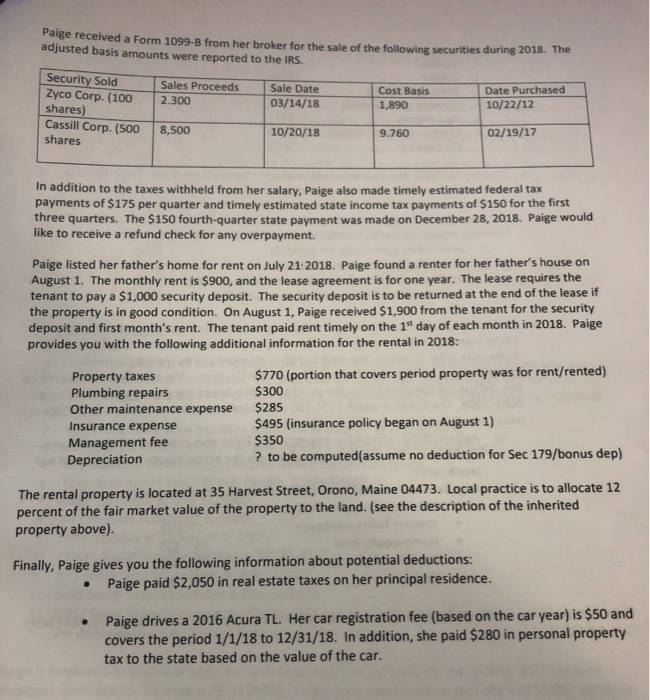

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500 - 4 $ $ $ $ $ $ $ authorized by. This excel file assists lawyers with calculating inheritance tax. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? The inheritance tax is repealed as of january 1, 2025. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Tax paid to all counties (residents and nonresidents) 1. Web the nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. When and where to file. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; The form ecit is due when distributions have been made.

Web complete nebraska inheritance tax worksheet form online with us legal forms. Tax paid to all counties (residents and nonresidents) 1. Complete, edit or print tax forms instantly. Edit your nebraska probate form 500 inheritance tax online type text, add images, blackout confidential details, add comments, highlights and more. Enjoy smart fillable fields and. Sign it in a few clicks draw your. The form ecit is due when distributions have been made. Tax paid to all counties. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; This excel file assists lawyers with calculating inheritance tax.

Download or email ne form 500 & more fillable forms, register and subscribe now! Tax paid to all counties. Web the inheritance tax is due and payable within twelve (12) months of the decedent’s date of death, and failure to timely file and pay the requisite tax may result in. Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Web to the county of the decedent's residence within one year of death. Web if a nonresident dies owning intangible personal property, such as accounts, located in nebraska, that property will be subject to nebraska inheritance tax only if the laws of. This excel file assists lawyers with calculating inheritance tax. Web complete nebraska inheritance tax worksheet form online with us legal forms. Enjoy smart fillable fields and. Save or instantly send your ready documents.

34 Nebraska Inheritance Tax Worksheet support worksheet

The inheritance tax is repealed as of january 1, 2025. Get your online template and fill it in using progressive features. Web the nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. This excel file assists lawyers with calculating inheritance tax. Web complete nebraska inheritance tax worksheet form.

Nebraska Inheritance Tax Worksheet Form 500

Easily fill out pdf blank, edit, and sign them. Edit your nebraska probate form 500 inheritance tax online type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back fill nebraska inheritance tax worksheet form 500, edit online. The fair market value is the. The form ecit is due when distributions have been.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Tax paid to all counties. Save or instantly send your ready documents. Tax paid to all counties (residents and nonresidents) 1. Sign it in a few clicks draw your. When and where to file.

Nebraska Inheritance Tax Worksheet Form 500

Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments, highlights and more. Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? Web the inheritance tax is due.

Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet

Web if a nonresident dies owning intangible personal property, such as accounts, located in nebraska, that property will be subject to nebraska inheritance tax only if the laws of. The inheritance tax is repealed as of january 1, 2025. Edit your nebraska probate form 500 inheritance tax online type text, add images, blackout confidential details, add comments, highlights and more..

Nebraska Inheritance Tax Worksheet Resume Examples

Web to the county of the decedent's residence within one year of death. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Tax paid to all counties. Complete, edit or print tax forms instantly. Web up to $40 cash back fill nebraska inheritance tax worksheet form 500, edit online.

Irs Form 433 A Worksheet Universal Network

Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Once the amount of the. Web complete nebraska inheritance tax worksheet form online with us legal forms. This excel file assists lawyers with calculating inheritance tax. The form ecit is due when distributions have been made.

Nebraska Inheritance Tax Worksheet Form 500

Web to the county of the decedent's residence within one year of death. Complete, edit or print tax forms instantly. Fill & download for free get form download the form how to edit and fill out nebraska inheritance tax worksheet online to start with,. Sign it in a few clicks draw your. Web up to $40 cash back fill nebraska.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Easily fill out pdf blank, edit, and sign them. Edit your nebraska probate form 500 inheritance tax online type text, add images, blackout confidential details, add comments, highlights and more. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; When and where to file. Once the amount of the.

Nebraska Inheritance Tax Worksheet Form 500 Fill Online, Printable

Easily fill out pdf blank, edit, and sign them. When and where to file. Tax paid to all counties. File the form ecit with the county treasurer of the. Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests.

Web The Nebraska Inheritance Tax Applies To All Property, Including Life Insurance Proceeds Paid To The Estate, Which Passes By Will Or Intestacy.

Web video instructions and help with filling out and completing nebraska form 500 inheritance worksheet. The fair market value is the. When and where to file. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

Tax Paid To All Counties (Residents And Nonresidents) 1.

Edit your nebraska probate form 500 inheritance tax online type text, add images, blackout confidential details, add comments, highlights and more. Web the inheritance tax is due and payable within twelve (12) months of the decedent’s date of death, and failure to timely file and pay the requisite tax may result in. 4 $ $ $ $ $ $ $ authorized by. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024;

Web Nebraska Inheritance Tax Worksheet:

File the form ecit with the county treasurer of the. Once the amount of the. Get your online template and fill it in using progressive features. This excel file assists lawyers with calculating inheritance tax.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Sign it in a few clicks draw your. Web complete nebraska inheritance tax worksheet form online with us legal forms. Download or email ne form 500 & more fillable forms, register and subscribe now! Tax paid to all counties.