motor fuel refund claim for rate increases:. You must register for a motor fuel. Web this form is used to claim a refund.

missouri gas tax refund Christel Engel

26, 2022 at 2:44 am pdt springfield, mo. R yes r no (if yes, attach a copy of your sales or use tax exemption letter or complete a sales or use tax exemption certificate (form. Web register to file a motor fuel consumer refund highway use claim select this option to register for a motor fuel consumer refund account. Web.

missouri gas tax refund spreadsheet Unperformed LogBook Diaporama

If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Web are you exempt from missouri sales tax? Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. In the form drivers.

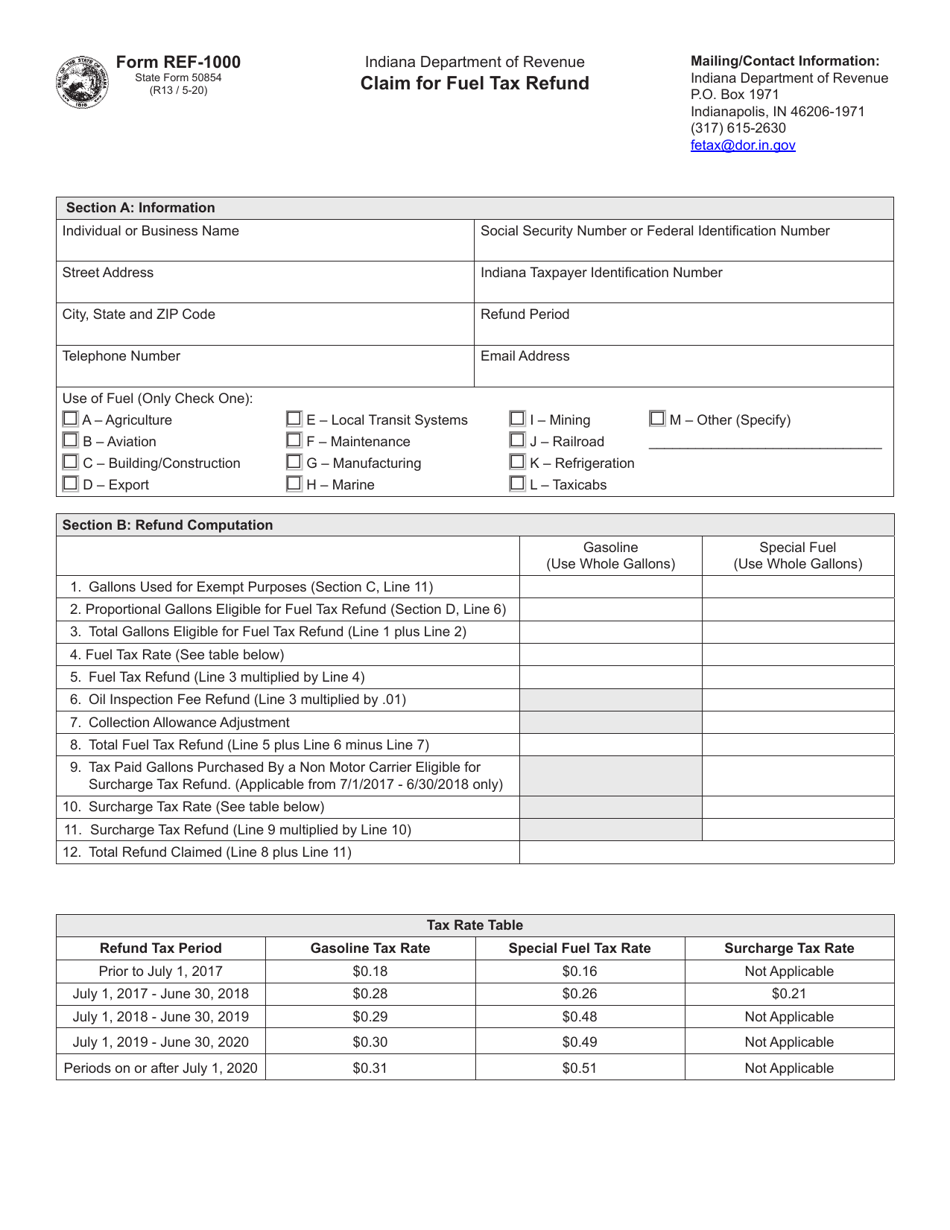

Form REF1000 (State Form 50854) Download Fillable PDF or Fill Online

In the form drivers need to include the. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. 1, 2021, the date missouri most recently increased its gas. 26, 2022 at 2:44 am pdt springfield, mo. “does missouri have a highway gasoline tax refund.

How to file for the Missouri gas tax refund

30, 2022, on purchases made after oct. In the form drivers need to include the. R yes r no (if yes, attach a copy of your sales or use tax exemption letter or complete a sales or use tax exemption certificate (form. Web how to get the refund. Web which the refund is claimed.

missouri gas tax refund spreadsheet Unperformed LogBook Diaporama

Highway use motor fuel refund claim for rate increases:. Web by kaitlyn schumacher published: If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Refund claims must be postmarked on or after july 1,. In the form drivers need to include the.

Web How To Get The Refund.

Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web gather up those gas receipts! Web are you exempt from missouri sales tax? 1, 2021, the date missouri most recently increased its gas.

Web Missouri Officials Said In April They Would Be Releasing A Form For Gas Tax Refunds In May, And It Was Released On May 31.

You must use the form 4923s with the tax rate that corresponds with the purchase. Highway use motor fuel refund claim for rate increases:. You must provide a separate worksheet detailing the. Refund claims must be postmarked on or after july 1,.

The Form Is Available At This Link.

You must register for a motor fuel. Web by kaitlyn schumacher published: “does missouri have a highway gasoline tax refund for the. 26, 2022 at 2:44 am pdt springfield, mo.

In The Form Drivers Need To Include The.

30, 2022, on purchases made after oct. A refund of the increased motor fuel tax is limited to the tax paid on motor fuel used in motor vehicles as defined in section 301.010, rsmo, with a gross. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Web refund claims can be submitted from july 1, 2022, to sept.