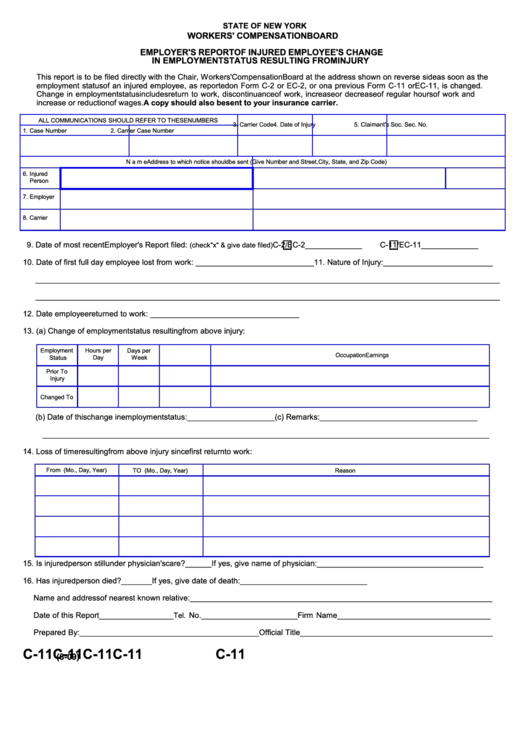

New York State Disability Form Db 450

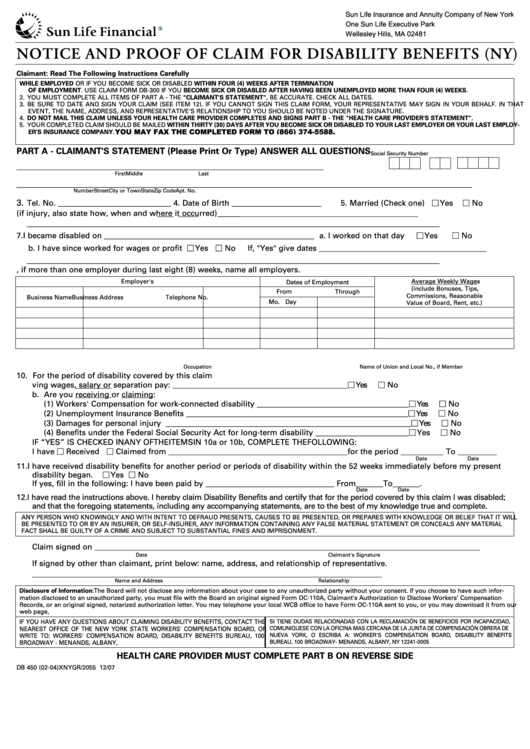

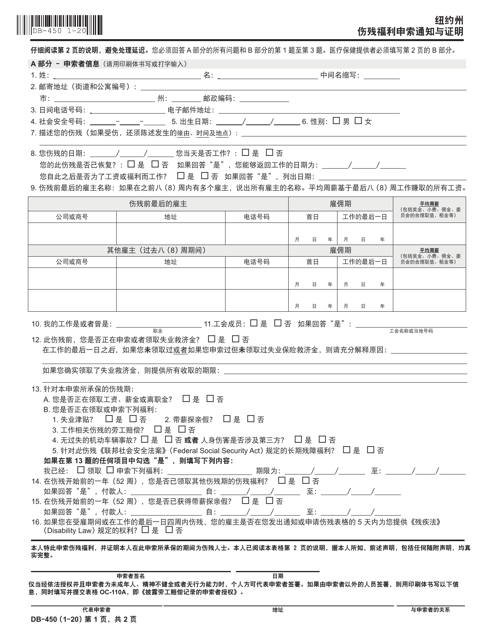

New York State Disability Form Db 450 - Is 50 percent of your average weekly wage for the last eight weeks worked cannot be more than the maximum benefit allowed, currently $170 per week (wcl §204). Additional information may be obtained at the board's website: Use this form if you become sick or disabled while employed or if you become sick or disabled within four (4) weeks after termination of employment. Is subject to social security and medicare taxes. Web any employee receiving or entitled to receive social security retirement benefits may submit this form at any time to waive any and all benefits under the disability and paid family leave benefits law: Please confirm with your employer or the worker's compensation board that your employer's disability benefits carrier is nysif. Web form db 450 disability is a document that certifies one's status as disabled to the internal revenue service. Your employer should complete part c. Www.wcb.ny.gov, or you may write to the disability benefits Use this form if you become sick or disabled while employedor if you become sick or disabled within four (4) weeks after termination of employment.

Please confirm with your employer or the worker's compensation board that your employer's disability benefits carrier is nysif. This is the only form that is required as part. Www.wcb.ny.gov, or you may write to the disability benefits Web new york state notice and proof of claim for disability benefits read instructions on page 2 carefully to avoid a delay in processing. File a claim for disability benefits. Web new york state notice and proof of claim for disability benefits use this form if you became disabled while employed or if you became disabled within four (4) weeks after termination of employment or if you became disabled after having been unemployed for more than four (4) weeks. Additional information may be obtained at the board's website: Is subject to social security and medicare taxes. Web find out who is covered and who is not covered by the new york state disability benefits law. Is 50 percent of your average weekly wage for the last eight weeks worked cannot be more than the maximum benefit allowed, currently $170 per week (wcl §204).

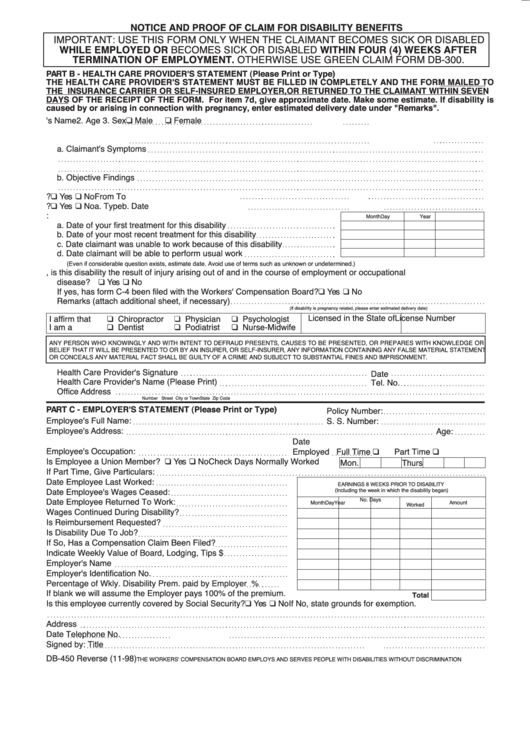

Pfl 1 & 2 forms This is the only form that is required as part. Web in the employer section (part c) of the db 450 claim form, we ask if wages were paid during the disability period, and whether or not the employer wishes to be reimbursed by the hartford. If you do not receive a response within 45 days or if you have questions about your disability benefits claim, please call your Be sure to date and sign your claim (see item 12). Article 9 (ny dbl law) § 237 of the new york workers’ compensation law states an employer, may be reimbursed Web any employee receiving or entitled to receive social security retirement benefits may submit this form at any time to waive any and all benefits under the disability and paid family leave benefits law: Your employer should complete part c. Is 50 percent of your average weekly wage for the last eight weeks worked cannot be more than the maximum benefit allowed, currently $170 per week (wcl §204). Www.wcb.ny.gov, or you may write to the disability benefits

New York State Disability Claim Form Db 300 Universal Network

This is the only form that is required as part. Article 9 (ny dbl law) § 237 of the new york workers’ compensation law states an employer, may be reimbursed File a claim for disability benefits. Use this form if you become sick or disabled while employed or if you become sick or disabled within four (4) weeks after termination.

Ssa Disability Form 3288 Universal Network

Is paid for a maximum of 26 weeks of disability during any 52 consecutive week period (wcl §205). For more information visit www.mattar.com copyright: Web your completed claim should be mailed to: Web new york state notice and proof of claim for disability benefits use this form if you became disabled while employed or if you became disabled within four.

2004 Form NY DB450 Fill Online, Printable, Fillable, Blank pdfFiller

Web form db 450 disability is a document that certifies one's status as disabled to the internal revenue service. A person with partial disability must attach additional forms to this form. Please confirm with your employer or the worker's compensation board that your employer's disability benefits carrier is nysif. You must answer all questions in part a and questions 1.

17 Nys Wcb Forms And Templates free to download in PDF

This is the only form that is required as part of your application for new york state disability benefi ts. Be sure to date and sign your claim (see item 12). Web completed claim must be mailed to: Please confirm with your employer or the worker's compensation board that your employer's disability benefits carrier is nysif. Notice and proof of.

Db450 Form Notice And Proof Of Claim For Disability Benefits (ny

New york state notice and proof of claim for disability benefits. Use this form if you become sick or disabled while employedor if you become sick or disabled within four (4) weeks after termination of employment. Is paid for a maximum of 26 weeks of disability during any 52 consecutive week period (wcl §205). Web new york state notice and.

2 Part Ncr Form Universal Network

You must answer all questions in part a and questions 1 through 4 in part b. This is the only form that is required as part of your application for new york state disability benefi ts. Additional information may be obtained at the board's website: Article 9 (ny dbl law) § 237 of the new york workers’ compensation law states.

New York State General Affidavit Form Universal Network

Additional information may be obtained at the board's website: If you do not receive a response within 45 days or if you have questions about your disability benefits claim,. Pfl 1 & 2 forms Web completed claim must be mailed to: Web in the employer section (part c) of the db 450 claim form, we ask if wages were paid.

Form DB450C Download Fillable PDF or Fill Online Notice and Proof of

If you do not receive a response within 45 days or if you have questions about your disability benefits claim, please call your Health care providers must complete part b on page 2. You must answer all questions in part a and questions 1 through 4 in part b. Web your completed claim should be mailed to: Web in the.

New York State Disability Claim Form Db 300 Universal Network

Is subject to social security and medicare taxes. For approved claims, disability benefits begin on the eighth day of disability. By pressing the orange button directly below, you'll access our document editor that allows you to work with this form efficiently. If you do not receive a response within 45 days or if you have questions about your disability benefits.

Db450 Form Notice And Proof Of Claim For Disability Benefits

By pressing the orange button directly below, you'll access our document editor that allows you to work with this form efficiently. A person with partial disability must attach additional forms to this form. Web any employee receiving or entitled to receive social security retirement benefits may submit this form at any time to waive any and all benefits under the.

A Person With Partial Disability Must Attach Additional Forms To This Form.

Additional information may be obtained at the board's website: Use this form if you become sick or disabled while employedor if you become sick or disabled within four (4) weeks after termination of employment. Is subject to social security and medicare taxes. Pfl 1 & 2 forms

Is 50 Percent Of Your Average Weekly Wage For The Last Eight Weeks Worked Cannot Be More Than The Maximum Benefit Allowed, Currently $170 Per Week (Wcl §204).

Notice and proof of claim for disability benefits: For more information visit www.mattar.com copyright: Web any employee receiving or entitled to receive social security retirement benefits may submit this form at any time to waive any and all benefits under the disability and paid family leave benefits law: Web in the employer section (part c) of the db 450 claim form, we ask if wages were paid during the disability period, and whether or not the employer wishes to be reimbursed by the hartford.

Web Form Db 450 Disability Is A Document That Certifies One's Status As Disabled To The Internal Revenue Service.

Is paid for a maximum of 26 weeks of disability during any 52 consecutive week period (wcl §205). Web your completed claim should be mailed to: Health care providers must complete part b on page 2. New york state notice and proof of claim for disability benefits.

If You Do Not Receive A Response Within 45 Days Or If You Have Questions About Your Disability Benefits Claim,.

Article 9 (ny dbl law) § 237 of the new york workers’ compensation law states an employer, may be reimbursed For approved claims, disability benefits begin on the eighth day of disability. Of your application for new york state disability benefits. Web find out who is covered and who is not covered by the new york state disability benefits law.