New Mexico Solar Tax Credit 2022 Form

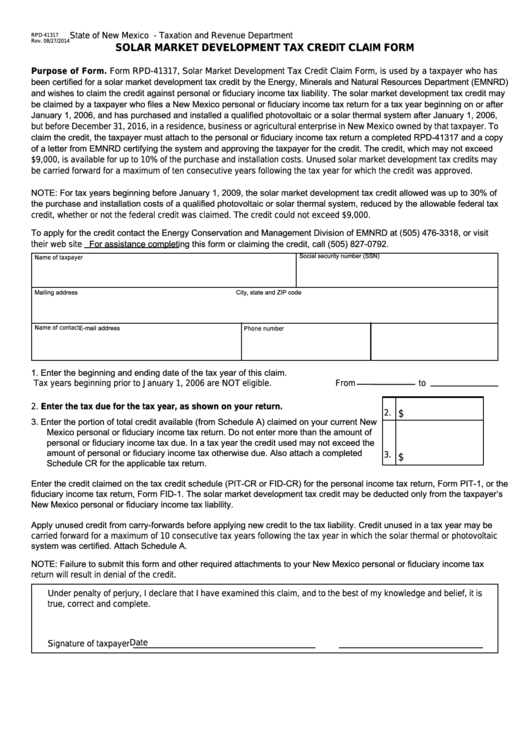

New Mexico Solar Tax Credit 2022 Form - If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. 30%, up to a lifetime. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web as the u.s.’s leading residential solar and energy storage company, 6 sunrun works to ensure you can create and store your own solar energy at home to get outage protection. Web new mexico energy, minerals, and natural resources department 1220 south st. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the.

Web home energy audits. Web r01 rural job tax credit. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. Web new mexico provides a 10% personal income tax credit (up to $9,000) for individuals, sole proprietorship businesses, and agricultural enterprises who purchase and install certified. This incentive can reduce your state. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web the new mexico state legislature passed senate bill 29 in early 2020. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy.

This incentive can reduce your state. 30%, up to a lifetime. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: This tax credit is based upon ten. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. R02 rural health care practitioners tax credit. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. If you checked the “no” box, you cannot claim the energy efficient home improvement credit.

New Mexico Solar Tax Credits Bill Not Yet Dead in Water

Web r01 rural job tax credit. Web home energy audits. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: This tax credit is based upon ten. R02 rural health care practitioners tax credit.

new mexico solar tax credit form In Morrow

Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. Web home energy audits. Web the new mexico state legislature passed senate bill 29 in early 2020. If you checked the “no” box, you cannot claim the energy efficient home improvement.

Solar at Home Solar Holler

Web new mexico energy, minerals, and natural resources department 1220 south st. Web home energy audits. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications.

New Mexico’s solar tax credit is back and it can save you thousands

Web new mexico energy, minerals, and natural resources department 1220 south st. Web home energy audits. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web new.

new mexico solar tax credit 2022 Deafening Bloggers Pictures

Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: This incentive can reduce your state. Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/.

Fillable Form Rpd41317 New Mexico Solar Market Development Tax

Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. R02 rural health care practitioners tax.

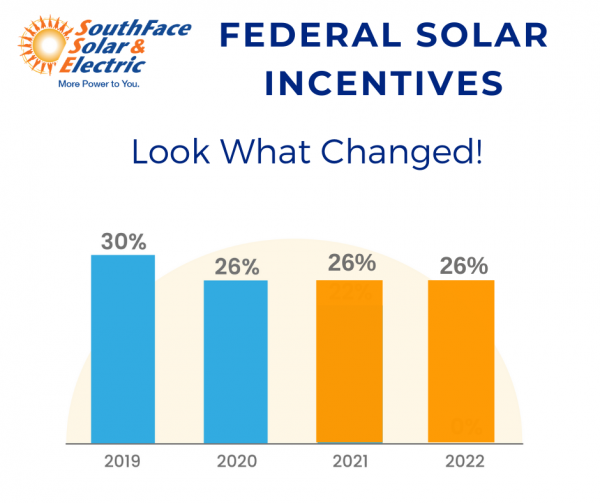

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

Web the new mexico state legislature passed senate bill 29 in early 2020. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications.

federalsolartaxcreditnewmexico Sol Luna Solar

If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web the new mexico state legislature passed senate bill 29 in early 2020. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web the credits for new.

new mexico solar tax credit 2020 We Have The Greatest Biog Photography

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy. Web r01 rural job tax credit. Web as the u.s.’s leading residential.

New Mexico solar tax credit clears Senate and proceeds through House

Web new mexico energy, minerals, and natural resources department 1220 south st. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Web the.

30%, Up To A Lifetime.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web new mexico energy, minerals, and natural resources department 1220 south st. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web the applicant understands that there are annual aggregate statetax credit limits in place for solar thermal systems and photovoltaic systems and that the department must certify the.

This Incentive Can Reduce Your State.

Santa fe, nm 87505 www.emnrd.state.nm.us/ecmd/ telephone: Web the new mexico state legislature passed senate bill 29 in early 2020. Web new mexico state solar tax credit for property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. Web home energy audits.

R02 Rural Health Care Practitioners Tax Credit.

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: Do not complete part ii. Web the credits for new construction or large commercial renovations went into effect on january 1, 2022, and applications for those credits can be submitted now via this online. This tax credit is based upon ten.

Web R01 Rural Job Tax Credit.

Web as the u.s.’s leading residential solar and energy storage company, 6 sunrun works to ensure you can create and store your own solar energy at home to get outage protection. Web new mexico provides a 10% personal income tax credit (up to $9,000) for individuals, sole proprietorship businesses, and agricultural enterprises who purchase and install certified. Web if the department finds the application package meets 3.3.14 nmac’s requirements and a state tax credit is available, the department shall certify the applicant’s solar energy.