Ohio Form 4738 Instructions

Ohio Form 4738 Instructions - Web ohio pass through entity tax 4738 addenda record format instructions ach credit method please provide this information to. If the user would like to pay the estimated tax based on the 3% rate, they will need to enter it in the. The pte can elect to file the it 4708, the it 4738 or the it. For taxable year 2022, the due date for filing is april 18, 2023. Web the tax rate for 2023 it 4738 will change from 5% to 3%. Senate bill 246 was passed by the general assembly and signed. It 4738 formalizes and strengthens the salt cap workaround. In june of 2022, am. 246 was passed by the general assembly. Web here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends.

2) the universal payment coupon (upc) for the it. Web reduces form instructions from 15 pages to 8 pages; Web ohio department of natural resources Web update regarding ohio’s pte tax for electing entities (form it 4738) new updates as of september 23, 2022. Web here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. The pte can elect to file the it 4708, the it 4738 or the it. It 4738 formalizes and strengthens the salt cap workaround. If the amount on a line is. Repeal hb 6 of 133rd ga and revive prior. Web the ohio department of taxation (odt) recently published guidance to help taxpayers make this election.

If the amount on a line is. Previously in ohio, entities may have taken composite taxes. Web update regarding ohio’s pte tax for electing entities (form it 4738) new updates as of january 20, 2023. Facts to know when the entity elects to file the it 4738: The pte can elect to file the it 4708, the it 4738 or the it. 2) the universal payment coupon (upc) for the it. Repeal hb 6 of 133rd ga and revive prior. Web the tax rate for 2023 it 4738 will change from 5% to 3%. For taxable year 2022, the due date for filing is april 18, 2023. Summary documents status votes committee activity return to search.

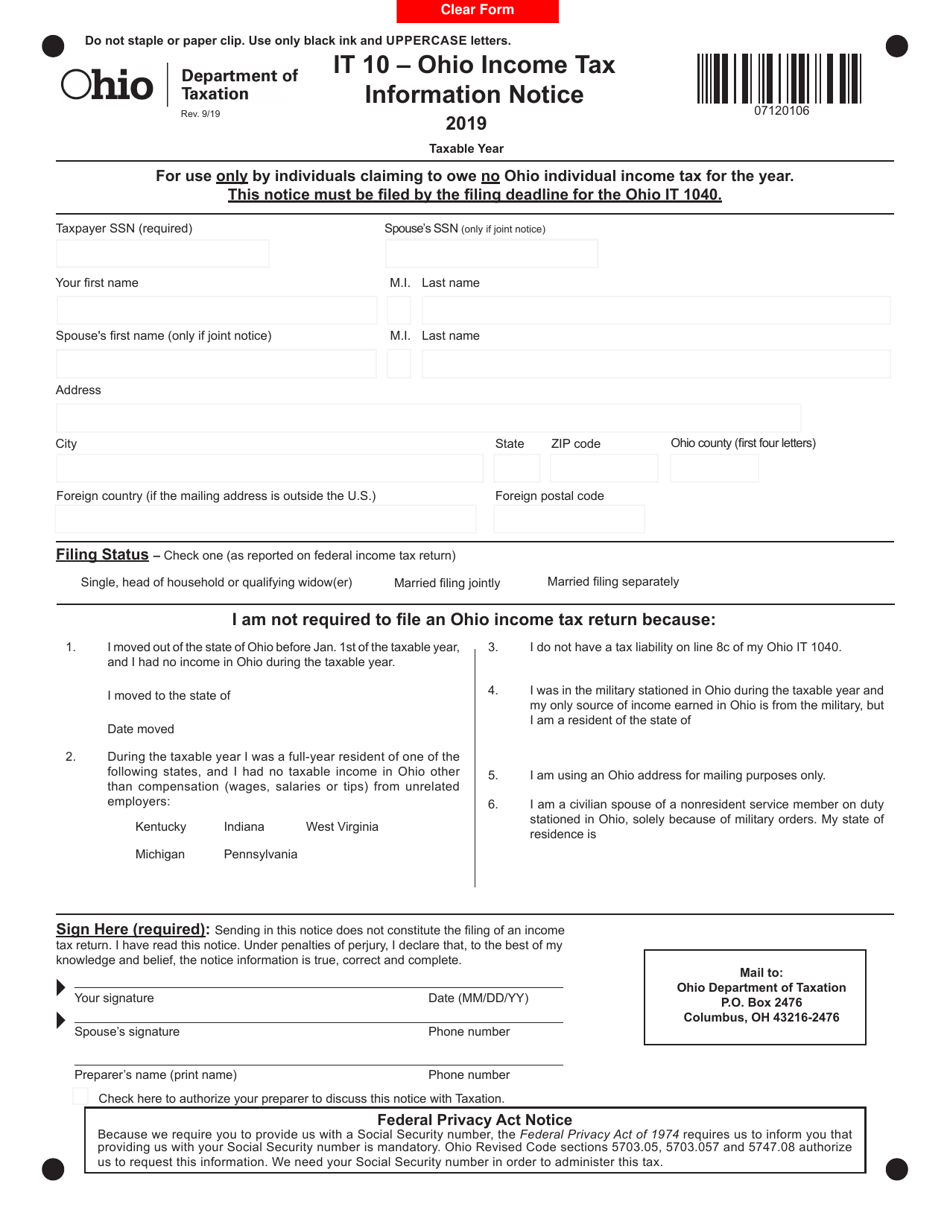

Form IT10 Download Fillable PDF or Fill Online Ohio Tax

Repeal hb 6 of 133rd ga and revive prior. Web the information includes: The pte can elect to file the it 4708, the it 4738 or the it. Web update regarding ohio’s pte tax for electing entities (form it 4738) new updates as of september 23, 2022. Web here’s how you know the due date for filing the it 4738.

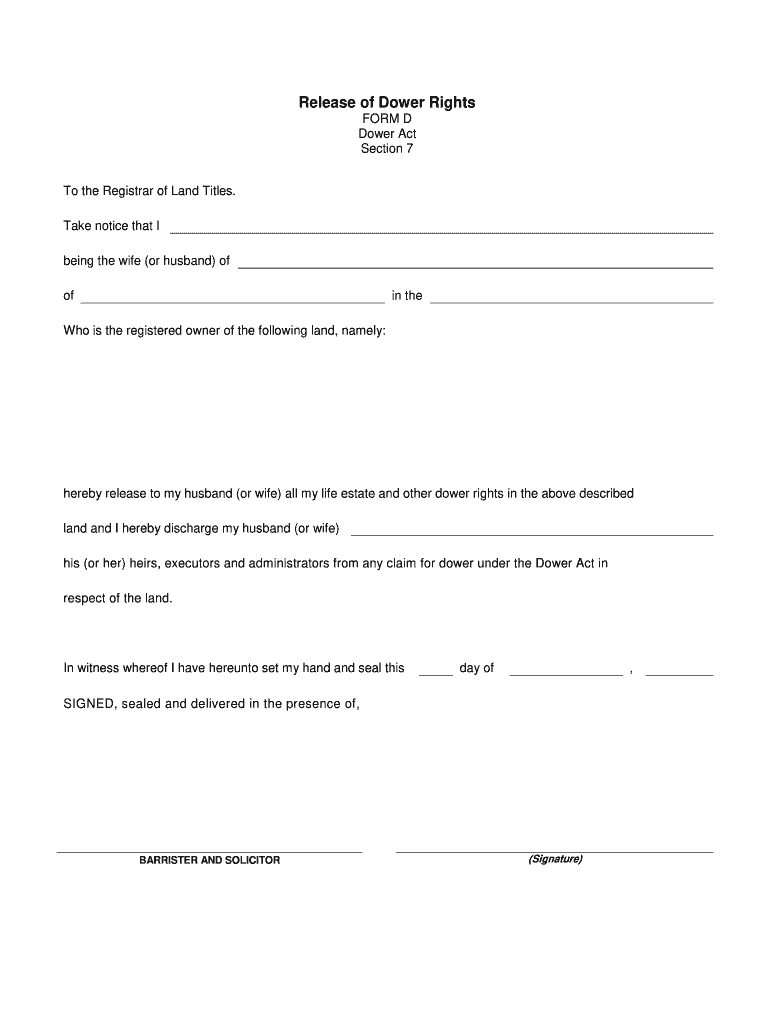

Ohio Dower Release 20202021 Fill and Sign Printable Template Online

Repeal hb 6 of 133rd ga and revive prior. Web the tax rate for 2023 it 4738 will change from 5% to 3%. Web the ohio department of taxation (odt) recently published guidance to help taxpayers make this election. The idea behind it 4738 is not new. Web here’s how you know the due date for filing the it 4738.

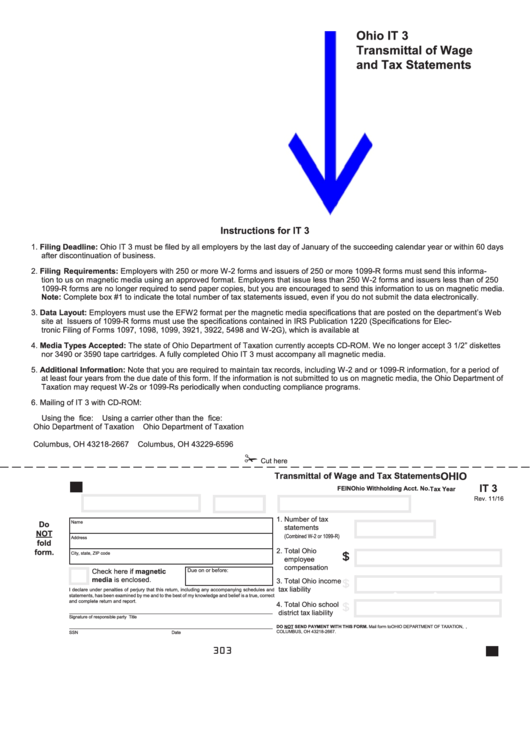

Ohio Form It 3 Transmittal Of Wage And Tax Statements printable pdf

Web update regarding ohio’s pte tax for electing entities (form it 4738) new updates as of september 23, 2022. The idea behind it 4738 is not new. The pte can elect to file the it 4708, the it 4738 or the it. Web the information includes: Web a pte must file an ohio return to report and pay tax on.

Form Order Ohio Fill Online, Printable, Fillable, Blank pdfFiller

Previously in ohio, entities may have taken composite taxes. For taxable year 2022, the due date for filing is april 18, 2023. Web the tos no longer requires pte and fiduciary filers to submit an eft authorization form to register before making an it 4708, it 1140, it 4738 or it 1041 payment via ach credit. Web the ohio department.

Ohio Prevailing Wage Form Fillable Fill Online, Printable, Fillable

Web ohio pass through entity tax 4738 addenda record format instructions ach credit method please provide this information to. Summary documents status votes committee activity return to search. Web the tos no longer requires pte and fiduciary filers to submit an eft authorization form to register before making an it 4708, it 1140, it 4738 or it 1041 payment via.

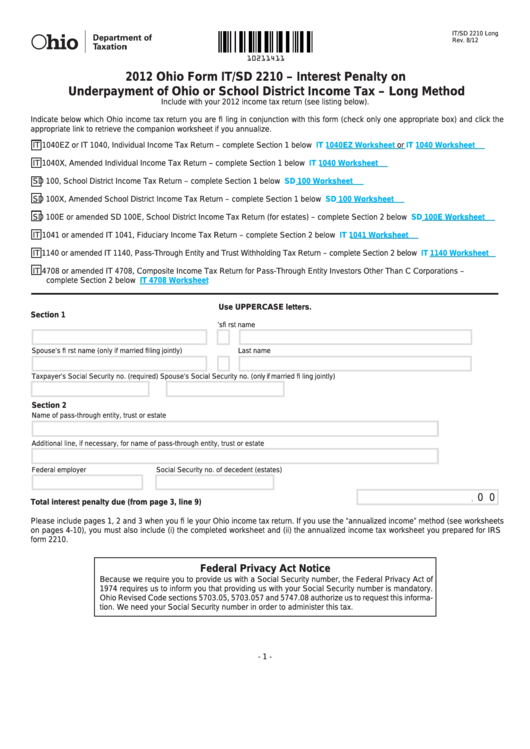

Fillable Ohio Form It/sd 2210 Interest Penalty On Underpayment Of

For taxable year 2022, the due date for filing is april 18, 2023. 246 was passed by the general assembly. Web the information includes: The pte can elect to file the it 4708, the it 4738 or the it. Web ohio department of natural resources

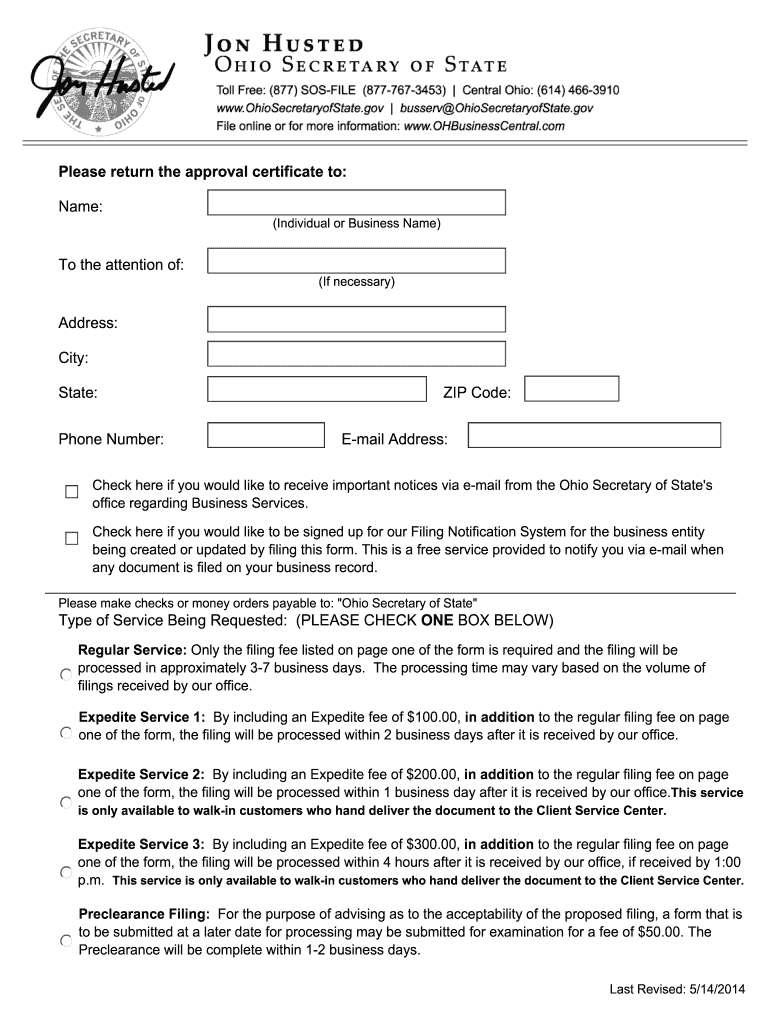

2014 OH Form 521 Fill Online, Printable, Fillable, Blank pdfFiller

The election is made by the. Web ohio pass through entity tax 4738 addenda record format instructions ach credit method please provide this information to. Web here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. 246 was passed by the general assembly. Repeal hb.

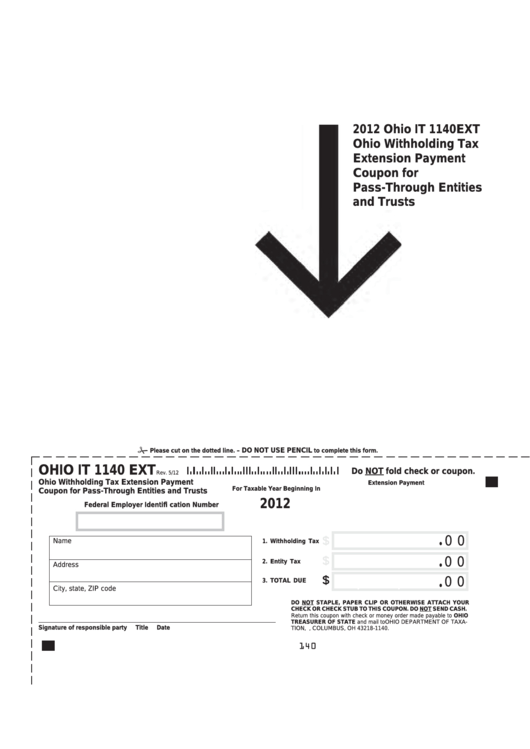

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

Web the guidance includes a final version of the new it 4738 form and instructions, a new payment coupon, and currently a total of 35 faqs. Web pte tax form (it 4738) for taxable year 2022, instructions, faqs and related information. The idea behind it 4738 is not new. If the user would like to pay the estimated tax based.

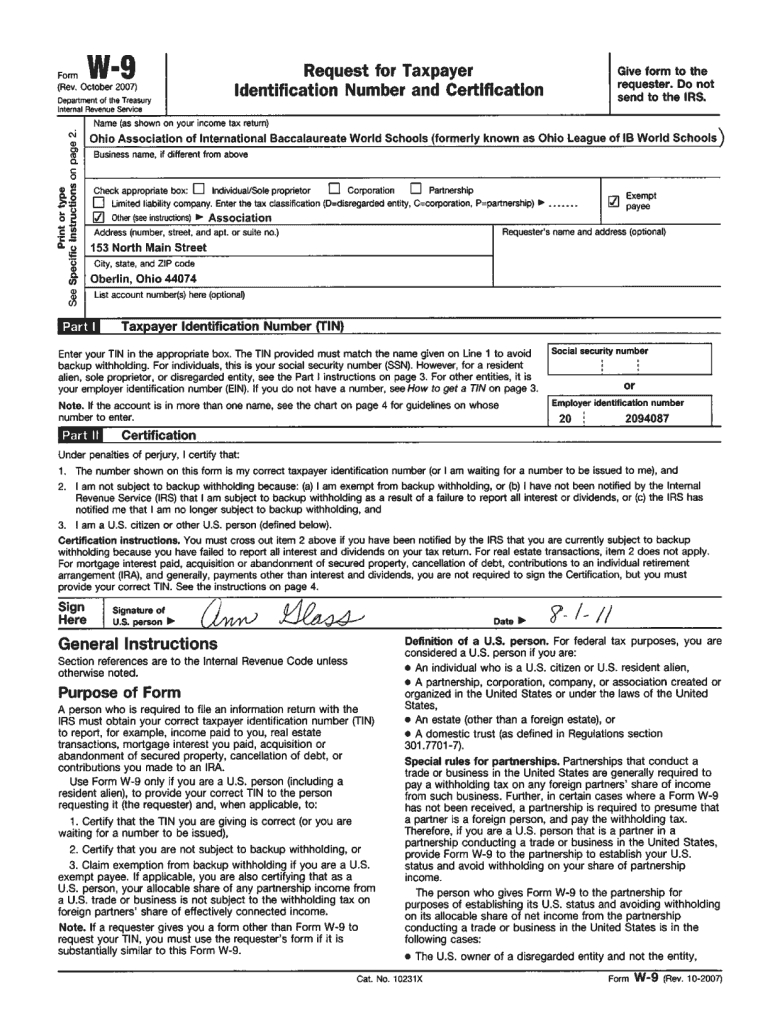

Printable W9 Tax Form 2021 Example Calendar Printable

Web the information includes: Web ohio pass through entity tax 4738 addenda record format instructions ach credit method please provide this information to. Web the guidance includes a final version of the new it 4738 form and instructions, a new payment coupon, and currently a total of 35 faqs. It 4738 formalizes and strengthens the salt cap workaround. 1) the.

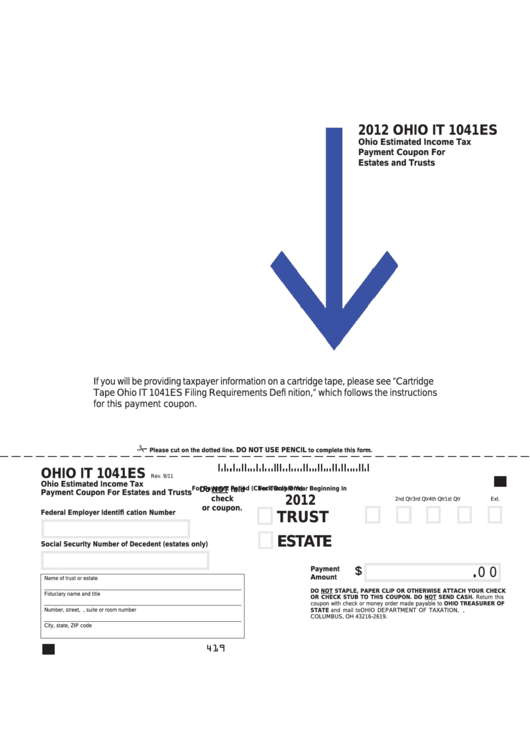

Fillable Ohio Form It 1041es Ohio Estimated Tax Payment Coupon

The idea behind it 4738 is not new. Web the tax rate for 2023 it 4738 will change from 5% to 3%. Web a pte must file an ohio return to report and pay tax on behalf of its nonresident individual, trust, and pte investors. In june of 2022, am. Repeal hb 6 of 133rd ga and revive prior.

Web The Ohio Department Of Taxation (Odt) Recently Published Guidance To Help Taxpayers Make This Election.

If the user would like to pay the estimated tax based on the 3% rate, they will need to enter it in the. In june of 2022, am. Web the tax rate for 2023 it 4738 will change from 5% to 3%. Web the guidance includes a final version of the new it 4738 form and instructions, a new payment coupon, and currently a total of 35 faqs.

The Election Is Made By The.

Web update regarding ohio’s pte tax for electing entities (form it 4738) new updates as of january 20, 2023. It 4738 formalizes and strengthens the salt cap workaround. Web the information includes: If the amount on a line is.

Previously In Ohio, Entities May Have Taken Composite Taxes.

246 was passed by the general assembly. The pte can elect to file the it 4708, the it 4738 or the it. Web the application for a license for a motor vehicle salvage dealer, a salvage motor vehicle auction, or salvage motor vehicle pool, in addition to other information as. Web the tos no longer requires pte and fiduciary filers to submit an eft authorization form to register before making an it 4708, it 1140, it 4738 or it 1041 payment via ach credit.

For Taxable Year 2022, The Due Date For Filing Is April 18, 2023.

Senate bill 246 was passed by the general assembly and signed. Summary documents status votes committee activity return to search. Web here’s how you know the due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Repeal hb 6 of 133rd ga and revive prior.