Ohio State Withholding Form 2023

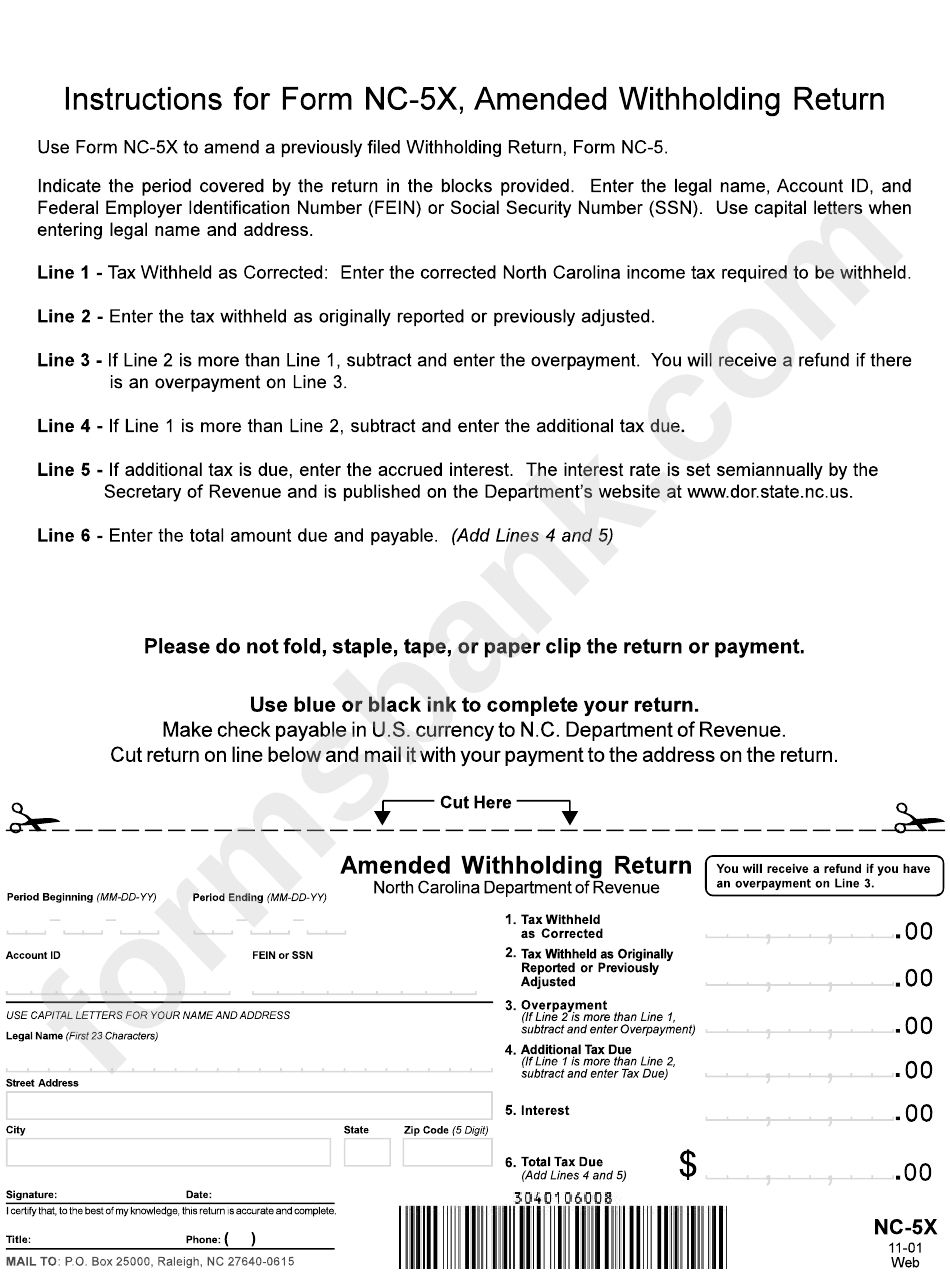

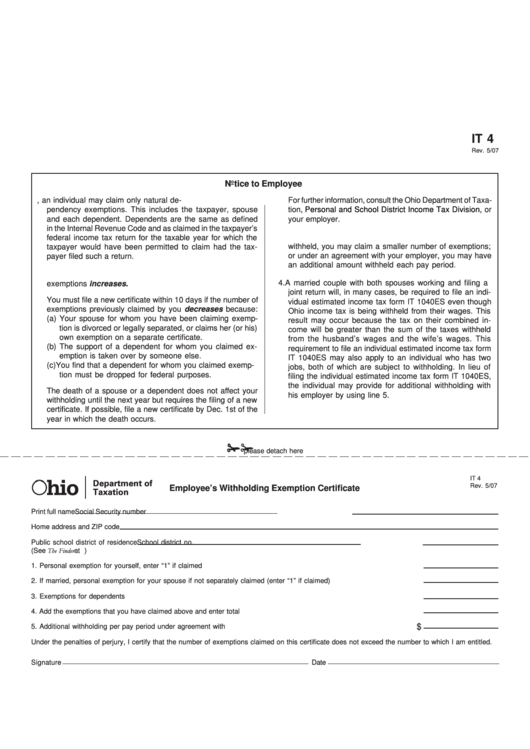

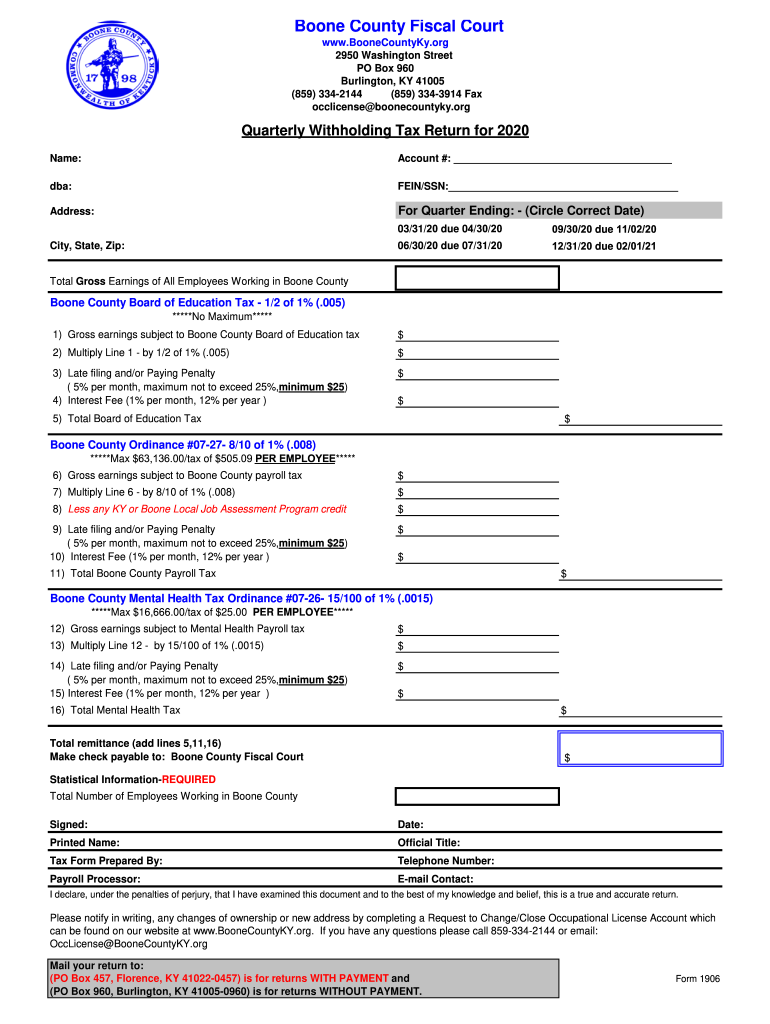

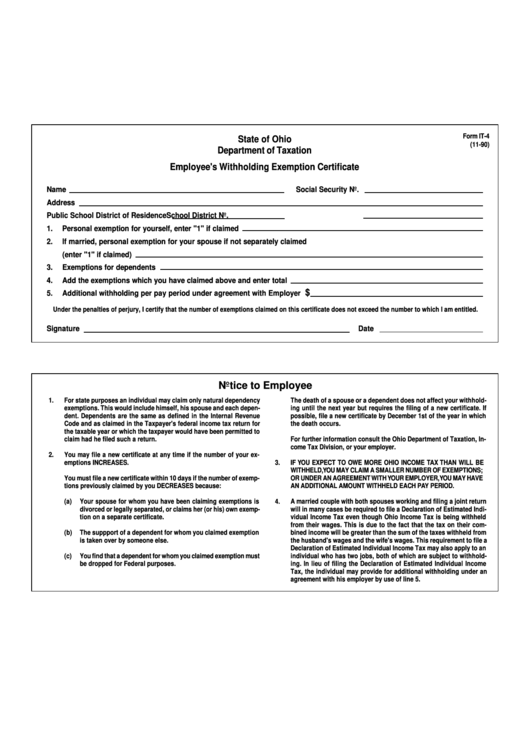

Ohio State Withholding Form 2023 - Estimated payments are made quarterly according to the following schedule: Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. Most forms are available for download and some can be. Is this form sent to the ohio department of taxation? The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Updated school district income tax rates effective january 1, 2022 (pdf) 12/17/2021. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): 2 what is the ohio it 4? 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation.

Web more details on employer withholding are available below. Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. 5 i am an ohio employer and i have an. Access the forms you need to file taxes or do business in ohio. Make check or money order to: Updated school district income tax rates effective january 1, 2022 (pdf) 12/17/2021. 2 what is the ohio it 4? Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment.

Make check or money order to: Request a state of ohio income tax form be mailed to you. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Is this form sent to the ohio department of taxation? Web department of taxation employee’s withholding exemption certificate it 4 rev. Ohio withholding filing reminder (pdf) 02/25/2022. 3 when is an employee required to complete a new ohio it 4? If applicable, your employer will also withhold school district income tax. Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes.

Ohio State Tax Rates INVOMECA

Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Make check or money order to: Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes..

Ohio New Hire Reporting Form 2023 Pdf

Web more details on employer withholding are available below. Request a state of ohio income tax form be mailed to you. Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): 12/20 submit form it 4 to your employer on or before the start date of employment so.

Ms State Withholding Form 2022

Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. 5 i am an ohio employer and i have an. Web department of taxation employee’s withholding exemption certificate it 4 rev. If applicable, your employer will also withhold school district income.

Fillable Heap Form Printable Forms Free Online

Make check or money order to: 3 when is an employee required to complete a new ohio it 4? 5 i am an ohio employer and i have an. Web department of taxation employee’s withholding exemption certificate it 4 rev. If applicable, your employer will also withhold school district income tax.

Ohio hotel tax exempt form Fill out & sign online DocHub

12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): 2 what is the ohio it 4? Estimated payments are made quarterly according to the following schedule: Most.

Ky Quarterly Tax Fill Out and Sign Printable PDF Template signNow

12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form):.

Arkansas Employee Tax Withholding Form 2023

Most forms are available for download and some can be. 5 i am an ohio employer and i have an. 4 can an employee increase the amount of ohio tax withholding? Web more details on employer withholding are available below. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on.

State Tax Withholding Certificate Triply

Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. 2 what is the ohio it 4? Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Ohio withholding filing reminder (pdf) 02/25/2022. Web department of taxation employee’s withholding exemption certificate it 4 rev.

Top Ohio Withholding Form Templates free to download in PDF format

Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022. Most forms are available for download and some can be. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web department of taxation employee’s withholding exemption certificate it 4 rev. If.

2022 Ohio State Withholding Form

If applicable, your employer will also withhold school district income tax. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Estimated payments are made quarterly according to the following schedule: Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022.

Web More Details On Employer Withholding Are Available Below.

1 where do i find paper employer withholding and school district withholding tax forms? The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Estimated payments are made quarterly according to the following schedule: Ohio’s w2/1099r upload application is now available (pdf) 01/03/2022.

If Applicable, Your Employer Will Also Withhold School District Income Tax.

Access the forms you need to file taxes or do business in ohio. 2 what is the ohio it 4? Web you should make estimated payments if your estimated ohio tax liability (total tax minus total credits) less ohio withholding is more than $500. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment.

12/20 Submit Form It 4 To Your Employer On Or Before The Start Date Of Employment So Your Employer Will Withhold And Remit Ohio Income Tax From Your Compensation.

Make check or money order to: Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Most forms are available for download and some can be. Request a state of ohio income tax form be mailed to you.

4 Can An Employee Increase The Amount Of Ohio Tax Withholding?

5 i am an ohio employer and i have an. Updated school district income tax rates effective january 1, 2022 (pdf) 12/17/2021. Ohio withholding filing reminder (pdf) 02/25/2022. Is this form sent to the ohio department of taxation?