Ohio Withholding Form 2023

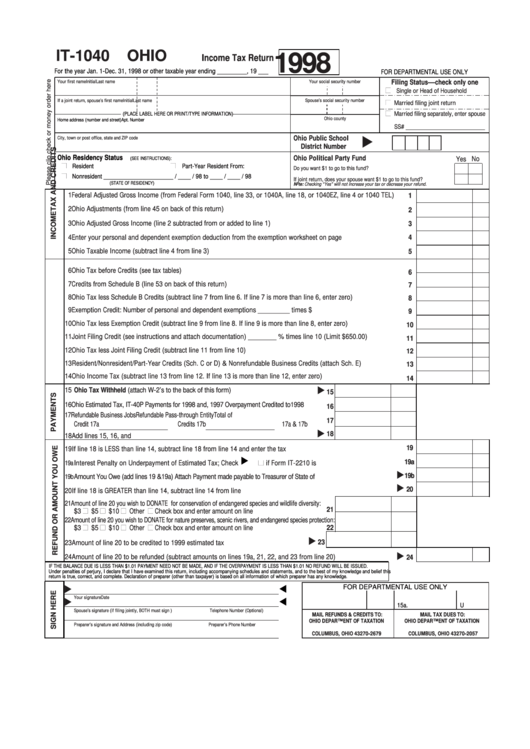

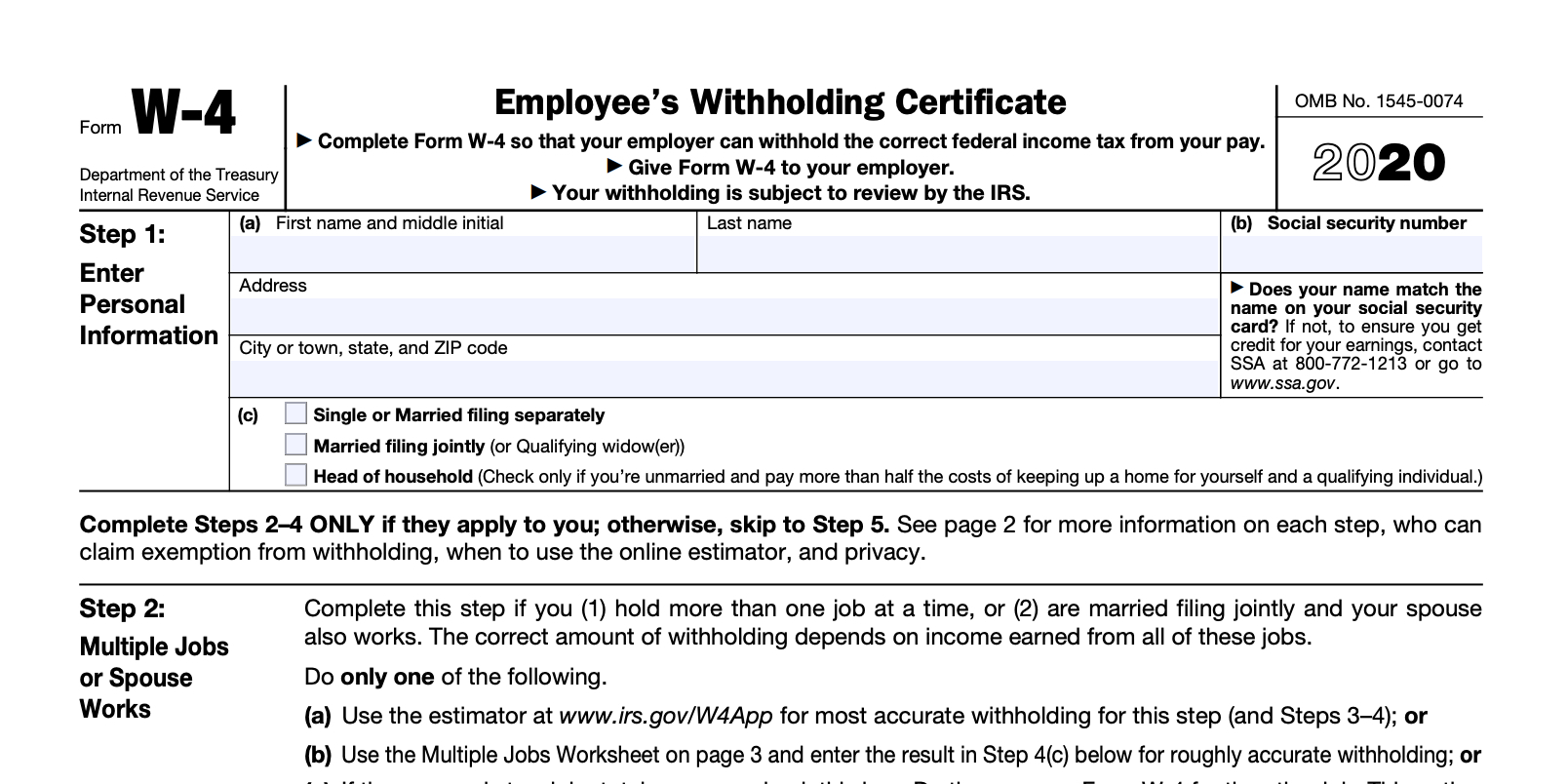

Ohio Withholding Form 2023 - Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Web 2023 withholding forms. Access the forms you need to file taxes or do business in ohio. This form is for income earned in tax year 2022, with tax returns due in april 2023. Last updated march 21, 2023. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. The states that border ohio are: Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a reciprocity agreement. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form):

Individual income tax forms (37) corporate income tax forms (41) other forms (5) The states that border ohio are: Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a reciprocity agreement. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): If applicable, your employer will also withhold school district income tax. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the ohio government. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Last updated march 21, 2023. Indiana, kentucky, michigan, pennsylvania and west virginia.

The states that border ohio are: Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment. Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a reciprocity agreement. Request a state of ohio income tax form be mailed to you. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the ohio government. Access the forms you need to file taxes or do business in ohio. Indiana, kentucky, michigan, pennsylvania and west virginia.

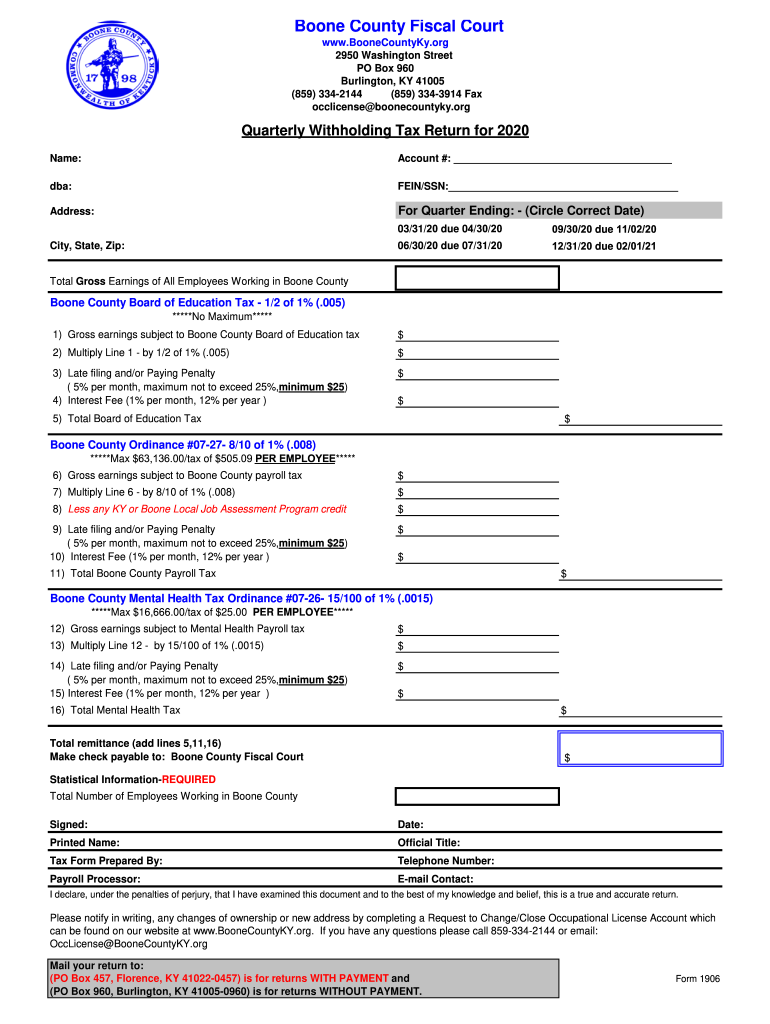

Ky Quarterly Tax Fill Out and Sign Printable PDF Template signNow

12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Indiana, kentucky, michigan, pennsylvania and west virginia. The states that border ohio are: Web 2023 withholding forms. This form is for income earned in tax year 2022, with tax returns due.

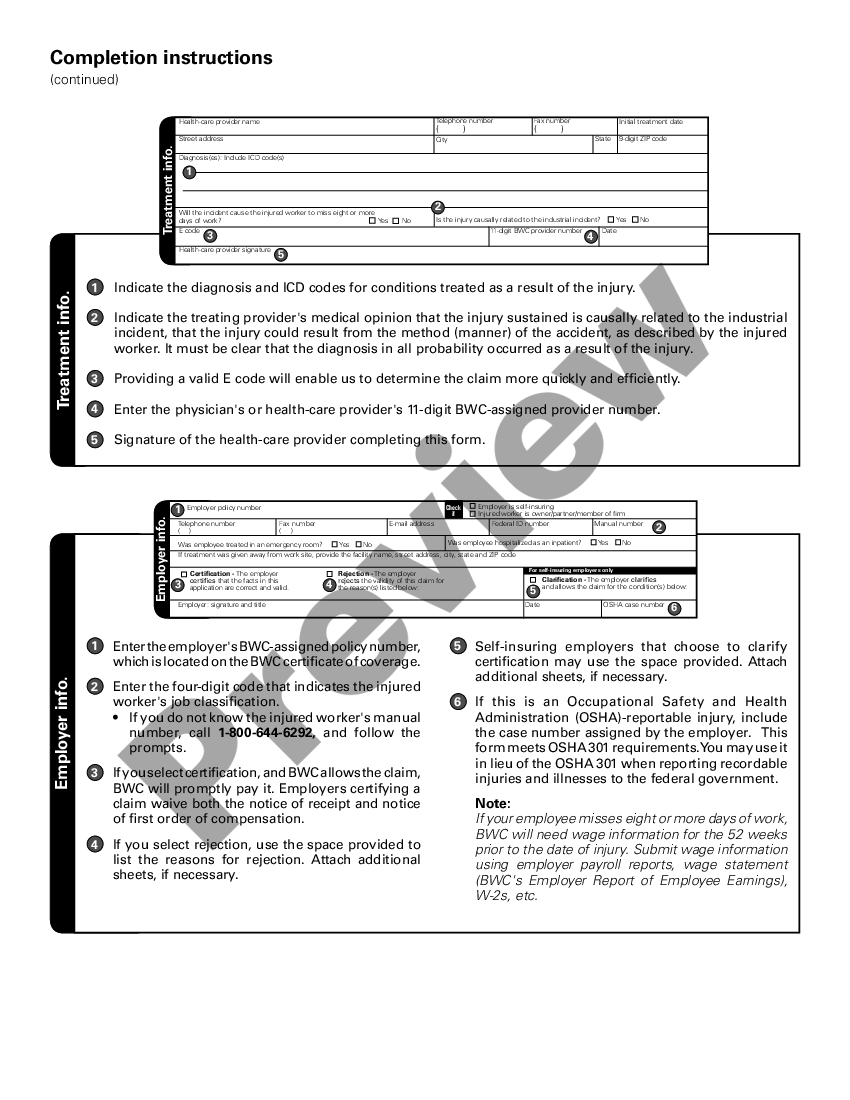

First Report Of Injury Form Ohio Withholding US Legal Forms

Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment. Web taxformfinder provides printable pdf copies of 83 current ohio income tax forms. Web 2023 withholding forms. Web more details on employer withholding are available below. Web you must withhold ohio income tax from the compensation that the employee earned in ohio,.

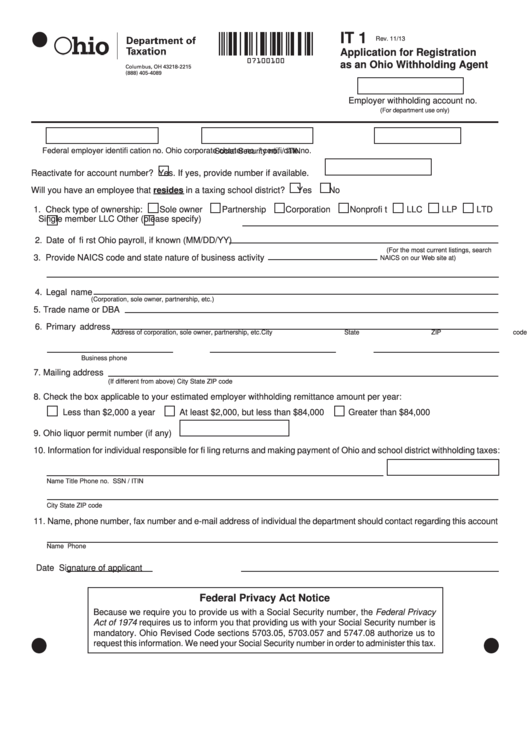

Fillable Form It 1 Application For Registration As An Ohio

The states that border ohio are: Access the forms you need to file taxes or do business in ohio. Create date march 6, 2023. Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a reciprocity.

Ohio Employee Tax Withholding Form 2022 2023

Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income.

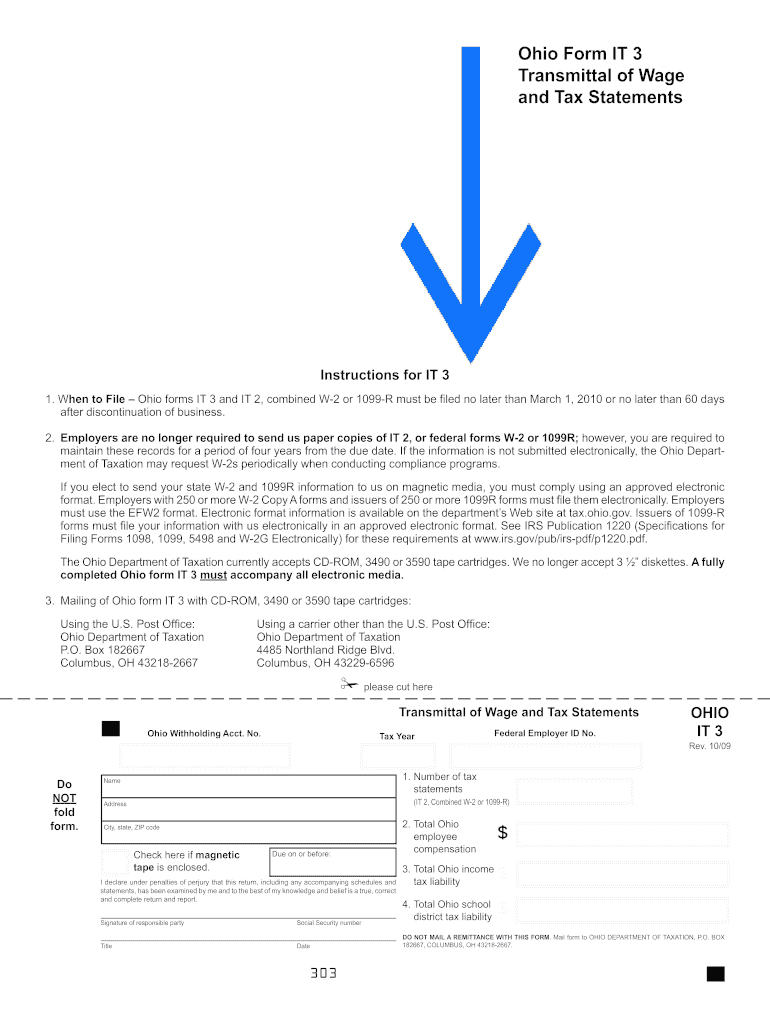

2009 Form OH ODT IT 3 Fill Online, Printable, Fillable, Blank pdfFiller

Individual income tax forms (37) corporate income tax forms (41) other forms (5) Indiana, kentucky, michigan, pennsylvania and west virginia. Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Last updated march 21, 2023. Access the forms you need to file taxes or do business in ohio.

Ohio Tax Withholding Form 2022

Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Access the forms you need to file taxes or do business in ohio. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and.

State Tax Withholding Form Ohio

Create date march 6, 2023. Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Each employee must complete an ohio it 4, employee’s.

2021 Ohio Withholding Form 2022 W4 Form

Request a state of ohio income tax form be mailed to you. Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. Individual income tax forms (37) corporate income tax forms (41) other forms (5) The current tax year is 2022, and most states will release updated tax forms between january and april.

Ohio Department Of Taxation Employee Withholding Form

12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which.

Fillable Heap Form Printable Forms Free Online

Indiana, kentucky, michigan, pennsylvania and west virginia. Create date march 6, 2023. Web 2023 withholding forms. Web taxformfinder provides printable pdf copies of 83 current ohio income tax forms. Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which.

Ohio Employer And School District Withholding Tax Filing Guidelines (2023) School District Rates (2023) Due Dates And Payment.

Request a state of ohio income tax form be mailed to you. Web taxformfinder provides printable pdf copies of 83 current ohio income tax forms. Web we last updated ohio form it 4 in february 2023 from the ohio department of taxation. We will update this page with a new version of the form for 2024 as soon as it is made available by the ohio government.

If Applicable, Your Employer Will Also Withhold School District Income Tax.

Access the forms you need to file taxes or do business in ohio. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Individual income tax forms (37) corporate income tax forms (41) other forms (5) Most forms are available for download and some can be.

The States That Border Ohio Are:

Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2023 withholding forms. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023.

Web More Details On Employer Withholding Are Available Below.

Indiana, kentucky, michigan, pennsylvania and west virginia. Web you must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one of the five states with which ohio has signed a reciprocity agreement. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Create date march 6, 2023.