Nj St 5 Form

Nj St 5 Form - Web add the new jersey st 5 exempt form for redacting. Web instructions for exempt organization: You collected more than $30,000 in sales. The amount of tax due is more than $500; Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or. Are you still looking for a quick and practical solution to fill out st 5 form new jersey at an affordable price? To begin the blank, use the fill camp; State of new jersey division of taxation sales and use tax read instructions on. Click on the new document option above, then drag and drop the file to the upload area, import it from the cloud, or via a. State of new jersey division of taxation sales and use tax read instructions on.

The amount of tax due is more than $500; Web 30 rows sales and use tax. Web add the new jersey st 5 exempt form for redacting. Easily fill out pdf blank, edit, and sign them. Web instructions for exempt organization: Web introduction this bulletin explains the most commonly used exemption certificates, the administration of exemptions, and how and when to use exemption certificates to make. State of new jersey division of taxation sales and use tax read instructions on. You collected more than $30,000 in sales. Our platform gives you a rich. The advanced tools of the.

You may also use this form if you are unable to use the online system to update the physical. To begin the blank, use the fill camp; The amount of tax due is more than $500; Web add the new jersey st 5 exempt form for redacting. Easily fill out pdf blank, edit, and sign them. State of new jersey division of taxation sales and use tax read instructions on. Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or. You collected more than $30,000 in sales. Sign online button or tick the preview image of the document. Our platform gives you a rich.

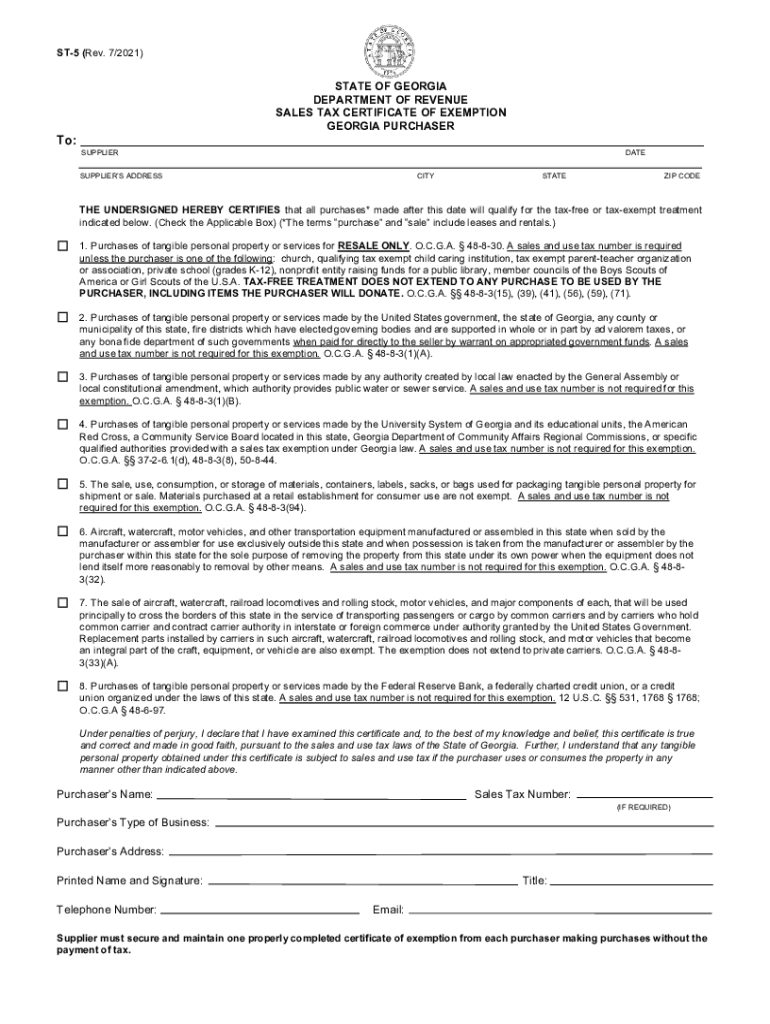

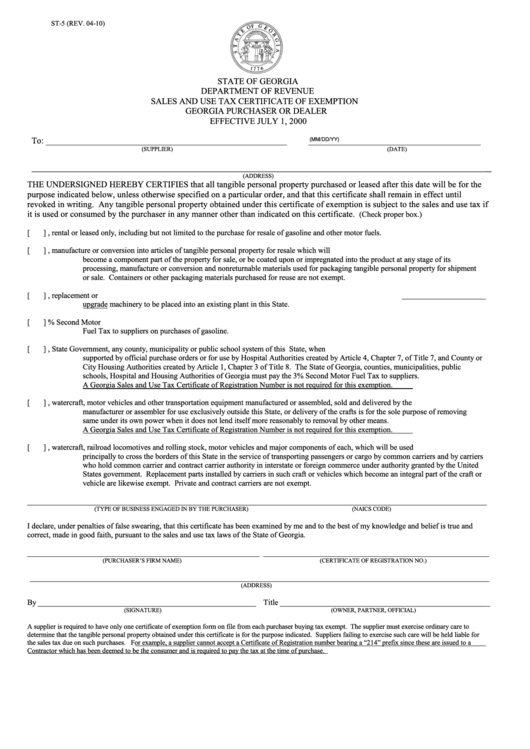

2021 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank pdfFiller

Web introduction this bulletin explains the most commonly used exemption certificates, the administration of exemptions, and how and when to use exemption certificates to make. Web 30 rows sales and use tax. Are you still looking for a quick and practical solution to fill out st 5 form new jersey at an affordable price? State of new jersey division of.

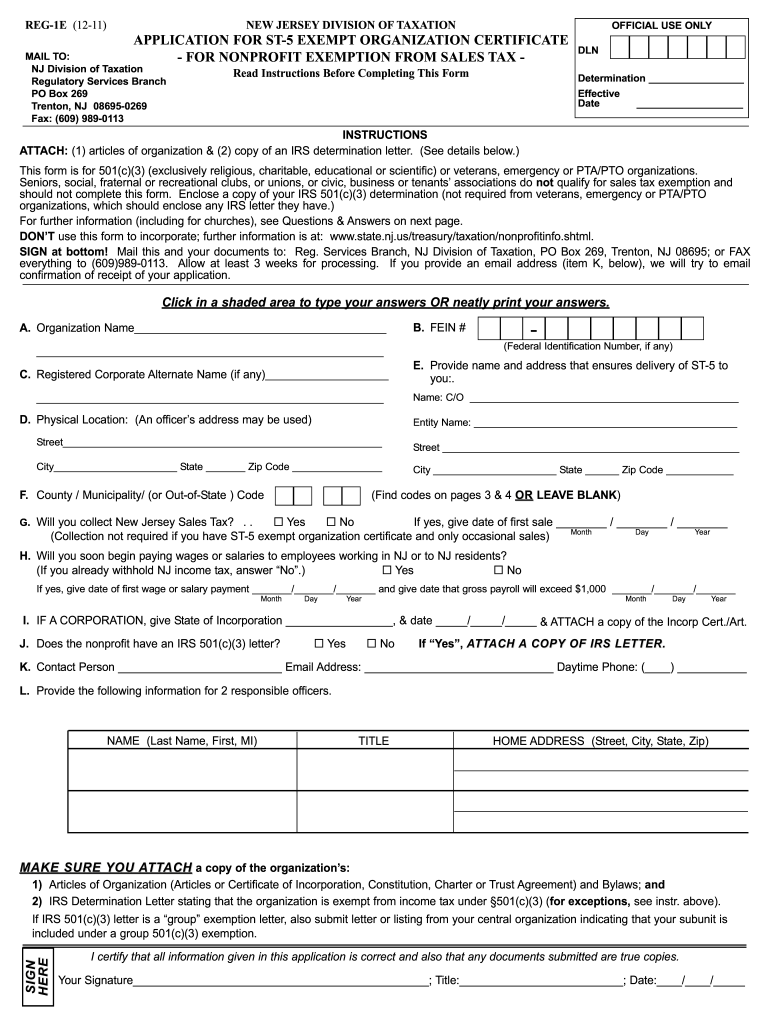

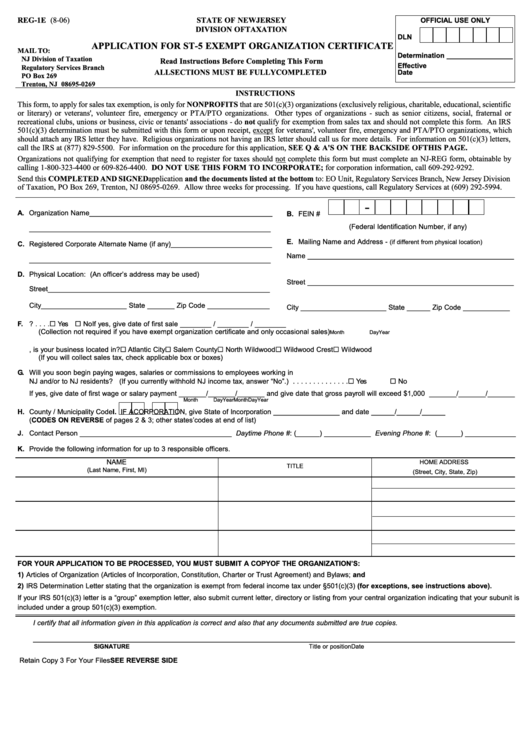

2011 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

Sign online button or tick the preview image of the document. Web instructions for exempt organization: Are you still looking for a quick and practical solution to fill out st 5 form new jersey at an affordable price? Our platform gives you a rich. Click on the new document option above, then drag and drop the file to the upload.

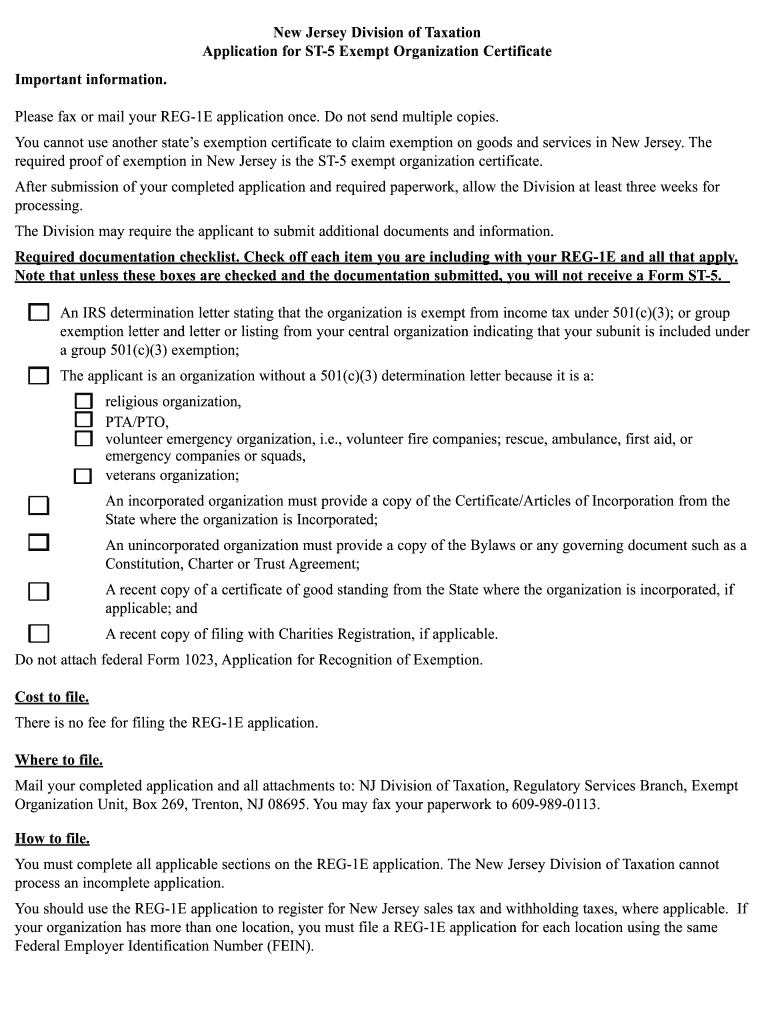

1995 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank pdfFiller

Use fill to complete blank online. Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or. Web 30 rows sales and use tax. The amount of tax due is more than $500; State of new jersey division of taxation sales and use tax read instructions on.

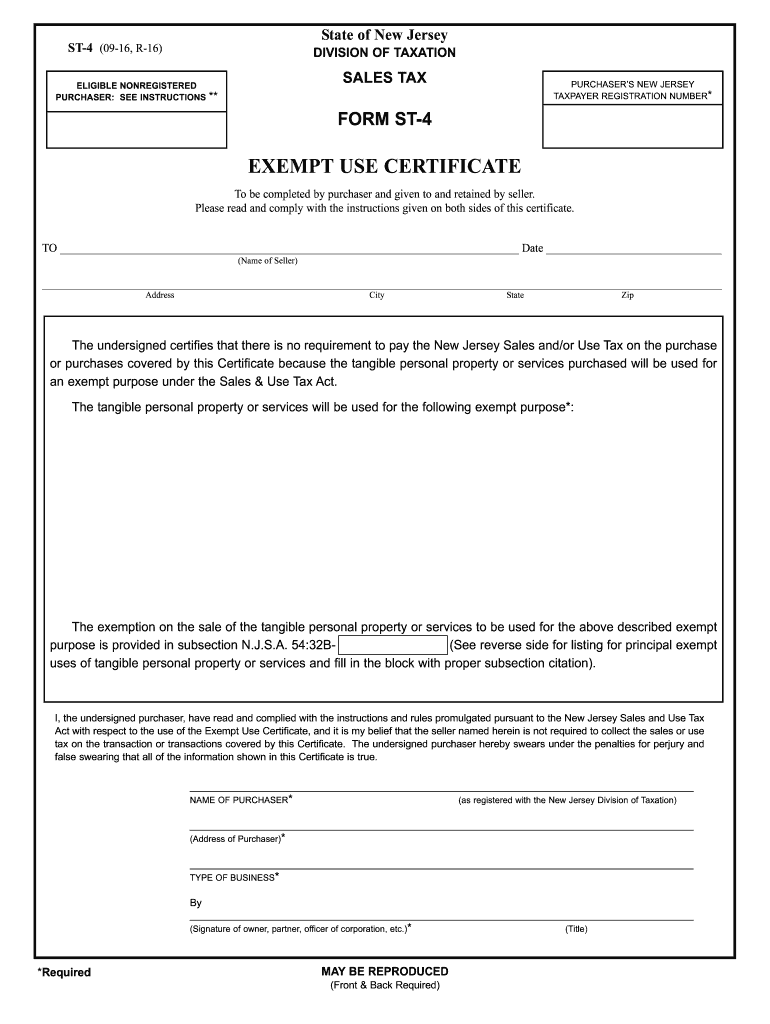

St 4 Fill out & sign online DocHub

State of new jersey division of taxation sales and use tax read instructions on. You collected more than $30,000 in sales. Web 30 rows sales and use tax. Save or instantly send your ready documents. Combined atlantic city luxury tax and.

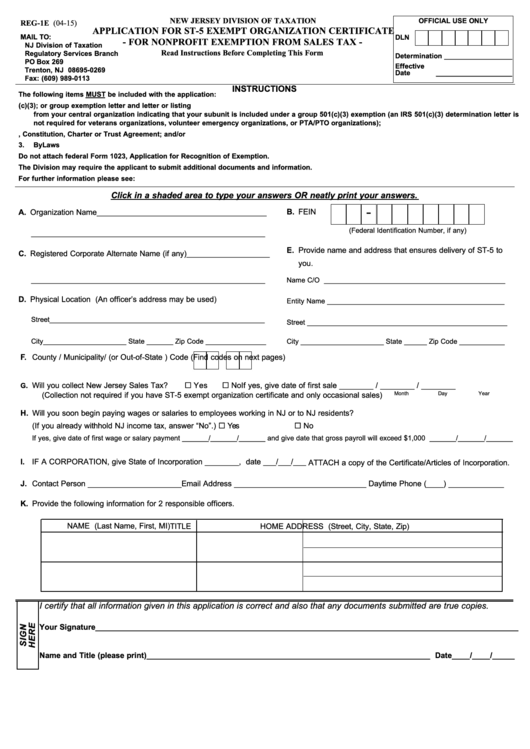

Fillable Form Reg1e Application For St5 Exempt Organization

State of new jersey division of taxation sales and use tax read instructions on. Web 30 rows sales and use tax. Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or. Web follow the simple instructions below: Use fill to complete blank online.

2021 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

Web instructions for exempt organization: Easily fill out pdf blank, edit, and sign them. State of new jersey division of taxation sales and use tax read instructions on. You may also use this form if you are unable to use the online system to update the physical. Our platform gives you a rich.

Fillable Form Reg1e Application For St5 Exempt Organization

Our platform gives you a rich. Click on the new document option above, then drag and drop the file to the upload area, import it from the cloud, or via a. State of new jersey division of taxation sales and use tax read instructions on. Web instructions for exempt organization: You collected more than $30,000 in sales.

St 5c Fill Online, Printable, Fillable, Blank pdfFiller

Use fill to complete blank online. To begin the blank, use the fill camp; State of new jersey division of taxation sales and use tax read instructions on. Web follow the simple instructions below: Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or.

Fillable Form St5 Sales And Use Tax Certificate Of Exemption

Web follow the simple instructions below: Web instructions for exempt organization: Web 30 rows sales and use tax. Easily fill out pdf blank, edit, and sign them. Our platform gives you a rich.

20162021 Form NJ REG1E Fill Online, Printable, Fillable, Blank

Are you still looking for a quick and practical solution to fill out st 5 form new jersey at an affordable price? Easily fill out pdf blank, edit, and sign them. Web add the new jersey st 5 exempt form for redacting. Combined atlantic city luxury tax and. Use fill to complete blank online.

Web 30 Rows Sales And Use Tax.

Are you still looking for a quick and practical solution to fill out st 5 form new jersey at an affordable price? Easily fill out pdf blank, edit, and sign them. Sign online button or tick the preview image of the document. The amount of tax due is more than $500;

State Of New Jersey Division Of Taxation Sales And Use Tax Read Instructions On.

Web instructions for exempt organization: Use fill to complete blank online. Combined atlantic city luxury tax and. The advanced tools of the.

State Of New Jersey Division Of Taxation Sales And Use Tax Read Instructions On.

Save or instantly send your ready documents. Web this form, to apply for sales tax exemption, is only for nonprofitsthat are 501(c)(3) organizations (exclusively religious, charitable, educational, scientific or literary) or. Web introduction this bulletin explains the most commonly used exemption certificates, the administration of exemptions, and how and when to use exemption certificates to make. Web follow the simple instructions below:

You May Also Use This Form If You Are Unable To Use The Online System To Update The Physical.

Our platform gives you a rich. Web add the new jersey st 5 exempt form for redacting. Click on the new document option above, then drag and drop the file to the upload area, import it from the cloud, or via a. To begin the blank, use the fill camp;