Nebraska Form Ptc

Nebraska Form Ptc - Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web an individual or entity may claim the credit by filing the appropriate nebraska tax return together with a nebraska property tax credit, form ptc (form ptc). This act allows a refundable credit to. For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web form ptc, property tax incentive act credit, is available on turbotax. Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web complete and submit a nebraska property tax credit, form ptc.

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web an individual or entity may claim the credit by filing the appropriate nebraska tax return together with a nebraska property tax credit, form ptc (form ptc). This act allows a refundable credit to. Mail the 2021 form ptcx to: Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web complete and submit a nebraska property tax credit, form ptc. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: For taxable years beginning on or after january 1, 2020, a property tax incentive act credit.

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web complete and submit a nebraska property tax credit, form ptc. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web form ptc, property tax incentive act credit, is available on turbotax. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Web an individual or entity may claim the credit by filing the appropriate nebraska tax return together with a nebraska property tax credit, form ptc (form ptc). For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Mail the 2021 form ptcx to: Web form ptcx must be filed within three years from the date your original 2021 1040n was filed.

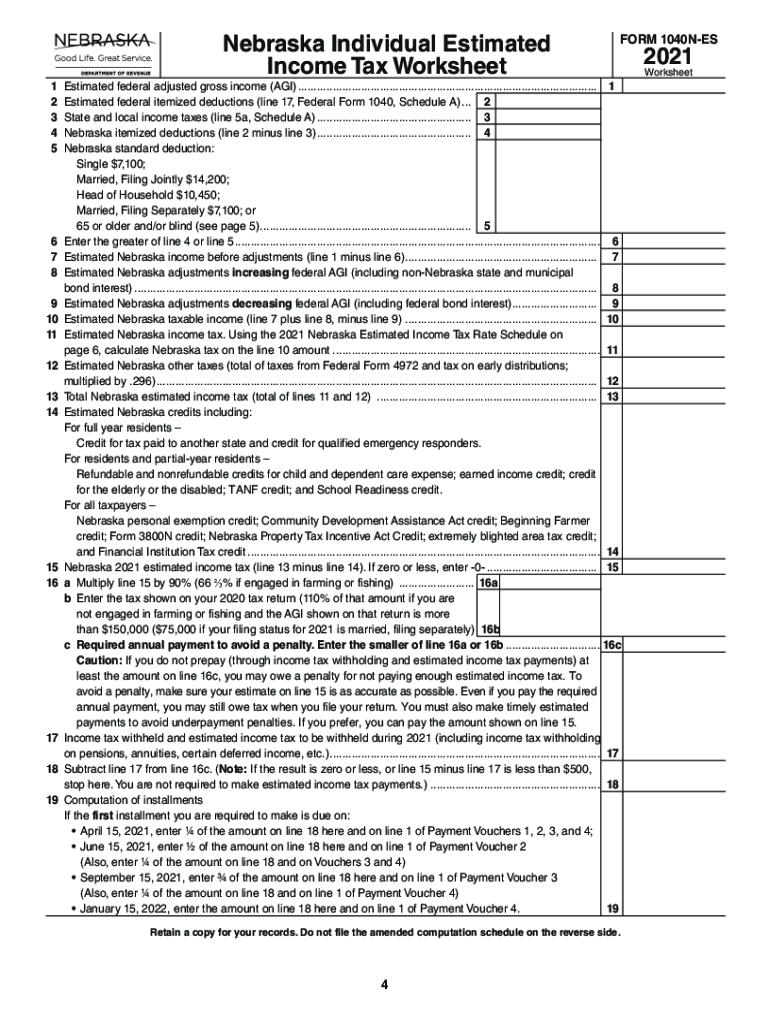

2021 Nebraska Tax Fill Out and Sign Printable PDF Template signNow

Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Mail the 2021 form ptcx to: Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web taxpayers who pay property taxes.

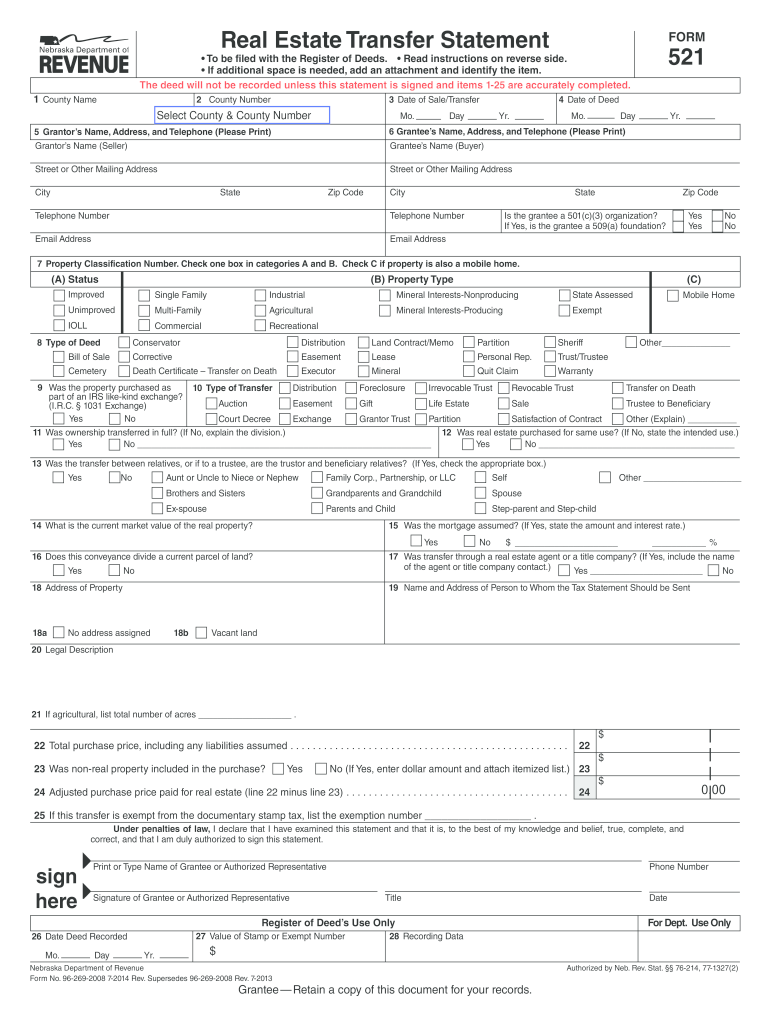

Nebraska Form 521 Fill Out and Sign Printable PDF Template signNow

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web form ptc, property tax incentive act credit, is available on turbotax. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Web the.

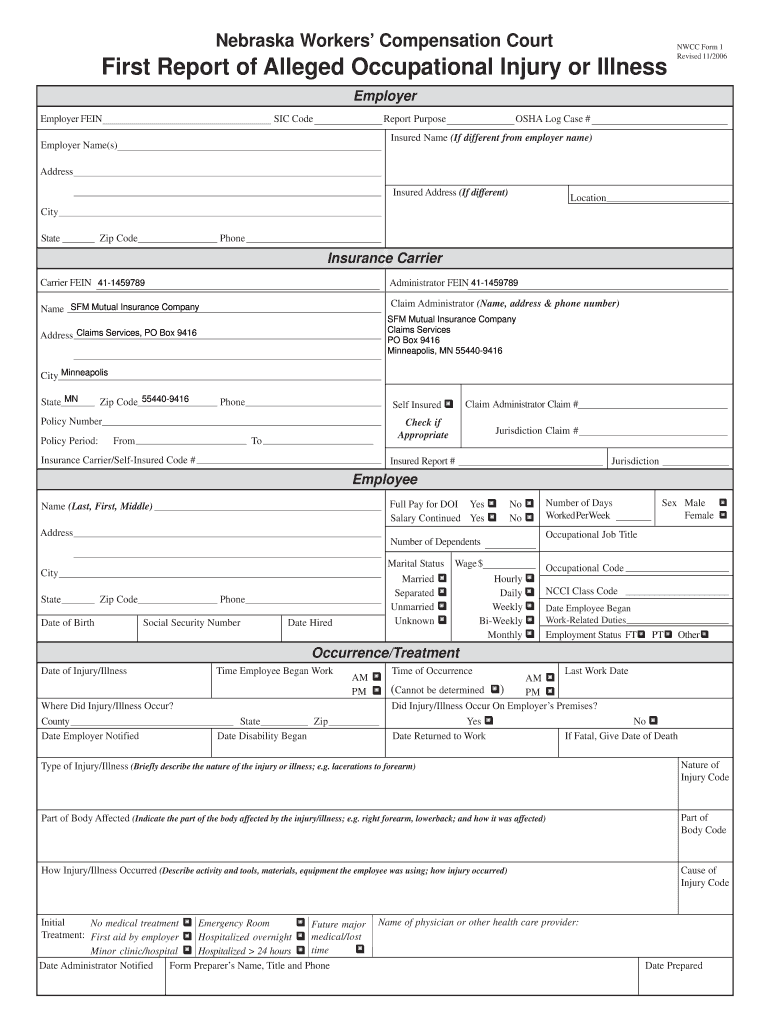

Nebraska First Report of Injury Fill in Form Fill Out and Sign

This act allows a refundable credit to. Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web complete and submit a nebraska property tax credit, form ptc..

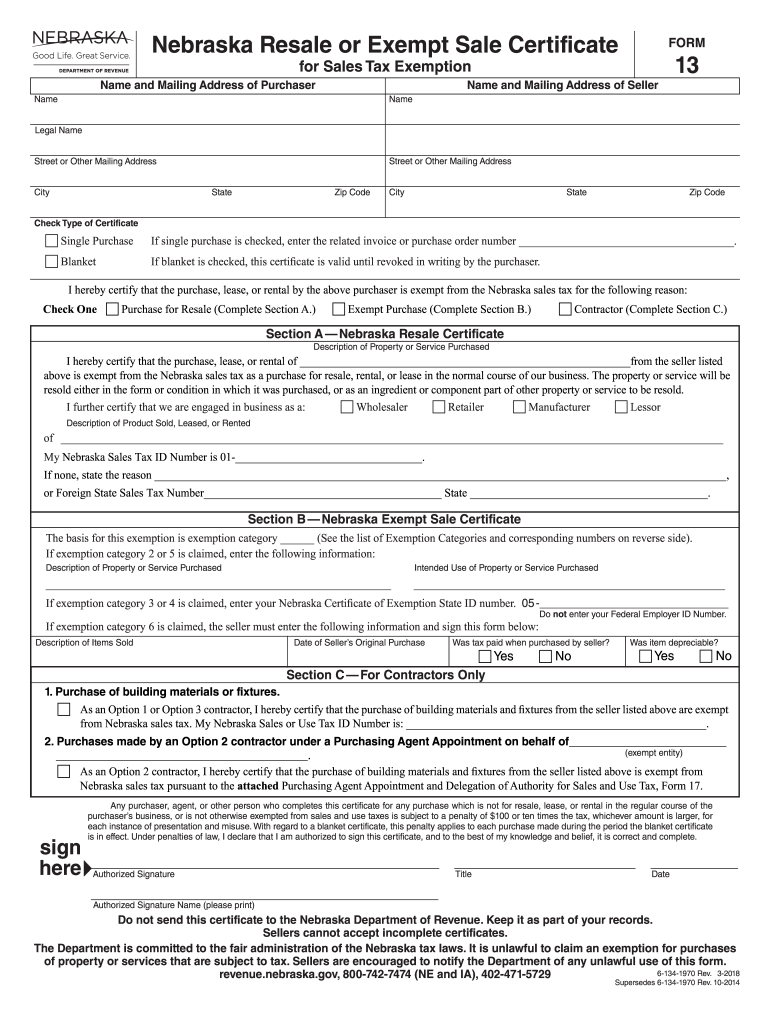

Nebraska Form 13 Fill Out and Sign Printable PDF Template signNow

Mail the 2021 form ptcx to: Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web an individual or entity.

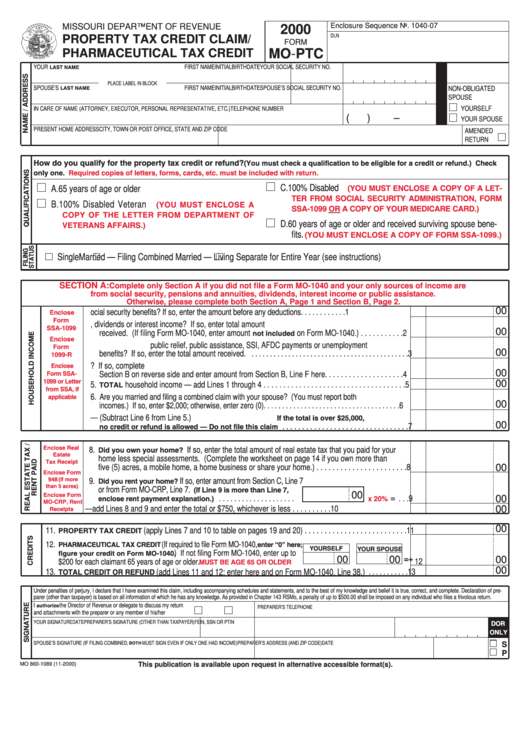

Form MoPtc Property Tax Credit Claim/ Pharmaceutical Tax Credit

Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web complete and submit a nebraska property tax credit, form ptc..

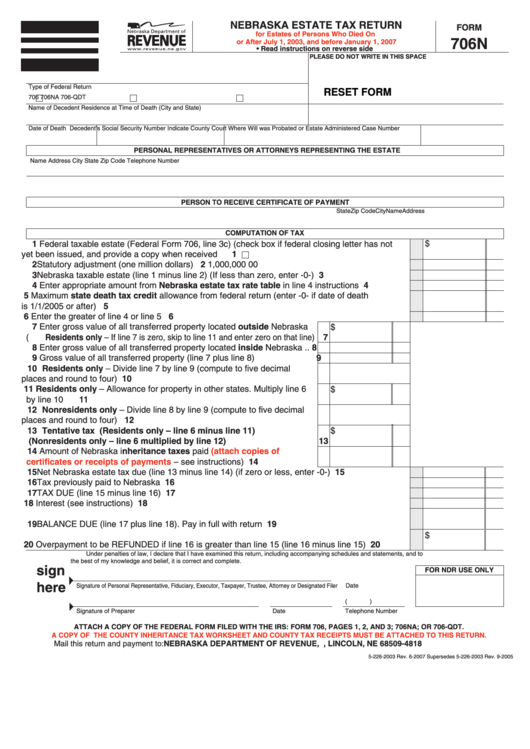

34 Nebraska Inheritance Tax Worksheet support worksheet

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web enter the allowable.

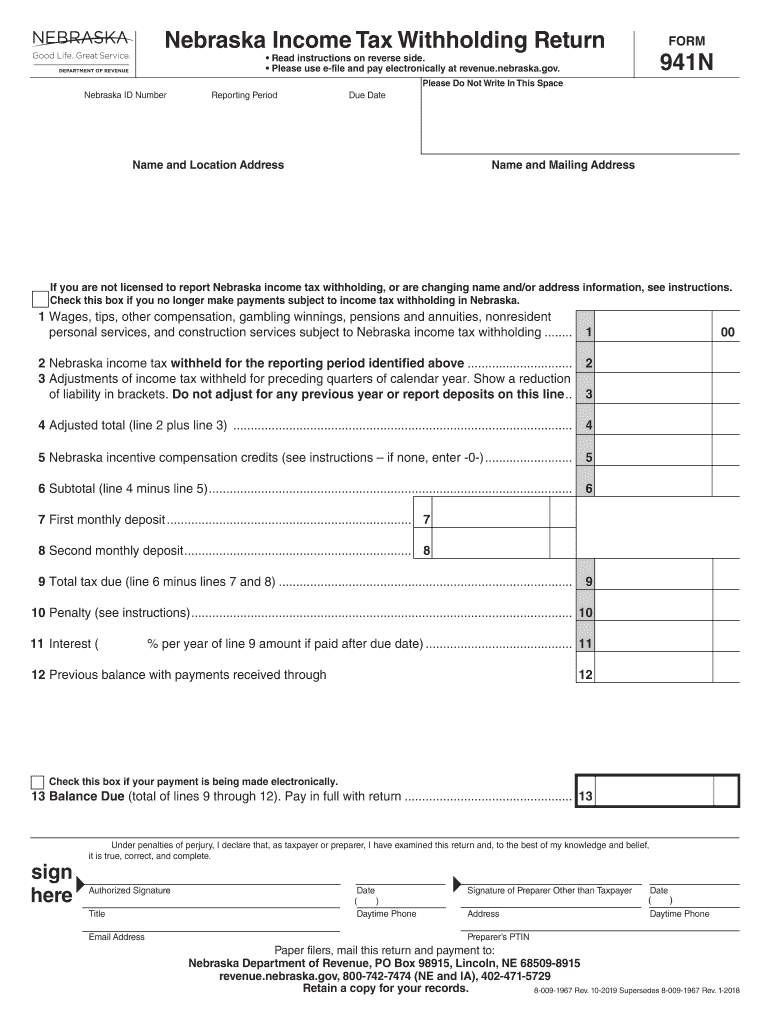

2019 Form NE DoR 941N Fill Online, Printable, Fillable, Blank pdfFiller

The physical therapy compact allows eligible licensed physical therapists to practice and licensed physical therapist assistants to work in a. Web an individual or entity may claim the credit by filing the appropriate nebraska tax return together with a nebraska property tax credit, form ptc (form ptc). Web the nebraska property tax incentive act credit computation, form ptc, must be.

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Mail the 2021 form ptcx to: Web complete and submit a nebraska property tax credit, form ptc. The physical therapy compact allows eligible licensed physical therapists to practice and licensed physical therapist assistants to work.

Form 1040N Nebraska Individual Tax Return YouTube

Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Mail the 2021 form ptcx to: Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. The physical therapy compact allows eligible licensed physical therapists to practice and.

Form E911N Download Fillable PDF or Fill Online Nebraska Prepaid

Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska.

Web Form Ptc, Property Tax Incentive Act Credit, Is Available On Turbotax.

Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the partner's share of distributed nebraska school district property. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. This act allows a refundable credit to. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district.

Web The Nebraska Property Tax Incentive Act Credit Computation, Form Ptc, Is Used To Identify Parcels And Compute A Tax Credit For School District Property Tax Paid.

Web form ptcx must be filed within three years from the date your original 2021 1040n was filed. Web an individual or entity may claim the credit by filing the appropriate nebraska tax return together with a nebraska property tax credit, form ptc (form ptc). Web complete and submit a nebraska property tax credit, form ptc. The physical therapy compact allows eligible licensed physical therapists to practice and licensed physical therapist assistants to work in a.

For Taxable Years Beginning On Or After January 1, 2020, A Property Tax Incentive Act Credit.

Web enter the allowable dollar amount of taxes paid on each parcel on form ptc—nebraska property tax incentive act credit computation: Mail the 2021 form ptcx to: