Nj Form 500

Nj Form 500 - Begin form 500 at section a, line 1. 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Return number return name type year; Tax credit for employers of employees with impairments: Web we last updated the 2015 net operating loss deduction in february 2023, so this is the latest version of form 500, fully updated for tax year 2022. Web employer payroll tax electronic filing and reporting options. Or on schedule a, part 2, line 23 and continue with section b. Web employers payroll tax forms employer payroll tax forms. Web this package contains form 500 which will be used to compute the current return period’snol deduction. New jersey gross income tax instruction booklet and samples for employers, payors of pension and annuity income and payors of gambling winnings.

2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. New jersey gross income tax instruction booklet and samples for employers, payors of pension and annuity income and payors of gambling winnings. Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Web this package contains form 500 which will be used to compute the current return period’snol deduction. Web form 500 computation of the 2021 post allocation net operating loss (nol) and prior net operating loss conversion carryover (pnol) deductions (see instructions) does the taxpayer have any prior net operating loss conversion carryovers? Return number return name type year; Pnol/nol merger/acquisition certificate in cases of regulatory delay: You can print other new jersey tax forms here. Web employers payroll tax forms employer payroll tax forms.

Computation of the available converted net operating loss: Web form 500 computation of the 2021 post allocation net operating loss (nol) and prior net operating loss conversion carryover (pnol) deductions (see instructions) does the taxpayer have any prior net operating loss conversion carryovers? 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Use this option to fill in and electronically file the following form (s): Web this package contains form 500 which will be used to compute the current return period’snol deduction. Prior net operating loss conversion worksheet: Web employer payroll tax electronic filing and reporting options. Begin form 500 at section a, line 1. Or on schedule a, part 2, line 23 and continue with section b. Tax credit for employers of employees with impairments:

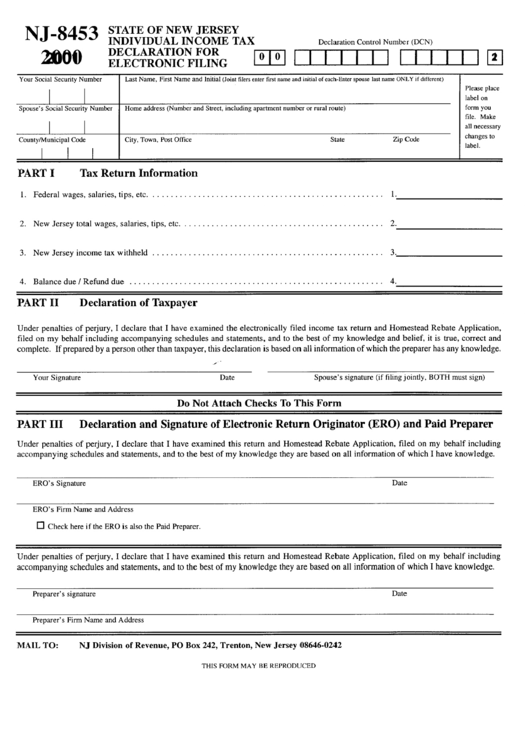

Form Nj8453 Individual Tax Declaration For Electronic Filing

Web form 500 computation of the 2021 post allocation net operating loss (nol) and prior net operating loss conversion carryover (pnol) deductions (see instructions) does the taxpayer have any prior net operating loss conversion carryovers? 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. New jersey gross income.

2016 Form NJ DoT NJ630 Fill Online, Printable, Fillable, Blank pdfFiller

Prior net operating loss conversion worksheet: Begin form 500 at section a, line 1. Web employer payroll tax electronic filing and reporting options. Or on schedule a, part 2, line 23 and continue with section b. You can print other new jersey tax forms here.

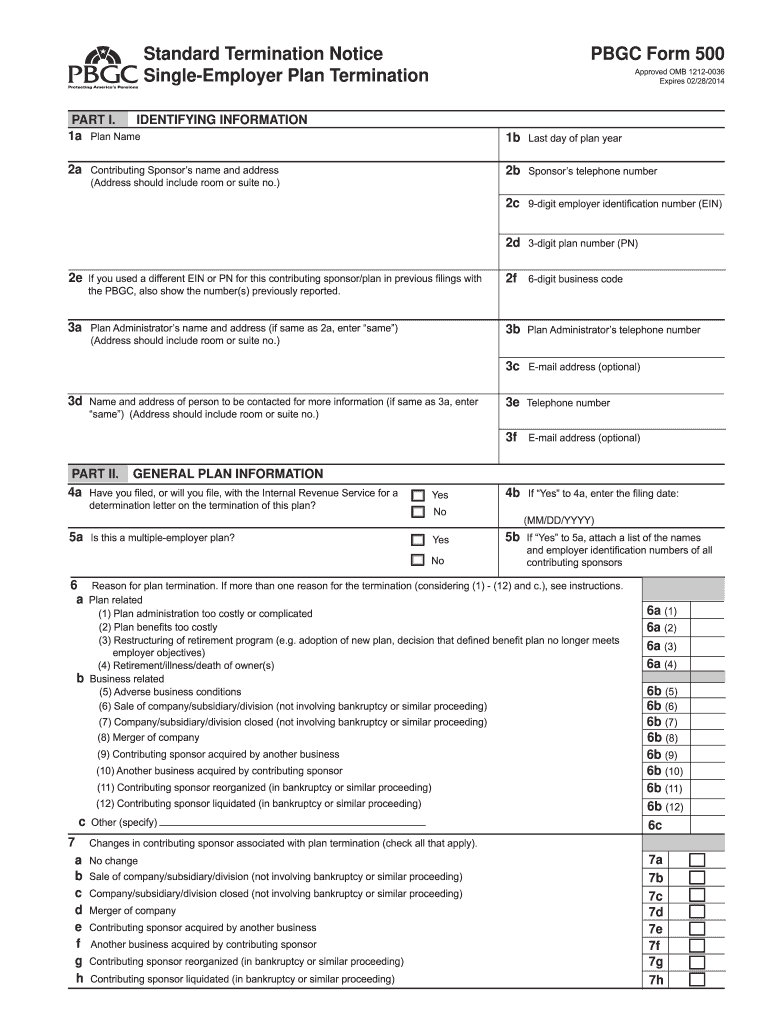

2013 Form PBGC 500 & 501 Fill Online, Printable, Fillable, Blank

Web new jersey general information this package contains form 500 which will be used to compute the current return period’s nol deduction. Web employers payroll tax forms employer payroll tax forms. Tax credit for employers of employees with impairments: Use this option to fill in and electronically file the following form (s): Web we last updated the 2015 net operating.

Automatic Multi Track Liquid Filling Machines, Rs 1100000 Genius

2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Use this option to fill in and electronically file the following form (s): Prior net operating loss conversion worksheet: 2002, c.40 (business tax reform act) disallows net operating loss deductions forprivilege periods beginning during calendar years 2002 and 2003..

Nj form 500 instructions Australian tutorials Working Examples

Or on schedule a, part 2, line 23 and continue with section b. 2002, c.40 (business tax reform act) disallows net operating loss deductions forprivilege periods beginning during calendar years 2002 and 2003. Begin form 500 at section a, line 1. Use this option to fill in and electronically file the following form (s): New jersey gross income tax instruction.

Nj form 500 instructions Australian tutorials Working Examples

Web this package contains form 500 which will be used to compute the current return period’snol deduction. 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Use this option to fill in and electronically file the following form (s): Tax credit for employers of employees with impairments: Begin.

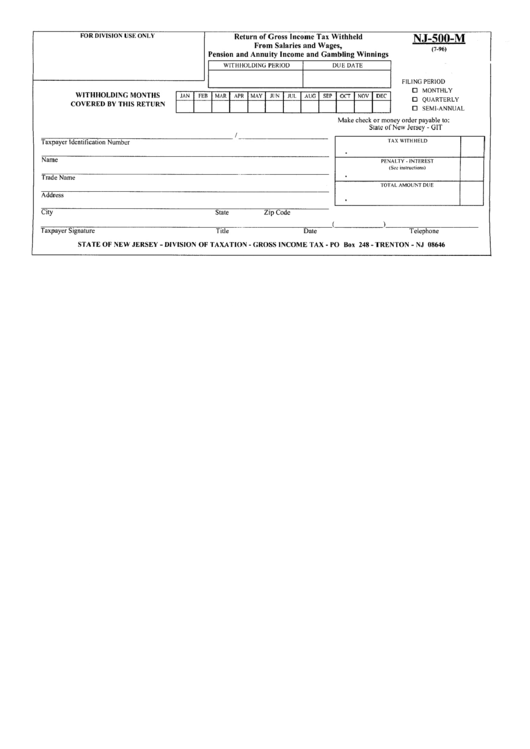

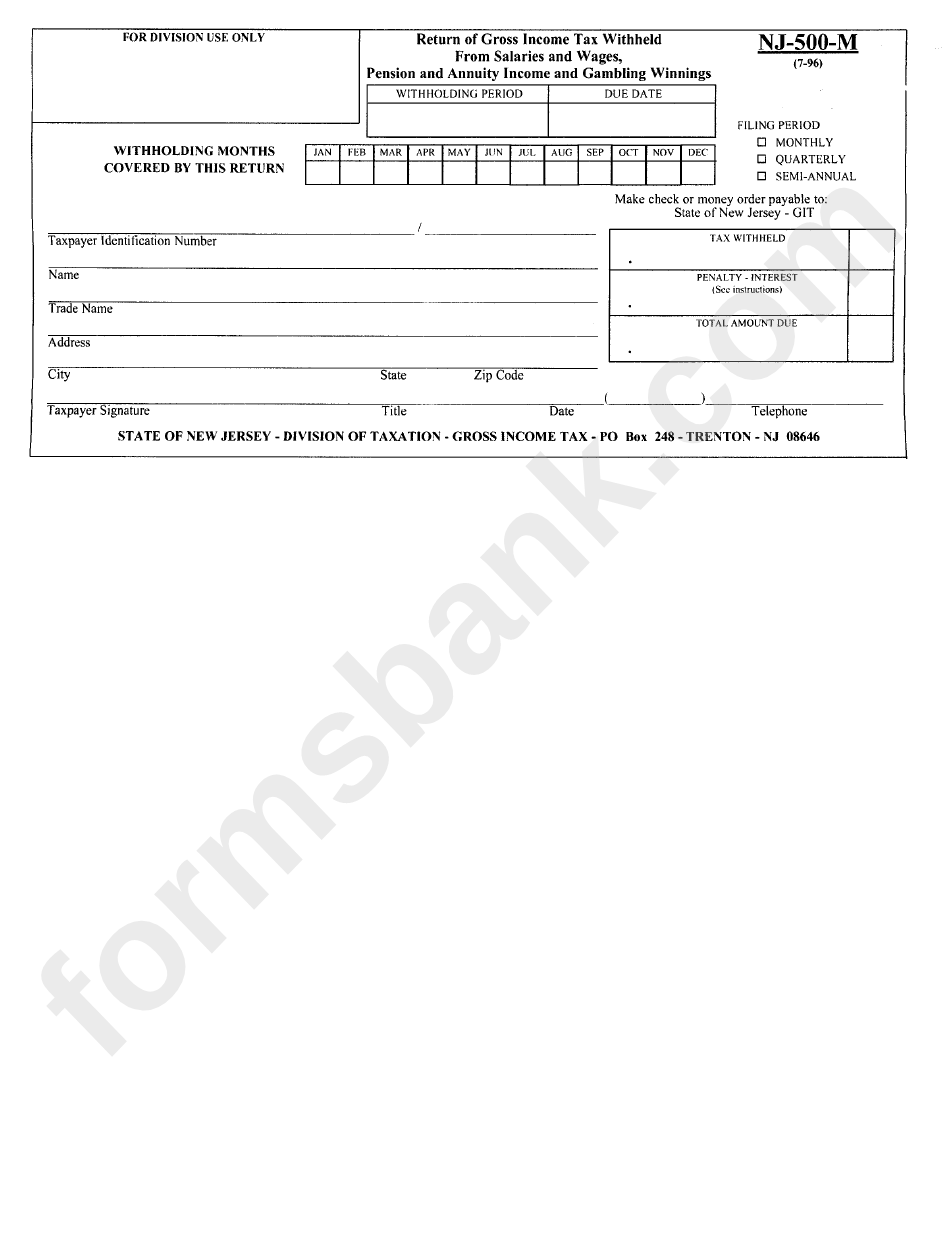

Form Nj500M Return Of Gross Tax Withheld Form Salaries And Wages

Begin form 500 at section a, line 1. Pnol/nol merger/acquisition certificate in cases of regulatory delay: New jersey gross income tax instruction booklet and samples for employers, payors of pension and annuity income and payors of gambling winnings. 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Computation.

Form Nj500M Return Of Gross Tax Withheld Form Salaries And Wages

2002, c.40 (business tax reform act) disallows net operating loss deductions forprivilege periods beginning during calendar years 2002 and 2003. Begin form 500 at section a, line 1. You can print other new jersey tax forms here. Or on schedule a, part 2, line 23 and continue with section b. Use this option to fill in and electronically file the.

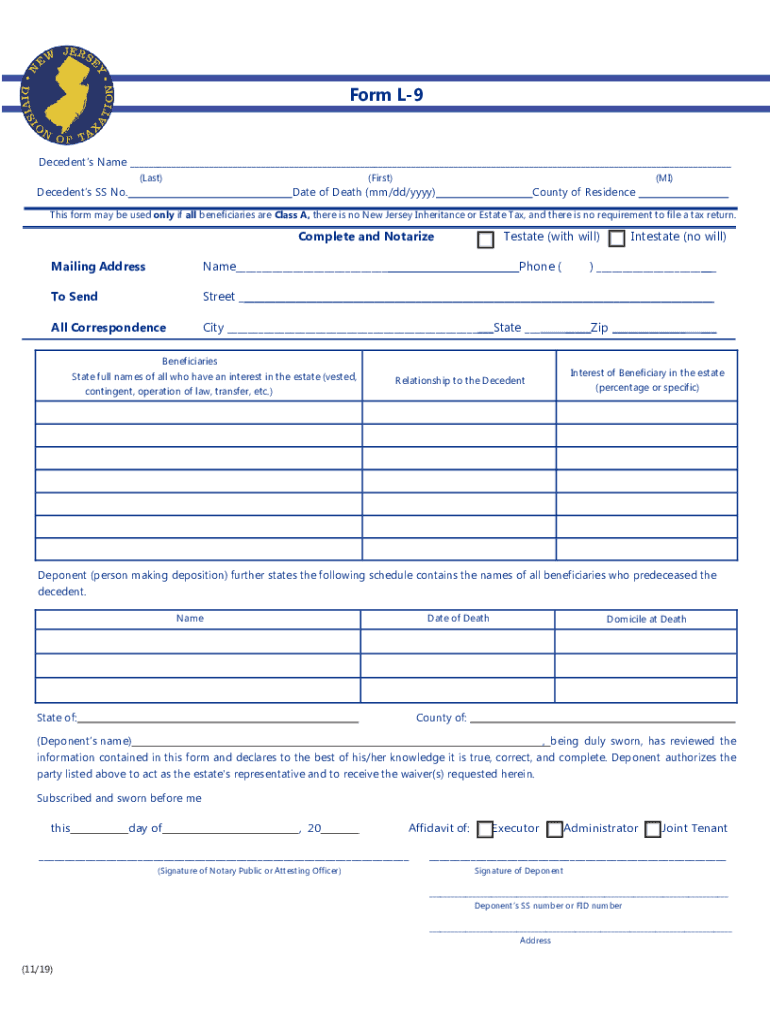

L 9 Form Fill Out and Sign Printable PDF Template signNow

Or on schedule a, part 2, line 23 and continue with section b. Begin form 500 at section a, line 1. Web form 500 computation of the 2021 post allocation net operating loss (nol) and prior net operating loss conversion carryover (pnol) deductions (see instructions) does the taxpayer have any prior net operating loss conversion carryovers? Pnol/nol merger/acquisition certificate in.

2011 Form NJ DoR NJREG Fill Online, Printable, Fillable, Blank pdfFiller

Web this package contains form 500 which will be used to compute the current return period’snol deduction. Or on schedule a, part 2, line 23 and continue with section b. Web employers payroll tax forms employer payroll tax forms. Use this option to fill in and electronically file the following form (s): Tax credit for employers of employees with impairments:

Web Employer Payroll Tax Electronic Filing And Reporting Options.

Return number return name type year; 2002, c.40 (business tax reform act) disallows net operating loss deductions for privilege periods beginning during calendar years 2002 and 2003. Web new jersey general information this package contains form 500 which will be used to compute the current return period’s nol deduction. Web this package contains form 500 which will be used to compute the current return period’snol deduction.

Tax Credit For Employers Of Employees With Impairments:

Or on schedule a, part 2, line 23 and continue with section b. Begin form 500 at section a, line 1. You can print other new jersey tax forms here. Prior net operating loss conversion worksheet:

New Jersey Gross Income Tax Instruction Booklet And Samples For Employers, Payors Of Pension And Annuity Income And Payors Of Gambling Winnings.

Web we last updated the 2015 net operating loss deduction in february 2023, so this is the latest version of form 500, fully updated for tax year 2022. Web form 500 computation of the 2021 post allocation net operating loss (nol) and prior net operating loss conversion carryover (pnol) deductions (see instructions) does the taxpayer have any prior net operating loss conversion carryovers? Web employers payroll tax forms employer payroll tax forms. Computation of the available converted net operating loss:

2002, C.40 (Business Tax Reform Act) Disallows Net Operating Loss Deductions Forprivilege Periods Beginning During Calendar Years 2002 And 2003.

Pnol/nol merger/acquisition certificate in cases of regulatory delay: Use this option to fill in and electronically file the following form (s):