New Mexico Withholding Form

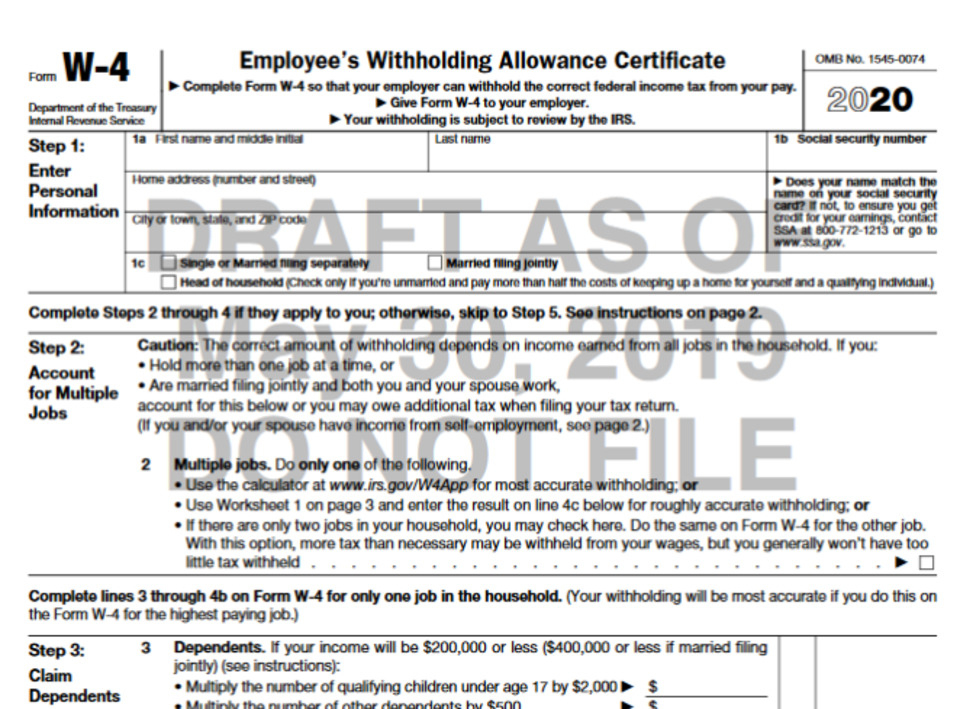

New Mexico Withholding Form - There are no longer adjustments made to new mexico withholding due to the number of allowances. Employers engaged in a trade or business who pay. New mexico also requires you to deduct and. Web state tax withholding state code: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico has released two new withholding forms and related instructions. Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Employee's withholding certificate form 941; Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers who are not required to.

Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Employers who are not required to. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico withholding tax effective january 1, 2022 please note: New mexico also requires you to deduct and. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers engaged in a trade or business who pay. Employee's withholding certificate form 941; Web state tax withholding state code:

New mexico also requires you to deduct and. Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Employers who are not required to. Web new mexico withholding tax effective january 1, 2022 please note: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web state tax withholding state code: Employee's withholding certificate form 941; Employers engaged in a trade or business who pay.

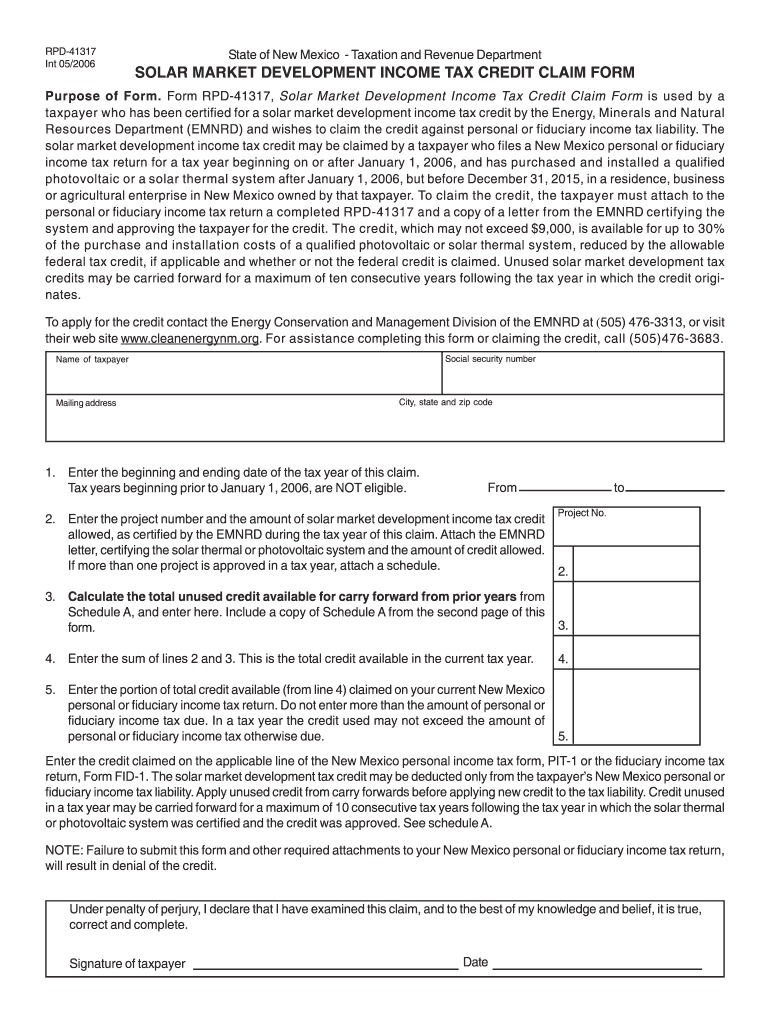

New Mexico Tax Form Fill Out and Sign Printable PDF Template

There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1)..

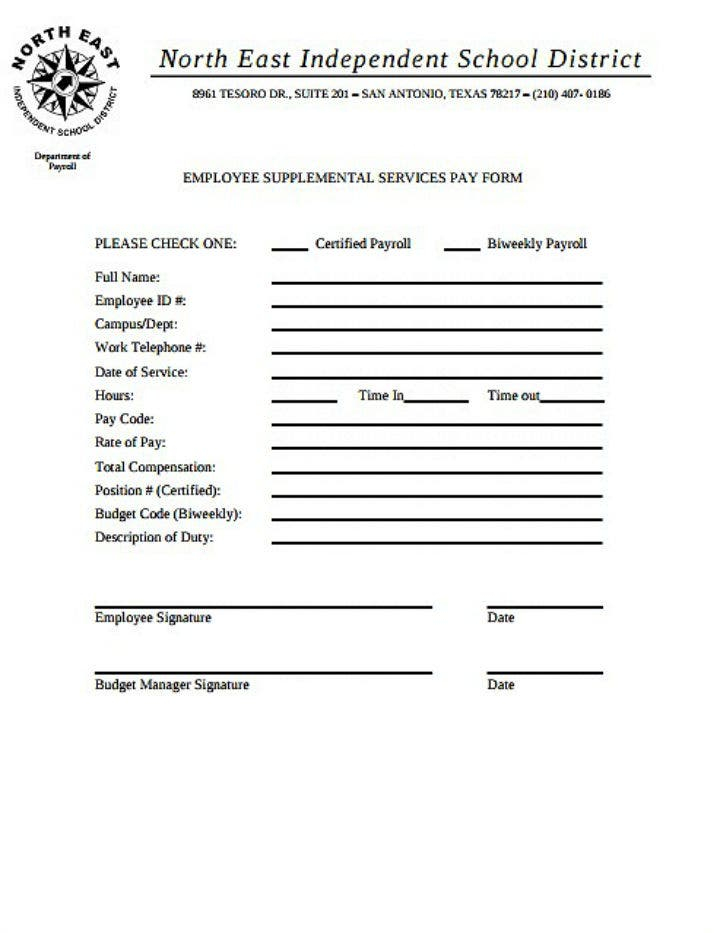

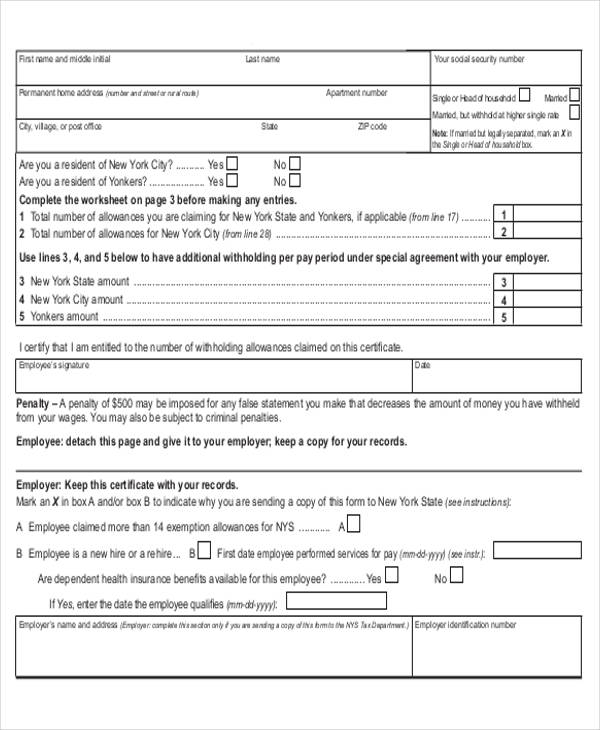

FREE 9+ Sample Employee Tax Forms in MS Word PDF

Web new mexico has released two new withholding forms and related instructions. Employers who are not required to. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code: Employers engaged in a trade or business who pay.

IRS Urges Taxpayers to Review Their Withholding Status [CALCULATOR] WDET

Web state tax withholding state code: Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does. Web new mexico withholding tax effective january 1, 2022 please note: Employee's withholding certificate form 941;

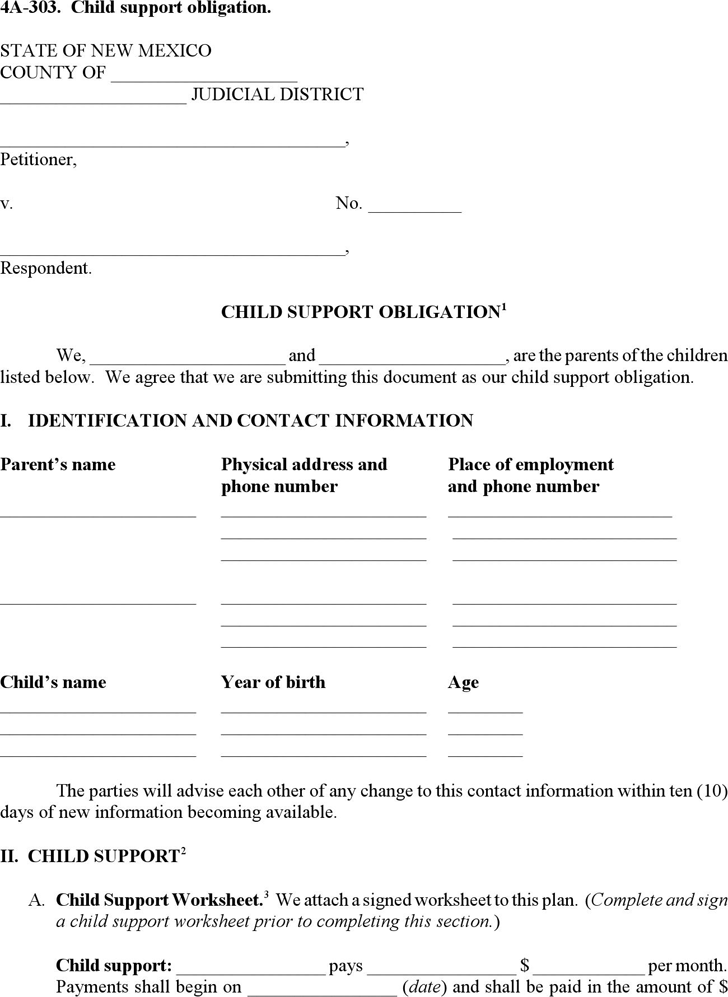

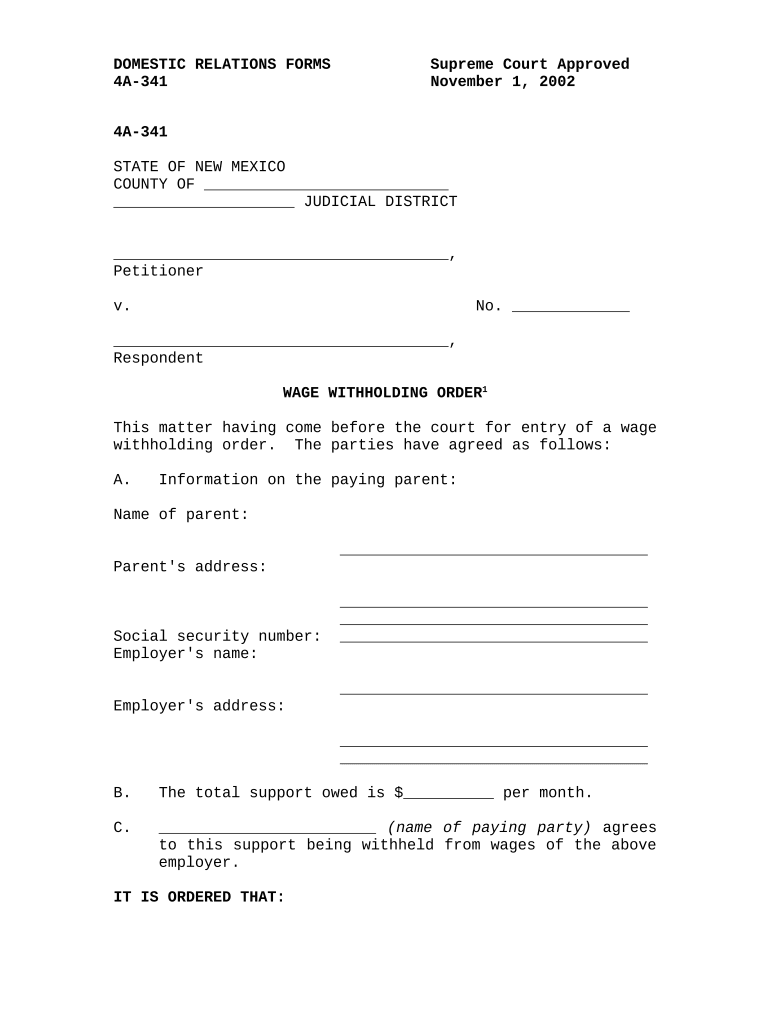

Free New Mexico Child Support Obligation Form PDF 16KB 5 Page(s)

Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). There are no longer adjustments made to new mexico withholding due to the number of allowances. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web state tax withholding state code:.

Nm Withholding Form Fill Out and Sign Printable PDF Template signNow

Employee's withholding certificate form 941; New mexico also requires you to deduct and. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web new mexico withholding tax effective january 1, 2022 please note: Employers who are not required to.

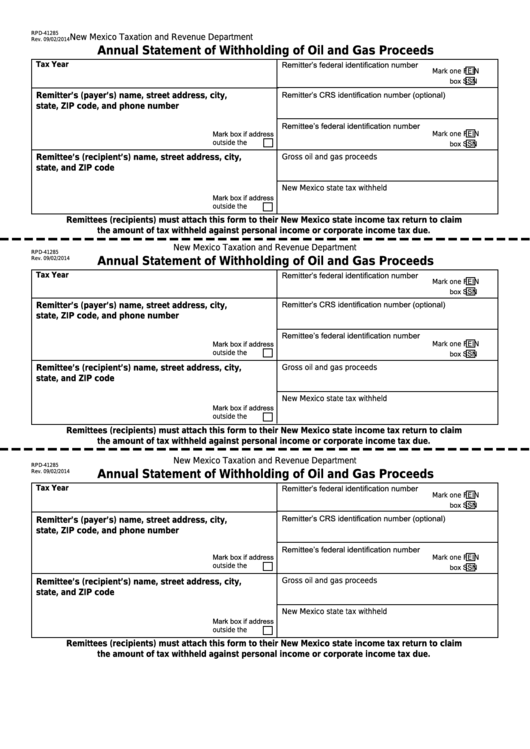

Fillable Form Rpd41285 New Mexico Annual Statement Of Withholding Of

Employers engaged in a trade or business who pay. Employee's withholding certificate form 941; Web new mexico has released two new withholding forms and related instructions. Employers who are not required to. New mexico also requires you to deduct and.

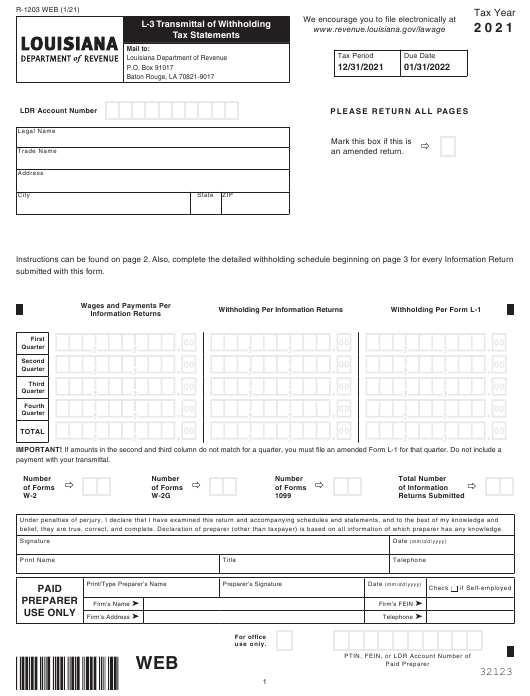

Michigan 2022 Annual Tax Withholding Form

New mexico also requires you to deduct and. Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Employers engaged in a trade or business who pay. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code:

New Mexico Employee Withholding Form 2022 2022

Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: New mexico also requires you to deduct and. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Web new mexico has released two new withholding forms and related instructions. Employee's withholding.

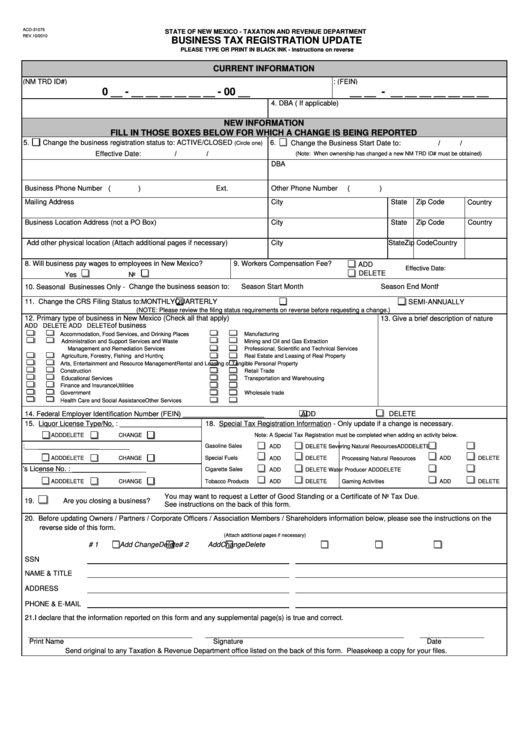

Business Tax Registration Update Form New Mexico Taxation And Revenue

Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Web state tax withholding state code: Employee's withholding certificate form 941; Employers engaged in a trade or business who pay. There are no longer adjustments made to new mexico withholding due to the number of allowances.

New Mexico Employee Withholding Form

Web employer's quarterly wage, withholding and *82260200* workers' compensation fee report who must file: Employee's withholding certificate form 941; Employers engaged in a trade or business who pay. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web state tax withholding state code:

Web State Tax Withholding State Code:

Employers engaged in a trade or business who pay. New mexico also requires you to deduct and. There are no longer adjustments made to new mexico withholding due to the number of allowances. Web new mexico taxation and revenue department withholding from wages an employee’s wages are subject to new mexico withholding tax if the employer does.

Web Employer's Quarterly Wage, Withholding And *82260200* Workers' Compensation Fee Report Who Must File:

Employers who are not required to. Web new mexico income tax withholding status/ number of exemptions • if you want new mexico stateincome tax withheld, check box number one (1). Web new mexico has released two new withholding forms and related instructions. Employee's withholding certificate form 941;

![IRS Urges Taxpayers to Review Their Withholding Status [CALCULATOR] WDET](https://wdet.org/media/daguerre/2018/03/08/ba020281c80c289f0c3a.jpeg)