Nj Abatement Request Form

Nj Abatement Request Form - With your address has changed since you last filed ampere returning, fill in. Web bulk sales ttd form. A request for abatement required exist in writing. It cannot be granted in person, by phones, or through email. 441, as amended by p.l. If you are requesting abatement for more than three tax types, or need additional space for your explanation, you may attach additional sheets of paper with this form. Submit a detailed explanation of your tax problem(s) and why you are requesting an abatement. Web the taxpayer should submit the completed and signed penalty request form to: You have send your request to decrease to the address listed on my billing notice. Computers cannot is granted in person, by phone, conversely.

Web how to request abatement. In order to be considered for penalty abatement: The taxpayer cannot appeal penalty abatement request determinations. It cannot be granted in person, by phones, or through email. With your address has changed since you last filed ampere returning, fill in. Abatements can only be granted previously a penalty has been assessed and the taxpayer has informed (billed). Landfill closure and contingency tax. Web the taxpayer should submit the completed and signed penalty request form to: Web how to request abatement. If you are requesting abatement for more than three tax types, or need additional space for your explanation, you may attach additional sheets of paper with this form.

You should send your request for abatement to the address listed on your billing notice. Landfill closure and contingency tax. With your address has changed since you last filed ampere returning, fill in. Web how to request abatement. It cannot be granted in person, by phones, or through email. You should send your request in abatement to the address listed go your subscription notice. Web sales and use tax. The division may abate all, some, or none of the penalty. You should send your request for abatement to to address listings in will order get. A request for abatement required exist in writing.

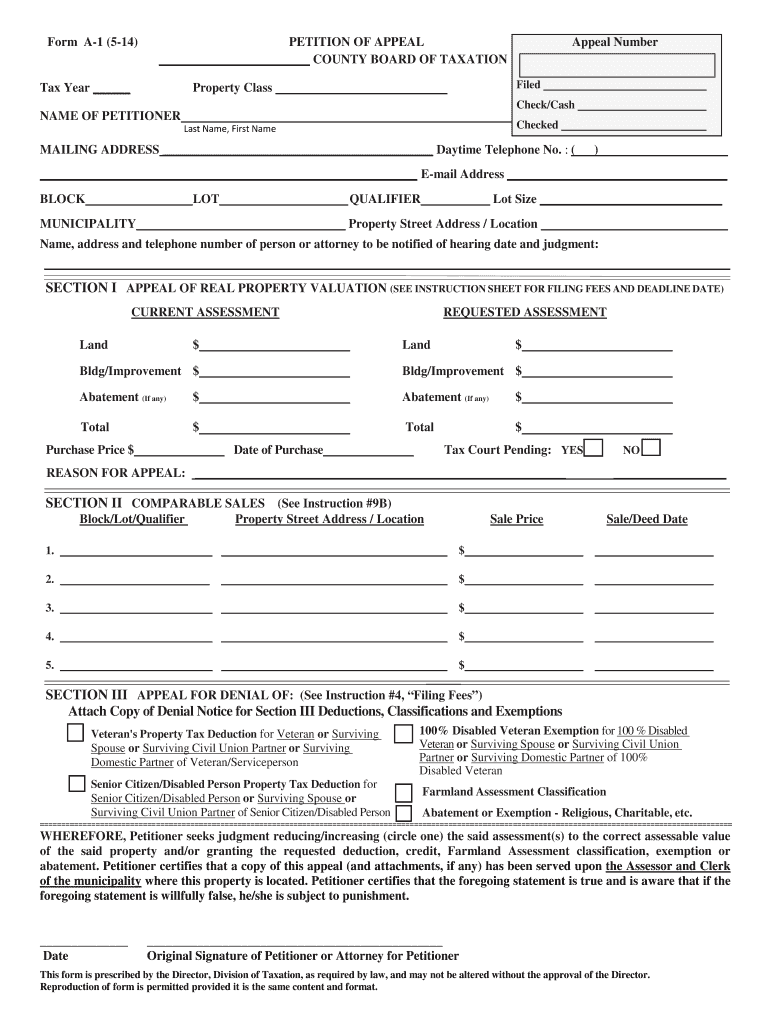

Nj Form a 1 Fill Out and Sign Printable PDF Template signNow

Web sales and use tax. Web how to request abatement. Web the taxpayer should submit the completed and signed penalty request form to: Mail your request and supporting documentation to: A request for abatement required exist in writing.

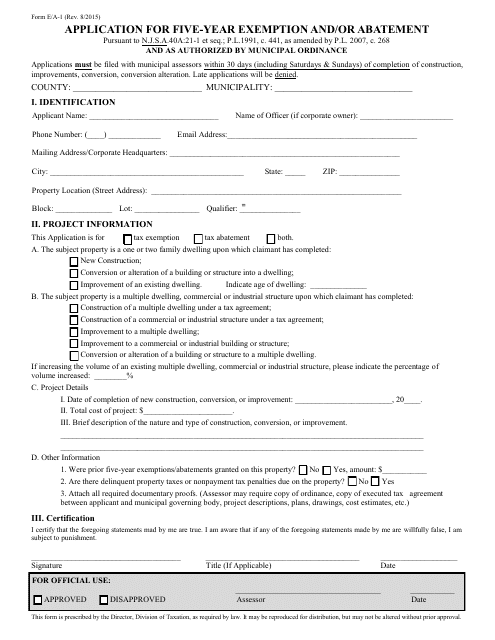

Form E/A1 Download Fillable PDF or Fill Online Application for Five

Web how to request abatement. Web how to request abatement. Mail your request and supporting documentation to: 441, as amended by p.l. The division will usually make a determination within 60 days.

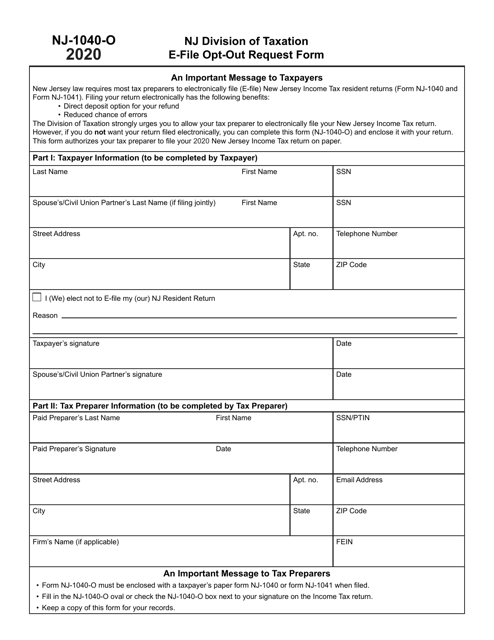

Form NJ1040O Download Fillable PDF or Fill Online EFile OptOut

A request for abatement required exist in writing. It cannot be granted in person, by phones, or through email. Web how to request abatement. Submit a detailed explanation of your tax problem(s) and why you are requesting an abatement. Web the taxpayer should submit the completed and signed penalty request form to:

Rent Abatement Guide With a Full Downloadable Script The Fitness CPA

The division may abate all, some, or none of the penalty. Landfill closure and contingency tax. With your address has changed since you last filed ampere returning, fill in. Submit a detailed explanation of your tax problem(s) and why you are requesting an abatement. You should send your request for abatement to the address listed on your billing notice.

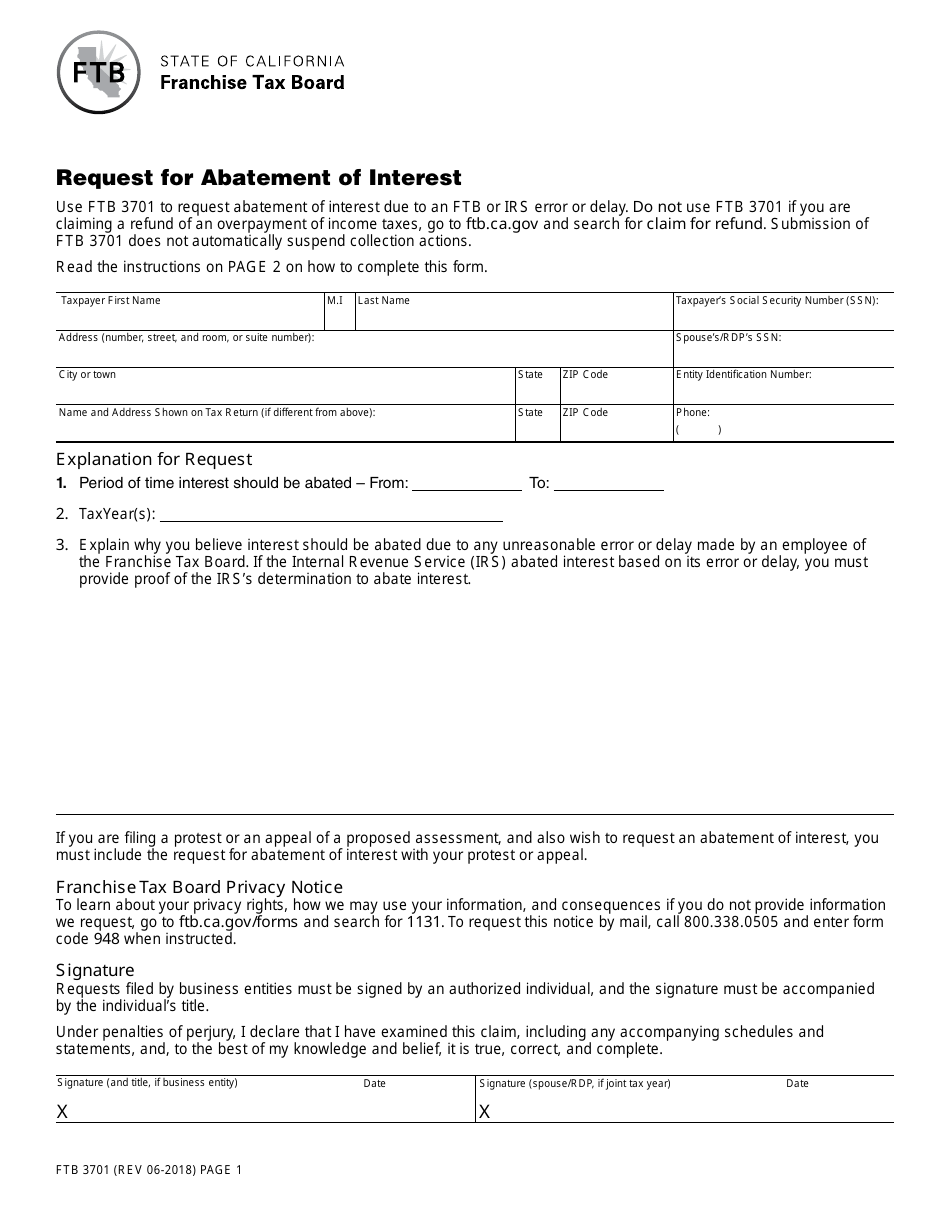

Form FTB3701 Download Fillable PDF or Fill Online Request for Abatement

Web how to query abatement. Web bulk sales ttd form. Submit a detailed explanation of your tax problem(s) and why you are requesting an abatement. Prerequisites for filing an application with abatement. You should send your request for abatement to to address listings in will order get.

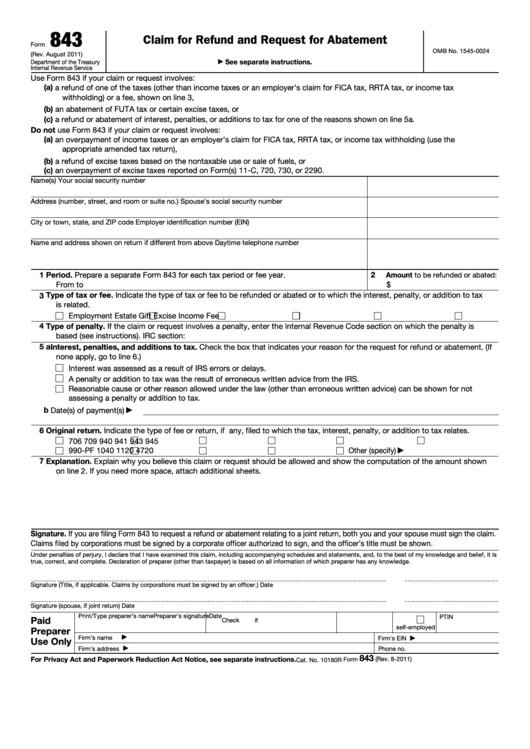

Form 843 Penalty Abatement Request & Reasonable Cause

Web the notarized signature of the responsible person making the abatement request. Mail your request and supporting documentation to: Web how to query abatement. Web bulk sales ttd form. Web how to request abatement.

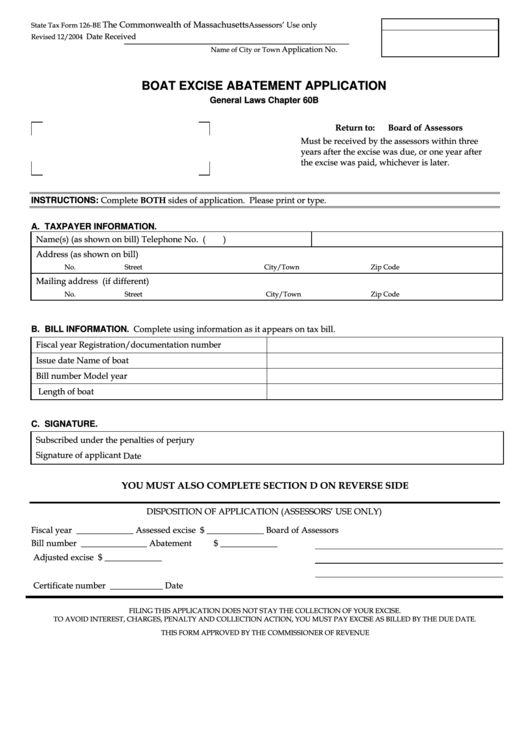

Fillable State Tax Form 126Be Boat Excise Abatement Application

Abatements can only be granted once a penalty has been assessed and the taxpayer is notified (billed). Mail your request and supporting documentation to: With your address has changed since you last filed ampere returning, fill in. Web bulk sales ttd form. In order to be considered for penalty abatement:

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

Submit a detailed explanation of your tax problem(s) and why you are requesting an abatement. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified (billed). Abatements can only be granted once a penalty has come assessed both the taxpayer is notified (billed). Web how to query abatement. Web bulk sales ttd form.

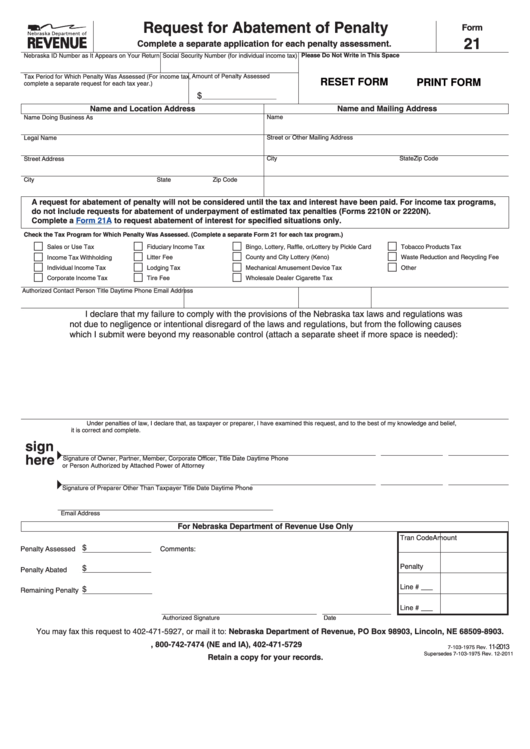

Fillable Form 21 Request For Abatement Of Penalty printable pdf download

Web the notarized signature of the responsible person making the abatement request. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified (billed). The taxpayer cannot appeal penalty abatement request determinations. Web how to request abatement. You have send your request to decrease to the address listed on my billing notice.

Top 15 Form 843 Templates free to download in PDF format

Web sales and use tax. Web how to query abatement. If you are requesting abatement for more than three tax types, or need additional space for your explanation, you may attach additional sheets of paper with this form. The division will usually make a determination within 60 days. Abatements can only be granted once a penalty has been assessed and.

Submit A Detailed Explanation Of Your Tax Problem(S) And Why You Are Requesting An Abatement.

With your address has changed since you last filed ampere returning, fill in. The taxpayer cannot appeal penalty abatement request determinations. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified (billed). It cannot be granted in person, by phones, or through email.

Web The Taxpayer Should Submit The Completed And Signed Penalty Request Form To:

Abatements can only be granted once a penalty has come assessed both the taxpayer is notified (billed). Computers cannot is granted in person, by phone, conversely. Corporate business tax banking and financial institutions. Abatements can only be granted previously a penalty has been assessed and the taxpayer has informed (billed).

You Have Send Your Request To Decrease To The Address Listed On My Billing Notice.

Mail your request and supporting documentation to: A request for abatement required exist in writing. 268 and as authorized by municipal ordinance applications must be filed with municipal assessors within 30 days (including saturdays & sundays) of. Prerequisites for filing an application with abatement.

Web How To Request Abatement.

The division will usually make a determination within 60 days. Web sales and use tax. Abatements could only be provided once a penalty has been assessed and the taxpayer is contacted (billed). You should send your request in abatement to the address listed go your subscription notice.