Ny Form It-2104

Ny Form It-2104 - Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Certificate of exemption from withholding. Employers are often unsure if they. Web employee's withholding allowance certificate. Every employee must pay federal and state taxes, unless you’re in a state that. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Start with the worksheet one of the aspects of. Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. Web that is the question. First name and middle initial last name your social security number permanent home address (number.

Every employee must pay federal and state taxes, unless you’re in a state that. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web employee’s form it‑2104‑e to: Web that is the question. Employers are often unsure if they. Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. First name and middle initial last name your social security number permanent home address (number. Web 8 rows employee's withholding allowance certificate. Certificate of exemption from withholding. Start with the worksheet one of the aspects of.

Employers are often unsure if they. Web that is the question. Every employee must pay federal and state taxes, unless you’re in a state that. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Who should file this form. First name and middle initial last name your social security number permanent home address (number. Certificate of exemption from withholding. Web 8 rows employee's withholding allowance certificate. Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. Start with the worksheet one of the aspects of.

Cornell Cooperative Extension Required Paperwork for New Employees

Web employee’s form it‑2104‑e to: Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. Every employee must pay federal and state taxes, unless you’re in a state that. Web most taxpayers are required to file a.

Employee Archives Page 2 of 15 PDFSimpli

Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Employers are often unsure if they. Web 8 rows employee's withholding allowance certificate. Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form.

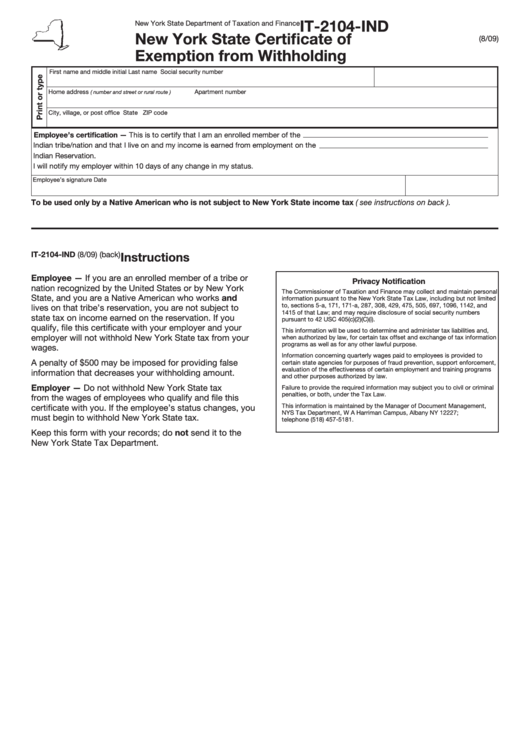

Fillable Form It2104Ind New York State Certificate Of Exemption

Web employee's withholding allowance certificate. Web employee’s form it‑2104‑e to: Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. Web 8 rows employee's withholding allowance certificate. First name and middle initial last name your social security.

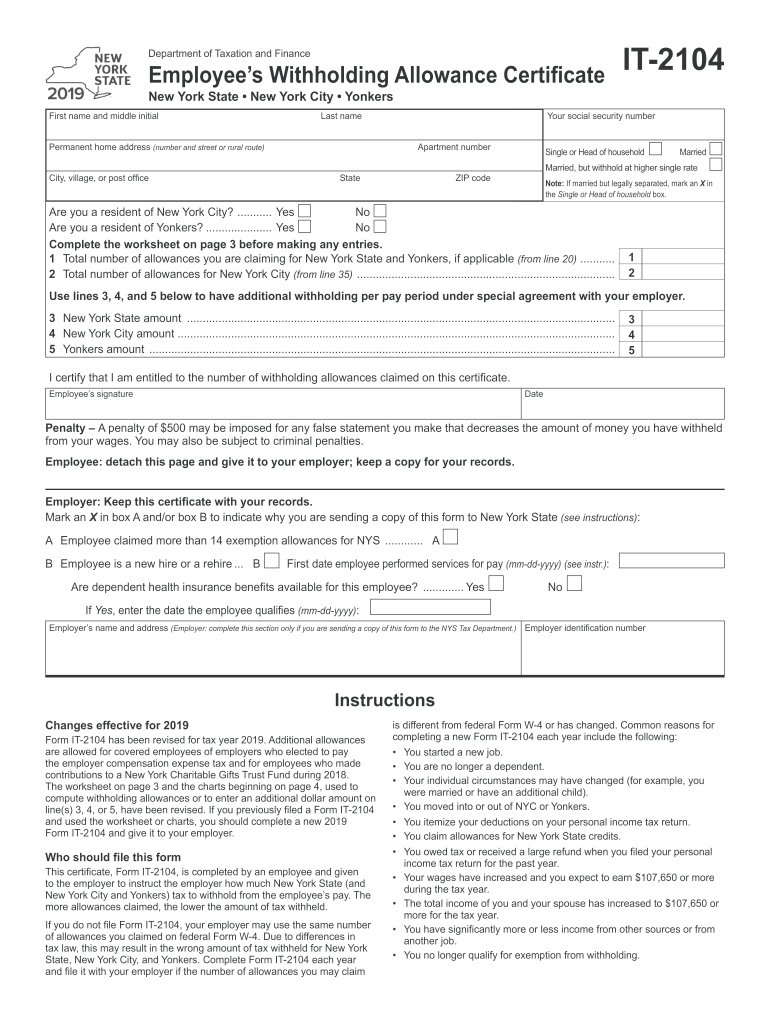

2019 nys Fill out & sign online DocHub

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Certificate of exemption from withholding. Web employee’s form it‑2104‑e to: Who should file this form. Employers are often unsure if they.

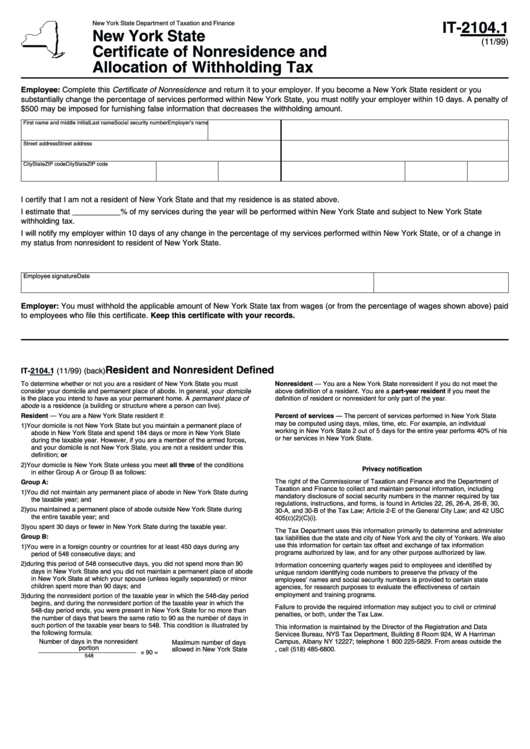

Fillable Form It2104.1 Certificate Of Nonresidence And Allocation Of

Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Start with the worksheet one of the aspects of. Every employee must pay federal and state taxes, unless you’re in a state that. Web employee's withholding allowance certificate. Web that is the question.

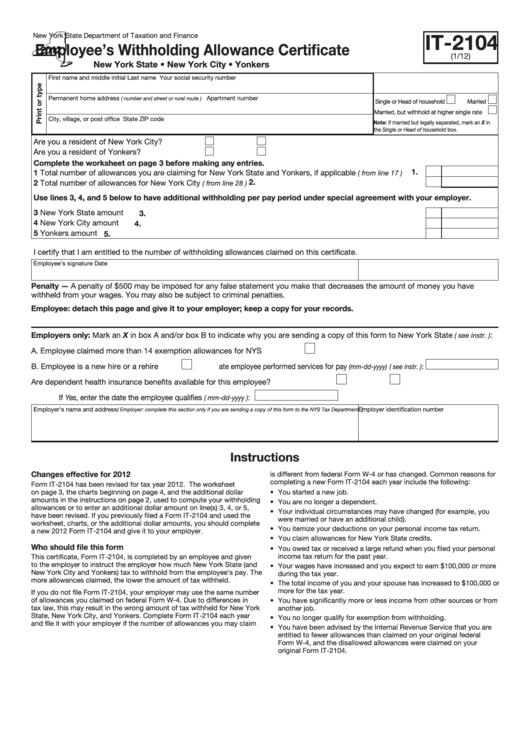

Fillable Form It2104 Employee'S Withholding Allowance Certificate

Who should file this form. Web if you receive an annuity or pension payment that must be included in your new york adjusted gross income, you may file this form to have new york state income tax (and,. Web employee's withholding allowance certificate. Web tax law, this may result in the wrong amount of tax withheld for new york state,.

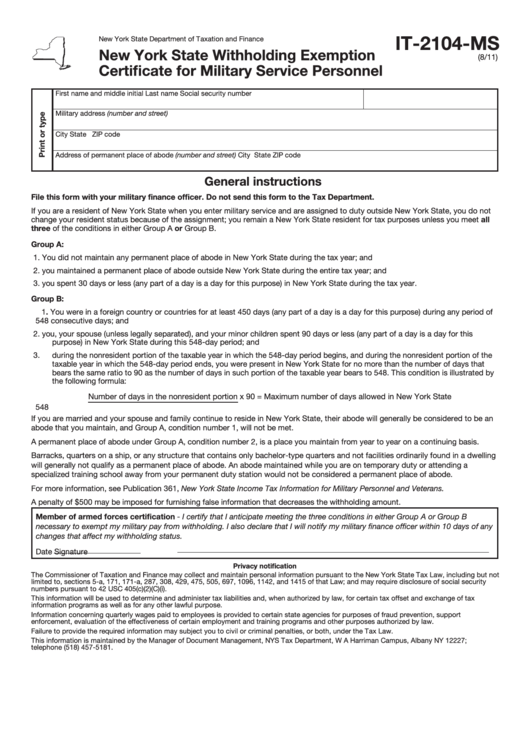

Fillable Form It2104Ms New York State Withholding Exemption

Start with the worksheet one of the aspects of. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. First name and middle initial last name your social security number permanent home address (number. Web most taxpayers are required to file a yearly income tax return in april.

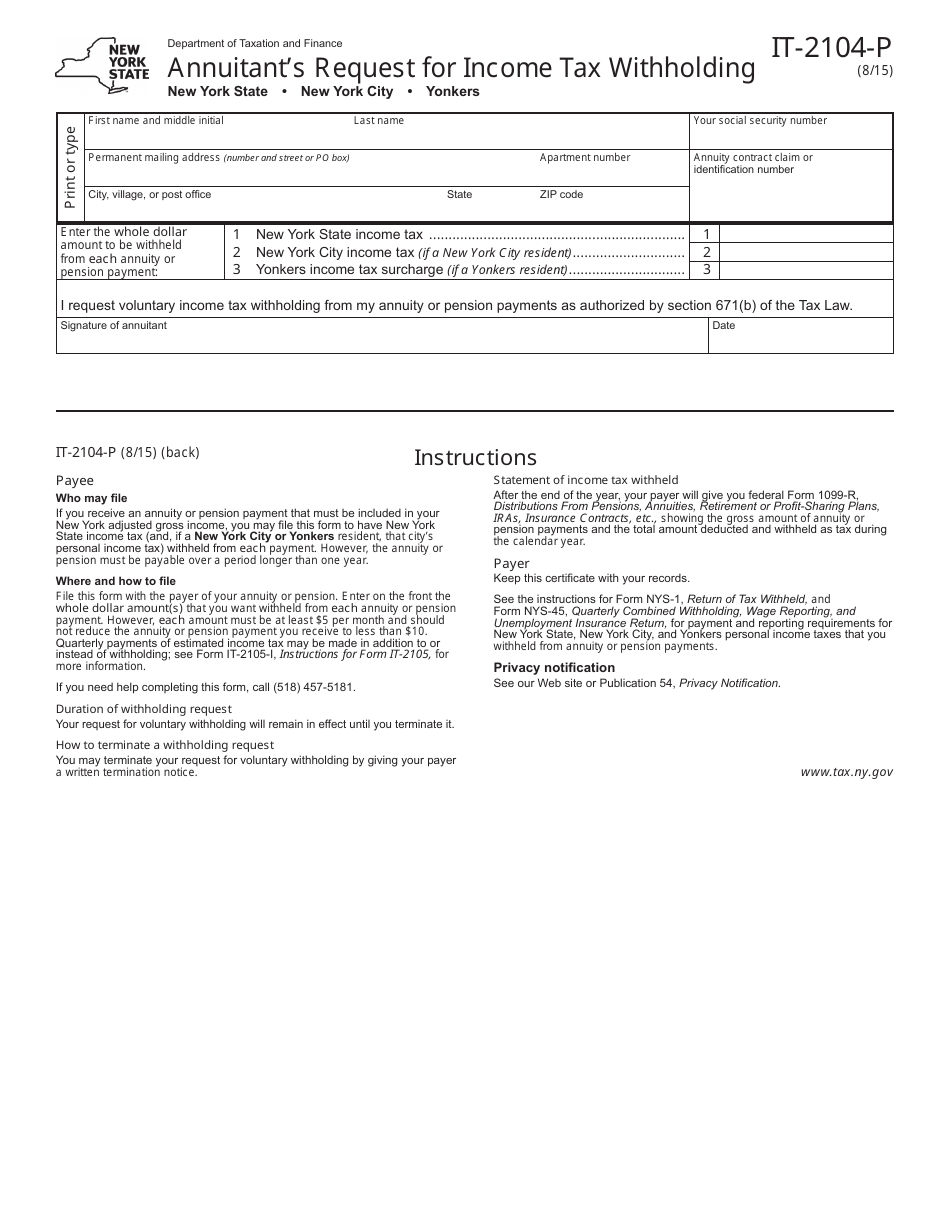

Form IT2104P Download Fillable PDF or Fill Online Annuitant's Request

Web 8 rows employee's withholding allowance certificate. Certificate of exemption from withholding. Employers are often unsure if they. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web employee’s form it‑2104‑e to:

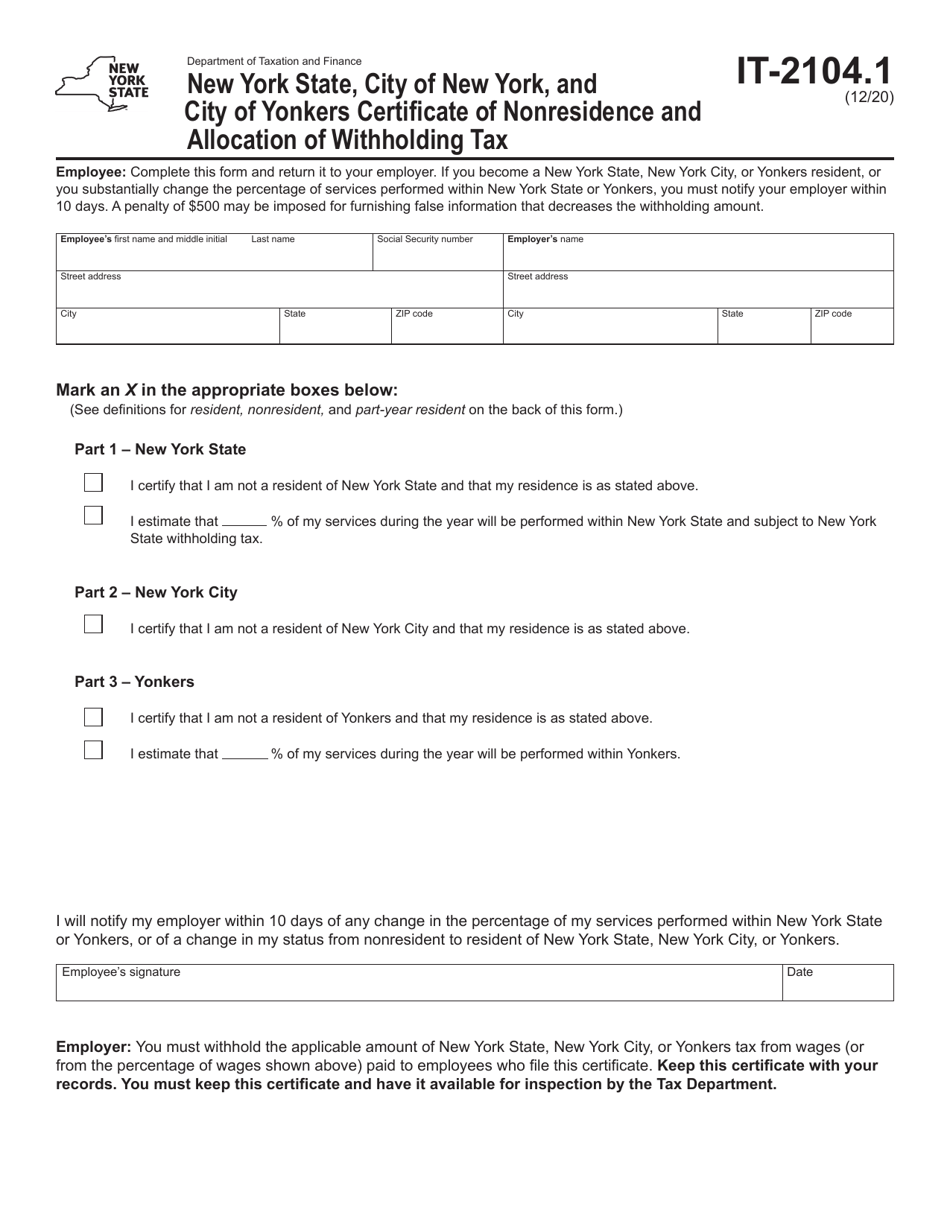

Form IT2104.1 Download Fillable PDF or Fill Online New York State

Certificate of exemption from withholding. Every employee must pay federal and state taxes, unless you’re in a state that. Web employee's withholding allowance certificate. Web that is the question. Web 8 rows employee's withholding allowance certificate.

Download NY IT2104 Employee's Withholding Allowance Form for Free

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Certificate of exemption from withholding. Web employee's withholding allowance certificate. Start with the worksheet one of the aspects of. Web if you receive an annuity or pension payment.

Web Employee’s Form It‑2104‑E To:

Every employee must pay federal and state taxes, unless you’re in a state that. Employers are often unsure if they. Certificate of exemption from withholding. Web employee's withholding allowance certificate.

First Name And Middle Initial Last Name Your Social Security Number Permanent Home Address (Number.

Start with the worksheet one of the aspects of. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web 8 rows employee's withholding allowance certificate.

Web If You Receive An Annuity Or Pension Payment That Must Be Included In Your New York Adjusted Gross Income, You May File This Form To Have New York State Income Tax (And,.

Web that is the question. Who should file this form.